(#119) 🧑🎨 Chat GPT “Ghibli Studio” mania; 🚙 Is Waymo a good investment?

SAP has overtaken Novo Nordisk in market capitalization

Dear #onStrategy reader,

Here is what you’ll find in this edition:

Chat GPT “Ghibli Studio” mania

SAP has overtaken Novo Nordisk in market capitalization

Is Waymo a good investment?

BYD sales tops Tesla

On to the update:

Chat GPT “ghibli” mania

Open AI is again top of mind for most Gen AI users. Here are the insights and implications:

1/ Shift from Diffusion to Autoregression

OpenAI’s “Ghibli” mode represents a crucial architectural pivot from diffusion models, which start with noise and iteratively refine, to autoregressive models that predict images pixel-by-pixel. This is about control and precision. Diffusion gives originality, but autoregression gives iterative control, perfect for fine-tuning or transforming existing images.

2/ Practical use over raw capability

What matters here isn’t merely that OpenAI released powerful technology; it’s that they embedded it directly into ChatGPT, a tool already central to workflows. Unlike Google’s Gemini, which launched impressive tech without immediate practical integration, OpenAI prioritized accessibility, usability, and immediate user value. Tech is cool, but integrated products win.

3/ AI as an everyday creative companion

OpenAI is now “selling” a daily utility. Stylizing personal images in “Studio Ghibli” fashion isn’t just amusing; it demonstrates AI’s potential as a routine creative partner. By transforming everyday photos effortlessly, OpenAI positions AI not as abstract, futuristic tech, but as a commonplace creative tool everyone can (and will) use in it’s daily workfrom. Indeed, creativity remains one of the 4 pillars where Gen AI will thrive. LINK

SAP has overtaken Novo Nordisk in market capitalization

1/ Subscription beats Pills (eventually)

SAP’s surge past Novo Nordisk shows the enduring power of predictable, recurring revenue. Novo Nordisk rose fast on blockbuster drugs, but when trial data disappoints, pharma stocks tank quickly. In contrast, SAP’s steady climb was driven by subscription-based cloud services, a business model that’s boring, predictable, and apparently, extremely valuable. Investors like growth, but they love reliability even more.

2. AI as a strategic differentiator

SAP’s strategic bet on artificial intelligence is directly fueling their growth. Their market cap didn’t soar because they sold more software licenses, it grew because they shifted decisively to cloud and AI-driven offerings. SAP made a structural bet that aligned perfectly with investor expectations about where technology (and money) is heading. Novo Nordisk, meanwhile, faced the hard reality of biotech: a single failed trial can wipe billions off your valuation overnight. Reuters, WSJ.

Is Waymo a good investment?

Three ideas on this topic:

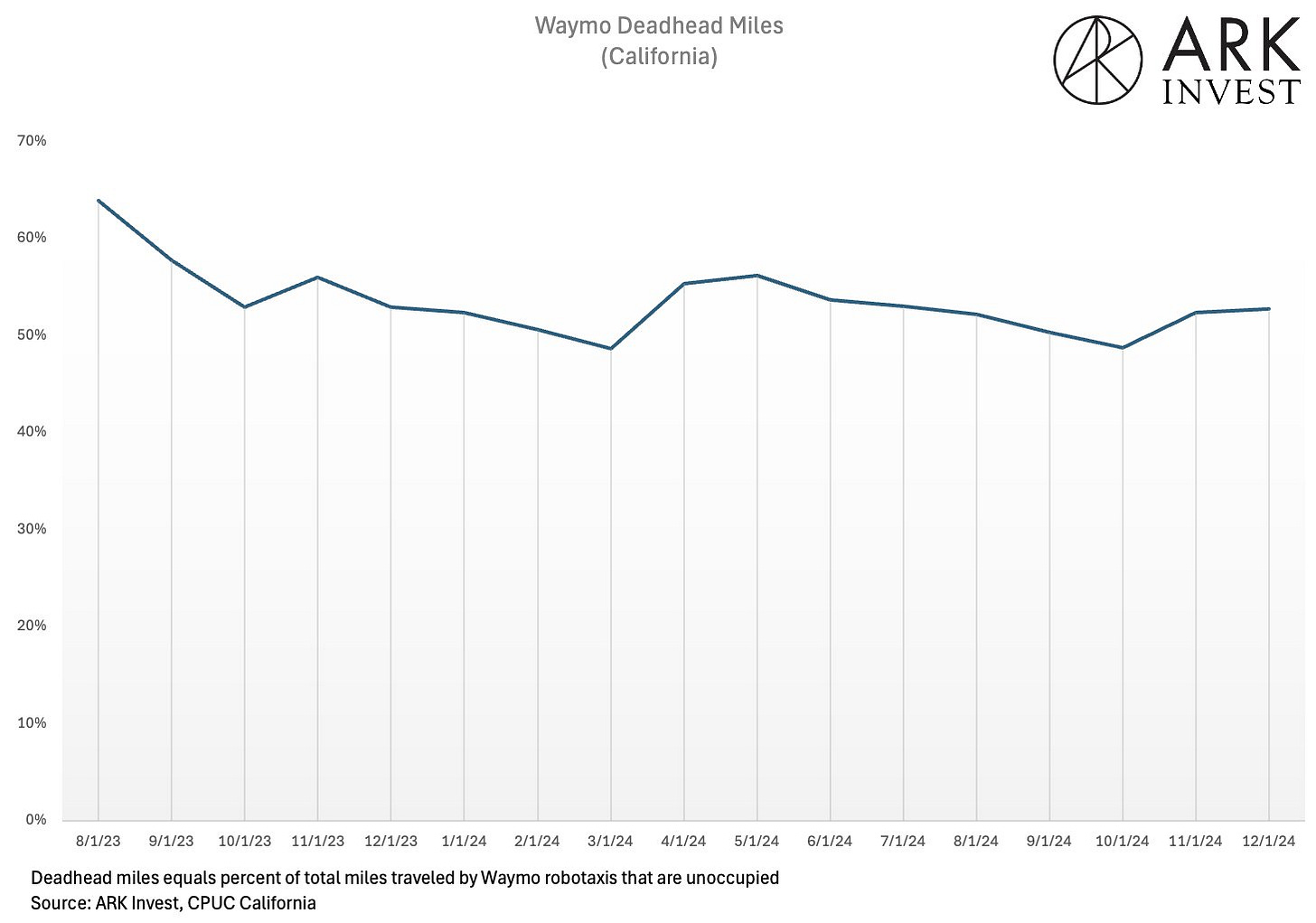

1/ Waymo’s struggle to expand its capacity significantly contributes to its asset underuse.

2/ If you oversupply vehicles to handle peak hours, you’ll see many sitting idle during quieter times. To avoid this, Waymo tends to undersupply. But this creates a different problem: insufficient reliability at peak times makes it tough to maintain steady demand, which is crucial for achieving the density needed to reduce empty trips through dynamic vehicle positioning.

3/ Ultimately, this leaves you with idle resources and higher service costs. Higher costs mean higher prices, which in turn discourages new users from entering the system, limiting your ability to reduce waiting times and empty vehicle miles.

So, the answer for the moment is NO.

Middle East’s UBER is pursuing a classic strategy

Well, this a classic strategy move:

1/ Careem’s CEO wants to turn the ride-hailing app into a “digital butler,” and yeah, that’s pretty classic as far as tech strategy goes. It’s the usual story: start by moving people around, then realize you can probably move other things too - food, groceries, money - and suddenly you’re not just a taxi service, you’re an “everything” service. This super-app ambition is a textbook strategy: deepen customer relationships and maximize lifetime value without endlessly chasing new geographies, which are messy and expensive anyway.

2/ But the real twist here, and where Careem is actually doing something clever, is that they’re positioning themselves as quality-focused service providers rather than just connecting customers with third-party sellers. Instead of being an impersonal platform (“We’re sorry your lemons didn’t arrive, that’s the grocery store’s fault”), Careem says, “If we promise five lemons, you’ll get five lemons.” They’re betting that reliability, accountability, and (maybe) a bit of hand-holding will beat generic convenience. That’s smart, but it’s also harder. So sure, the strategy is classic, but actually pulling it off might be the real trick here. LINK

BYD sales tops Tesla

1/ BYD’s growth isn’t subtle. They just passed Tesla in annual sales, hitting $107 billion. It turns out that consumers like cars that charge in five minutes, come loaded with tech, and don’t depend on the antics of one volatile CEO. BYD sells roughly as many pure EVs as Tesla, but if you toss in hybrids, and they’re on Ford’s heels, BYD is scaling fast and it’s starting to get awkward for everyone else in the EV market.

2/ BYD is basically doing Tesla, but better (or at least cheaper due to massive Chinese subsidies). Chairman Wang Chuanfu says BYD’s tech it’s leading. Tesla still has the bigger valuation (because Elon Musk and memes), but BYD owns the real-world battle in China and increasingly, the rest of Asia and Europe too. If you’re Tesla, that’s not great, because China isn’t just another market, it’s the biggest EV market in the world .

3/ The real strategy insight here? BYD’s succeeding because they’re boring, in a good way. They execute, they scale, and they innovate quietly. Unlike Tesla, they’re not endlessly promising robots, tunnels, or colonies on Mars. They just make good now, reliable electric vehicles at scale, which turns out to be exactly what customers want. Less hype, more cars, and $107 billion later, you have yourself the world’s biggest EV maker by revenue. Who knew? LINK

I just launched my book on strategy:

Through 28 chapters, I covered three parts: (1) Strategy, (2) Innovation & Growth, and (3) Generative AI.

See a full sample - the chapter on Network Effects. - click HERE