(#120) 🏆 Who are the 4 AI monopolies; 📱Case study: tariffs on the iPhone

Why Oracle is leading the “TikTok” bid

Dear #onStrategy reader,

Here is what you’ll find in this edition:

Who are the 4 AI monopoly companies?

Why Oracle is leading the “TikTok” bid

What not to tell Chat GPT

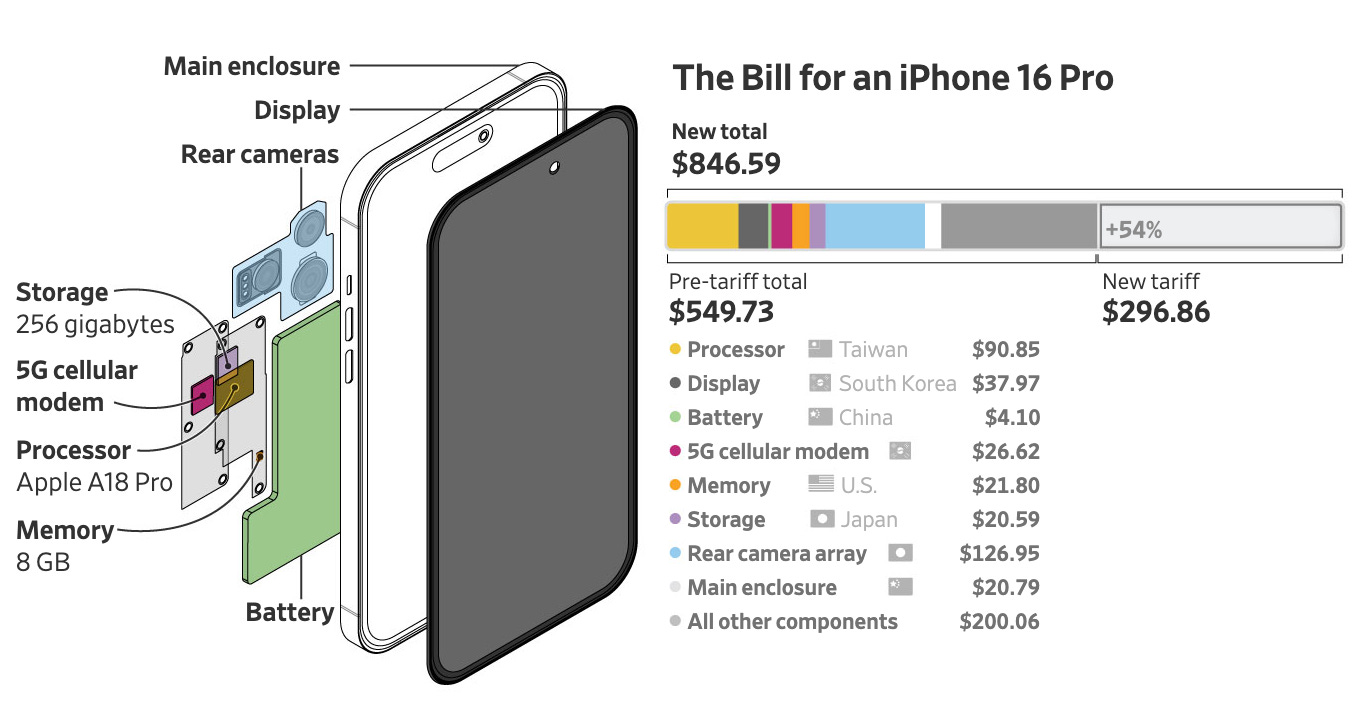

How tariffs will change the price of the iPhone 16 PRO

Onto the update:

Kudos to the 4 AI monopolies out there

Which is the best monopoly in the world? The AI monopoly, of course. There are only a bunch of companies winning massively from the AI boom. Here are some insights:

1/ Nvidia’s Monopoly is structural

Nvidia controls 92% of the AI accelerator chip market, effectively acting as the gatekeeper for artificial intelligence today. Their monopoly is about a carefully constructed ecosystem of software (CUDA), relationships (TSMC, ASML, SK Hynix), and scale. Nvidia sells more than GPUs; they’re selling the infrastructure upon which everyone else depends.

2/ Dominance through dependence

What Nvidia understands deeply is leverage. The company’s suppliers (TSMC for manufacturing, ASML for critical equipment, and SK Hynix for high-speed memory chips) each have their own near-monopoly positions. These interdependencies fortify each company’s position, making it almost impossible for competitors to replicate the entire stack quickly enough to disrupt Nvidia’s dominance (ie. quickly = minimum 5-7 years)

3/ The Risk of “bundled” dominance

Nvidia’s acquisition of software firms like Run:AI is a strategic play straight from the Microsoft-era playbook: bundle software and hardware tightly together, creating a walled garden that customers find almost impossible to escape. Regulators are paying close attention, but historically, tech monopolies built this way aren’t dismantled quickly or easily.

4/ Competitors can’t simply copy Nvidia

Amazon, Microsoft, and even OpenAI want to reduce dependence on Nvidia’s GPUs, building their own chip solutions. But here’s the catch: It’s not enough to replicate hardware. You have to match Nvidia’s software ecosystem, its mature supply chain, and its customer relationships. This makes genuine competition both expensive and complicated.

5/ AI Monopolies thrive on scale, not just on innovation

Companies like Nvidia, TSMC, and ASML aren’t just monopolies because they innovated once. They’re monopolies because they’ve scaled faster and smarter. Massive upfront capital requirements act as natural moats, making entry prohibitively expensive even for giants like Intel and Samsung. You don’t out-innovate Nvidia; you out-invest them, which few can actually afford.

6/ The fragility of tech monopolies

However, the tech landscape is notoriously volatile. Nvidia’s dominance hinges on AI remaining computationally expensive. DeepSeek’s recent demonstration that competitive AI models could potentially be developed on older, cheaper chips hints at a vulnerability: innovation could redefine the playing field overnight, turning Nvidia’s scale advantage into a liability.

7/ Regulatory scrutiny is real, but slow

Antitrust regulators are scrutinizing Nvidia, but historically, regulation trails technological advancement by years or decades. By the time antitrust actions get anywhere meaningful, the market might have shifted anyway: either cementing Nvidia’s dominance further or breaking it apart through competitive innovation. This dance between regulators and monopolists is familiar, slow, and usually resolved by market forces rather than legal ones. LINK

Oracle is leading the “TikTok” bid

Three ideas on this possible transaction:

1/ Oracle emerging as a key player in the TikTok drama tells us something important: When you can’t buy innovation, buy trust instead. Oracle isn’t known for running trendy consumer apps. The company it’s a boring, dependable database giant. But in a geopolitical mess involving TikTok, “boring” becomes a strategic advantage. The U.S. government doesn’t want trendy; it wants reliable separation from Chinese ownership, and Oracle conveniently provides exactly that…credibility as a secure, safe middleman for sensitive data.

2/ But the bigger picture here is that Oracle stepping into TikTok’s world isn’t about Oracle suddenly discovering a passion for viral videos; it’s about Oracle doubling down on its strategic position in cloud infrastructure and security. Larry Ellison isn’t trying to become the next Zuckerberg. Instead, he’s positioning Oracle as the necessary infrastructure (ie. the one company the U.S. government trusts enough) to secure tech transactions that get politically messy. That might not be glamorous, but it’s definitely good business.

3/ I don’t think at any moment that the Chinese government will allow this sale because, like I said many times, algorithms are the new nuclear weapons. Soft power is much powerful than hard power. We’ll see. LINK

What not to tell Chat GPT

Here are things you shouldn’t tell Chat GPT:

1/ Identity information - Social Security numbers, passport, driver’s license, date of birth, addresses, and phone numbers.

Why? Protect yourself from identity theft and privacy breaches.

2/ Medical results - Detailed health records, blood tests, medical conditions.

Why? AI tools don’t have the privacy protections required for medical information.

3/ Financial account information - Bank account details, investment accounts, financial passwords.

Why? This sensitive data could be misused if leaked.

4/ Proprietary corporate data - Trade secrets, confidential client information, internal strategies.

Why? Risks accidental exposure of business secrets, as happened with Samsung.

5/ Login credentials - Passwords, PINs, security questions.

Why? Chatbots are not secure password managers; your data can become vulnerable in breaches. LINK

How tariffs will change the price of the iPhone 16 PRO

Note: The iPhone 16 Pro starts with 128 GB of storage but this pricing reflects the 256 GB upgrade. Some components have multiple suppliers from different countries of origin. (Adrienne Tong/WSJ)

Tariffs are and will always be a bad idea. Here is what these tariffs mean for the existing iPhone 16 Pro:

1/ Supply chains are global and, well, very fragile

The iPhone isn’t really American or Chinese. It’s a global puzzle assembled primarily in China. Each piece (processor from Taiwan, screen from Korea, memory from Japan) fits neatly together. Tariffs disrupt this carefully balanced ecosystem. It’s tempting to think tariffs would nudge manufacturing back home, but the complexities (and costs) of doing so are enormous. Rebuilding that supply chain elsewhere isn’t just hard it’s just borderline fantasy.

2/ Tariffs raise prices, not innovation

Apple’s business model relies on predictable margins. Introduce a 54% tariff on components, and the bill for making an iPhone jumps dramatically, from about $580 to nearly $850. Apple faces a choice: eat the costs (unlikely), raise prices (probable), or scramble to relocate production (painful). Tariffs might shift politics, but they’re more likely to shift prices upwards, hurting consumers far more than helping domestic manufacturing.

3/ The real innovation barrier isn’t tariffs…it’s capability

Could the iPhone be assembled in America? Maybe. But at a prohibitive cost: labor expenses alone could jump from $30 in China to $300 in the U.S. Manufacturing complexity matters more than politics here. The idea of an American-made iPhone sounds appealing until you realize that without the deep ecosystem built over decades in Asia, it’s not just expensive, it’s economically irrational. LINK

I just launched my book on strategy:

Through 28 chapters, I covered three parts: (1) Strategy, (2) Innovation & Growth, and (3) Generative AI.

See a full sample - the chapter on Network Effects. - click HERE