(#125) 🛍️ Amazon's boss on agility and AI; 🚕 on Uber reporting

🎢 Disney is looking to expand to the Middle East

Dear #onStrategy reader,

Here is what you’ll find in this edition:

🛒 Andy Jeassy on agility, AI and strategy

🎢 Disney is looking to expand to the Middle East

🚕 On Uber’s reporting

🤳 When will Snap’s stock going to be valuable? Never?

On to the update:

Harvard Business Review: Amazon CEO Andy Jassy on Agility, AI Strategy, and the Changing Role of Managers

If you have 32 minutes, make yourself some time and listen to this podcast. Here are 5 ideas I took with me after listening to it:

1/ Amazon is optimizing for speed by flattening itself

Jassy is building Amazon like a recursive function: the larger it gets, the more it tries to behave like it’s small. Flattening the organization and increasing the ratio of individual contributors to managers is a deliberate architectural bet. It’s about eliminating “pre-meeting for the pre-meeting” bloat and re-incentivizing ownership at the edge, precisely the zone where innovation tends to decay as companies scale.

2/ The AI stack matters and Amazon wants to own all three layers

Amazon’s AI strategy is infrastructure-first. Own the chips (Trainium), own the model-building service (SageMaker) and then provide the glue (Bedrock) that lets others build great AI products. That’s the classic AWS playbook: win by enabling, not competing directly at the UX level.

3/ Remote doesn’t scale for invention

Jassy’s call for five-day office returns isn’t nostalgic, but strategic. Invention, he argues, happens in the messy in-betweens: the lingering after a hard meeting, the whiteboard ambush, the offhand hallway insight. Amazon is optimizing for invention throughput, not calendar productivity. That tradeoff reflects a belief in high-bandwidth collaboration over asynchronous execution.

4/ AI is an input cost reducer and user experience transformer.

From inventory optimization to generative search assistants like Rufus, Amazon sees AI not just as a product but as a systems-level enabler. Every internal workflow and customer-facing interface will be redesigned with AI baked in. The bet is that these transformations drive both efficiency (margins) and differentiation (retention).

5/ Culture is not inherited, it’s actively maintained

Perhaps the most important insight: culture compounds only if you constantly reinforce it. Jassy knows that entropy wins if culture isn’t systematized. That’s why there’s a “no-bureaucracy” email alias, apprenticeships in real time and visible corrections. Leadership, here, is as much about attention architecture as it is about decision-making. LINK

Disney is looking to expand to the Middle East

Why now and why Middle East?

1/ Disney’s move to open a theme park in Abu Dhabi is less about Mickey Mouse and more about strategic capital allocation. The real story here is about the structure. By outsourcing the financing and construction to Miral, a local partner with regional expertise, Disney effectively de-risks the CAPEX while still monetizing its intellectual property. This is Disney as a platform company, not just a theme park operator. It’s licensing magic, not laying concrete and it fits perfectly with Bob Iger’s goal of doubling down on margin-rich IP extensions while minimizing operational drag.

2/ Second, the timing is no accident. With its “Experiences” business now accounting for a majority of operating income, Disney is shifting more chips onto the global board. Streaming may still be volatile and cable (liniar TV) continues to decline, but parks (especially internationally) offer tangible, high-margin growth. Abu Dhabi adds proximity to an underserved but brand-loyal market and doing it with someone else’s money allows Disney to keep its $60B investment firepower pointed at other long-term bets. This is a platform leverage in real estate form. LINK

On Uber’s reporting

Here are three key insights from Uber’s Q1 2025 results:

1/ A platform’s biggest strength is also its biggest dependency

Uber missed on gross bookings despite strong delivery growth and better-than-expected profitability. Why? Because rides in the US, which still drive more than half of Uber’s profits, were hit by a decline in inbound travel and softening consumer sentiment. This illustrates a classic platform tension: scale brings reach but also vulnerability. A platform dependent on macro inputs like travel flows and currency strength cannot isolate itself from geopolitical shocks or economic slowdowns. Uber is still strong, but the miss reminds us it’s not invincible.

2/ Autonomous and geographic expansion are the new margin levers

Uber’s investments in autonomous vehicles (like its Waymo partnership in Austin) and the expansion of its scheduled rides into less dense areas show a deliberate push to expand TAM without proportional increases in headcount or operating cost. Add in the Trendyol Go acquisition in Turkey and you get a strategy designed around optionality: new use cases, more defensible markets and better cost structures. These are classic platform expansion plays: growth not through more of the same, but through new distribution modes.

3/ Financial discipline is becoming a moat

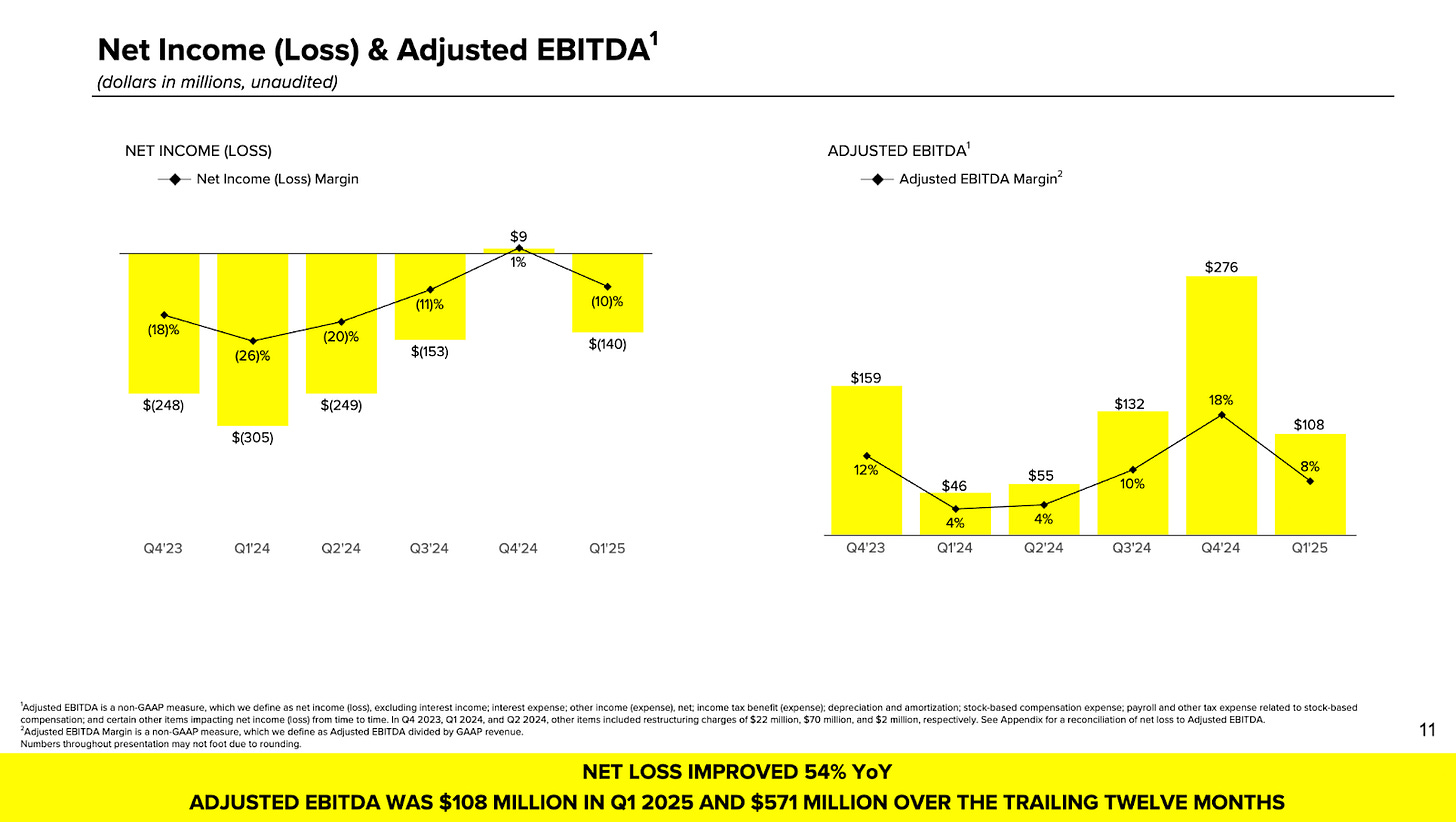

Despite the headline miss, Uber’s fundamentals look solid: free cash flow of $2.3 billion, adjusted EBITDA up 35% YoY, and a clear outlook beat for Q2. That’s not “growth at all costs.” That’s a business maturing into its scale. Uber is signaling it wants to be priced like an operating business, not a speculative one, which is a big deal in a market still trying to figure out how to value AI-powered logistics platforms. Uber is betting that predictable financial execution, layered with strategic autonomy bets, is more durable than just chasing growth. And they’re probably right. Uber, Bloomberg

When will Snap’s stock going to be valuable? Never?

I remember one of the first investor letters from Snap: “We may never reach profitability”. So, even if they do, will this be worth it? I doubt it..

Here are some conclusions from the earnings calls:

1/ Snap posted decent Q1 numbers: revenue up 14%, losses down, free cash flow positive

By most traditional metrics, this is a sign of a business trending in the right direction. The problem is Snap has been doing this dance for years (e.g. growing users, tightening spend, tweaking ads) and the market still doesn’t know what it is. A social network? A camera company? An AR platform? Investors have seen this movie before and the ending is always the same: lots of engagement, not a lot of conviction.

2/ Snap’s pitch is that it’s now running more efficiently

Advertisers are spending smarter with AI-powered tools, the subscription business (Snap+) is growing fast and the platform is getting stickier with 900 million MAUs. But the structural question remains: can Snap ever command pricing power? Or does it live in a world permanently priced below Meta and TikTok, unable to fully monetize because of the way people use it: fleeting, private, and hard to target? Snap has built a habit-forming product without a habit-forming revenue model.

3/ Ultimately, Snap’s stock remains a bet on something it hasn’t proven yet: that augmented reality or new hardware will be the inflection point

Until then, it’s an ad business for brands too small for Meta, a subscription business for users who like badges, and a platform for creators that isn’t quite paying off. Investors want a story. Snap keeps handing them updates. Which is why the real answer to “When will Snap’s stock be valuable?” might just be: when the company figures out what it wants to be. And not a quarter sooner. Quarterly results, Bloomberg

I just launched my book on strategy:

Through 28 chapters, I covered three parts: (1) Strategy, (2) Innovation & Growth, and (3) Generative AI.

See a full sample - the chapter on Network Effects. - click HERE