(#134) Why do we have a shortage of 🍵 matcha and how did it become cool

Apple missed AI

Thank you for being one of the +4,000 minds reading this newsletter.

Here is what you’ll find in this edition:

Why do we have a shortage of matcha and how did it become cool

Copycats in Russia 🇷🇺

on the 🇪🇺 EU’s trade deficit with 🇨🇳 China

Apple missed AI

PRINCIPLE: Strategy in mud, not stone

…and more 👇

Onto the update

There is a shortage of matcha

There’s a certain poetry in watching a 900-year-old Japanese tea ceremony implode under the weight of TikTok clout-chasing and sugary syrups. The global matcha shortage is less about supply chains and more about attention economies. Blank Street Coffee figured out that if you pour neon-green powder into a plastic cup, give it a cartoon name, and make a teen feel like a character from a moodboard, you don’t just sell a drink—you manufacture identity. The cultural elite used to hoard art, land, and vintage wine. Now it’s 15-year-olds hoarding tins of finely milled green powder and rage-posting about it on Reddit.

Meanwhile, somewhere in Kyoto, a seventh-generation tea farmer is watching this circus unfold and wondering how their sacred tradition of handcrafted wellness became a $500 million VC-backed teenage sugar delivery system. The irony is that the matcha-pocalypse isn’t about health or ritual or even taste—it’s about scarcity, vibes, and a performative consumerism that has teens fighting over who deserves the last whiskful of chlorophyll. You know capitalism has peaked when the only way to access spiritual clarity is through a waitlisted subscription app and a strawberry shortcake flavor shot. LINK 1, LINK 2

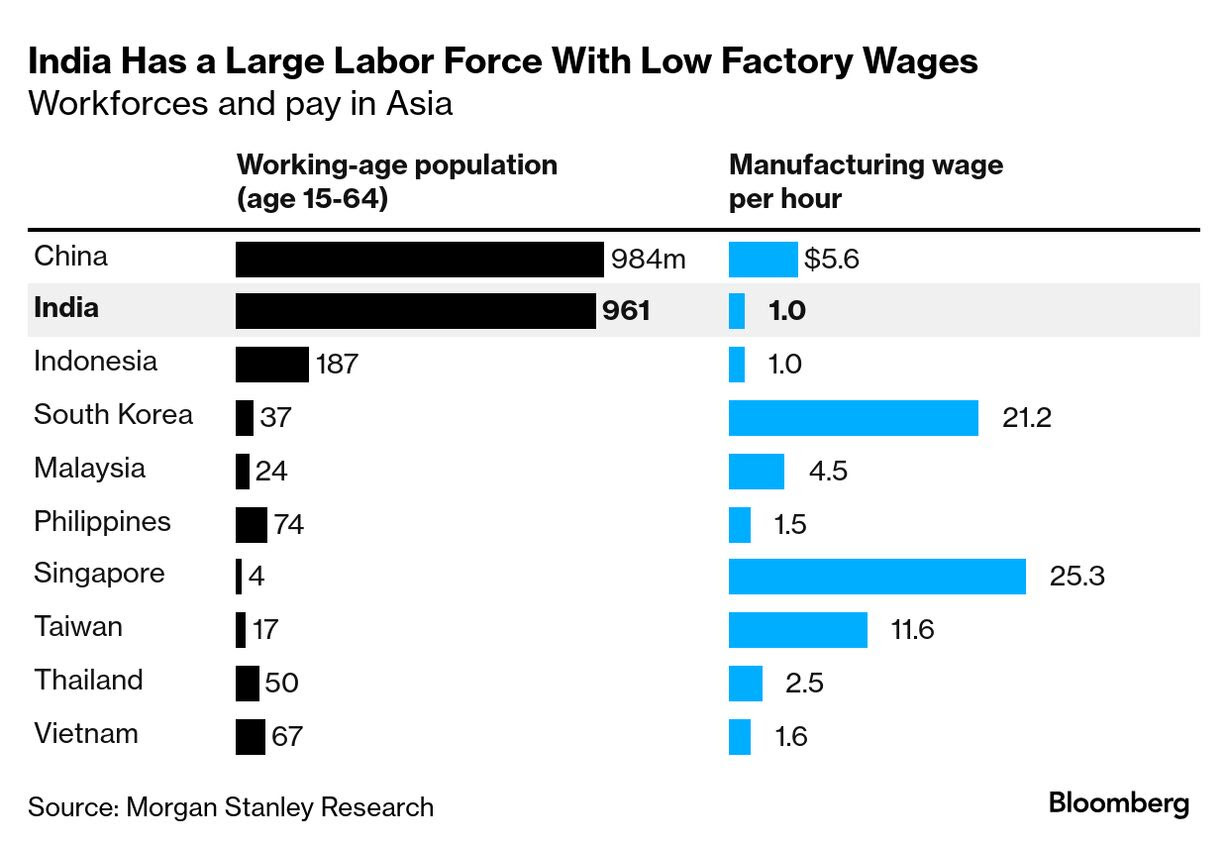

Challenges for Apple to move production to India

Look, you can have 961 million workers and pay them $1/hour, but if they’re assembling iPhones with parts stuck in customs or they value this kind of work, you’re just a giant warehouse with ambition and less of a manufacturing hub 🙃

Yes, India looks golden on paper: second-largest labor force in the world, factory wages five times cheaper than China, and southern states like Tamil Nadu bending over backward with 10-year tax breaks and “we’ll handle it” land deals.

Manufacturing iPhones is more than “hard work”. It’s about the speed, precision, and frictionless coordination of thousands of suppliers, most of whom are still rooted in China’s industrial ecosystem. You can build the factory in India, but the microcontrollers, experts, and rare-earth magnets are still flying in from Shanghai and that’s not just a cost problem, that’s a time bomb.

Delta Electronics knows this. Their Krishnagiri campus is a temple to optimism: 125 acres, shiny new lines, and 20 acres waiting for suppliers to show up. The only problem? Those plots are still empty. “We follow the customer,” they say. Sure. But customers want the same thing Apple wants: Just-in-time + just-in-quality + just-in-China speed (including no strikes, no unions). That’s not something you build with tax breaks alone. It’s industrial culture, not real estate.

And while southern India is doing its best cosplay of Shenzhen with Ola’s giga-factory, Tata’s iPhone lines, and TEAL’s factory-of-factories churning out the machines that make machines it’s still missing the soft infrastructure: logistics interoperability, supplier density, and a war-hardened supply chain culture that knows how to ship 200 million units with zero excuses.

So yes, India is on the map. It’s real. It’s rising. But for now, it’s not Shenzhen 2.0, it’s Shenzhen 0.5 beta, and the bugs are still being patched. LINK

Copycats in Russia

Look, if you squint hard enough, it’s not theft....it’s just spontaneous parallel evolution of trademarks, menus, logos, and customer experiences 🙃

The fact that your “Big hit” tastes and looks exactly like a Big Mac, served with fries in a red-and-yellow box with a suspiciously golden "M" on the front, is surely just a coincidence. Or maybe it’s like jazz: same notes, different rhythm 😅

After the sanctions, McDonald’s and Starbucks walked out the door, and in walked their new mottos: Vkusno i Tochka (“Tasty, and that’s it”) and Stars Coffee (“Bucks left, the stars remain”). These are Frankensteinian reconstructions built with the very bones of the original brands. The same staff, same kitchens, same suppliers, just without the licensing fees or the lawyers from Chicago and Seattle.

This it’s what happens when geopolitics meets intellectual property law in a dark alley and decides to swap uniforms. But it’s working. Revenues are up. Profits are soaring. The customers barely blinked. So when the West eventually comes knocking, perhaps with fresh trademarks and a new Spotify playlist Vkusno i Tochka will respond, with legal confidence and a straight face: “Sorry, we got here first. It’s not theft if you left your stuff behind.”

99.99% identical? Sure. But in Russia, that last 0.01% is sovereignty. LINK

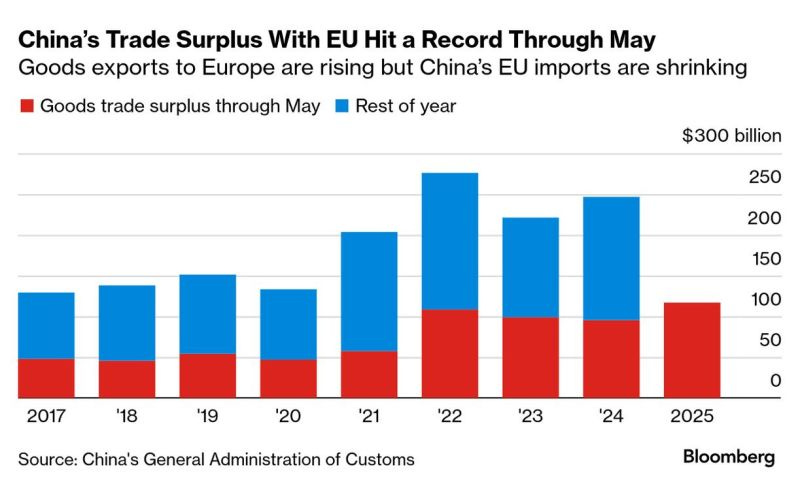

on the 🇪🇺 EU’s trade deficit with 🇨🇳 China

Bloomberg reports about the beautiful symmetry of regret: first you offshore manufacturing to China to cut costs, then you outsource innovation to China because they now run the factory and finally you complain when China runs a record trade surplus with you.

Europe essentially shipped its industrial base eastward and then discovered (surprise!) that Chinese imports go up while European exports go down. Turns out if you teach someone how to fish, give them your fishing boat, and ask them to build it cheaper, they eventually start selling you fish at scale, with a margin.

And now Brussels is stuck in a trade marriage with a partner that not only builds the appliances but rewrites the instruction manuals. In the meantime, the EU debates whether to apply tariffs or form another working group. There’s a kind of poetic justice in watching policymakers who once saw China as a “cheap labor hub” now get dunked on in luxury EVs and solar panels priced below cost.

Industrial policy was once a dirty word in Europe. Now it’s back, because the alternative is admitting that turning China into the world’s assembly line also handed them the blueprint for your future trade deficit and your overall unemployment.

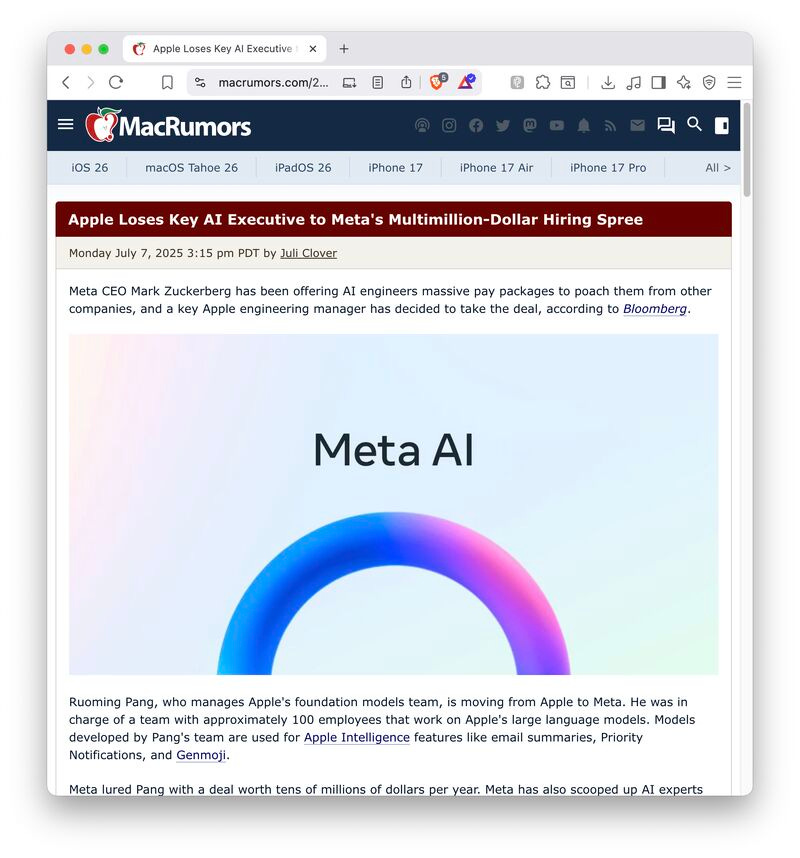

Apple missed AI

It has never been Apple’s culture to shower talent in stock-soaked hot tubs or offer unlimited kombucha options in the metaverse breakroom. Apple’s value proposition to employees has always sounded more like a whisper than a bribe: “Work on the most iconic hardware on Earth and maybe - just maybe -you will get paid...at your next job.” So when META throws tens of millions of dollars at Apple’s AI lead and poaches him like he’s a rare truffle, the response from Cupertino it's more like serene detachment. Yes, Ruoming Pang ran the team behind Apple’s LLMs. Yes, those same LLMs might now get shelved in favor of OpenAI or Anthropic. But Apple’s bet has never been on keeping people forever. It’s about getting the most out of them while they’re there and replacing them with someone just as talented but less jaded.

The real issue, though, is what happens when the people you’re replacing aren’t being drawn to Apple’s mystique anymore. When the engineers who once whispered “I’m going to change the world” in the mirror now mutter “I’m going to cash out like a Saudi-backed football player.”

Apple doesn’t need to outbid Meta dollar for dollar. That’s a losing game. But it does need a compelling answer to the question: Why build AI at Apple if your model might get scrapped, your product delayed, and your bonus dwarfed by Mark Zuckerberg’s signing fee? Because if Apple Intelligence becomes Apple Ambivalence, there’s not enough secrecy in the world to keep the talent from walking out and Siri’s not smart enough to stop them. Yet. [Bloomberg, MacRumors]

Javier Milei is running Argentina contrary to the economists’ belief

Ah yes, the classic “100 economists sign a letter” genre, the intellectual equivalent of forwarding a chain email to The Guardian with the subject line “IF YOU ELECT HIM, YOU’LL DIE.”

In this case, it was Javier Milei, Argentina’s chainsaw-wielding libertarian president, who was supposed to bring on “devastation,” “economic collapse,” and presumably, dogs marrying cats. One year later? Inflation is down, the currency has stabilized, and foreign investors are actually calling back. Turns out if you stop printing money, fire half the regulatory bureaucracy, cut taxes, and tell the IMF you’re done being their punching bag, it’s not Armageddon. It’s.... macroeconomic competence.

Of course, these economists weren’t wrong in the academic sense; they were just professionally horrified that someone tried to fix a broken economy without first getting a PhD in Keynesian waffling. When you cut through layers of institutional fat and turn the central bank into a glorified dollar [pesso] ATM, it doesn’t feel like “serious policy”, it feels like heresy.

Surprise! Markets love heretics who balance the books. The devastation didn’t come. The deficit did. LINK

on teaching 👩🏻🏫🧑🏻🏫

There’s a persistent myth in academia (and, let’s be honest, in a lot of industries) that the best people to learn from are the ones who are best at doing the thing.

Students chase professors with the longest publication lists, the fanciest journal placements, and the keynote speaker energy. And then they sit through 80-minute lectures that feel like being read a PDF aloud by someone allergic to eye contact. The problem is that intellectual brilliance and pedagogical ability are not correlated. If anything, they might be slightly negatively correlated, because the more effortlessly someone grasps a concept, the harder it is for them to remember what it felt like not to understand it.

Even when we do find someone who can explain clearly, we often stop there and declare victory. But clarity is just the opening bid. Great teaching is not about information transfer, but about transformation. It’s the ability to make someone want to understand, to reshape their mental models, to get them to ask better questions. It’s not just “Here’s how this works,” it’s “Here’s why this matters and why you can do something important with it.”

A good explainer gives you a map, but a great teacher makes you want to explore. LINK

PRINCIPLE: Strategy in mud, not stone

In a world that moves like a river, why build your strategy out of stone?

Leaders love certainty. Investors crave confidence. And powerpoint loves a five-year plan with bulletproof logic.

But the best strategies? They’re sketched in pencil. Etched in mud. Solid enough to hold shape. Soft enough to reshape.

So, yes, strategy is an iterative process, besides an intellectual one.

Because things will change. Markets flip. Competitors copy. Customers surprise you.

The rigid break. The flexible adjust.

Etching in mud doesn’t mean you’re unsure. It means you’re aware.

Aware that the map isn’t the territory. That feedback is data. That agility beats arrogance.

The most dangerous words in strategy are: “But this was the plan.”

So plan, yes. Think hard, aim high, commit.

But hold it lightly. Be ready to remix, refine, even restart.

Etch in mud, so you can move when it matters. LINK

Six months ago, I launched my book on strategy:

Through 28 chapters, I covered three parts: (1) Strategy, (2) Innovation & Growth, and (3) Generative AI.

See a full sample - the chapter on Network Effects. - click HERE