(#106) Top 10 most read articles in 2024

AI, German Auto Industry, META, Apple, Netflix, TikTok, SAP, Mario Draghi, Google, Revolut.

As we wrap up an exciting year of strategic insights and thought-provoking updates, I want to mark the moment by sharing the top 10 most-read updates from the #onStrategy newsletter.

You might find insights and inspiration for your life and career.

Enjoy it!

1. Nobels for AI

Geoffrey E. Hinton (from the University of Toronto, Canada) won the Nobel in physics “for foundational discoveries and inventions that enable machine learning with artificial neural networks”.

Demis Hassabis (co-founder of Google DeepMind) & John Jumper (DeepMind Research Director) were awarded the Nobel Prize in Chemistry for “their work developing AlphaFold, a groundbreaking AI system that predicts the 3D structure of proteins from their amino acid sequences”.

From DeepMind’s press release:

“[...] Before AlphaFold, predicting the structure of a protein was a complex and time-consuming process.

AlphaFold’s predictions, made freely available through the AlphaFold Protein Structure Database, have given more than 2 million scientists and researchers from 190 countries a powerful tool for making new discoveries. The AlphaFold 2 paper, published in 2021, remains one of the most-cited publications of all time.

AlphaFold’s contributions to science have been widely praised, and among its recognitions are the 2023 Albert Lasker Basic Medical Research Award, the 2023

Breakthrough Prize in Life Sciences, the 2023 Canada Gairdner International Award, the 2024 Clarivate Citation Laureate award, and the 2024 Keio Medical Science Prize Award. [...]

Congrats and well done! Physics. DeepMind

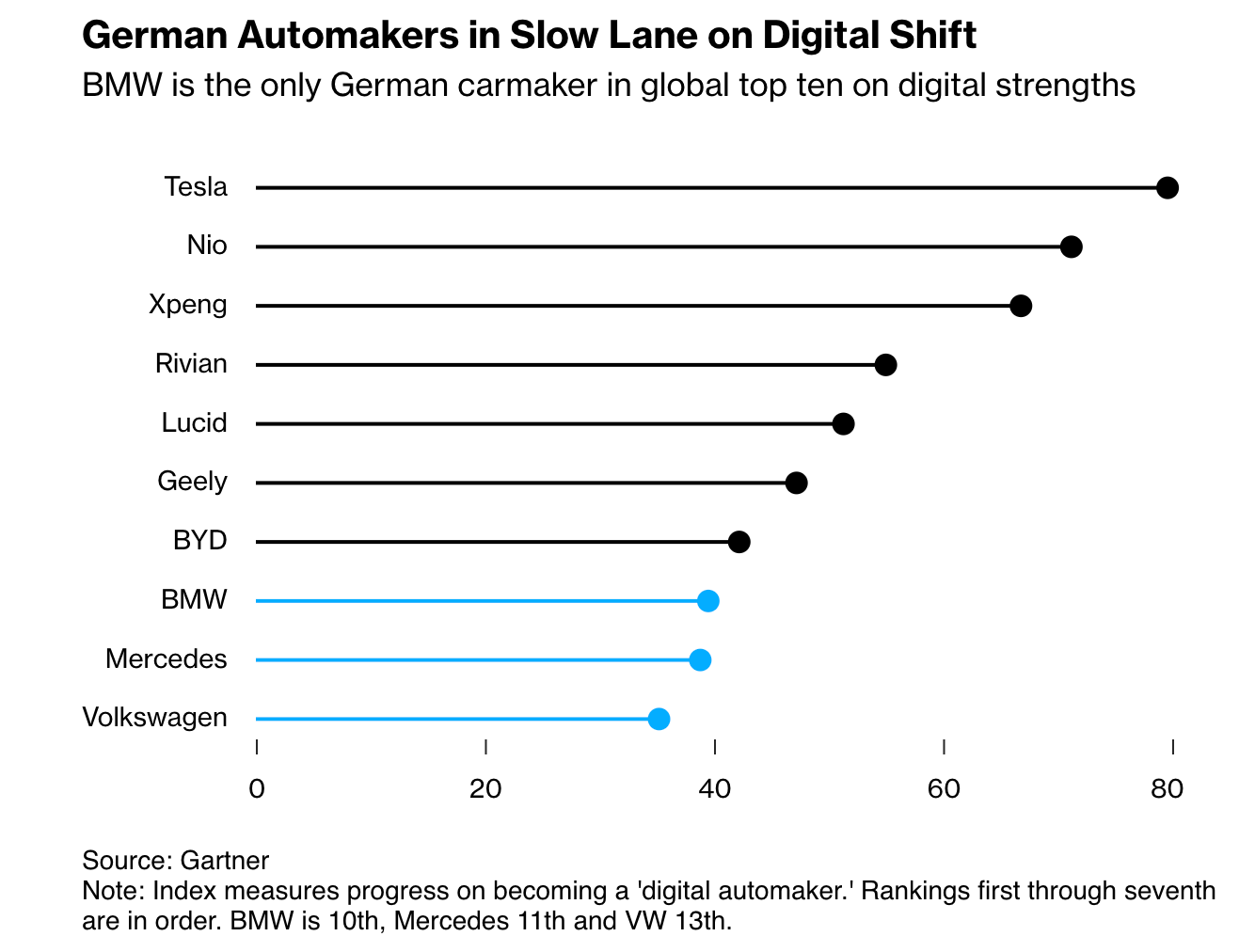

2. German Auto Tragedy in China.

Maybe the best conclusion is the quote from the article:

“Zhou, an IT engineer living in Wuhan, had to endure the frustration after buying an ID.4 in early 2022. With screens going black several times in the middle of driving, he got glitches instead of German quality. Updates were also regularly behind schedule or available only via the dealer.

He’s now seeking a replacement. It will be another EV, but this time “I won’t visit any German dealerships,” he said. “I’ll only go for local brands, or Tesla.”

Here is what Europe needs to do:

1/ Develop its software on open source. When not possible, partner with American companies (e.g. VW with Rivian)

2/ Integrate vertically

3/ Develop battery technology

4/ Move away from relying on Chinese tech and raw materials.

5/ Time to understand that consumers have less money. Chinese consumers now prioritize technological innovation, digital features, and affordability over traditional selling points like horsepower and brand prestige. This will become a global trend.

3. Google’s dominance in the search market is slowly coming to an end

There are several reasons for this slow, but real, decline:

1/ TikTok has entered the search advertising market by allowing brands to target ads based on users’ search queries, posing a direct challenge to Google’s core business. With TikTok’s daily search volume surpassing three billion globally, it represents a growing threat, particularly among younger users. This shift reflects a broader trend in which social platforms are becoming alternative search engines, especially for product discovery, as seen in a survey where almost 40% of Gen Z now use platforms like TikTok or Instagram for search instead of Google.

2/: Startups like Perplexity (which I also use), backed by Jeff Bezos, are leveraging AI to provide ad-supported search answers. This is a direct challenge to Google’s traditional model, as AI-driven search results prioritize user engagement through conversation-like responses rather than traditional links. AI-driven models such as Perplexity or Microsoft’s AI-powered Bing offer a more personalized user experience, which could erode Google’s dominance in the long term, as these systems provide tailored, high-quality search results.

3/ Google’s share of the U.S. search ad market is expected to fall below 50% for the first time in a decade, according to eMarketer. Meanwhile, Amazon, which now controls over 22% of the search ad market, continues to chip away at Google’s lead by offering product searches directly on its platform. This reflects a broader shift in search behavior, where e-commerce platforms are becoming primary search destinations for consumers, indicating that Google’s position as the go-to search engine is weakening.

4/ Google has begun integrating ads into AI-generated search results, signaling a shift in how search advertising works. By embedding ads directly into AI summaries, Google is attempting to maintain its dominance, but this model faces challenges. Users may be less likely to click on AI-generated ads compared to traditional search ads, raising questions about whether this model will be as profitable. A New Street Research survey suggests that while 60% of U.S. consumers use AI chatbots for product research, their interaction with ads in AI-generated results may not match the effectiveness of traditional ads. LINK

4. Netflix won the streaming wars

Netflix’s turnaround strategy will probably be a Harvard case study at some point. Financial Times had a long piece on this, but here is where I think I made a difference:

1/ Netflix's swift response to the 2022 subscriber loss crisis, including password sharing crackdowns and introducing an ad-supported tier, demonstrated agile leadership and resulted in substantial subscriber growth and stock price recovery.

2/ By capping its content budget and leveraging the "Netflix effect" on licensed shows, the company optimized its content strategy, maintaining growth even during industry strikes and reducing dependence on expensive original productions. Some of the productions moved to cheaper places…like Europe and Asia.

3/ Netflix's tech-savvy leadership, exemplified by Greg Peters, enabled rapid implementation of new initiatives like password sharing controls and building an in-house advertising platform in record time, outpacing traditional media competitors.

4/ Netflix solidified its position as the leading streaming service, capturing 8.4% of US screen time compared to its nearest rival's 4.8%, while expanding into new areas like live events and sports to maintain its competitive edge.

5/ While Hollywood studios struggle with profitability in streaming, Netflix has demonstrated superior financial performance, allowing it to invest in strategic initiatives and maintain its market leadership position.

A strategy well executed. Chapeau bas! LINK

5. Apple’s new plan: take over your house

Having failed with Apple Car, Vision Pro, and other initiatives Apple has realized that they focus on the place where the smartphone is not a leading product: the house.

Here is their plan, according to Mark Gurman from Bloomberg:

1/ Apple aims to dominate the smart home market by integrating its devices and software throughout the home. This involves developing a new homeOS operating system and introducing smart displays that can act as affordable, multi-functional screens for streaming, videoconferencing, and managing household tasks. The goal is to provide a seamless experience across various Apple devices, similar to how its ecosystem works for personal devices like iPhones and MacBooks.

2/ A significant aspect of Apple's smart home strategy is the use of AI through its new Apple Intelligence platform. This platform will enhance automation, allow precise control of home devices, and offer advanced features like recognizing individuals interacting with the system. The integration of AI is meant to boost the functionality of Apple’s smart home products, making them more responsive and intuitive.

3/ To better compete with Amazon and Google, Apple plans to ensure compatibility with other brands' smart home accessories through the Matter protocol. This strategic shift from a closed ecosystem to one that supports multiple platforms is crucial for expanding Apple’s footprint in the smart home market, offering users more flexibility and encouraging broader adoption of its smart home solutions. LINK

6. TikTok is helping its creators to manufacture their own products

Why? Well, at least three reasons:

1/ TikTok is expanding its role from being just a content-sharing platform to becoming a full-fledged e-commerce player. By helping creators develop and sell their own products, TikTok is positioning itself as a key player in the growing creator economy, allowing it to capture more value from the massive creator-led content market.

2/ By providing creators with tools to build their own brands and revenue streams, TikTok fosters deeper loyalty within its creator community. Offering product development services and e-commerce infrastructure enhances the platform’s value proposition, making creators more dependent on TikTok not just for exposure but also for monetization. This could help TikTok compete more effectively with other platforms like Instagram and YouTube, which are also vying for top creators.

3/ Social commerce, where products are sold directly via social media platforms, has been growing rapidly. TikTok has seen success with its e-commerce initiatives, particularly in China through its sister app Douyin. By replicating this strategy in other markets, TikTok is capitalizing on its entertainment-driven user base to drive product sales, which is a natural progression from its content-first approach.

4/ Finally, the more the app is interconnected with the West the harder will be to ban it. LINK

7. Financial Times: “Europe can still birth the occasional unicorn”

Europe struggles to produce more unicorns for several reasons, beyond the financial cycles and current market trends:

1/Unlike the U.S. or China, Europe is not a single, unified market. The continent is divided by different languages, regulatory frameworks, and cultures, making it harder for startups to scale quickly. While the European Union provides some level of integration, each country still has unique business environments and consumer behaviors, which slows down the growth potential for startups compared to their U.S. or Chinese counterparts.

2/ European venture capital tends to be more conservative compared to the U.S., where investors are more willing to fund high-risk, high-reward ventures. European investors often prioritize profitability and sustainability over rapid scaling, which can stifle startups that require large amounts of capital to achieve unicorn status. This cautious approach limits the opportunities for rapid valuation growth.

3/ While Europe has strong sectors like fintech (e.g., Revolut and Monzo), it lags in other high-growth areas such as artificial intelligence, biotech, and e-commerce. These sectors have produced numerous unicorns in the U.S. and China, where innovation ecosystems are better supported by governments, private investment, and academic institutions. Europe's less aggressive focus on these cutting-edge technologies has limited its ability to create a broader range of unicorns. LINK

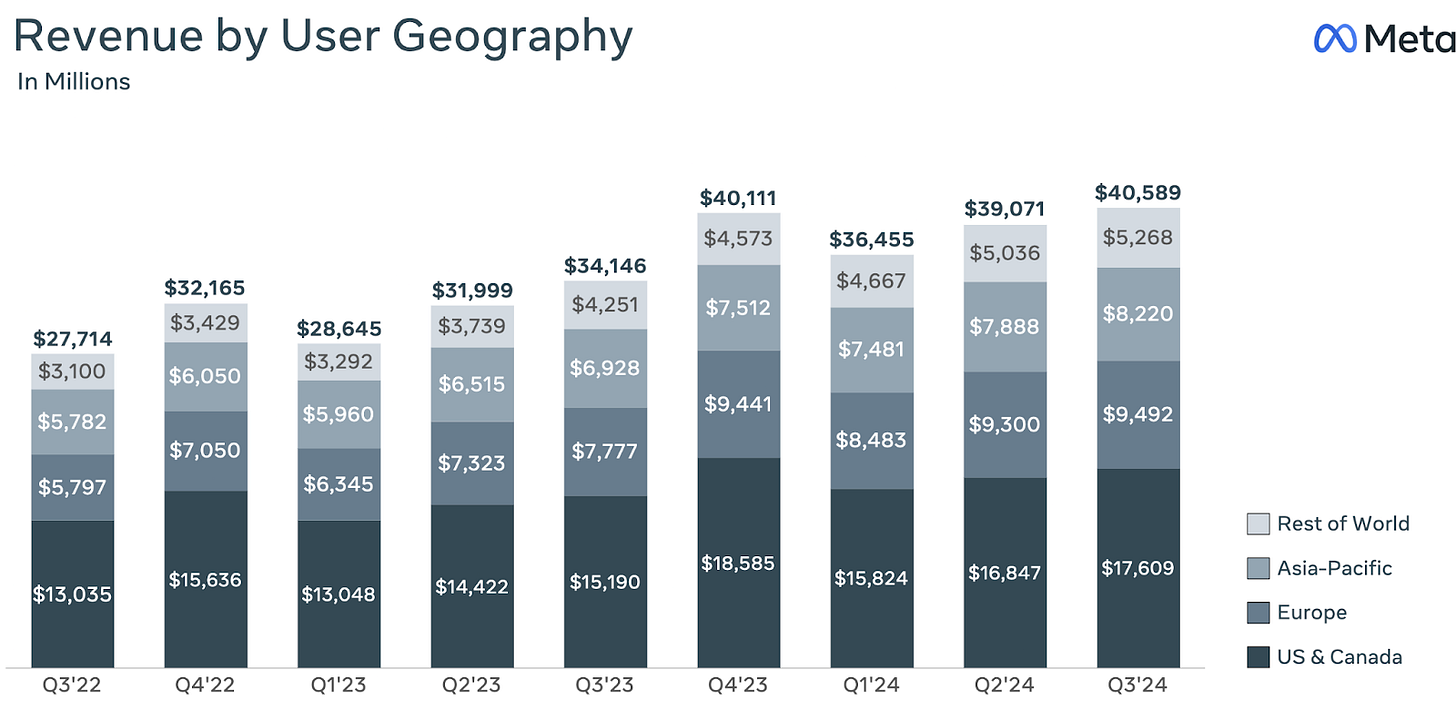

8. Meta is one of the two winners in the Social Media space

META and TikTok won the Social Media wars. So, that’s I follow up on META regularly. Here are some ideas after their latest earning reports:

1/ Meta’s Q3 2024 results showed solid performance, with revenue up by 19% and net income increasing by 35%. However, CEO Mark Zuckerberg emphasized that Meta’s significant investments in AI infrastructure would intensify in 2025, leading to rising capital expenditures (a pessimist sign to investors). This commitment reflects Meta’s strategy to use AI as a core enhancer of its advertising and content feed capabilities. While the increased spending on AI infrastructure may worry investors, Zuckerberg’s focus indicates a long-term vision to maintain a competitive advantage in personalized content and advertising, areas critical to Meta’s core business.

2/ Meta’s Reality Labs division, which oversees virtual and augmented reality initiatives, continues to post substantial losses. Despite these challenges, the company is determined to pursue its metaverse ambitions, including products like Ray-Ban Meta smart glasses. Meta’s commitment to Reality Labs, despite its financial burden, suggests a strategy to establish an early foothold in immersive technologies. While these efforts have yet to yield profits, they align with Zuckerberg's vision of future social interaction, though they require investor patience as the returns may only materialize in the long run. I remain skeptical.

3/ Meta is working on consolidating its recommendation models across different products, inspired by the scaling benefits observed in large language models. By using a unified model for video and other content recommendations, Meta aims to improve engagement and reduce operating costs, thanks to better data-driven insights. This strategic move supports Meta’s shift from a network-based content approach to a broader, cross-platform content recommendation system, positioning it better against competitors like TikTok. Over time, this can enhance user retention and ad revenue by delivering more relevant content efficiently.

Overall, I remain LONG on META. LINK

9. SAP has a new moat

SAP has one of the greatest moats ever: companies already paid millions of dollars for their software Now the trend is changing. Here are three insights:

1/ SAP’s cloud revenue has surged from €6 billion to €16 billion over the last five years, achieving a 20% CAGR. This rapid growth has transformed cloud into the dominant revenue source, now comprising half of SAP’s total revenue compared to just a quarter in 2019. This shift highlights SAP’s successful transition to cloud services, aligning with broader market trends toward subscription-based and scalable solutions over traditional software models.

2/ While cloud revenue has increased significantly, the traditional software license and support revenue has declined as a percentage of total revenue (from 60% in 2019 to 39% currently). This business model provides more predictable and stable cash flows, which is a shift attractive to investors as it may reduce revenue volatility over time.

3/ The services segment, which now represents only 13% of total revenue, has shown minimal growth relative to cloud and software. This may indicate SAP’s strategic prioritization of high-margin software and cloud services over lower-margin services., which of course tells one thing: the company is focusing where it creates value.

All American companies are trying to disrupt SAP. We’ll see. LINK

10. Mario Draghi on EU’s future

If someone understands Europe’s problems for sure that one is Mario Draghi. In his 328-page reports, he shows exactly what’s wrong with the EU: overregulation, disastrous ‘green’ plans, high energy prices, lack of common policies on many things, etc. He points clearly that at the core of the EU’s problems is Germany and its business model.

Just a reminder, Germany's business models rely on cheap energy from Russia, cheap workforce from Eastern Europe, and exports (mainly to China). This model is flawed from all points of view.

Here is what I wrote in June after hearing him at the EFMD Annual Conference in June 2024, in Bologna, Italy:

“1/ Europe must concentrate on three main areas to become competitive: defense industry consolidation, economic change, and expansion preparedness. To improve competitiveness, a significant shift in economic policy should be emphasized in the European mandate for the next five years. This entails strengthening investments in infrastructure and research and development (R&D) as well as defending the European market without resorting to isolationism. It also entails completing the single energy market to guarantee accessible, carbon-free energy. These steps are essential to fending off the US Inflation Reduction Act and China's aggressive industrial policies, both of which have damaged Europe's standing in the global economy.

2/ Second, to handle present issues, Europe has to modernize its defense sector. Past efforts to forge a cohesive European defense have fallen short, leaving the continent with disparate and inadequate defense capabilities. The difficulties in providing military assistance to Ukraine highlight the need for improved coordination and expanded manufacturing capabilities within the European defense industry. This does not imply creating a single army but rather strengthening ties between European nations to effectively supply and manufacture military hardware, guaranteeing a prompt reaction to new threats.

3/ Finally, Europe has to ensure security and stability along its borders to be ready for future EU expansion. To do this and keep the single market's advantages while accommodating new member states, the EU will need to undergo substantial budgetary and governance changes. It will be important to implement the reforms recommended in forthcoming assessments on the single market and European competitiveness. In addition, utilizing private funding, public-private partnerships, and bolstering EU resources through customs duties and taxes will help secure the budget required to support ambitious projects, ranging from the reconstruction of Ukraine to the development of artificial intelligence and low-carbon technologies.”

Three hours after the report came out Germany said that it opposed it. It would not end well for Germany. This is what I wrote in Newsletter #89:

“If Germany goes then it will be together with Austria, Hungary, Slovakia, and maybe the Netherlands. Those who will be somehow fine: Poland, Romania, and Turkey.”

There are only two options for the EU: (1) business as usual where Germany has superpowers and (b) new Europe with less power for Germany. We’ll see how Italy and France will play option #2, but overall the party is over.

Everyone in the EU has to change. Report, EFMD, Rejection

The feedback from the readers for my newest book has been amazing…so far 🙃

Through 28 chapters I covered three parts: (1) Strategy, (2) Innovation & Growth, and (3) Generative AI.

See a full sample - the chapter on Network Effects. - click HERE

More about the book:

Buy it as an e-book: https://book.onstrategy.eu

Buy a hardcopy on EMAG

Buy it for your Kindle on Amazon