(#133) 👟 Nike turnorund; 🔴 China eats cars

Why does META pay “signing bonuses” of $ 100 m for each AI star?

Thank you for being one of the +4,000 minds reading this newsletter.

Here is what you’ll find in this edition:

👟 Turnarounds are hard, regardless of whether your name is NIKE

Why does META pay “signing bonuses” of $ 100 m for each AI star?

There's a new (super) doctor in town: Microsoft

China eats cars

[Essay] Toy story: How great companies get disrupted by seemingly insignificant innovations

…and more 👇

Onto the update:

Turnarounds are hard, regardless of whether your name is NIKE

Nike’s recent “kitchen sink” earnings report is a reminder that when you’re the biggest name in sneakers, the fall is loud and the comeback is monetized. Sales down 10%, earnings halved, and a $1 billion tariff bill courtesy of Trump’s geopolitical sneaker diplomacy, yet the stock jumped 15% because, apparently, investors love a redemption arc. CEO Elliott Hill, back from retirement like Jordan in ’95, has decided to jettison bad news like it’s a bad batch of Air Maxes. No forward guidance, just vibes and inventory clean-up. If you’re going to crater, might as well make it look like intentional demolition.

But the deeper story is that Nike forgot it was a performance brand, not a nostalgia act. Relying on retro Jordans and alienating retail partners might’ve looked good on a spreadsheet, but in practice it handed market share to upstarts like Hoka and ON, brands that are actually innovating for people who, you know, run. Now Hill wants to double down on athletes and R&D, while shuffling supply chains away from China to dodge tariffs. But with shares trading at 40 times forecast earnings, the bar for success is less “can he fix it” and more “can he recreate a Just Do It miracle before investors Just Bail.” LINK

See my previous analysis on NIKE here, here and here.

Why does META pay “signing bonuses” of $ 100 m for each AI star?

META just announced a bold move into the superintelligence race, assembling an elite AI team under the Meta Superintelligence Labs. People raised eyebrows at the reported signing bonuses of up to $100 million per new AI superstar.

But is $100 million really that much?

Consider John Carmack, whose groundbreaking innovations (e.g., Wolfenstein, Doom, Quake, and later his pivotal contributions to Oculus VR) shaped entire industries and generated billions in value.

A single visionary can fundamentally alter the technological landscape and redefine markets.

This is not your regular AI talent hunt. Companies like META are investing in the future inventions, breakthroughs, and ideas capable of unlocking exponential growth.

With multiple platforms of more than +2 bn users, META is the best positioned to leverage AI. Llama 4.0 was a disappointment and what we see with this talent hunt is Mark's fear that he will miss it and not deliver it (remember that META spent $100 bn on Reality Labs...what a flop)

We'll see what the new team will deliver. I'm bullish on META. LINK

[Essay] Toy story: How great companies get disrupted by seemingly insignificant innovations

In 1997, Clayton Christensen introduced the world to a concept called the Innovator’s Dilemma, a phenomenal book explaining why well-managed companies often falter when faced with disruptive innovation. Christensen illustrated how incumbents, despite having abundant resources and expert management, get disrupted precisely because they’re great at serving their existing customers and, I would add, making sure the next earnings call it’s super OK. These companies see new entrants and technologies as “toys,” insignificant distractions that don’t match the power, precision, or profits of their current offerings. But the toys evolve. They become useful. And by the time incumbents realize what’s happened, it’s already too late. (continue reading it HERE)

There's a new (super) doctor in town: Microsoft

The Diagnostic Orchestrator (because “AI Doctor Supreme” was apparently too flashy) crushed a real-world benchmark, that is, solving complex New England Journal of Medicine case studies four times more accurately than a panel of actual human doctors. This is Microsoft flexing its legacy muscles. Because if you already run most of the world’s hospital backends through Azure and your software is embedded deeper than the stethoscopes, why not own the front-end too?

What’s more interesting is what this says about Microsoft’s strategic position in health data. While the cool kids at OpenAI dream about AGI and wear Patagonia in San Francisco 😎, Microsoft is busy retrofitting the entire healthcare stack. With millions of daily health queries via Bing and Copilot, plus backend access through hospital systems and Dragon dictation software, they don’t need to guess what’s wrong with you. They’ve already read your MRI, your search history, and your doctor’s notes.

The implications are staggering: healthcare might become a function of software updates, not waiting rooms. And suppose this thing actually works at scale, it’s not just doctors being disrupted. In that case, it’s the entire billing apparatus, testing labs, and every insurance company trying to justify charging $700 for a blood test.

Welcome to the age of medicine. Microsoft, WIRED

🇷🇴 Romania at number 40 in the global economic rankings?

Not bad for a country that, within living memory, had queues for all food products, a secret police, and a dictator who thought concrete was the answer to everything. Today, it sits comfortably above Egypt and Chile, and only a few billion dollars shy of overtaking South Africa.... not exactly a small feat for a post-communist nation that spent the ’90s discovering what capitalism was and the 2000s trying to install a decent Wi-Fi router in every village. This is the kind of quietly competent rise that doesn’t get flashy headlines but steadily builds momentum. Think Poland, but with more monasteries and fewer functioning highways.

The future can be bright only with fiscal reform. Romania is like a startup that has product-market fit, growing user base, and VC attention, but still hasn’t figured out how to charge for anything. The fiscal deficit is the national equivalent of forgetting to turn on monetization in your youtube settings. Everyone agrees it’s a problem. No one agrees on how to fix it. Until that’s sorted (ie. meaning tax evasion addressed, spending made smarter, and public finance actually put on rails) Romania risks being that promising middleweight stuck in economic limbo: too developed to play the low-cost labor card, too dysfunctional to break into the big leagues.

In short: great fundamentals, questionable cash flow. IMF 1, IMF 2

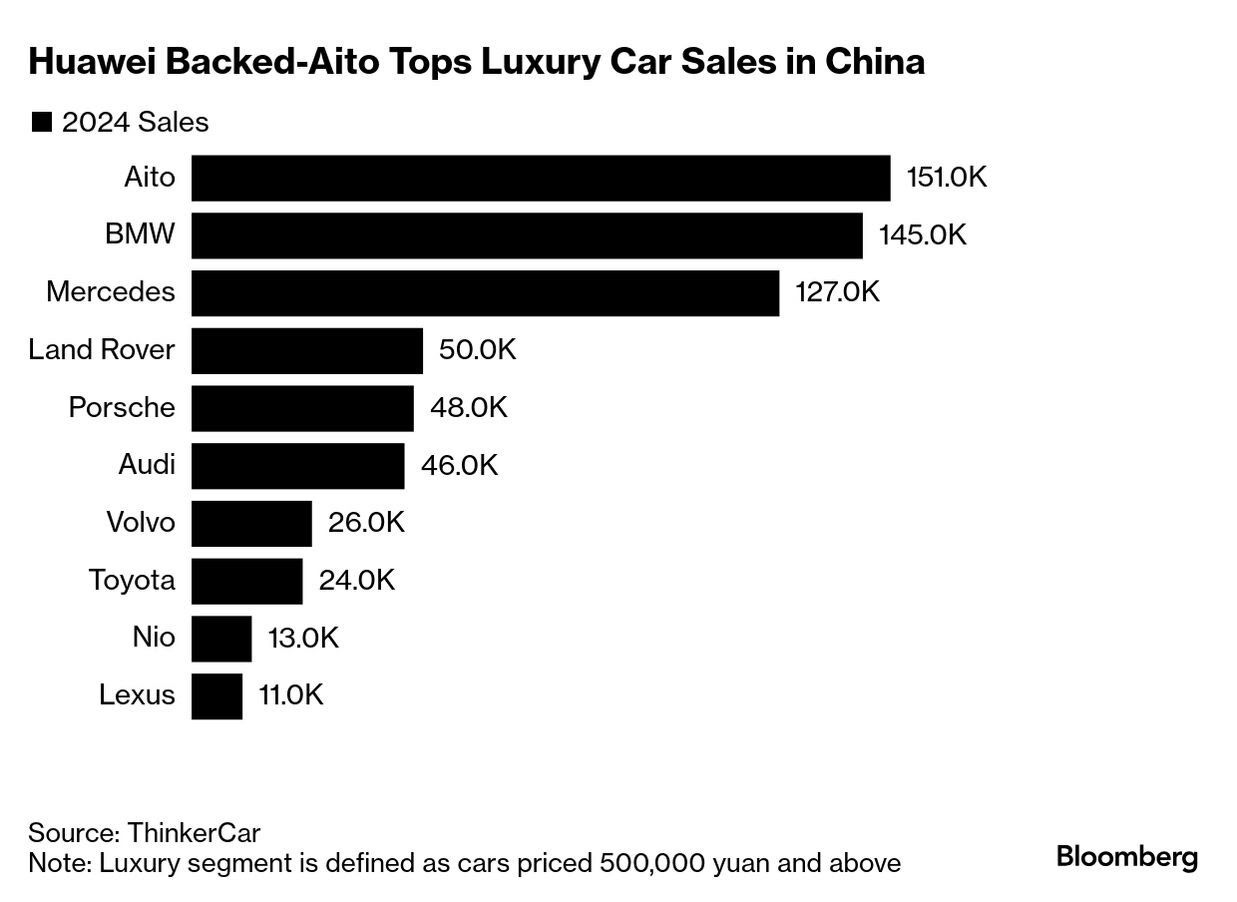

China eats cars

There is something oddly poetic about a company once known for $4,200 minivans suddenly outselling Mercedes-Benz in China’s luxury segment. It’s as if your neighborhood noodle shop decided to start doing omakase 😎 and, three quarters later, put Nobu out of business. That’s essentially what Seres Group and Huawei have done with Aito. And look, Huawei was banned from selling 5G equipment in the West, so they pivoted to selling SUVs with refrigerators and mood lighting to rich Chinese consumers. Because if you can’t dominate Western telcos, maybe you can at least build a car that lets a guy in Chengdu chill two champagne bottles while watching three dashboards tell him he’s late for yoga.

But behind the red glow of those Oakley-style M9 taillights is a deeper lesson in modern industrial strategy. Aito’s rise it’s what happens when you fuse China’s state-enabled industrial muscle with consumer electronics playbooks. Forget brand heritage and German engineering: if the car looks slick, runs HarmonyOS, and connects to your Huawei ecosystem, that’s the new luxury. Still, it’s not all victory laps. Huawei’s polyamorous strategy of licensing their software stack to any carmaker with a badge might backfire. The more partners they onboard, the more Aito risks becoming just another tile on a grid of indistinguishable glass cockpits and AI assistants that recommend scenic detours to sell you more dumplings. And in a market where consumer sentiment is tanking and luxury cars.

on “Digital transformation”

Nothing says “digital transformation” quite like a login page with five separate apps that all basically scream: “We couldn’t agree on anything, so we shipped everything.”

Romania’s largest bank, Banca Transilvania, seems to have interpreted fintech innovation as a game of Pokémon....gotta launch ’em all 😅. There’s BT24 for the legacy customers, NeoBT for the ones who like gradients, BT Go for people who probably won’t, BT Ultra for users who expect more than Neo but don’t want to trade, and BT Trade for people who…do?

At this point, the true innovation is just remembering which one actually lets you see your balance. LINK

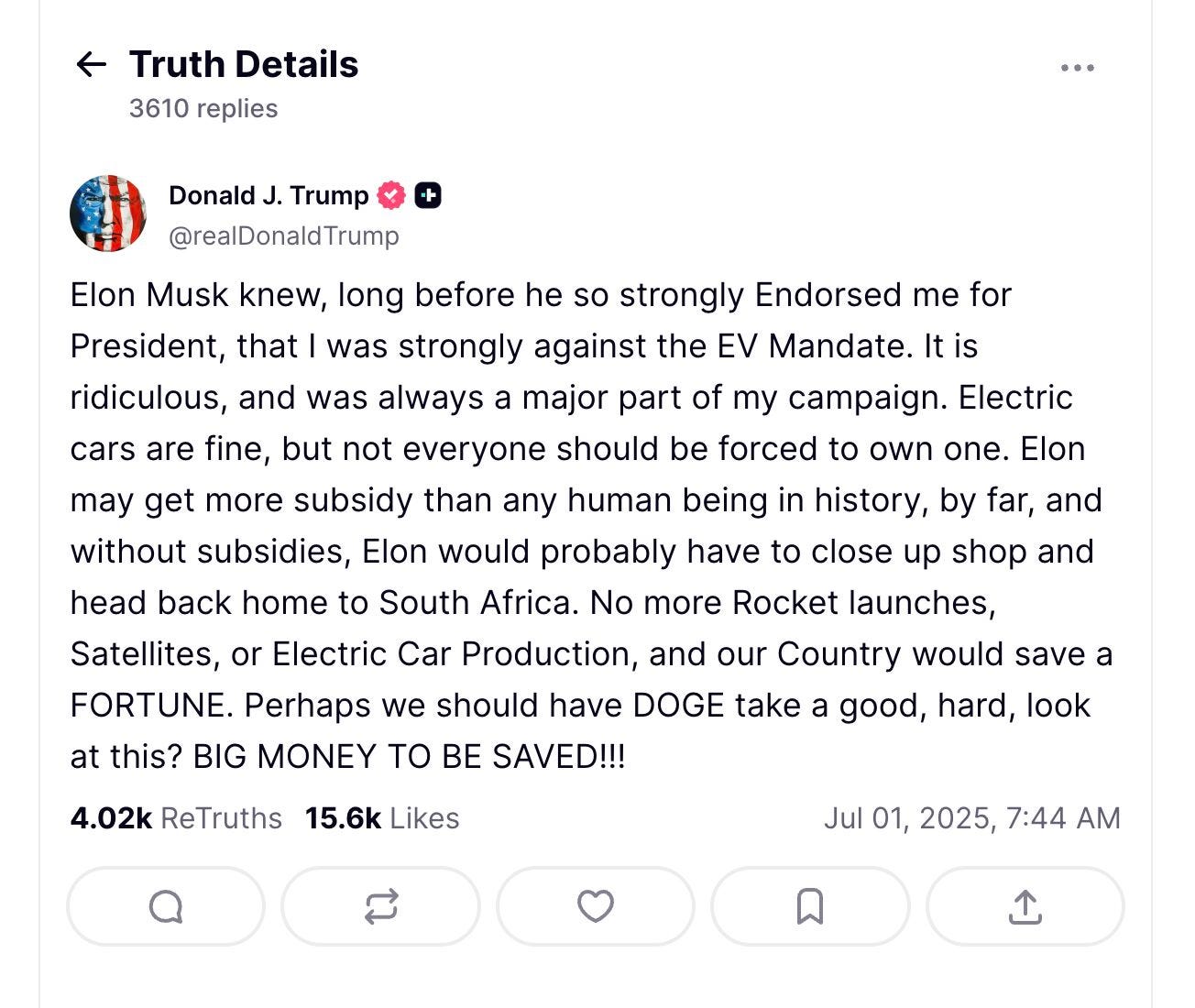

🔴 Trump vs. ⚫️ Elon (part 2)

Here we go again 😅

It’s a strange world where the richest man alive gets a hostile eulogy from a presidential frontrunner for… being too good at getting subsidies. Trump’s post here reads like a breakup text from an ex who wants the dog back and regrets ever letting you crash at his place. The logic is, as usual, uniquely Trumpian: Elon Musk is a subsidy welfare queen, space is expensive, EV mandates are communist and maybe we should put DOGE in charge of the federal budget.

And yet, buried under the caps lock and rhetorical 🍹 Molotovs, there’s a surprisingly important economic point. What if the USA actually decides it doesn’t want to subsidize its industrial champions anymore? If SpaceX and Tesla are “state-backed innovation projects” in disguise, then pulling the plug means betting that the market alone will build rockets and AI chips and gigafactories.

Or, more cynically, it means letting China do it instead while the U.S. saves “BIG MONEY” by not doing anything at all. Which is fine, if your long-term vision for American industry is outsourcing advanced manufacturing to Shenzhen while watching TikToks about your former global dominance. This is the neoliberal fantasy brought full circle: cut government support, watch the private sector flail, and then blame someone else for the decline of American exceptionalism.

Of course, the hilarious part is that Elon is now too big to cancel. The federal government may not like how much money it sends his way, but it sure likes having his rockets, his broadband constellation, and his EV supply chain when push comes to geopolitical shove. That’s the Musk paradox: too libertarian to be trusted, too strategic to be ignored. And if DOGE actually does end up in charge of the federal budget? Well, at least it won’t have to file quarterly earnings. LINK

Six months ago, I launched my book on strategy:

Through 28 chapters, I covered three parts: (1) Strategy, (2) Innovation & Growth, and (3) Generative AI.

See a full sample - the chapter on Network Effects. - click HERE