(#117) 🍎 Boring Apple; 🚙 Tesla suffers. A lot.

Amazon is building AI Agents in-house

Dear #onStrategy reader,

Here is what you’ll find in this edition:

Boring Apple

Manus AI is not Deepseek

Amazon is building AI Agents in-house

Tesla suffers. A lot.

Onto the update:

Boring Apple

What’s happening with the innovation at Apple?

1/ Incrementalism as a Strategy

Apple announcing a “new” iPad Air, MacBook Air and other products is predictable, boring, and somehow also perfect. Look, Apple is very good at this game: they’ve turned the minor product refresh into a carefully orchestrated event. You add a slightly better screen, a marginally improved chip, and call it innovation. Investors clap, analysts nod, and customers line up, vaguely satisfied that they got something new. The risk, of course, is that at some point customers realize they’re buying a nicer case and slightly brighter screen, not a revolutionary leap forward.

2/ Tim Cook’s Apple is playing it safe, maybe too safe.

Apple has mastered the art of incrementalism. The new iPad Air looks great, sleek, elegant, predictably competent, but it’s also exactly what you’d expect. And the real innovation story isn’t hardware anymore; it’s software, services, and AI - areas where Apple, awkwardly, is still playing catch-up. Cook tweets about incremental updates while OpenAI, Google, and Amazon race past Apple in AI-driven experiences. In other words, Apple’s incrementalism might maintain revenue today, but it isn’t setting them up for tomorrow.

3/ Hardware is easy, relatively speaking…just look at Apple’s nice keyboard. But the thing that’s hard, apparently, is turning Siri into something that’s actually useful. And on that front, Apple is embarrassingly behind. So yes, enjoy your new iPad Air….it’s beautiful, thin, and predictably elegant. But as Apple struggles to deliver a real AI-powered Siri by 2027 (!), it’s hard not to wonder: when will customers start asking for more than a shiny slab of aluminum? Apple might find out sooner than it thinks.

…and 2 years in “AI years” is a looooot. AirPad, MacBook Air

Manus AI is not Deepseek

1/ Manus AI is making headlines, but here’s the thing: they’re not building the foundation, they’re building on top of it. And that’s where all the attention is shifting - the application layer. The infrastructure race (training massive models) is expensive, slow, and dominated by a few players. The real action? It’s in who can build something useful on top of those models, fast.

2/ But that also means Manus AI might not matter in a year. Application companies come and go because they depend on underlying platforms they don’t control. If they win, they scale fast. If they lose, they vanish just as quickly. Unlike DeepSeek, which is an AI lab focused on pushing the science forward, Manus AI is playing in a space where differentiation is razor-thin and competition is brutal.

3/ The lesson? Bet on the infrastructure or be prepared to sprint in the application layer. The future of AI won’t be won by just building better models, but it’ll be about who turns those models into something people actually need. Manus AI has its shot. But like many before them, their biggest challenge isn’t getting attention…it’s keeping it. LINK

Microfost goes full-on internal AI

Three ideas on this topic:

1/ Microsoft is playing the long game. Despite pouring $14 billion into OpenAI, it’s clear that being a big investor doesn’t mean getting a front-row seat to the technology. OpenAI is keeping its best secrets locked away, and Microsoft doesn’t like being left in the dark. So, it’s doing what any ambitious company would do, that is building its own AI models. The MAI family of models is Microsoft’s answer to OpenAI’s dominance, a hedge against being just another customer in the AI revolution.

2/ But Microsoft isn’t just going solo. It’s diversifying. Testing models from xAI, Meta, Anthropic, and DeepSeek means it’s keeping its options open. A single-source supplier is a single point of failure. Microsoft knows this, and it’s making sure that Copilot, and every other AI-powered tool in its ecosystem, isn’t tied to a single technology provider. Control isn’t just about owning the tech, it’s about making sure no one else can pull the plug.

3/ And then there’s the talent. Microsoft isn’t just buying AI, it’s buying the people who build it. Bringing in DeepMind’s Mustafa Suleyman and others signals a shift: Microsoft doesn’t want to just integrate AI, it wants to lead. The future of AI won’t be about who invested the most. It’ll be about who built the best, fastest, and smartest. And Microsoft is making sure it’s in the race to win. LINK

Amazon is building AI Agents in-house

1/ The interesting thing about Amazon forming an “agentic AI” group inside AWS isn’t just about tech, it’s about where the company sees its next billions coming from. This new team, led by AWS executive Swami Sivasubramanian, aims to create AI systems that do things proactively, meaning you don’t even need to ask them. Forget talking to your Alexa; soon it might just do things without you ever saying a word. This matters because Amazon knows something crucial: the money in AI isn’t just in answering your questions, but in quietly becoming indispensable.

2/ But also: it’s funny how Amazon frames this. They talk about automating our lives (like scheduling, purchasing, managing), yet quietly omit that this might also mean Amazon is automating our buying habits. Alexa+, agentic AI, all this automation, it sounds convenient until you remember the classic Amazon playbook: once Amazon automates something, they own the relationship. So sure, “agentic AI” will do your grocery shopping, but who decides which groceries? Probably Amazon. The broader implication here? AI is the new battleground not just for technology but for market control, and Amazon intends to set the rules. LINK

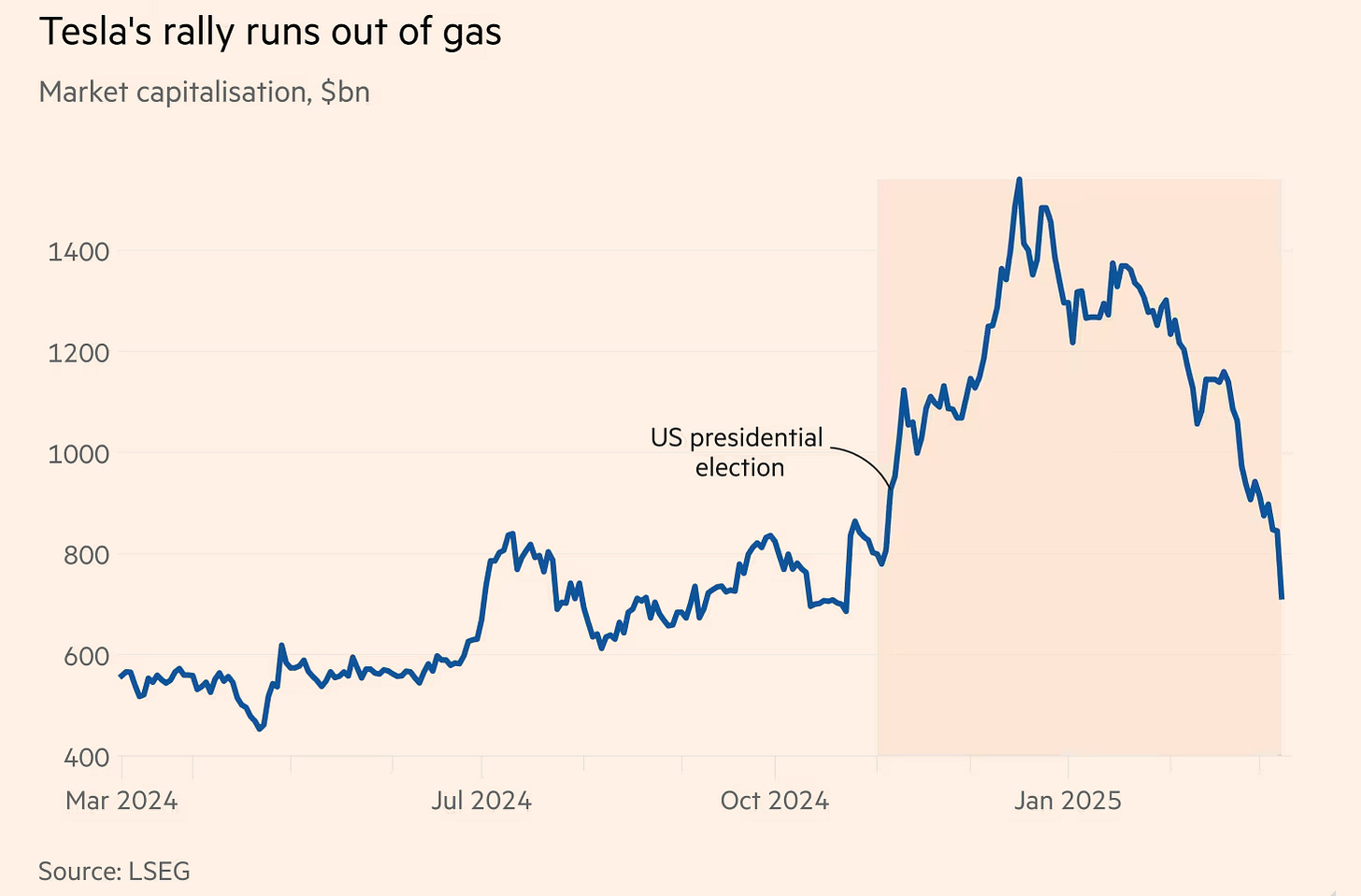

Tesla suffers. A lot.

1/ Tesla stock isn’t crashing because Tesla suddenly forgot how to make cars. it’s crashing because Elon Musk’s personal credibility has evaporated. Investors used to price Tesla like a “moonshot,” a bet on Musk’s futuristic promises. But lately, every Musk promise (self-driving cars, humanoid robots, even Tesla’s sales forecasts) has looked increasingly implausible. This matters because Tesla’s value was always about Musk’s credibility as much as it was about selling cars, and credibility isn’t something you easily rebuild once it’s gone.

2/ But the real issue might be even simpler: Musk became a political figure, and politics is a terrible business model. Tesla sales in Europe and China have cratered, and production issues are piling up, problems that political antics and extravagant promises won’t solve. Elon Musk has inadvertently shown the world that you can’t run a trillion-dollar company like a Twitter account, at least not without consequences. Tesla’s stock is down over 50%, not because the cars got worse, but because investors realized that Musk might actually mean what he tweets and they’re not thrilled with that reality. LINK

I just launched my book on strategy:

Through 28 chapters, I covered three parts: (1) Strategy, (2) Innovation & Growth, and (3) Generative AI.

See a full sample - the chapter on Network Effects. - click HERE