(#113) Costco isn’t just a retailer; Has BYD outsold Tesla in the EU?

Central and Eastern Europe will be the future of the EU

Greetings from the 🇺🇸

I am at Kansas State University to make a university agreement, so I also had to chance to explore and engage in the American ecosystem. What you will find in this newsletter:

1/ Costco isn’t just a retailer

2/ The Economist: “Germany’s “business model is gone”, warns Friedrich Merz”

3/ Three observations from Sam Altman

4/ Central and Eastern Europe will be the future of the EU

5/ Is BYD outselling Tesla?

6/ Chestnut Carbon gets $160M to turn old farms into forests

Onto the update:

Costco isn’t just a retailer, it’s a subscription-based efficiency machine that thrives on scale, trust, and disciplined execution

Costco’s success is built on a disciplined, counterintuitive strategy that maximizes customer loyalty, operational efficiency, and pricing power. Here’s how:

1/ Pay to Enter – Membership fees create a recurring revenue moat, ensuring that profits come from dues rather than inflated product margins.

2/ Employees get a living wage – Higher wages result in lower turnover, better customer service, and increased productivity, reinforcing Costco’s efficiency edge.

3/ High trust – A relentless focus on quality and transparency builds customer loyalty, making Costco one of the most trusted retailers.

4/ Get caught doing shady s*** and your membership will be revoked – Strict enforcement of policies (from resale bans to misuse of perks) maintains fairness and enhances exclusivity.

5/ Extreme efficiency – Limited SKU selection, no-frills warehouses, and bulk sales drive unbeatable cost advantages.

6/ Loss leaders drive traffic – Iconic items like the $1.50 hot dog combo and rotisserie chicken keep members coming back.

7/ Private label power – Kirkland Signature delivers premium quality at unbeatable prices, strengthening Costco’s pricing power.

8/ Relentless margin discipline – Costco caps markups at 14% on most items, reinforcing its customer-first reputation.

9/ Strategic real estate – Owning rather than renting many locations reduces overhead costs and long-term liabilities.

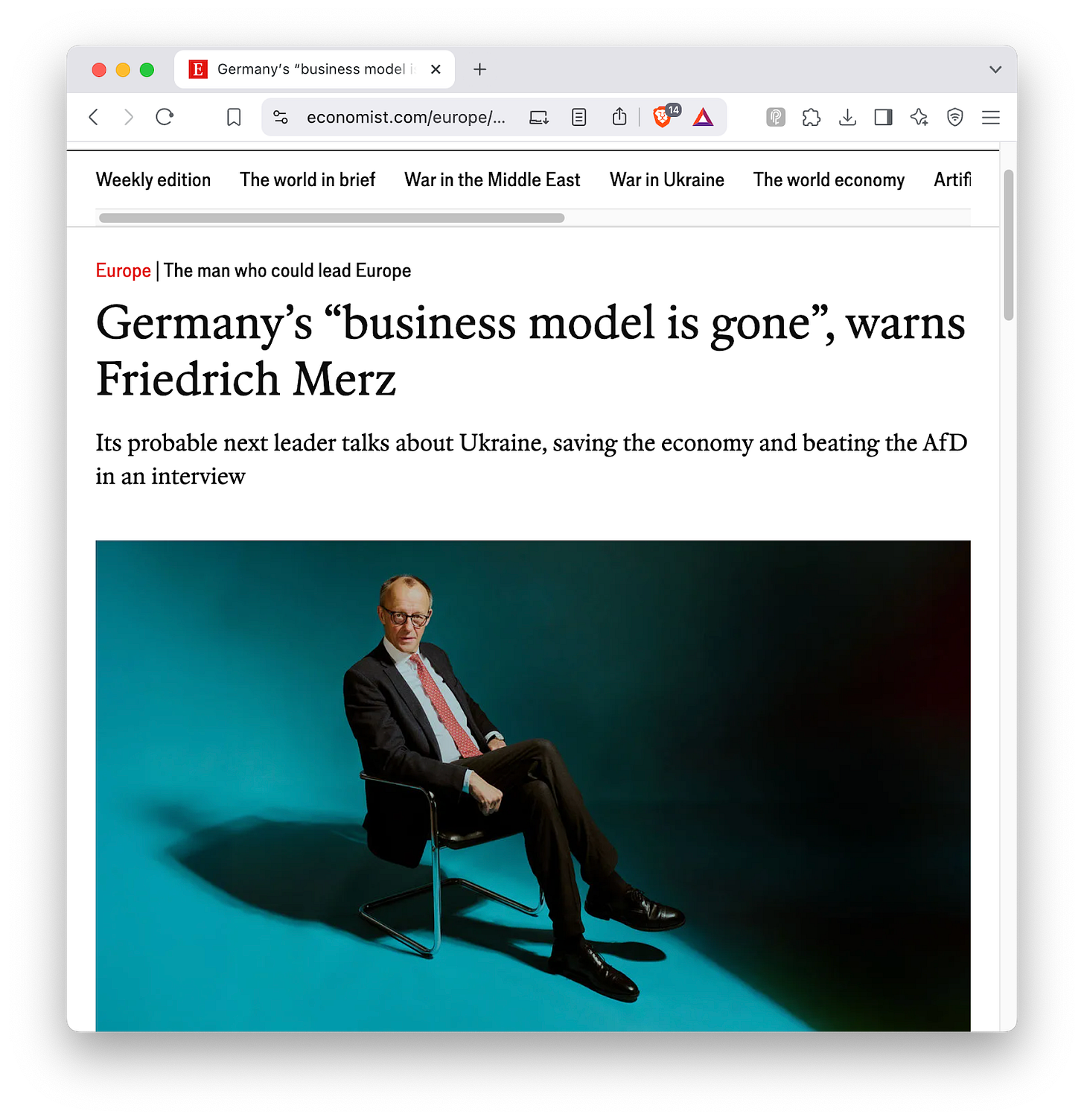

The Economist: “Germany’s “business model is gone”, warns Friedrich Merz”

1/ Merz declares Germany’s economic model “gone” but offers few radical solutions

Friedrich Merz is blunt: Germany’s traditional business model - export-driven, energy-intensive, and bureaucracy-heavy - is unsustainable. Germany’s “business model is gone”, warns Friedrich Merz. He advocates cutting red tape, slashing benefits, and investing in gas power plants, but stops short of proposing major structural overhauls. The reality? Germany’s economic stagnation - two years of recession - won’t be solved with incrementalism. While Merz acknowledges the need for reform, his approach lacks the urgency and depth that Germany’s economic crisis demands.

2/ Merz wants a stronger Europe but rejects deeper fiscal integration

Merz positions himself as a pro-European leader, supporting defense cooperation with France and Poland and AI investments to compete with China and the US. Yet, he firmly rejects joint EU borrowing for defense spending, calling it a non-starter. This highlights a contradiction: he wants Germany to lead in Europe, but not at the cost of greater financial commitments. His strategy may reinforce Germany’s reputation as an unreliable partner in European economic and defense policy.

3/ Germany’s economic revival hinges on energy, but Merz is hedging his bets

Merz acknowledges Germany’s energy policy failures, particularly after its premature nuclear phase-out, but his solution - 50 new gas power plants and long-term US LNG contracts - suggests a short-term fix rather than a long-term strategy. He remains open to revisiting nuclear energy, but stops short of committing to it. Without a clear stance on how Germany will secure competitive, low-cost energy, his economic revival plan remains half-formed, risking Germany’s industrial competitiveness in the face of global protectionism and high energy costs. LINK

I have written many times about Germany (#62, #89, #102, #106, etc.), and I am skeptical of what the future chancellor proposes.

3 observations from Sam Altman

In his last blog post, Sam Altman laid out his plan for GPT releases and optimisation:

1/ AI’s intelligence scales predictably, and investment won’t slow down

The intelligence of AI models grows logarithmically with compute, data, and training resources. More investment equals more predictable improvements.

With AI costs dropping 10x every year, usage will explode, just like we saw with GPT-4o. This kind of acceleration makes Moore’s Law look slow and ensures that AI investment will keep climbing at an exponential rate.

2/ AI agents are the next frontier, and they will reshape knowledge work

AI won’t just be a tool, it will be a virtual coworker. Imagine millions of junior-level AI engineers, analysts, and researchers working alongside humans.

The shift won’t be instant, but it will be impossible to ignore. Just like transistors became embedded in everything, AI will become an expected layer of intelligence in all industries.

3/ The economic shift will be massive, but power dynamics must be addressed

AI will lower the cost of intelligence and make many goods cheaper, but luxury goods and scarce resources like land may skyrocket.

The balance of capital vs. labor could be disrupted. Altman suggests radical solutions like giving everyone access to AI compute, ensuring that AGI benefits are distributed widely, not just concentrated among the wealthy. LINK

Anyway, GPT 4.5 will be launched soon and GPT 5 coming this year too.

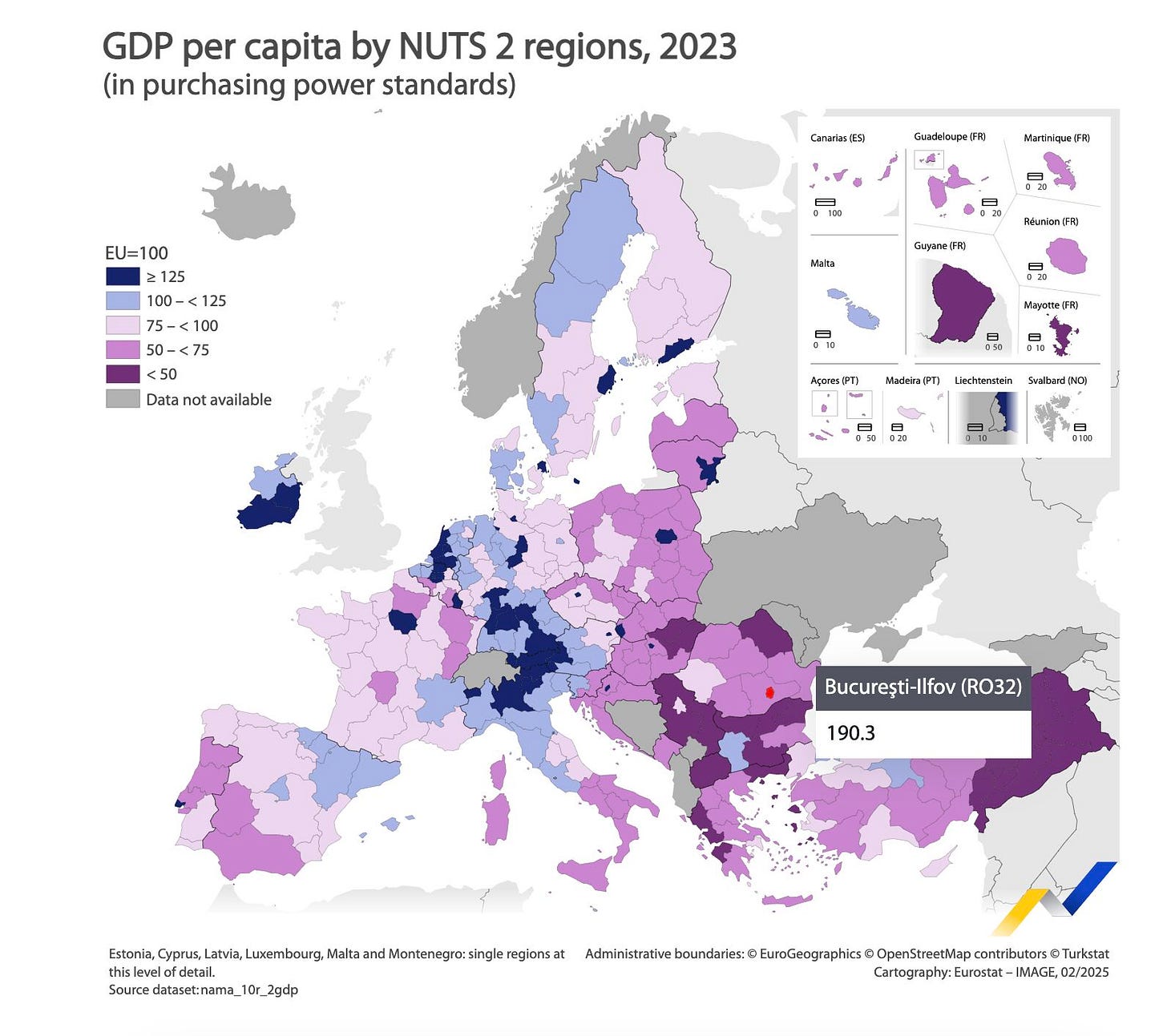

Central and Eastern Europe will be the future of the EU

Two interesting insights (for me) from this report:

1/ Ilfov - Bucharest region 🇷🇴 is now 3rd in the 🇪🇺 after Prague and Bruxelles Capitale/Brussels Hoofdstedelijk Gewest in terms of GDP per capita. (we need to exclude 'anomalies' like Luxemburg or anything coming out of Ireland)

2/ The Ilfov - Bucharest region has a GDP of bn EUR 95.5 bn in 2023 higher than Bulgaria's GDP (EUR 94.7 bn).

Looking forward to seeing this chart updated for 2024. LINK

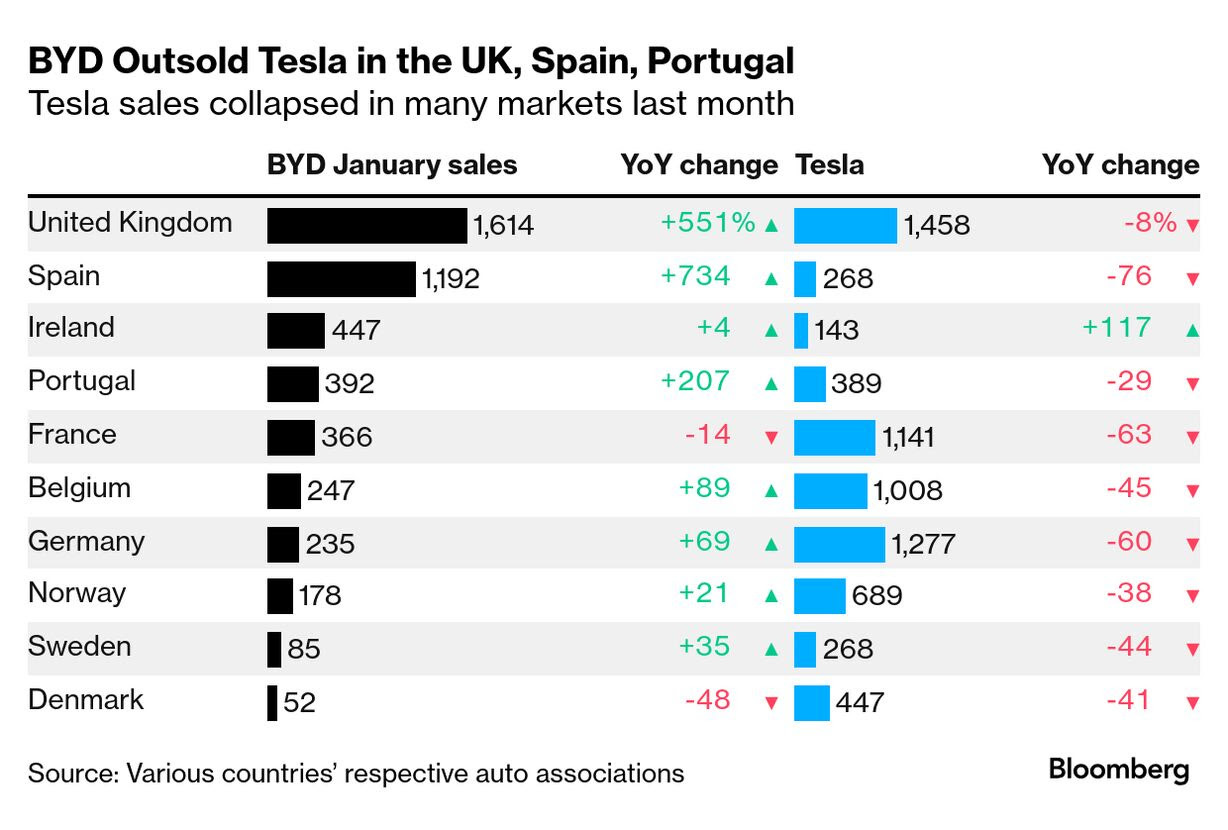

Is BYD outselling Tesla?

Some ideas:

1/ Showing the sales in one month is not relevant

2/ Europe is getting poorer, so it’s normal to buy cheap cars. FYI: the top ICE car sold in the EU is Sandero from Dacia.

3/ BYD is subsidized at the entire supply chain: mining & refining, battery production, EV competent manufacturing, vehicle assembly, export & global expansion support.

The result: an unmatched cost advantage. BYD isn’t just subsidized, it’s engineered for dominance. LINK

Chestnut Carbon gets $160M to turn old farms into forests

Three key Insights on the growing trend in the carbon business:

1/ Reforestation as a Carbon Asset Class is becoming institutionalized

Chestnut Carbon’s $160 million funding round, backed by institutional investors like the Canada Pension Plan Investment Board and DBL Partners, signals that carbon sequestration is no longer just a corporate offset tool, but it’s an investable asset class. By buying degraded farmland and converting it into forests, Chestnut is positioning itself at the intersection of land restoration and carbon finance, where nature-based solutions are gaining credibility as long-term climate investments.

2/ Big tech is fueling the demand for high-quality carbon credits

Microsoft’s 25-year deal for 7 million carbon credits from Chestnut demonstrates a major trend: the AI-driven energy boom is accelerating corporate demand for offsets. As data centers expand and energy consumption rises, companies like Microsoft, Google, and Meta are turning to certified carbon removal projects to balance their emissions. The race for high-quality credits, those with long-term permanence and verifiable impact, is intensifying, giving companies like Chestnut a clear market advantage.

3/ Scaling carbon removal is still a numbers game, and forests alone won’t cut it

While Chestnut’s goal of 100 million metric tons of carbon sequestration by 2030 sounds impressive, it represents less than 0.3% of annual global emissions. Reforestation is one piece of the puzzle, but scaling carbon removal to climate-relevant levels will require diversifying beyond forests, into direct air capture, soil carbon storage, and ocean-based sequestration. The challenge isn’t just planting trees; it’s ensuring the permanence, scalability, and economic viability of carbon removal solutions in a market that is still evolving. LINK

I just launched my book on strategy:

Through 28 chapters I covered three parts: (1) Strategy, (2) Innovation & Growth, and (3) Generative AI.

See a full sample - the chapter on Network Effects. - click HERE

But the E-Book:

https://book.onstrategy.eu