(#104) Youtube, Dell, Duolingo and Waymo are some of the winners in 2024

The cleantech revolution is unstoppable

What a hectic week! I just launched my book on strategy:

Through 28 chapters I covered three parts: (1) Strategy, (2) Innovation & Growth, and (3) Generative AI.

See a full sample - the chapter on Network Effects. - click HERE

More about the book:

https://book.onstrategy.eu

Buy a hardcopy on EMAG

Soon to come to Amazon and Gumroad.

Onto the update:

Duolingo won the learning war

The strategy was quite straight-forward:

1/It started by targeting the nonconsumption. Initially, Duolingo appealed to language learners with limited access to expensive formal education or tutoring. By offering free, gamified language lessons, it created a new market among casual learners, hobbyists, and underserved populations.

2/ Duolingo's freemium model, coupled with its gamification strategies like badges, streaks, and bite-sized lessons, significantly lowered the barriers to entry for learning languages.

3/ By leveraging AI and data-driven personalization, Duolingo continuously improved its offerings, providing features like live AI chats and tailored exercises. This aligns with Christensen's insight that disruptors often gain a foothold through simple offerings and then advance in sophistication.

4/ Duolingo's mobile-first approach ensured accessibility across devices, serving diverse demographics globally. Its owl mascot and humorous approach appealed to users emotionally, enhancing retention and engagement.

5/ Duolingo benefits from network effects, where its large user base enhances the data quality for its AI algorithms, improving the learning experience for all. This mirrors Christensen's notion that successful disruptive companies use scale to reinforce competitive advantages. LINK

🧑🏻💻👩💻 Youtube won

Some interesting conclusions from this report:

1/YouTube won the youth by a high margin. What’s your ‘YouTube strategy’?

2/ Traditional platforms like Facebook and X (formerly Twitter) have seen a sharp decline in teen usage over the past decade, with only 32% and 17% of teens using them, respectively. In contrast, newer platforms like TikTok and Snapchat continue to dominate.

3/ Nearly half of teens report being online "almost constantly," a dramatic rise from 24% a decade ago.

4/ Usage patterns vary by demographic factors such as gender, race, and household income. For instance, Black and Hispanic teens are more likely than White teens to use platforms like TikTok and Instagram "almost constantly." Teen girls also favor TikTok, while boys lean toward YouTube.

5/ Almost all teens (95%) have access to a smartphone, and a large majority also have access to computers (88%), gaming consoles (83%), and tablets (70%).

6/ Teens in households that earn > 75.000$ use less most of the social media platforms. LINK

✅ The cleantech revolution is unstoppable

So many insights from this report, but I’d mention two:

1/ We can see a clear S-curve pattern in the adoption of solar and wind energy. As mentioned in the report it will take approximately 10 years to achieve 5% penetration, 10 additional years to reach 25%, and another 10 years to achieve 50% penetration.

2/ The report identifies a similar S-curve for EV sales, indicating that it takes about 6 years to reach 5% of sales and only 6 more years to achieve 50% market share.

🚙 Waymo came out of nowhere…and $11 later

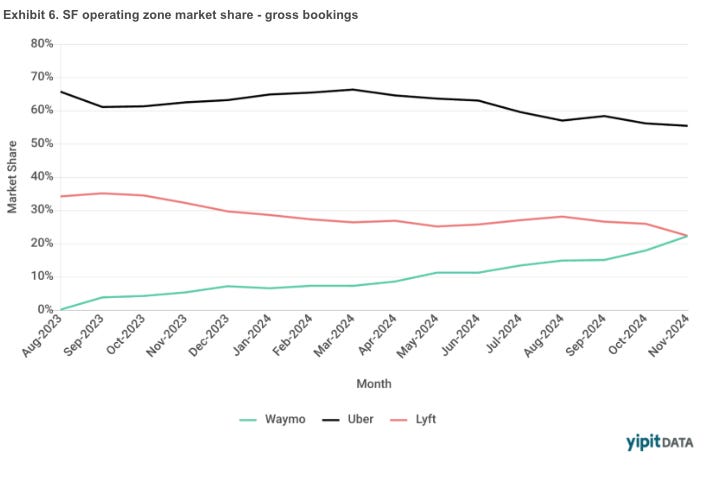

1/ The chart is remarkable when you think that Waymo's market share in San Francisco's operating zone, which started at 0% in August 2023 and reached 22% by November 2024, equaling Lyft's share. During the same period, Uber's market share dropped from 66% to 55%, while Lyft's decline was steeper, losing approximately one-third of its market share. This shift suggests that despite Waymo’s relatively longer wait times, its product, cleaner cars and driverless experiences, has successfully attracted a significant portion of riders.

2/ The data demonstrates that network effects in ridesharing have diminishing returns once a minimum operational threshold is met. Uber and Lyft maintain competitive wait times (e.g., 2-4 minutes), and beyond that, incremental reductions offer minimal rider benefits. However, Waymo's current wait times, though slightly longer due to limited car availability, appear to be within the acceptable range for users, who value the superior experience of driverless cars more than marginally shorter waits.

3/ Looking forward, Waymo’s market share could grow even faster as it scales its fleet and reduces wait times further, positioning itself as a preferred alternative to Uber and Lyft. With driverless cars promising greater safety, affordability, and privacy, Waymo’s continued expansion signals a potential paradigm shift in ridesharing. As the saying goes, “The future comes slow, then all at once.”

4/ Who can disrupt Waymo? Tesla, of course, and it will if Waymo’s business model remains the same.

Michael Dell is a visionary

1/ Michael Dell has successfully transformed Dell Technologies from a 1990s PC powerhouse into a critical player in the modern AI infrastructure market. Over the past 40 years, Dell's strategic pivot has been marked by bold moves, including taking the company private in 2013 and acquiring EMC for $67 billion—then the largest tech deal in history. This foresight positioned Dell to build high-performance servers and storage systems, which are now vital for AI training and operations, signaling a fundamental shift toward becoming an infrastructure giant for the AI era.

2/ The company’s recent success stems from its ability to meet surging demand for AI-related hardware. Dell's PowerEdge servers and storage systems are widely used to power data centers and AI supercomputers, including high-profile projects like Elon Musk's Colossus. Between 2022 and 2024, Dell increased its AI customer base from 40 to over 2,000, with significant revenue growth in its server business. Despite not designing chips or writing all the software, Dell positions itself as a neutral "Switzerland" in the tech stack, integrating components from partners like Nvidia and Intel.

3/ While Michael Dell remains optimistic about AI’s explosive growth potential, challenges loom. The current AI investment boom may result in excesses or overestimations of demand, potentially leading to a correction. However, Dell believes the market is at the early stages of a hockey-stick growth curve, and his company's strategic infrastructure focus places it at the center of AI’s future. Whether AI fully meets its promises or not, Dell's four decades of preparation leave the company well-positioned to benefit from the next wave of technological transformation. LINK

🍎 Apple doing Apple things

1/ Apple’s strategy to shift toward in-house modem and wireless chip development reflects its long-term goal of increasing control over its ecosystem. By designing its own modem and wireless components, Apple aims to tightly integrate these technologies with its custom processors, improving efficiency, reducing dependency on external suppliers, and enabling thinner, more energy-efficient designs across its product lineup. This move aligns with its broader strategy to differentiate its hardware offerings, such as future slimmer iPhones, cellular-enabled Macs, and enhanced wearables like headsets and augmented reality devices.

2/ This vertical integration allows Apple to optimize performance and enhance user experiences, particularly through innovations like better power management, improved connectivity, and advanced features such as dual SIM standby and satellite support. These changes are expected to position Apple as a leader in integrating hardware and software, providing a unique edge in the competitive tech landscape.

3/ From a competitive standpoint, Apple's initiative secures its independence from rivals and ensures long-term technological advantage. The rollout plan, starting with mid-tier products like the iPhone SE and gradually scaling to flagship devices, minimizes risks and allows iterative improvements. While initial versions of Apple's modem may not match Qualcomm’s latest capabilities, the company's focus on iterative advancements through 2027 signals its intent to surpass competitors in connectivity performance. LINK 1, LINK 2, LINK 3.