(#128) 🤕 You may have a bad year, but nothing compares to Tim Cook’s one

🚗 Volvo is cutting its workforce. Why?

Dear #onStrategy reader,

Here is what you’ll find in this edition:

📔 Harvard Business Review: “How to rescue a failing strategy?”

🚗 Volvo is cutting its workforce. Why?

💬 xAI goes after new distribution: Telegram

🤕 You may have a bad year, but nothing compares to Tim Cook’s one

…and more

On to the update:

HBR: How to rescue a failing strategy?

You can’t fix a failing strategy with more powerpoints, but you can buy yourself time with liquidity, customer math and not paying your bills too early. That’s basically the thesis here: in a world where your five-year plan died halfway through Q1, survival is an operational art form. You don’t need a genius strategy, you need a cash flow model that doesn’t assume your suppliers are still solvent and your customers still employed. The good news? You can do most of this without reinventing your brand: e.g., forecast better, chase late payers, renegotiate your payables and keep your sales reps from going full ghost mode after a missed quarter. The bad news? If you don’t, your board will probably start asking what exactly your strategy is, and that’s a conversation you want to delay as long as possible.

But there’s a bigger point: real strategy lives in adaptation. In a world this unpredictable, strategic clarity is a myth. Strategic muscle memory (ie. the reflex to optimize liquidity, commercial fitness, retention, and risk) is the whole playbook. Which, if you think about it, is a lot more useful than pretending you still know what your strategy was supposed to be. LINK

Volvo is cutting its workforce. Why?

Well, I have two assumptions about it:

1/ Volvo just announced it’s cutting 3,000 jobs to “protect profits,” which is corporate code for: EVs don’t need oil filters and building them in Sweden is expensive. The shift to electric has flipped the unit economics of the entire supply chain. Fewer moving parts means fewer suppliers, fewer maintenance contracts, and fewer engineers needed to redesign components that no longer exist. Add in a 60% plunge in operating income and a market where price competition is increasingly dictated by BYD and Tesla, and suddenly that cozy Gothenburg headcount starts looking like an earnings drag.

2/ But there’s also geopolitics under the hood. Volvo is owned by Geely, and Geely is Chinese. So when Swedish jobs get cut while R&D and product integration move closer to Hangzhou, it’s hard not to see the contours of industrial consolidation. The official line is synergy and efficiency, not outsourcing. But in a world where cost structures matter more than national pride, the quiet truth is this: it’s cheaper to scale EV production and design in China, where the supply chain is faster, the labor is leaner, and the batteries are next door. Sweden still makes beautiful cars. It just might not be the place to make car companies anymore. LINK

xAI goes after new distribution: Telegram

Why?

1/ In what can only be described as Elon Musk’s latest platform arbitrage experiment, xAI is paying $300 million in cash and equity to Telegram to embed Grok (the edgiest chatbot on the internet) into an app that’s famously allergic to moderation. For Musk, the logic is obvious: Telegram gives Grok scale, with over a billion users, and none of the tiresome content rules that plague mainstream platforms. For Pavel Durov, it’s a win-win: he gets a big payday and half of Grok’s subscription revenue, all while watching regulators squirm over whether Telegram has now become the most powerful uncensored AI delivery system on the planet.

2/ The implications here go beyond just a monetization model. This is a pure go-to-market hack that reflects the new economics of AI distribution: platforms with massive engagement and zero editorial overhead become irresistible channels for LLMs, especially the chaotic ones. Forget app stores and curated UIs; just plug into Telegram and let the chaos scale itself. But here’s the catch: Grok has already been caught spouting conspiracy theories, and now it’s moving into an environment where moderation is more of a vibe than a function. So while the user base may grow, so will the risk profile. Welcome to the future, where frictionless AI monetization comes bundled with geopolitical headaches and memes. LINK

You may have a bad year, but nothing compares to Tim Cook’s one

1/ Tim Cook, it seems, is trapped in the worst kind of Apple update cycle: the kind where the only thing crashing is the company’s narrative. It’s not just that Cook didn’t anticipate the AI shift, but he actively missed it. While OpenAI, Google, Meta, and even Elon are out there building new paradigms, Apple is polishing the bezels on iPhones that, per their own executives, may not even be necessary in ten years. And when Jony Ive (aka the industrial design icon of Apple’s best decade) sells his new AI device startup to OpenAI for $6.5 billion, the message isn’t subtle. The next iPhone (or platform? One more thing?) won’t come from Cupertino.

2/ What makes this worse is that Cook doesn’t even get the basics right anymore. He’s got Trump threatening tariffs unless iPhones are built in the USA, regulators dragging Apple through court over App Store practices and now the EU wants a bite too. The response? Vague commitments to AI servers in Texas and an unshipped Siri “upgrade” that allegedly doesn’t meet Apple’s quality bar. Translation: we’re late and we know it. And when your biggest existential threat is being out-designed by your own former head of design, it might be time to stop taking meetings with Treasury and start hiring someone who’s actually seen GPT-4 in action. LINK

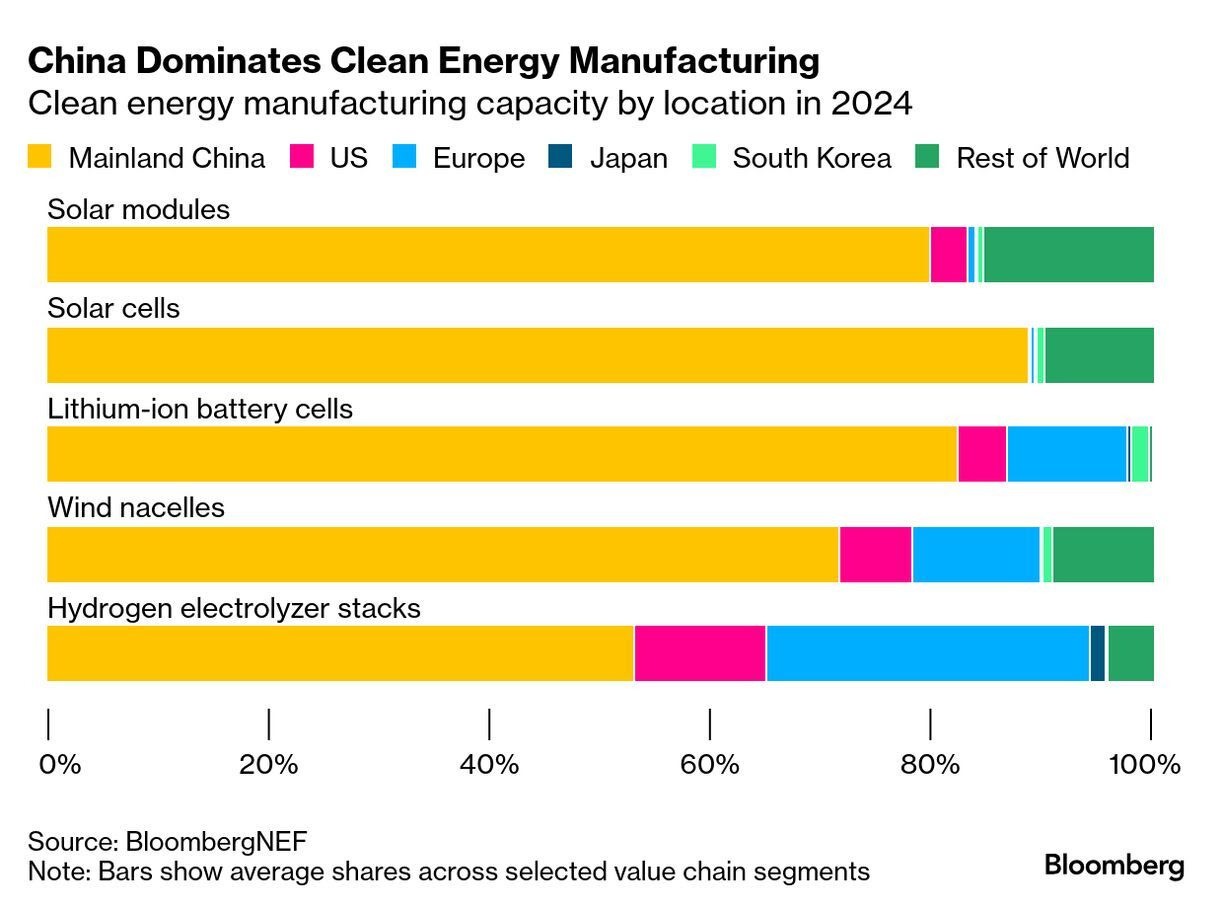

Green transition goes through…China

This chart looks like China printed the entire clean energy future in yellow ink. Sure, the global economy loves specialization...until it turns into dependency. At some point, relying on one country for 80 percent of your climate transition hardware becomes a less efficient supply chain strategy and more geopolitical liability.

It’s all fun and decarbonization until someone tweaks export controls.

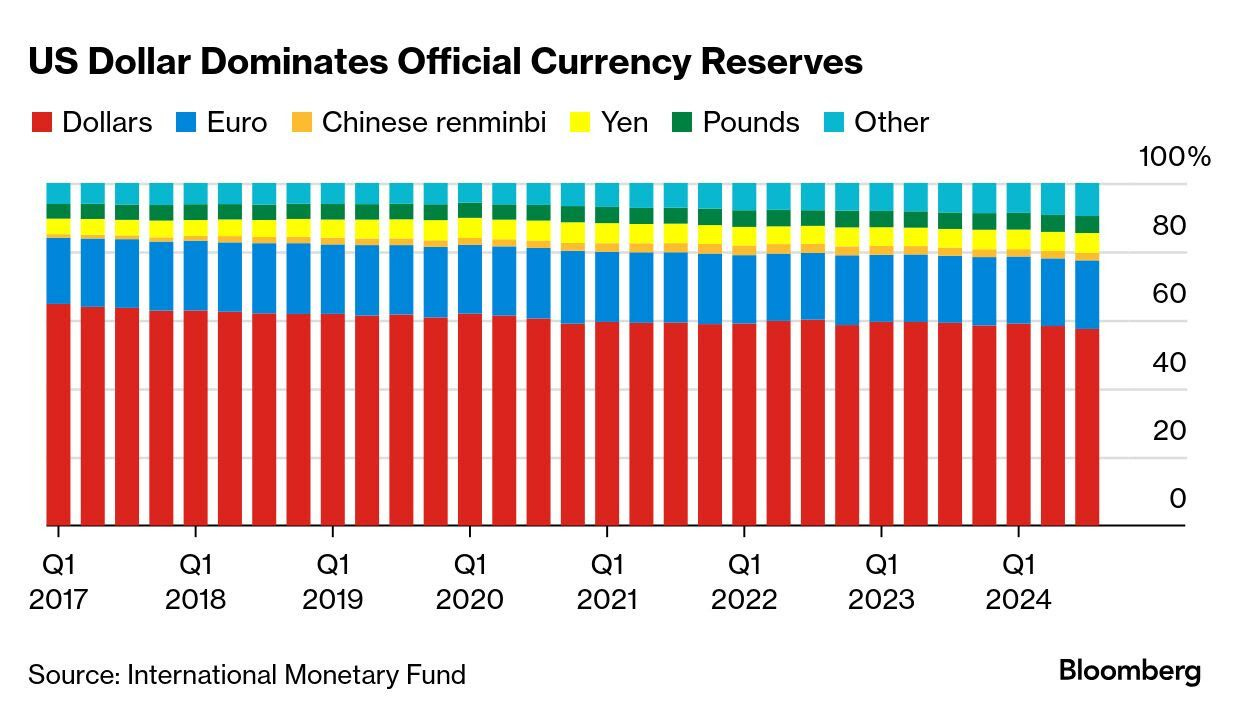

One currency to rule them all: the 🇺🇸 US Dollar

The US dollar is now close to 60% of the world reserve currencies....up from 34% in 2011 (!). LINK

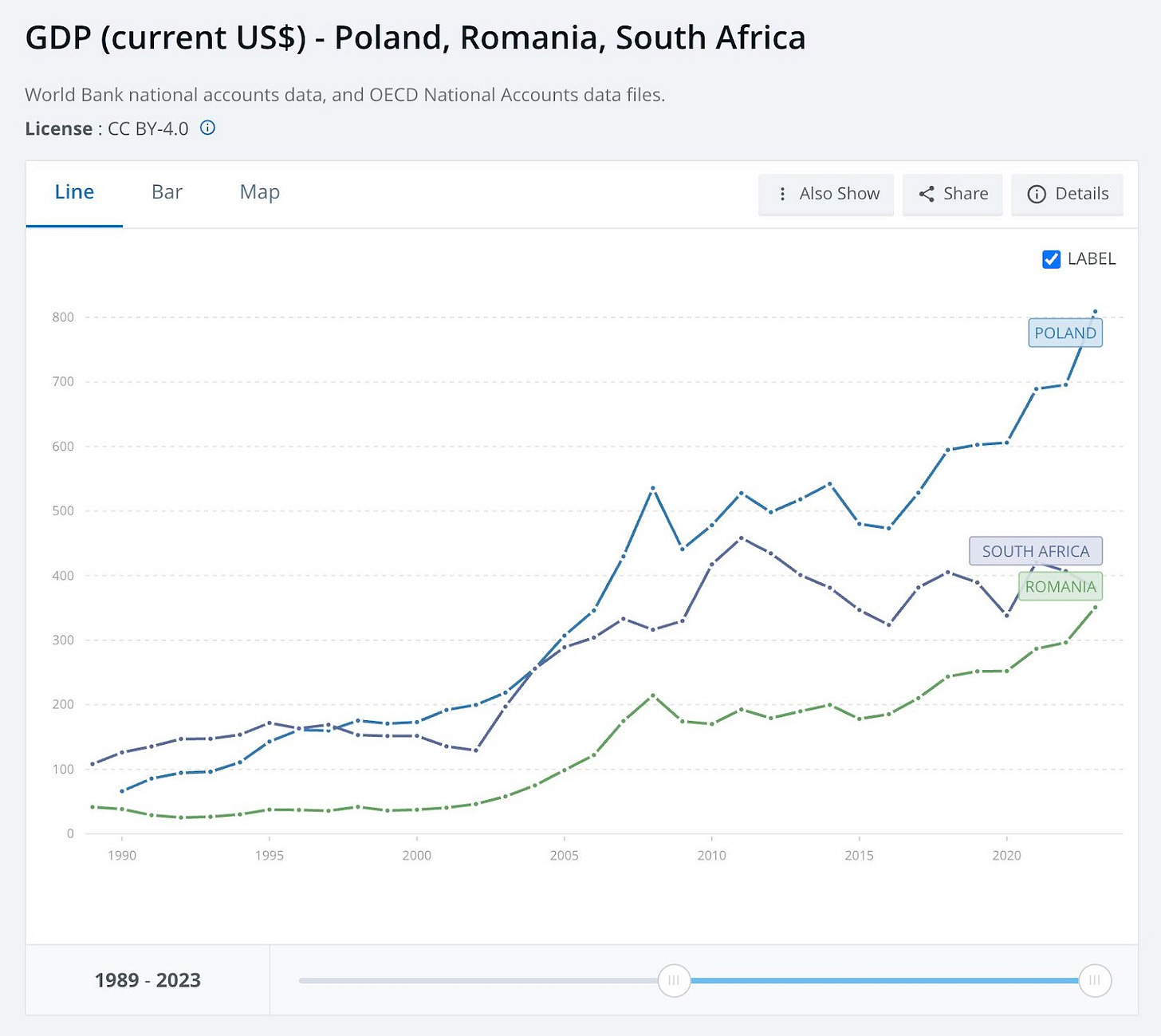

Systems and countries: Poland, Romania and South Africa

This year 🇷🇴 Romania (19 million) will surpass 🇿🇦 South Africa's economy (63 million).

This is what happens when countries make choices. Poland, with 37 million people, is sprinting ahead like a kid who trained all winter while everyone else was making excuses. Romania, with half the population, is also climbing steadily, slower but consistent. Both countries started the post-communist race from the institutional rubble of the 1990s and somehow turned it into economic lift. There were policy errors, corruption, EU bureaucracy but there was also discipline, trade integration and a basic respect for productivity (including meritocracy).

Then there’s South Africa. A BRICS member with 63 million people and a GDP line that has flatlined since 2008 like a patient someone forgot to check on. South Africa should be outperforming both Poland and Romania just on demographics alone. But instead, it’s drifting burdened by weak governance, crumbling infrastructure, energy blackouts and a political class more focused on internal power games than external competitiveness.

BRICS was supposed to be the alternative to Western decline. Instead, it’s a slogan for countries that share little but frustration with the dollar and a taste for underperformance. Poland isn’t in BRICS and it’s winning. Romania isn’t in BRICS and it’s catching up. South Africa is, and it’s stuck. Maybe it’s time we stop chasing acronyms and start following results. LINK

I just launched my book on strategy:

Through 28 chapters, I covered three parts: (1) Strategy, (2) Innovation & Growth, and (3) Generative AI.

See a full sample - the chapter on Network Effects. - click HERE