(#130) 📈 S&P 500 remains the best option for most of us; ⚱️ The gold is back

The strange death of the 🇩🇪 German auto industry

Dear #onStrategy reader,

Here is what you’ll find in this edition:

Financial Times: “Private market funds lag US stocks over short and long term”

Chat GPT: from hype curve to smile curve

Physics > Politics: Central Banks agree

The Economist: “The rise of the lone consumer”

Do we really need a camera on an iPad?

…and more

Onto the update:

Financial Times: “Private market funds lag US stocks over short and long term”

Turns out all those private equity pitch decks about “uncorrelated alpha” and “superior long-term returns” might have just been… powerpoints. This chart shows that the S&P 500 outperformed private equity across every time horizon: 1 year, 3 years, 5 years, 10 years. Which is another way of saying: you could’ve bought SPY, gone to the beach, and still beat the Harvard Business School guys running around in Patagonia vests trying to buy plumbing companies in Ohio.

And just to twist the knife, even the Russell 2000 (ie, America’s favorite underperforming small-cap mascot) put up better numbers than private equity for much of the ride. So all those lockups, waterfalls, clawbacks, and quarterly investor letters with phrases like “value creation roadmap” have effectively generated… less money, more fees, and the occasional catered LP summit. But hey, at least private markets are “less volatile.” You know, because no one marks things to market until someone asks too many questions. [Financial Times]

Chat GPT: from hype curve to smile curve

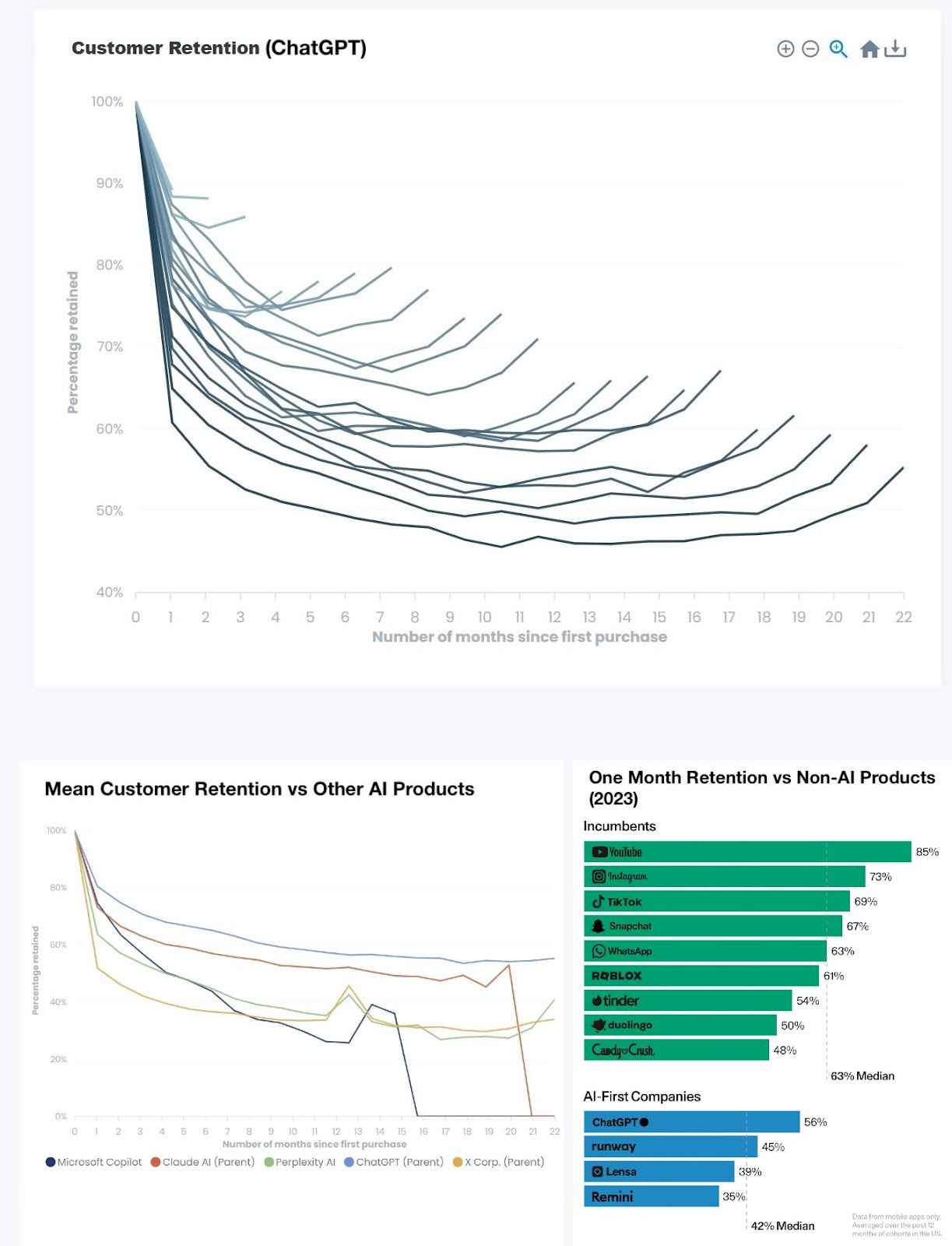

ChatGPT’s retention chart looks like it was hand-drawn by a product manager mid-manic episode: a perfect “smile curve” where users actually come back after they’ve ghosted you for a few months. It’s like the SaaS version of an ex texting at 2am, not because they’re bored, but because they realized you’re still the smartest thing they’ve ever talked to 🙃. One-month retention closing in on 90% puts it ahead of Youtube, Instagram, and TikTok, which means ChatGPT is now the one app people are using and pretending they’re being productive while doing it.

And it gets more ridiculous: six-month retention is trending toward 80%. That’s not a curve, that’s gravity failing. Compare that to other AI-first apps like Lensa or Remini, which basically fall off a cliff once the novelty of “turn me into an anime wizard” wears off. Even Microsoft Copilot and Claude can’t hold attention like this, and they’re built into your workday. What we’re looking at isn’t just product-market fit. It’s product-market clinginess. The kind of numbers that get PMs promoted, investors frothy, and entire content moderation teams nervous. Because when an LLM retains better than your social life, it’s no longer a feature, it’s infrastructure.

Physics > Politics: Central Banks agree

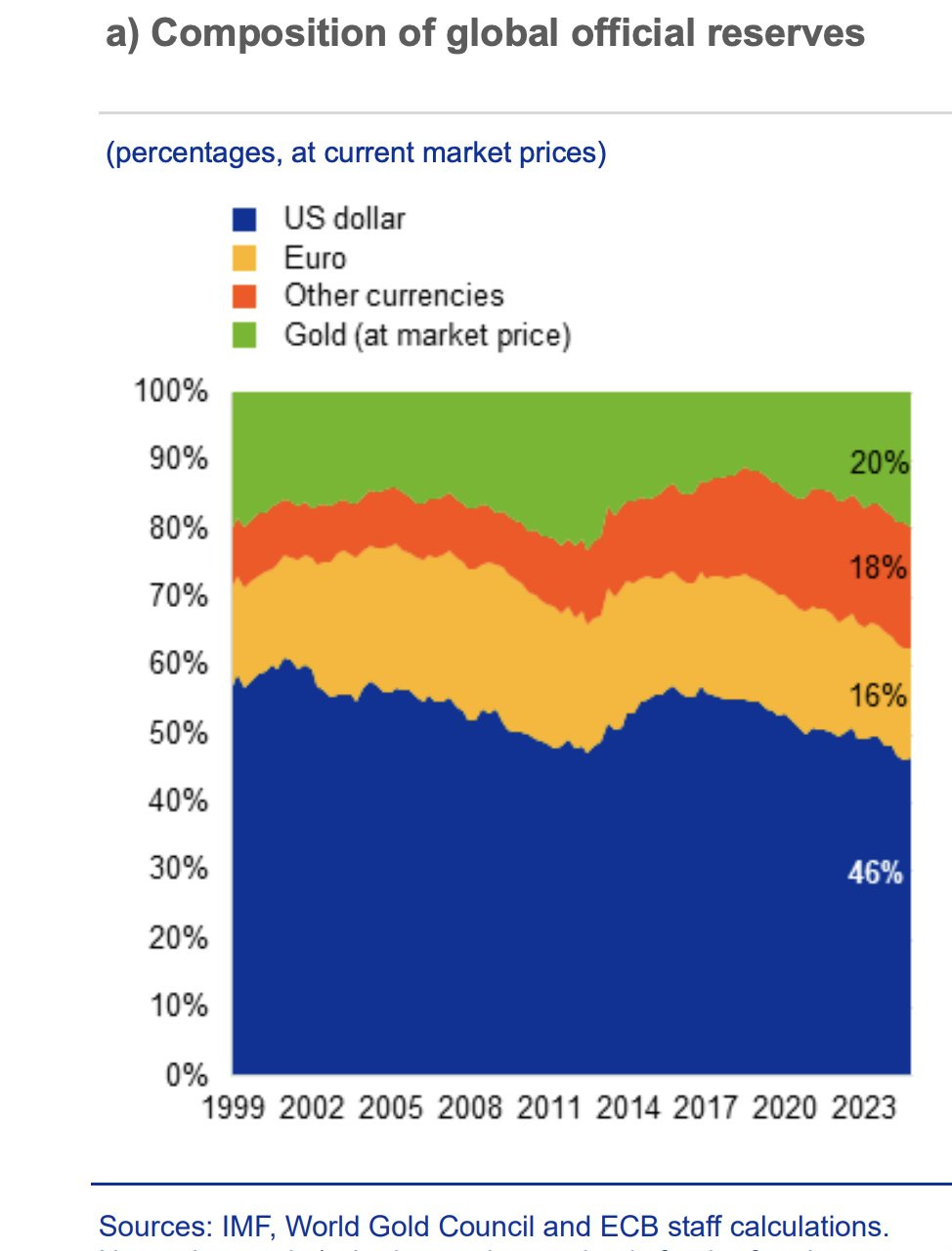

Well, this is awkward. After two decades of European technocrats politely insisting that the euro is the future of global finance, it’s now been overtaken in official reserves by… a shiny rock. That’s right: gold, the monetary equivalent of a doomsday bunker, now commands a 20% share of global official reserves, beating the euro’s 16%. Which means more central banks would rather hoard metal dug out of the earth than hold paper backed by Brussels bureaucracy and Italian bond spreads.

And sure, some of that is price action; gold’s had a nice run lately. But the symbolism is hard to miss. In a world of debt ceilings, sanctions, and weaponized finance, central banks are quietly saying: “We trust physics more than politics.” Gold doesn’t default, it doesn’t get sanctioned, and it doesn’t tweet. It just sits there, gleaming, while the euro writes memos and the dollar runs the empire. So congratulations to gold: the world’s oldest central bank hedge is now officially more credible than the world’s second most ambitious currency experiment. LINK

The Economist: “The rise of the lone consumer”

The loner consumer is here, and they’re not splitting the check. According to The Economist, the pandemic may be over, but the social habits it rewired are very much alive. The old “hermit economy” of sourdough kits and Peloton bikes has quietly evolved into something stranger: an out-and-about economy of people going everywhere...alone (!). They’re flying solo (literally), booking single tables, and ghosting public transport in favor of private rides. This is a redefinition of consumption itself. You don’t need friends to drive GDP. You just need a credit card and a deep aversion to other humans.

Brands are now optimizing for consumers who don’t need coordination, consensus, or conversation. Airbnb says solo travel is booming. Premium airline cabins are growing faster than coach. Uber’s quiet, judgment-free rides now have a stronger product-market fit than half of Silicon Valley’s social startups.

You don’t need someone to come with you. You just need the UI to get out of your way. And if you’re a business built on groups, friends, or “sharing”.... congrats, you’re the new fax machine. LINK

On the tipping culture in the USA

Ah yes, tipping culture in the 🇺🇸 USA, the only economic system where your cappuccino now comes with a built-in moral dilemma. This meme (taken from Threads) feels like satire, except it’s about 15 minutes away from becoming real.

I visited the US in February and found myself tipping someone for handing me a muffin from a glass case, no eye contact involved. The touchscreen asked for 20%, like it had done me a personal favor. And everyone in line just nodded, clicked “Custom,” and chose 18% out of guilt.

This it's a service economy duct-taped together by unspoken shame and broken wage models, where suddenly everyone is eligible for a tip: the barista, the cashier, the personnel in the museums (!), the self-checkout machine.

Welcome to America....home of free refills and involuntary gratuity.

Do we really need a camera on an iPad?

🧐 Owning an iPad for over a decade and never using the camera is basically the tech equivalent of buying a Swiss Army knife and refusing to use anything but the toothpick. And honestly? Totally valid. Because the iPad camera is one of those things that exists not because anyone asked for it, but because Apple needed something to upgrade every year. It’s there, looking confused and slightly embarrassed, like a tourist who wandered into the wrong keynote. Nobody wants to be that person holding up a dinner-plate-sized tablet to take a picture of a sunset. It’s less photography, more public performance art.

And yet, Apple keeps putting better cameras in these things, like it’s chasing some imaginary use case where people shoot wedding videos on a 12.9” piece of glass. Meanwhile, actual iPad owners are out here using it for Netflix, note-taking, and the occasional guilt-ridden Duolingo session. The rear camera is just there, collecting fingerprints and shame.

Deep down, even the iPad knows: it was never meant to be a camera. It was meant to be a rectangle with ambitions.

📺 Nobody younger than me is watching linear TV (!)

Paramount Global is laying off 3.5% of its US workforce because, shocker, no one is watching cable TV anymore. Not even out of nostalgia. Not even my Bachelor students, who treat linear TV the same way they treat fax machines: with a mix of curiosity and disbelief. This is what a structural collapse looks like. The business model built on bundling ads with content you didn’t ask for and forcing people to watch it on someone else’s schedule is… dead. Buried. Disinterred occasionally for reruns and congressional hearings.

Meanwhile, Paramount’s leadership seems stunned that a network designed for prime-time soap operas is losing to infinite-scroll TikTok chaos and Netflix’s personalized dystopia. What did they expect? That Gen Z would sit through detergent commercials to maybe catch five minutes of NCIS: Des Moines?

This it’s about reality finally catching up to a media model that’s been hollowed out for years. You can’t patch this with another reorg. You either become a tech company or become a trivia question. LINK

The strange death of the 🇩🇪 German auto industry

🇩🇪 Germany just got hit with a 100,000-job industrial reality check, and if you look closely, you can almost hear the electric motors whirring past the bodies. According to the latest EY data, nearly half of those job losses came from the auto industry, a sector once so proudly German it basically was the economy. But now, between Chinese EV imports, flatlining European demand, and the logistical nightmare of remaking Wolfsburg into Shenzhen-with-sausage, the wheels are literally coming off.

It’s the kind of transformation that’s less about innovation and more about entropy. And the brutal irony? While companies like Waymo are rewriting the rules of transport (e.g., with no drivers, no unions, no 4 a.m. shifts) Germany is still arguing over bureaucratic reform and the price of electricity. Meanwhile, the entire logic of industrial policy is collapsing like an overengineered, undercharged sedan. Because the future doesn’t wait for regulatory clarity or the next auto expo in Frankfurt. It arrives quietly, autonomously, and with no one in the driver’s seat.

The future isn’t something we enter. It’s something we build. But only if we’re willing to let go of the comfort of the familiar and ship something new. The German auto industry isn’t suffering from a lack of engineers, but it’s suffering from a lack of nerve.

Because in the end, it’s not the technology that’s missing. It’s the courage to change before you’re forced to. LINK

p.s. This is a warning for all countries interconnected to Germany in the automotive supply chain.

🇪🇺 EU vs. 🇸🇻El Salvador

You know Europe’s geopolitical relevance is slipping when the Brussels bureaucracy starts beefing with a Bitcoin president on X (Twitter). The EU issued a stern, vaguely condescending statement about El Salvador’s new Foreign Agents Law. And Nayib Bukele, who once governed a country known mostly for remittances and headlines from the 1980s, responded by body-slamming the entire European project in 280 characters: overregulated, aging, unelected, and still obsessed with telling everyone else what to do.

And honestly? He’s not wrong. The EU is like the guy who walks into the startup demo day to offer governance advice from a desk job he’s held since 1997. It’s a bloc running on bureaucratic fumes: tech-lagging, energy-fragile, and somehow still convinced it’s the global conscience. But El Salvador wasn’t even in the room five years ago. Now it’s issuing monetary experiments, cleaning up crime, and apparently annoying the Foreign Affairs Office in Brussels enough to warrant an official memo.

If Europe’s trying to hold Bukele back, it’s not because he’s failing. It’s because, awkwardly, he might be succeeding and doing it without their permission.

I just launched my book on strategy:

Through 28 chapters, I covered three parts: (1) Strategy, (2) Innovation & Growth, and (3) Generative AI.

See a full sample - the chapter on Network Effects. - click HERE