(#103) TikTok is helping a convenient outsider to become the Romania’s next President

Intel and Strategy

On the 7th of December, I’m launching my first book:

Business Strategies.

Building Sustainable Models with Artificial Intelligence and Digital Platforms

If you are in Bucharest (Romania) join us this Saturday from 11.00 AM at Gaudeamus International Book Fair (at Romexpo).

The books will be available on the same day on eMAG, Amazon (Kindle), Apple Books, and more.

Thank you for your support!

TikTok is helping a convenient outsider to become Romania’s next President

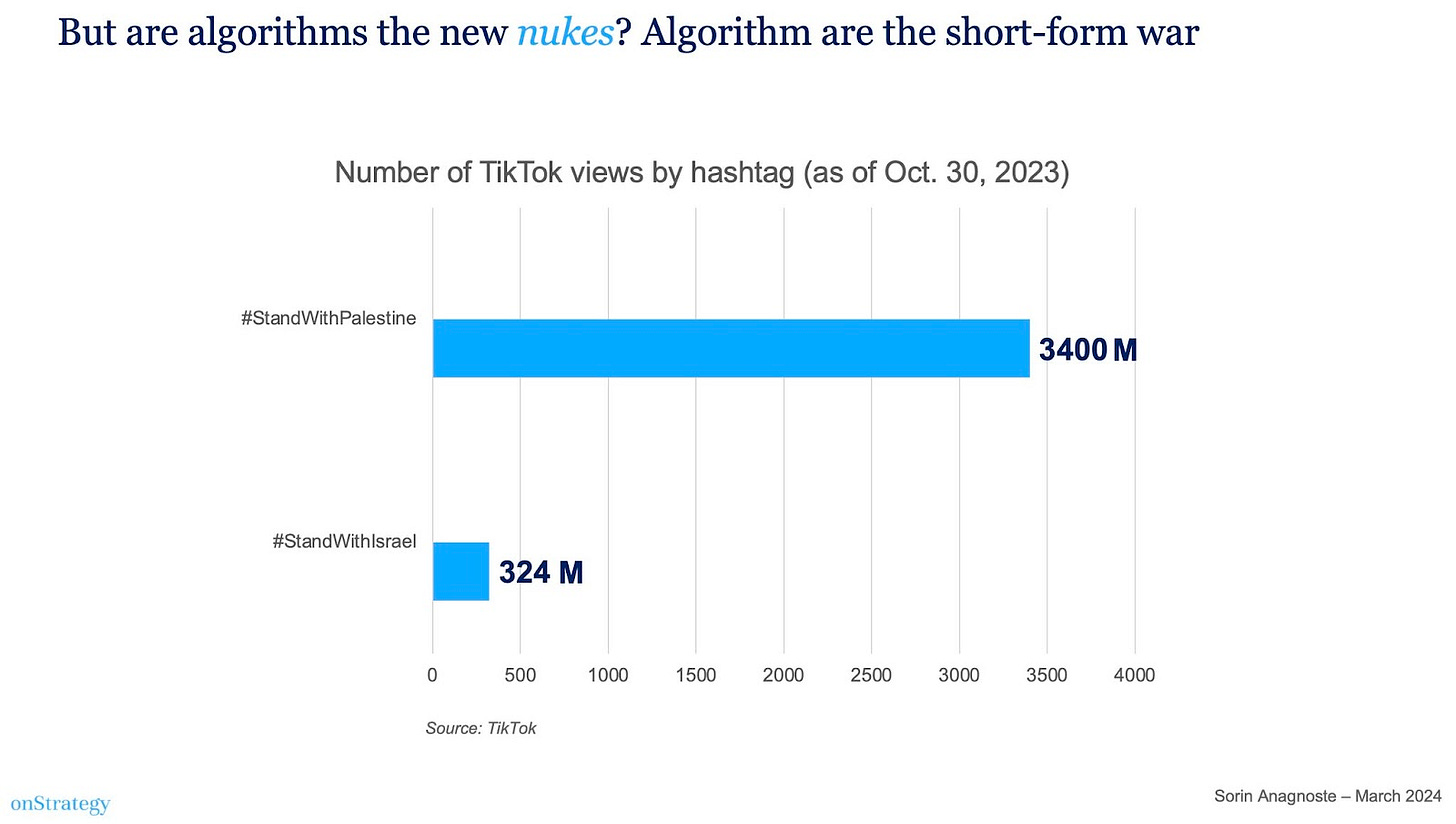

In my annual presentation, I presented a slide saying that “algorithms are the new nukes”

From Financial Times:

The TikTok official added that 66,000 fake accounts and 10mn fake followers were removed ahead of the election

The magnitude is truly astonishing: we're dealing not with hundreds or thousands of posts, but millions - every single day!

Just ban it!

Intel and Strategy

From the Bloomberg:

Intel Corp. Chief Executive Officer Pat Gelsinger was forced out after the board lost confidence in his plans to turn around the iconic chipmaker, adding to turmoil at one of the pioneers of the technology industry. The clash came to a head last week when Gelsinger met with the board about the company’s progress on winning back market share and narrowing the gap with Nvidia Corp., according to people familiar with the matter. He was given the option to retire or be removed, and chose to announce the end of his career at Intel, said the people, who asked not to be identified because the proceedings weren’t made public.

I was one of those bullish on Intel and Pat Gelsinger, but it seems that the market did not help him. So there are some lessons from his experience.

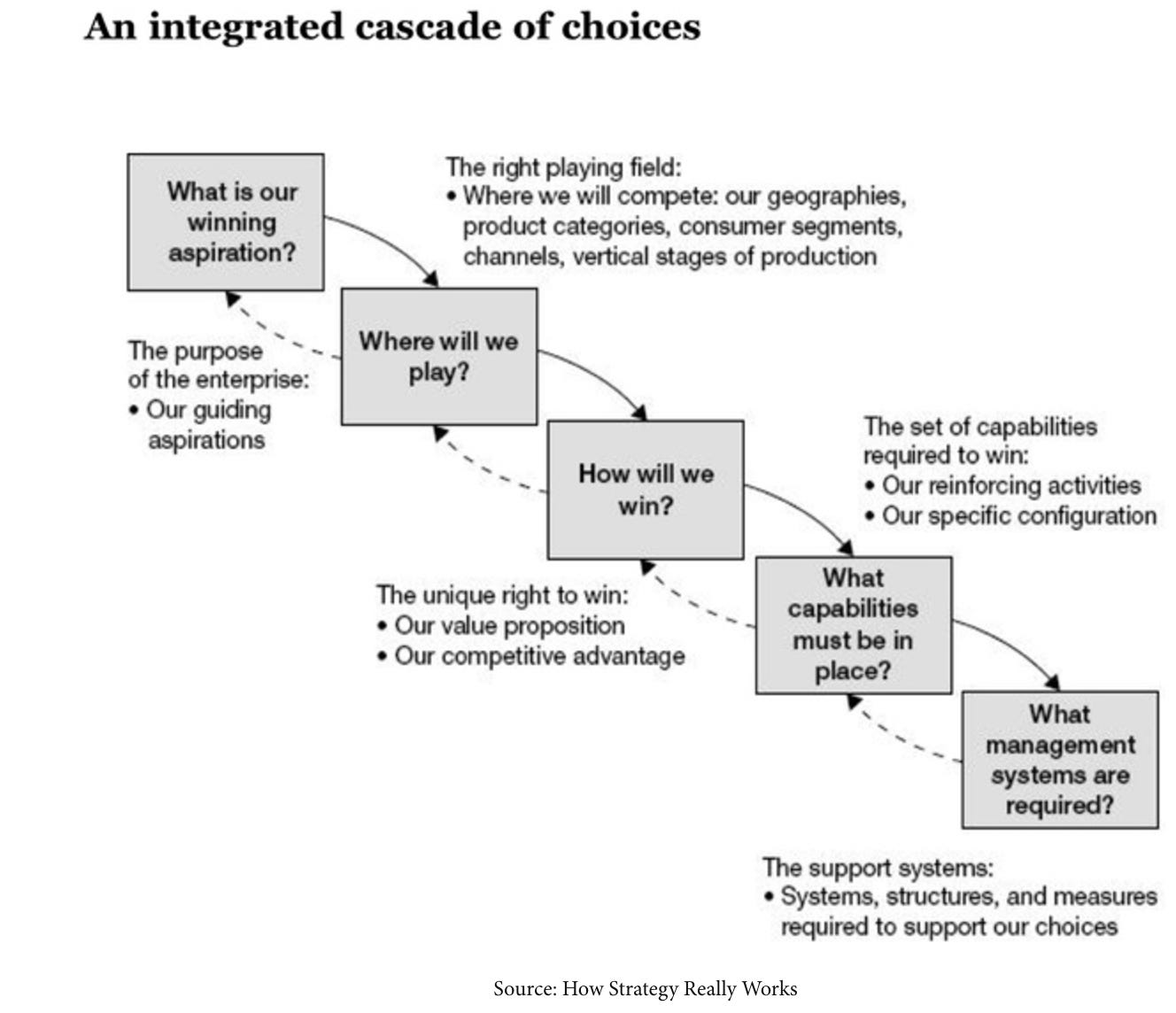

1/ You need to make choices for your strategy, as detailed by Roger Martin in his framework below:

2/ Here is the Amazon culture as mentioned on their website:

Speed matters in business. Many decisions and actions are reversible and do not need extensive study. We value calculated risk taking.

3/ Here is Tae Kim’s in his new book “The Nvidia Way:

Alex Krizhevsky and Illya Sutskever’s work stoked Jensen’s interest in artificial intelligence. He started talking frequently with Bill Dally and was focused on how much of an opportunity deep learning, and specifically GPU-powered deep learning, would be for Nvidia. There was considerable debate within the executive team on the topic. Several of Jensen’s key lieutenants were against investing more in deep learning, in the belief that it was just a passing fad. But the CEO overruled them. “Deep learning is going to be really big,” he said at an executive team meeting in 2013. “We should go all in on it.”

..and finally:

4/ Here is Ben Thompson from Stratechery.com:

2013 was three years after Intel killed the Larrabee general-purpose computing on graphics processing unit (GPGPU) project, which was intended to compete with Nvidia; Larrabee was headed by one Pat Gelsinger, who had left the year before after being passed over for the CEO job. 2013 was three years before Intel acquired Nervana Systems, a full stack deep learning company; 2013 was seven years before Intel shut Nervana down after acquiring Habana Systems and its Gaudi AI chip (manufactured by TSMC) in 2019.

In other words, Nvidia has been preparing for and executing on its AI ambitions for well over a decade, and even longer if you count the 2006 introduction of CUDA or the 2001 introduction of shaders. Intel, meanwhile, was consumed by corporate infighting and throwing spaghetti against the wall for the entire decade when Gelsinger was at VMWare; that is why Intel isn’t competitive in AI. To say that this is why he was suddenly fired over a holiday weekend doesn’t pass the smell test.

Conclusion: Some decisions cost hundreds of billions of US and you might not be the one who took it, but from time to time you will be the scapegoat, like our friend Pat here.

On the Chinese retaliation against the US

China has imposed restrictions on the export of germanium and gallium to the United States. These materials are crucial for the green technology and semiconductor industries. The restrictions are part of an ongoing issue with China's approach to negotiations and governance.

Some ideas:

1/ Unlike rare earth elements, where the United States could simply increase its processing capacity to negate Chinese supply concerns, the situation with germanium and gallium might be different. The US should create the entire supply chain, but for this, it needs bipartisanship acceptance (ie. Republicans and Democrats).

2/ This will only accelerate the “Chips Act” which has a section dedicated to “strategic material production”. This ban will accelerate it.

3/ This war on these materials will probably end very soon. Why? 90% of the world’s semiconductor silicon comes from the state of North Carolina (USA). Without silicon, nothing can work, including the semiconductors the Chinese are producing now.

Either way, the USA wins. LINK

Zoom reveals major rebrand

Two insights here:

1/ Zoom has announced a major rebranding effort, signaling a significant shift from its identity as a video conferencing platform to positioning itself as an "AI-first work platform for human connection." CEO Eric Yuan reflects on the company's journey since its inception in 2011, when its primary goal was to dominate video conferencing - a target it achieved, especially during the pandemic. With the unveiling of "Zoom 2.0," the company aims to transcend video calls by integrating advanced AI tools into its portfolio, including the AI Companion, which leverages institutional knowledge to enhance productivity. Yuan envisions a future where AI innovation reduces the workweek, reminiscent of Henry Ford's automation efforts that shortened work hours in the past.

2/ To underscore its transformation, Zoom has officially removed "Video" from its corporate name and is focusing on products like the upgraded AI Companion and the newly introduced Zoom Docs. These developments suggest a direct challenge to tech giants like Microsoft and Google in the productivity and collaboration space. While video conferencing remains part of its offering, Zoom's strategy now centers on creating customizable digital workspaces powered by AI, signaling its ambitions to redefine workplace technology and human collaboration.

Personally, I think should not be any by any company in tech or a strategic sector. Why? Because it’s not safe. Everything is in China: the dev team, leadership, and servers. All info from all the meetings can be accessed by the Communist party and then given to your competitors. LINK

Europe’s Mistral AI expand in Silicon Valley

I like Mistral because it’s the only AI model that got right in the US elections, as shown here. Now, the company is expanding to the US. Why?

1/ To attract top AI talent and establish a stronger presence in the competitive US market. The Paris-based company is opening an office in Palo Alto, California, and plans to expand its U.S. sales team while hiring AI engineers and scientists. Valued at €6 billion after a significant funding round in June, Mistral has gained international recognition for its open-source AI models, which allow businesses to customize and deploy them. The company’s focus on efficiency and cost-effective model development differentiates it from U.S. rivals like OpenAI and Anthropic, which are backed by significantly larger funding pools.

2. Despite its European roots, Mistral has increasingly leaned on US-based resources and support, including backing from prominent Silicon Valley firms like Andreessen Horowitz and tech giants Microsoft and Nvidia. The startup now employs over 100 people, with Paris remaining its central hub and a growing team of about 20 staff in the Bay Area. As the AI industry becomes more competitive and resource-intensive, Mistral is positioning itself as a global player, balancing its European identity with a strategic presence in the world’s largest tech market.

Financial Times: “China’s smartphone makers head upmarket in European push”

What the Chinese companies are doing are steps from a classic strategy book:

1/ Chinese smartphone brands like Realme, Oppo, and Honor are leveraging their innovative capabilities to penetrate Europe's premium smartphone segment, directly challenging the dominance of Apple and Samsung. This strategic pivot toward higher-margin products aligns with their long-term goal of expanding profitability and enhancing brand prestige in developed markets. The focus on advanced features, such as foldable screens and superior camera technology, is central to differentiating their offerings and capturing discerning European consumers.

2/ European market dynamics present significant barriers for new entrants, with entrenched consumer loyalty toward established brands and elevated marketing expenditures required to build awareness. For Chinese brands, overcoming these hurdles is critical for establishing a competitive position. Despite slower growth and high customer acquisition costs, their aggressive marketing campaigns and investments reflect a calculated risk to secure a foothold in a strategically valuable market. In the end, many of these costs are subsidized by the Chinese government.

3/ Finally, Chinese brands view success in Europe as a validation of their capability to compete in premium, high-demand markets, serving as a gateway to other developed regions such as the U.S. and Japan. Establishing credibility in Europe strengthens their global brand equity and sets the stage for scaling operations in additional high-value markets. LINK

Agile vs. unions. Case study: VW

From Bloomberg:

“VW’s corporate structure gives workers a strong voice in key decisions, making it difficult for management to push through painful cost cuts. Employee representatives occupy half of the company’s supervisory board seats, while VW’s home state of Lower Saxony holds an additional two seats.”

- imagine you are the CEO and read these two lines. Space of maneuvering fast: zero

Also this:

“Volkswagen AG Chief Executive Officer Oliver Blume told workers that current union proposals to cut costs offer a starting point for negotiations but don’t go far enough to address flagging competitiveness at the carmaker’s namesake brand.

<<We, the management, are not operating in a world of make-believe,” Blume told thousands of workers gathered at an assembly in Wolfsburg. “We are making decisions in a rapidly changing environment. We are concerned about the future of our company.>>

Q.E.D.

Where can I bet against VW? I mean not that they will disappear, although that’s a good chance, but they will become prevalent in the long run. LINK