(#126) 🏡 AirBnB makes a strategic mistake; 🚗🚙 Tesla vs. Waymo

top Chinese AI models have caught up to top US models

Dear #onStrategy reader,

Here is what you’ll find in this edition:

🏡 AirBnB’s makes a bad move by entering into “Services” and “Experiences”

🤖 top Chinese AI models have caught up to top US models

🚗🚙 Tesla vs. Waymo

💿 OpenAI for…countries?!

🇺🇸 There is only one stock exchange that matters: NYSE

On to the update:

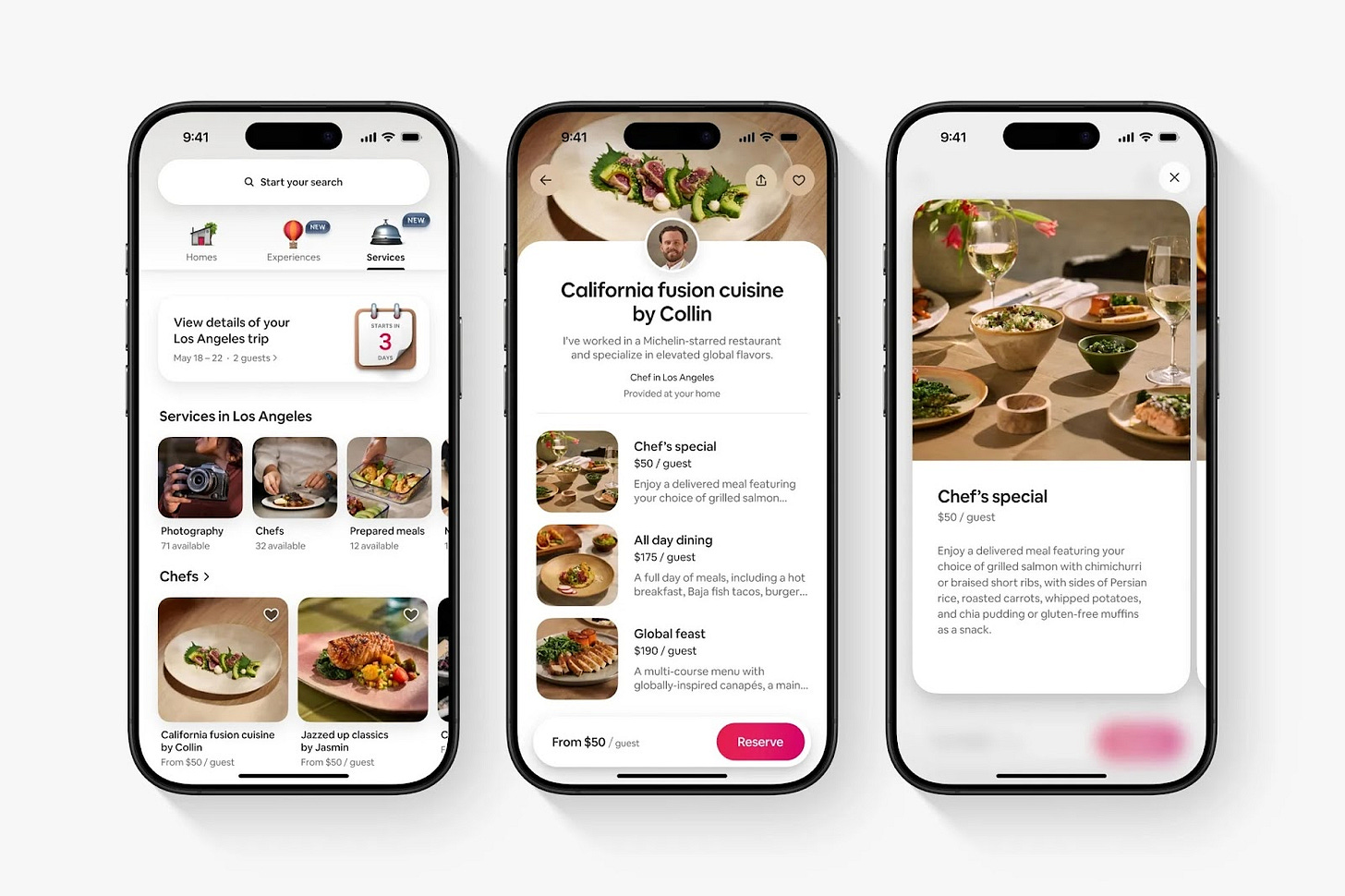

AirBnB’s makes a bad move by entering into “Services” and “Experiences”

I am skeptical about this move. Why? For at least 3 reasons:

1/ Brian Chesky wants Airbnb to be more than a travel platform. He wants it to become your local concierge, your neighborhood marketplace, your go-to for chefs, trainers, hairstylists, maybe even plumbers someday. But here’s the catch: the core business works precisely because it is occasional. You use it a few times a year, pay a premium for trust and convenience and everyone leaves satisfied. Trying to turn Airbnb into something people use weekly changes the game entirely. It goes from a high-margin, low-frequency marketplace to a low-margin, high-frequency one that competes with Yelp, Google and every local app with better repeat dynamics.

2/ The real problem isn’t the design, the UI, or even the concept. It’s the economics. These new “experiences” are supposed to be unique, memorable, artisanal. But things that scale usually aren’t artisanal and things that are artisanal usually don’t scale. Airbnb learned this already when it launched Experiences in 2016 and quietly let it fade. This reboot might have sleeker icons and a better algorithm for matching you with a pottery class, but it still has the same cost structure problem. If the only way to offer a curated walking tour is to charge $200 for it, you’re not creating a marketplace. You’re creating a luxury catalog.

3/ And then there’s Chesky’s vision of Airbnb as a Jobsian design artifact. The attention to aesthetic details is admirable, but this is not a consumer product. It’s a marketplace. What makes it work is not how delightful the animations are, but whether the incentives align across millions of fragmented providers and picky customers. You can paint the app with all the Michelangelo energy you want, but if the economics don’t add up, you just end up with a very pretty app that no one needs to open more than twice a year. Airbnb should stick to being weirdly good at what it already does, instead of stretching itself into a brand new business it doesn’t seem structurally built to win. Bloomberg, AIrBnB, WSJ

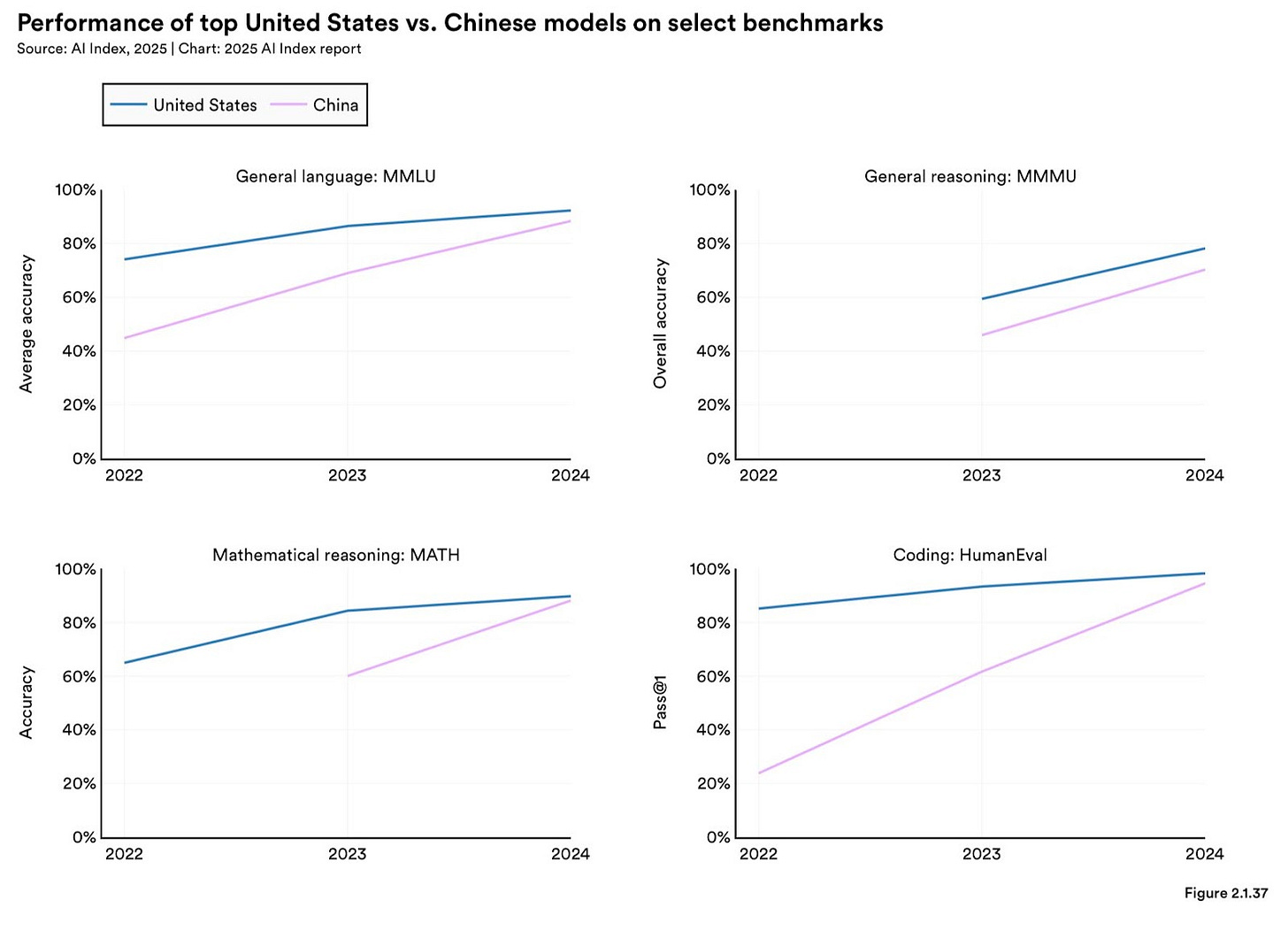

2025 Stanford AI Index: top Chinese AI models have caught up to top US models

1/ The Stanford AI Index says what everyone in the labs already knew but no one at the investor roadshow wanted to admit: China’s top models have caught up. Not sort of caught up, not “getting closer,” but actually matching USA models across key benchmarks. Which is awkward if your whole pitch to investors last year was “We’re three years ahead and have a moat.” Because it turns out that in AI, there is no moat. There is only momentum. And momentum burns fast when everyone has access to papers, weights and GitHub repos.

2/ The only sustainable advantage is a brutally simple one: the best people, the fastest chips and enough electricity to run all of it at scale. That’s it. There is no proprietary code that stays secret for long, no architecture that doesn’t get reverse-engineered, no clever trick that isn’t blogged about 48 hours later. The moat is not some defensible structure, it’s a treadmill. If you slow down, you get passed. If you stop, you become irrelevant. So when someone tells you they’ve built an “AI moat,” what they usually mean is they’re hoping to buy themselves six months of runway while the next model trains. Good luck with that. LINK

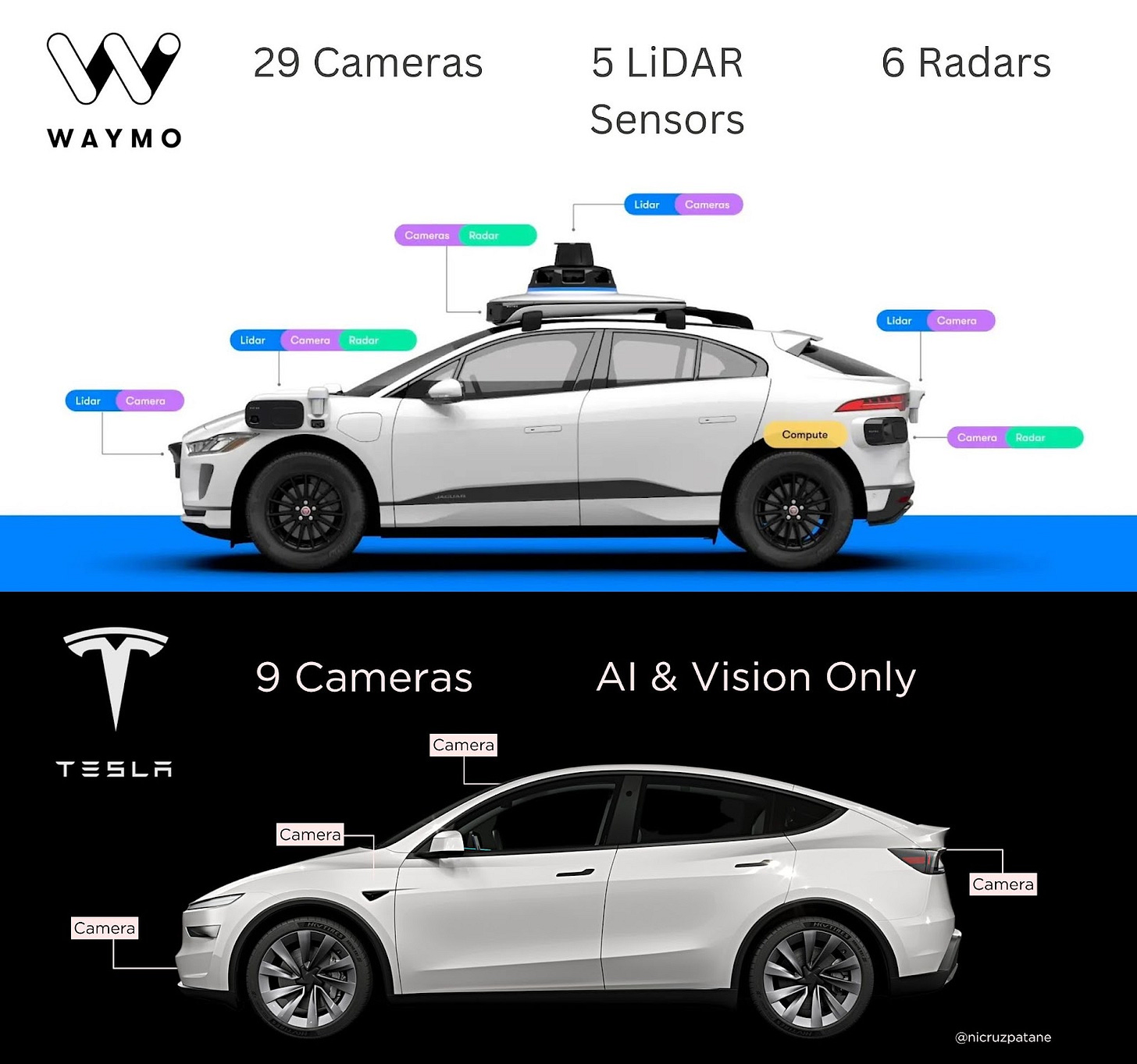

Tesla vs. Waymo

1/ Waymo’s car looks like it lost a fight with a RadioShack. It has 29 cameras, 5 LiDARs, and 6 radars stapled onto every available surface, like someone was trying to win a bet about how much hardware you could legally attach to a Jaguar. And it works, sort of. Waymo’s approach to autonomy is: map the world down to the last manhole cover, then drown the car in sensors so it never has to guess. The result is a robotaxi that performs pretty well in limited zones and costs so much to build that you wonder if it’s actually a tech product or just a proof of concept with a burn rate.

2/ Tesla, on the other hand, has a software problem. Its cars rely on nine cheap cameras and a whole lot of hope that machine learning will eventually see the world better than humans do. The bet is bold: vision-only, no maps, no LiDAR, just AI. And yes, that software isn’t quite there yet. But the thing about software problems is they scale well. Once solved, they can be patched over the air and instantly deployed to millions of cars. Hardware problems, on the other hand, need factories, supply chains, and years of retrofitting. So yes, Tesla’s autonomy may hallucinate a traffic cone or two, but at least it’s not trying to reinvent the roof rack industry along the way.

OpenAI for…countries?!

1/ OpenAI’s new “OpenAI for Countries” initiative is basically a Marshall Plan with GPUs. The idea is to export AI infrastructure to countries that want to build “on democratic rails,” complete with data centers, custom ChatGPTs, startup funding, and just enough language about sovereignty and freedom to make it feel less like a US-centric tech stack and more like an enlightened digital partnership. It’s soft power in the form of silicon and inference tokens. And yes, it’s a geopolitical move: if you can’t stop authoritarian AI from spreading, you counter it by giving the rest of the world an easier, friendlier API and a nicer onboarding experience.

2/ But under the idealism, it’s also a very practical business strategy. If you’re OpenAI, you don’t just want to dominate the U.S. enterprise market….you want to be the foundation of every national AI ecosystem, before the Chinese models get there first. And if countries are willing to co-invest and tie themselves to the Stargate platform, then great, you’ve just franchised your own data-sovereign, government-aligned version of AI as a Service. The only thing missing is the punch card that gets stamped after every successful deployment. Welcome to the era of diplomatic compute. You don’t need to sign a treaty anymore…just sign the infrastructure agreement. LINK

There is only one stock exchange that matters: NYSE 🇺🇸

1/ Scott Galloway wants you to rotate into Chinese stocks because US equities are expensive and China’s multiples look cheap. Sure. But here’s the problem: you can’t price what you can’t see. The Chinese economy is increasingly a black box. GDP figures are smoothed, private sector sentiment is staged and key financial data disappears when it gets politically inconvenient. You don’t need to believe the worst conspiracy theories to recognize the obvious: no one really knows what’s happening inside these companies, not even - sometimes especially - not the people running them. Investing in China today is less about valuation and more about ideology and the idea that “mean reversion” will magically save your portfolio assumes that the mean wasn’t fake to begin with.

2/ Galloway makes the case that Alibaba and BYD are undervalued gems. Maybe. But Jack Ma went missing for a year after a speech. Alibaba’s “rebound” was only possible because Xi Jinping gave him a literal thumbs-up in a staged meeting. That’s not corporate governance, that’s political theater. And BYD? Yes, they’re exporting like crazy, but they’re also sitting on graveyards of unsold EVs and no one can quite explain where the margin is coming from (ie. hint! massive subsidies). You can’t build an equity thesis on unit economics when the government is writing half the footnotes. Scott’s bet might work (anything can in the short term) but calling it “rational capital rotation” when the financial data is curated and the state is the majority stakeholder is like investing in Enron because it looks cheap after the write-downs. You’re not buying growth. You’re buying opacity. And that’s not a trade. That’s a dare. LINK

What can happen if the Chinese stop buying luxury goods? Maybe…this?

1/ For years, Chinese tourists were the reliable economic engine of the global luxury mall: structured itineraries, branded handbags and duty-free shops as pilgrimage sites. But something funny happened on the way to the Louis Vuitton store: they stopped going. Now it’s all self-guided adventure, TikTokable suffering, and “experiences.” Think less Chanel, more camping in the Arctic. One traveler summed it up with a generational shrug: “I feel like I need to enjoy life.” Which apparently involves rabbit hunting in New Zealand instead of hitting the boutiques in Milan.

2/ This is, obviously, a disaster if you’re a department store, a luxury watch brand or anyone who built a business on the assumption that middle-class aspiration in China meant air-conditioned consumption. Instead, it turns out that the new currency is not stuff but stories. And stories don’t require receipts. They just need Wi-Fi and a drone. So if you’re still betting your margins on the idea that globalization meant everyone eventually becomes a wealthy Parisian housewife, well… that idea may need to go hiking too. Possibly forever. LINK

I just launched my book on strategy:

Through 28 chapters, I covered three parts: (1) Strategy, (2) Innovation & Growth, and (3) Generative AI.

See a full sample - the chapter on Network Effects. - click HERE

Awesome curation & insights. Thanks, Sorin!

Will go through the implications of 'OpenAI for Countries' rabbit hole 😅