(#100) on Trump or Open.Gov; Apple’s “new big thing”

Financial Times: “Why Europe’s car crisis is mostly made in China”

OnStrategy has reached 100 editions and nearly 3,500 subscribers — thank you all for the support! This newsletter has evolved into a platform for sharing strategic insights, and I've sometimes lost track of its original purpose along the way. Over time, I’ve continued to add ideas and content, and your feedback has been clear:

You’d like it shorter

You want it focused on strategy only

Starting this week, I'll feature just 7 companies per issue — pure strategy, no extras.

Thank you for being with me on this journey! Here’s to reaching at least 100 more newsletters together 🙏

on Trump or Open.Gov

I lost count of how much grew the US stock market since the election. This is based on what Trump can do, now that he has Elon in his team. I think, there are at least 8 directions when you look at Trump’s 2nd term:

Trump’s second term could initiate a massive “bubble” focused on technological and infrastructural advancements, reminiscent of transformative projects like the Manhattan Project and Apollo Program. This period may pull resources and human capital toward significant innovations due to the administration’s vision.

Unlike vague promises, successful bubbles require “definite optimism,” with concrete and achievable goals. For Trump, a well-defined, constrained vision will be essential to generate lasting, impactful change, with efforts targeted at specific sectors such as government efficiency.

The administration is portrayed as attempting to refine America's institutional “machinery” by removing bureaucratic barriers, which could, if successful, streamline operations across industries. This involves reducing regulatory hurdles and aiming for a more agile government that fosters innovation.

Figures like Elon Musk and Vivek Ramaswamy tapped to co-lead the Department of Government Efficiency (DOGE 🐶), represent a shift towards engaging private-sector leaders in government reform. They aim to restructure the national agencies and more.

The political environment is creating a sense of FOMO among investors and entrepreneurs, driving them to take greater risks in technology and infrastructure. This dynamic could lead to overinvestment, a common trait in bubbles, which might accelerate progress despite its risks.

There is a strong focus on simultaneous efforts by multiple players (parallelization) and coordinated attempts to improve national infrastructure and technological capabilities. This approach aims to catalyze growth across sectors by addressing bottlenecks in government processes and approval systems.

With government figures promising to crowdsource ideas from citizens, there’s a new participatory element.

Key industries such as nuclear energy, space exploration, and crypto could see a surge in development, as fewer regulatory constraints might encourage rapid expansion. Reduced government intervention could enable faster deployment of innovations in these fields, hence out-innovating China.

The bad stuff about this term has been said and written by everyone: from legacy media to international academic stars (ie. Acemoglu, Fukuyama, etc) but one thing remains clear: don’t bet against Elon!

I think this century will be American and what will happen in the next 4 years can define the next 75. LINK

Disney is looking for a new CEO. Why not promote internally?

I’m against looking for candidates externally unless the company doesn’t have any real solution from the internal pipeline. And if the company doesn’t have any internal pipelines then that’s the real problem and the CEO should be the first liable, ie. Bob Iger.

Here are some ideas from both perspectives:

1/ Promoting internally can be advantageous as existing leaders are already embedded within Disney’s unique culture and understand its complex operations, from streaming to theme parks. Internal candidates like Dana Walden and Josh D’Amaro have proven track records in managing Disney’s major business segments, which could ensure stability and continuity during the transition. As a parenthesis, P&G is promoting only internally.

2/ Disney’s challenges, such as adapting to streaming demands and reimagining traditional media, might benefit from an external candidate's fresh perspective. An outsider, like EA’s Andrew Wilson, could bring innovative ideas from other industries, particularly in digital and gaming, potentially injecting new strategies that drive growth in underdeveloped areas like gaming.

3/ The ideal strategy may involve evaluating both internal and external candidates while focusing on a clear succession process that prioritizes innovation and experience in navigating digital transformations. Given Disney's large portfolio, appointing co-CEOs, as Iger explored with Netflix’s model, could leverage complementary skill sets, hence balancing internal stability with external vision.

I am bullish on Disney. LINK

Shopify matters

Why Shopify matters?

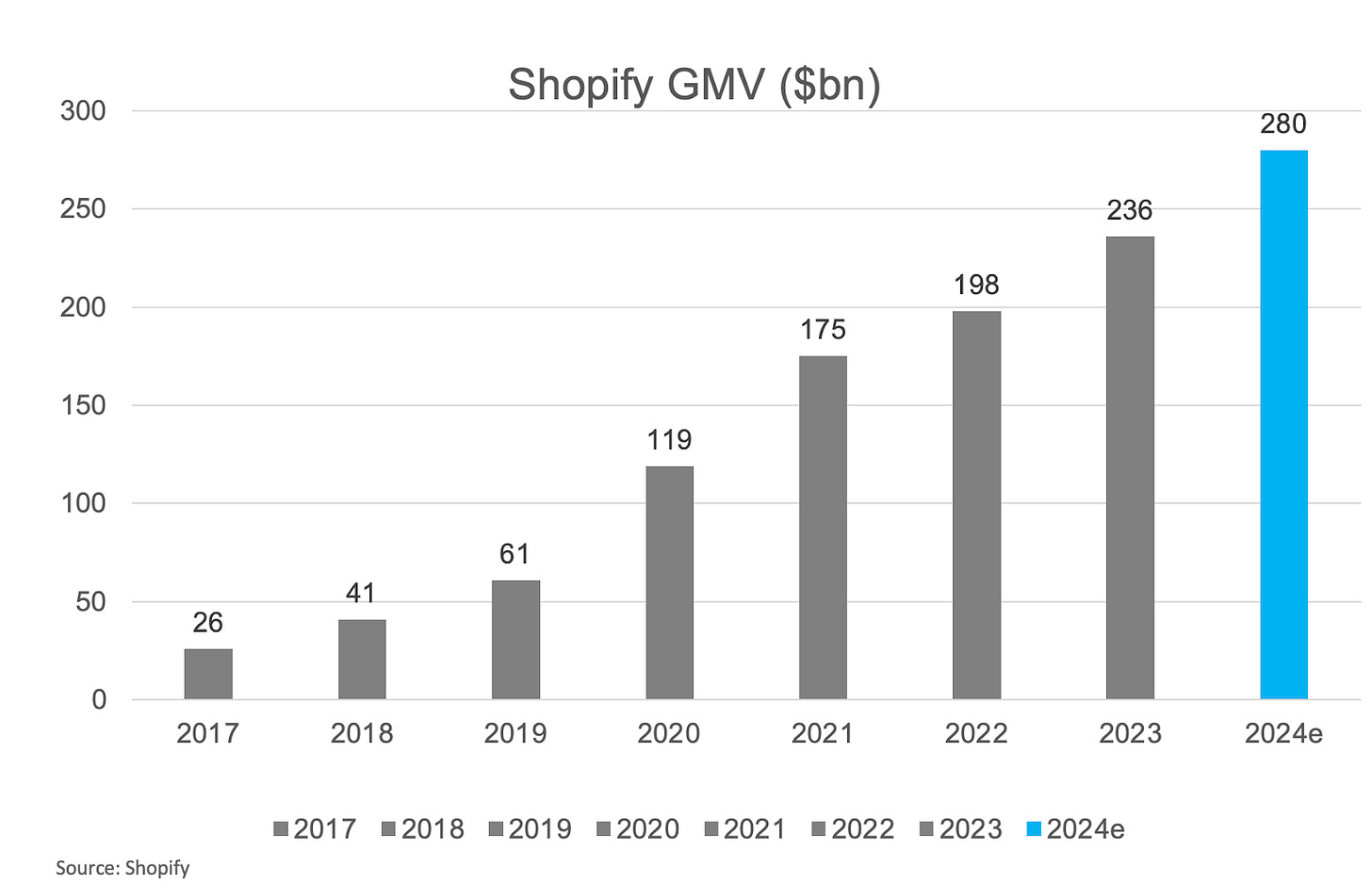

1/ In the latest quarter, Shopify's earnings revealed strong performance, with revenue growing by 26% and operating income doubling from last year. This growth reflects Shopify's strategic pivot towards attracting larger clients and expanding into international markets, underscoring its shift from a small-business-focused platform to one appealing to companies of all sizes globally. How? By attracting more enterprise clients and integrating tools like in-store payment systems, Shopify has reinforced its value proposition across diverse markets.

2/ Shopify's strategic evolution is marked by a return to its core strength as a software company. After a misstep in entering the logistics sector to compete with Amazon, Shopify refocused on providing scalable software solutions for merchants, which plays to its strengths and core competencies. CEO Tobi Lütke recognized the need to exit logistics in 2023, understanding that the company's value lies in its software platform, which can serve many merchants without the physical limitations of logistics. This self-awareness has allowed Shopify to focus on its long-term vision of empowering merchants with streamlined commerce solutions.

3/ The shift in Shopify’s approach has positioned it as a "commerce operating system" rather than just a platform for small businesses. Now, Shopify offers modular services that cater to various merchant needs, from startups to large enterprises, emphasizing a unified and comprehensive approach to retail. By evolving from merely supporting "rebels" (small businesses) to becoming an "arms dealer" for all merchants, Shopify has embraced a broader, more inclusive market strategy that maximizes scalability and flexibility, opening doors to growth in multiple sectors. Bloomberg, Shopify

Apple’s “new big thing”

I wrote in Newsletter #88 that the house is the only place where Apple’s ecosystem is not dominant yet.

1/ Apple's move into tabletop robotics isn't just about a new product category - it's a strategic play to aggregate user attention in the smart home space. By combining an iPad-like display with robotic functionality, Apple is creating a central hub for home automation, communication, and security. This positions them to capture more of the user's time and data, potentially leading to increased lock-in to the Apple ecosystem. It's a classic move of integrating hardware and software to create a superior user experience, which has been Apple's hallmark strategy for decades.

2/ The emphasis on Siri and Apple Intelligence controlling this new device signals a shift towards AI-first product development at Apple. This aligns with the broader industry trend, but with an Apple twist - they're leveraging AI not just in software, but as a core component of hardware interaction. This could be the first major Apple product where AI isn't just a feature, but the primary interface. It's a bold bet that could redefine how we interact with technology in our homes and potentially set a new standard for AI-integrated hardware.

…and this is what I wrote in Newsletter #97:

1/ Apple aims to dominate the smart home market by integrating its devices and software throughout the home. This involves developing a new homeOS operating system and introducing smart displays that can act as affordable, multi-functional screens for streaming, videoconferencing, and managing household tasks. The goal is to provide a seamless experience across various Apple devices, similar to how its ecosystem works for personal devices like iPhones and MacBooks.

2/ A significant aspect of Apple's smart home strategy is the use of AI through its new Apple Intelligence platform. This platform will enhance automation, allow precise control of home devices, and offer advanced features like recognizing individuals interacting with the system. The integration of AI is meant to boost the functionality of Apple’s smart home products, making them more responsive and intuitive.

3/ To better compete with Amazon and Google, Apple plans to ensure compatibility with other brands' smart home accessories through the Matter protocol. This strategic shift from a closed ecosystem to one that supports multiple platforms is crucial for expanding Apple’s footprint in the smart home market, offering users more flexibility and encouraging broader adoption of its smart home solutions.

…and this is what Mark Gurman is announcing in Bloomberg:

Apple may never find another product with as much revenue potential as the iPhone…

The company is planning two new devices: a smart display (due in the first half of 2025) and a higher-end home hub with a robotic limb (planned for a couple of years from now). With the addition of new HomePods and TV set-top boxes, Apple could become more of a force in the home market.

There are other areas, too. Apple has skunk-works teams exploring mobile robots — even humanoid models — and how they could help with household tasks a decade from now. Though this early work may never lead to a product, it reflects Apple’s continual focus on the future. The company also is pondering how it could turn its health features into a recurring subscription and has evaluated a push into home energy products.

QED. LINK

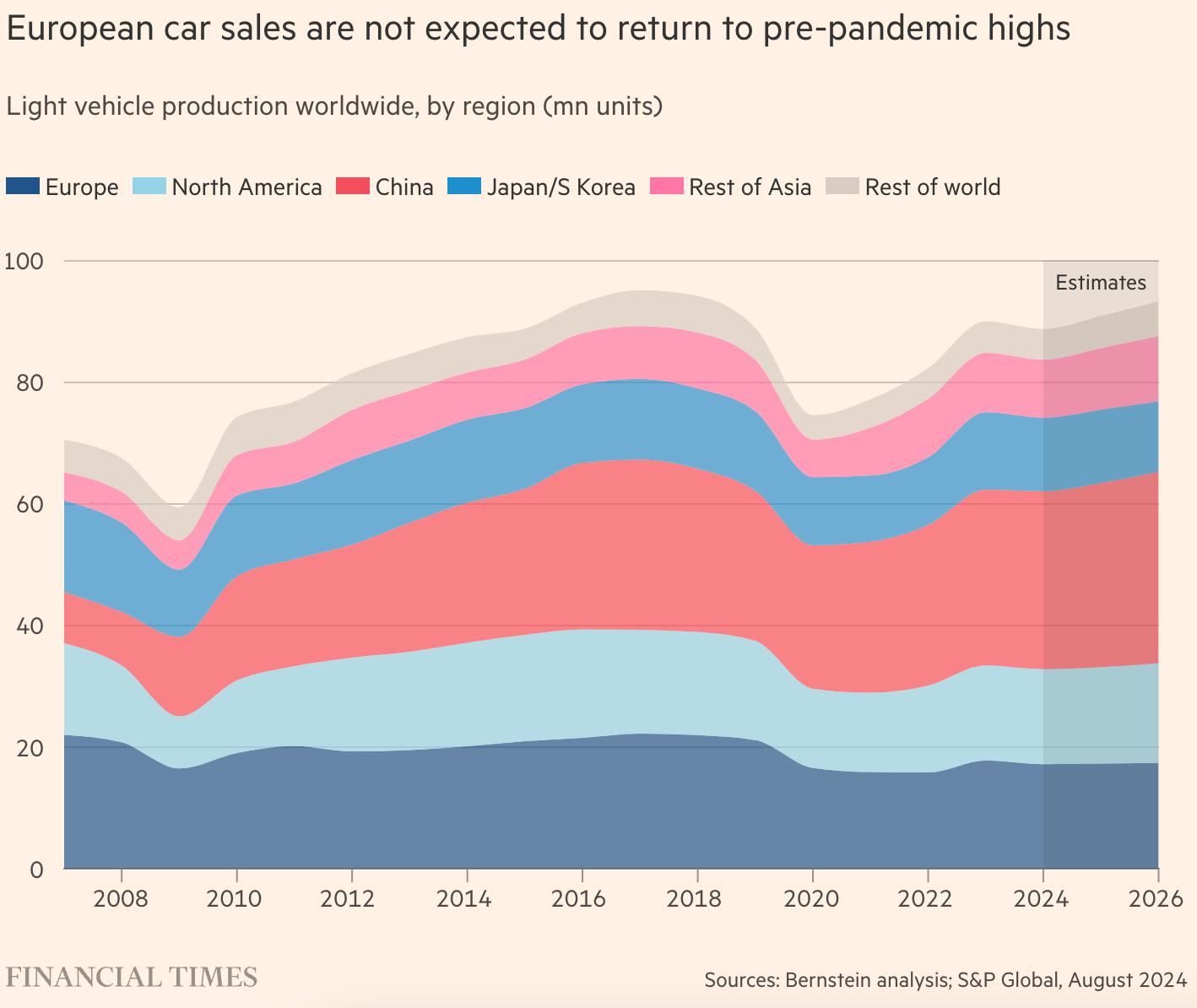

Financial Times: “Why Europe’s car crisis is mostly made in China”

Let’s recap briefly how Erurope ended in this situation:

1/ Chinese electric vehicle manufacturers have gained a competitive advantage over European carmakers through massive state subsidies at all levels: production, efficient design processes, raw materials, and advancements in battery and EV technology. This is challenging European carmakers, who face higher costs (especially different pollution taxes) and slower production timelines.

2/ The rise of high-quality, lower-cost (due to subsidies) Chinese EVs in Europe is intensifying market competition. European carmakers, including Volkswagen and Stellantis, are doing factory closures and cost-cutting measures to adapt, while some are forming strategic partnerships with Chinese firms to leverage technological advancements.

3/ European car manufacturers and governments are divided on strategies to counter the Chinese influx. Some leaders advocate for protectionist measures, like tariffs, to safeguard the European market. Others suggest that collaborating with Chinese manufacturers, especially in battery technology, might be essential for competitiveness and adaptation to shifting market dynamics. Tariffs can work for a short period of time (3-5 years), but Europe should massivele deregulate and support this industry. Otherwise will vanish, just like the solar panels. LINK

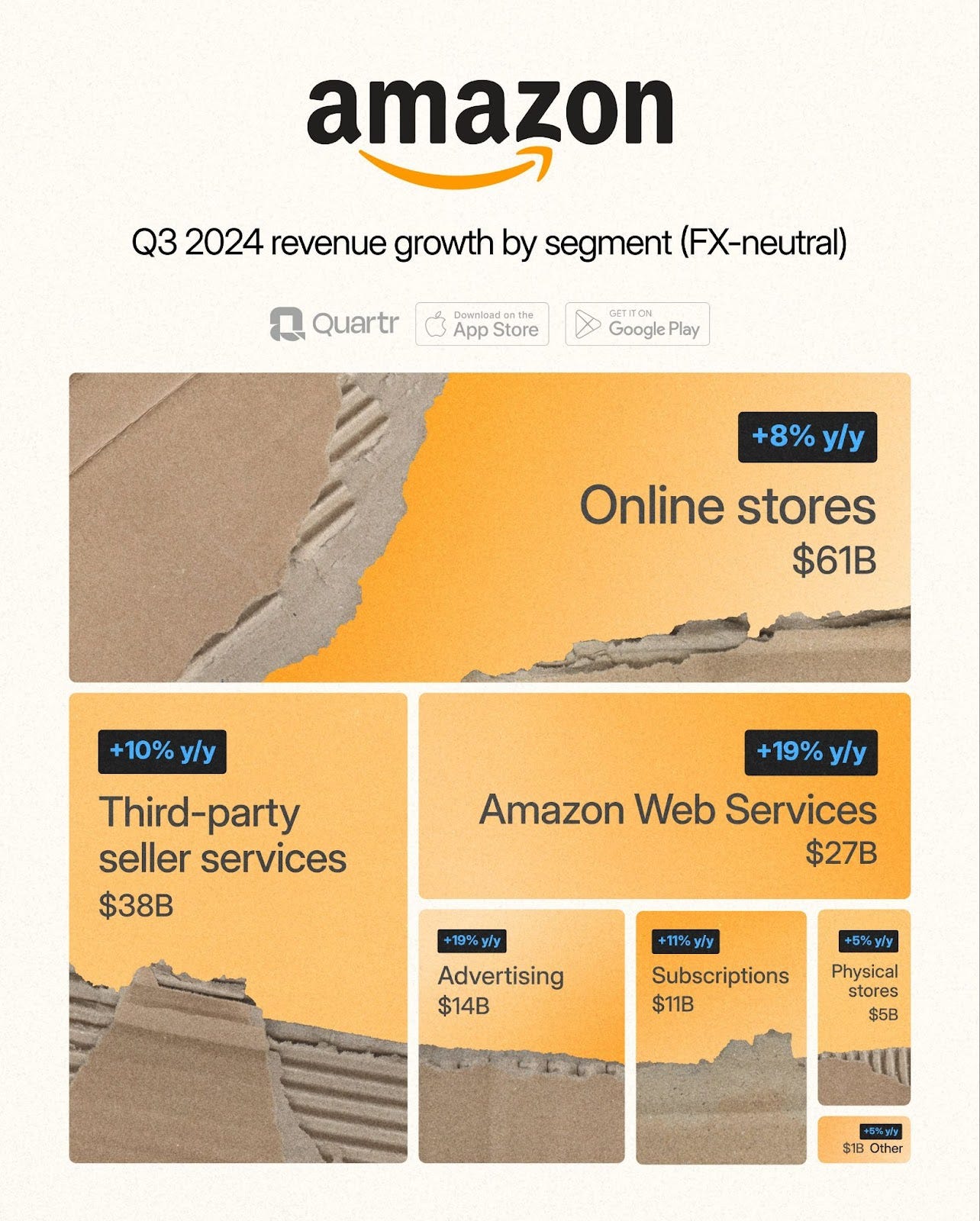

Amazon is executing perfectly its strategy

1/ Amazon’s recent earnings report showcases strong growth in its cloud computing and e-commerce segments, with AWS reaching a $110 billion annualized run rate, attributed partly to its AI services expansion. The company’s increased capital expenditure, expected to exceed $75 billion this yea, shows its commitment to bolstering its generative AI capabilities, marking Amazon’s investment in sustaining long-term growth. Despite economic fluctuations, AWS continues to grow steadily, with recent advancements in AI offerings setting the foundation for substantial future revenue.

2/ In its retail sector, Amazon has seen significant profitability improvements, especially in North America, thanks to efficiency gains from its optimized logistics network built during the pandemic. The focus on “Everyday Essentials” - low-margin, high-turnover items like toiletries - has widened Amazon’s addressable market, driving consumer engagement through fast delivery options. Amazon’s expanding share in this low-margin segment demonstrates the importance of speed and efficiency in capturing customer loyalty, ultimately translating to higher overall order volumes and profitability.

3/ Amazon is also advancing its automation strategy, unveiling a new, highly robotic fulfillment center in Shreveport, Louisiana. This facility, designed to cut processing time by 25% and reduce costs by the same margin, reflects Amazon’s aim to streamline its fulfillment network through robotics, lowering operational expenses over time. By prioritizing automated solutions, Amazon positions itself to maximize margins on high-turnover, first-party goods while leveraging third-party sellers for lower-demand items, thus reinforcing its dual approach to profitability across both its retail and cloud computing sectors.

I remain super LONG on Amazon. LINK