(#137) 💉 How Novo Nordisk lost its lead in the weight loss race; 🇨🇳 on China's 2nd economic shock

Samsung partners with Tesla to build AI chips

Thank you for being one of the +4,000 minds reading this newsletter

Here is what you’ll find in this edition:

[Essay] 🤓 Adapting the Higher Education system to the beginning of the AI era

How Novo Nordisk lost its lead in the weight loss race

on the USA 🇺🇸 🤝 EU 🇪🇺 deal

Samsung partners with Tesla to build AI chips

Opinion: Facts vs. Beliefs

PRINCIPLE: Don’t network, make friends

…and more 👇

Onto the update:

How Novo Nordisk lost its lead in the weight loss race

Novo Nordisk had the first-mover advantage, the brand recognition, and the drug everyone memed about on TikTok. And then Eli Lilly just sprinted past them like it was a 100-meter dash and Novo was still doing warm-up stretches. Ozempic became a cultural phenomenon, but Lilly turned Mounjaro into a platform strategy with better efficacy, faster execution, and (critically) less puking. Turns out, winning in pharma is about momentum.

What happened next is textbook corporate inertia: Novo underestimated the American consumer, who doesn’t want to wait for insurance approval. They want weight loss now, via direct-to-patient logistics and influencer partnerships. Lilly read the room. Novo read the clinical trial PDFs. Novo was selling science; Lilly was selling identity. And while Novo debated dosing protocols, Lilly launched LillyDirect. In the weight loss Olympics, Novo brought a lab coat to a marketing war.

And now? Investors are circling like it’s a biotech version of “Succession.” The CEO’s out, the pipeline is late, and Novo is busy writing press releases while Lilly prepares to drop a weight loss pill with Netflix-level hype. Novo had the lead and lost it not because they lacked a good drug, but because they lacked speed, swagger, and a Shopify checkout button. In pharma, like in comedy and crypto, timing is everything. LINK

Apple has many critical challenges

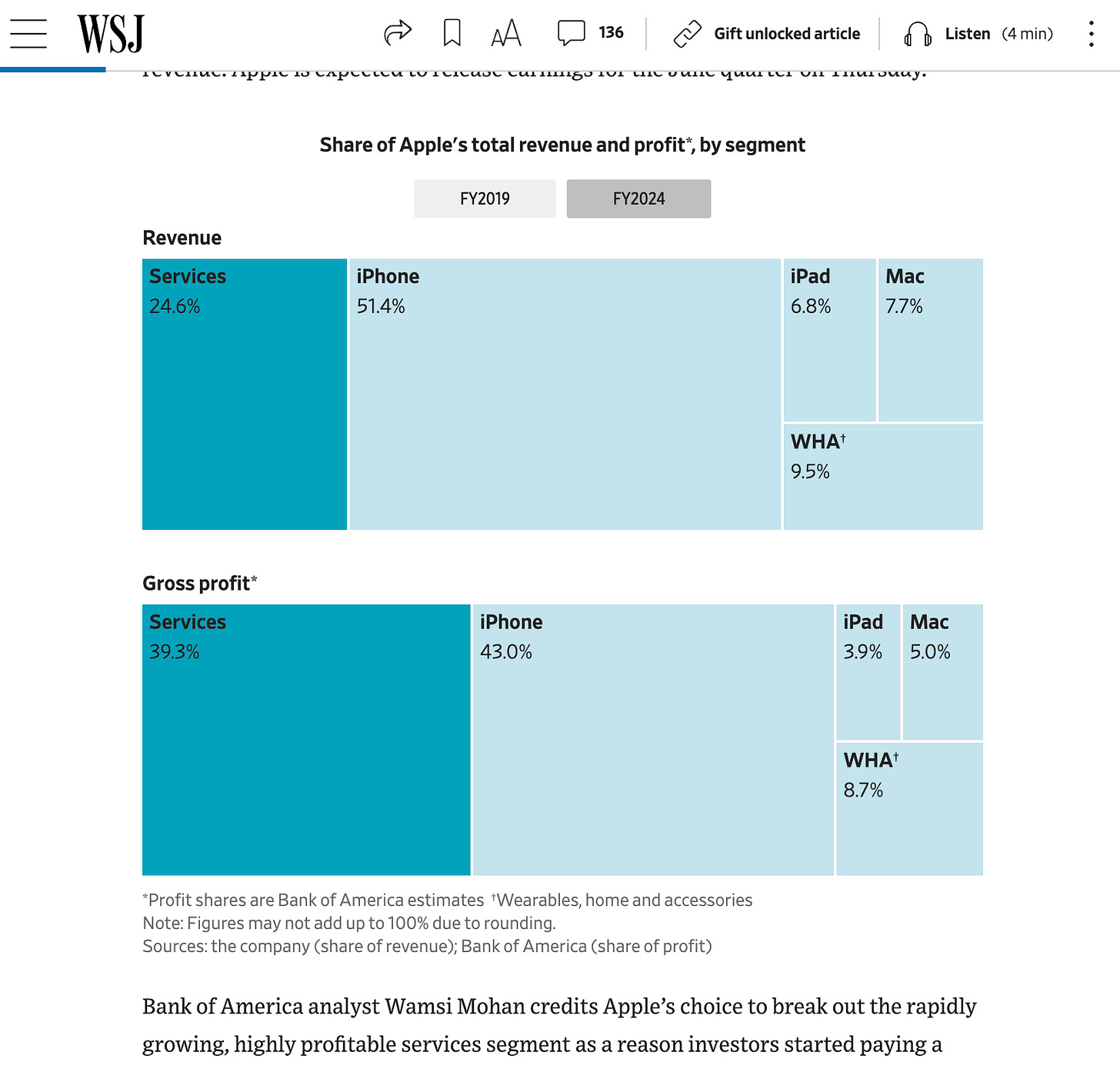

Apple sold the same number of iPhones in 2024 as in 2015. But its stock? Up 9x. Because what’s the real product Apple sells now? Not aluminum rectangles, but toll booths. App Store fees, Google’s “please let us be the default” tax, iCloud upgrades when your baby videos hit 5.01 GB. These are the invisible scaffolds holding up a $3 trillion valuation. And they’re all pure margin: 70%+ profit, no shipping required, just vibes and a lock-in.

But now regulators are doing what regulators do: slowly, expensively, and with occasional punctuation, they’re prying open the gates. If Apple can’t force you to pay 30% for imaginary rails in the App Store or if Google gets cut from Safari because of, you know, antitrust, then suddenly Apple’s services business looks less like a growth engine and more like a cartel that got caught.

Which is… awkward. Because services now account for a huge slice of Apple’s profits, especially the bits with no real cost (read: Google bribes). So yeah, Eddy Cue is losing sleep. Because if developers start routing payments outside the App Store and the EU finally gets serious, it’s not just “privacy and simplicity” that Apple’s selling, but margin fantasy. And like all great fantasies, it only works until someone checks the receipts. LINK

Samsung partners with Tesla to build AI chips

Back on Aleph Business to discuss the new partnership between Tesla and Samsung.

Here are some ideas mentioned:

It revives confidence in Samsung’s Taylor (ie. Texas fab) which had previously faced delays due to lack of customers

It positions Samsung as a credible alternative to TSMC

Hopefully, it will bring Samsung some customer trust after the negative reputation it made after working with Apple and Qualcomm (both companies now work with TMSC)

Tesla becomes Samsung’s top customer in this deal, unlike at TSMC, where it would have to compete for capacity with Apple, Nvidia, and others.

Samsung agreed to let Tesla “walk the line” in the fab (ie., actively participate in optimizing manufacturing ), something Elon Musk explicitly valued. This level of access is unprecedented at TSMC or Intel. Does Elon have some insights about optimization and scaling chips?

The fab is located in Texas, close to Tesla’s operations, making collaboration logistically easier and aligning with US efforts to localize semiconductor supply chains. LINK

[Essay] 🤓 Adapting the Higher Education system to the beginning of the AI era

The Higher Education system has to change due to AI:

1/ Bachelor - become Bachelor and 80% Master

2/ Master - develop the student up to the Senior level in a company

Read it all HERE.

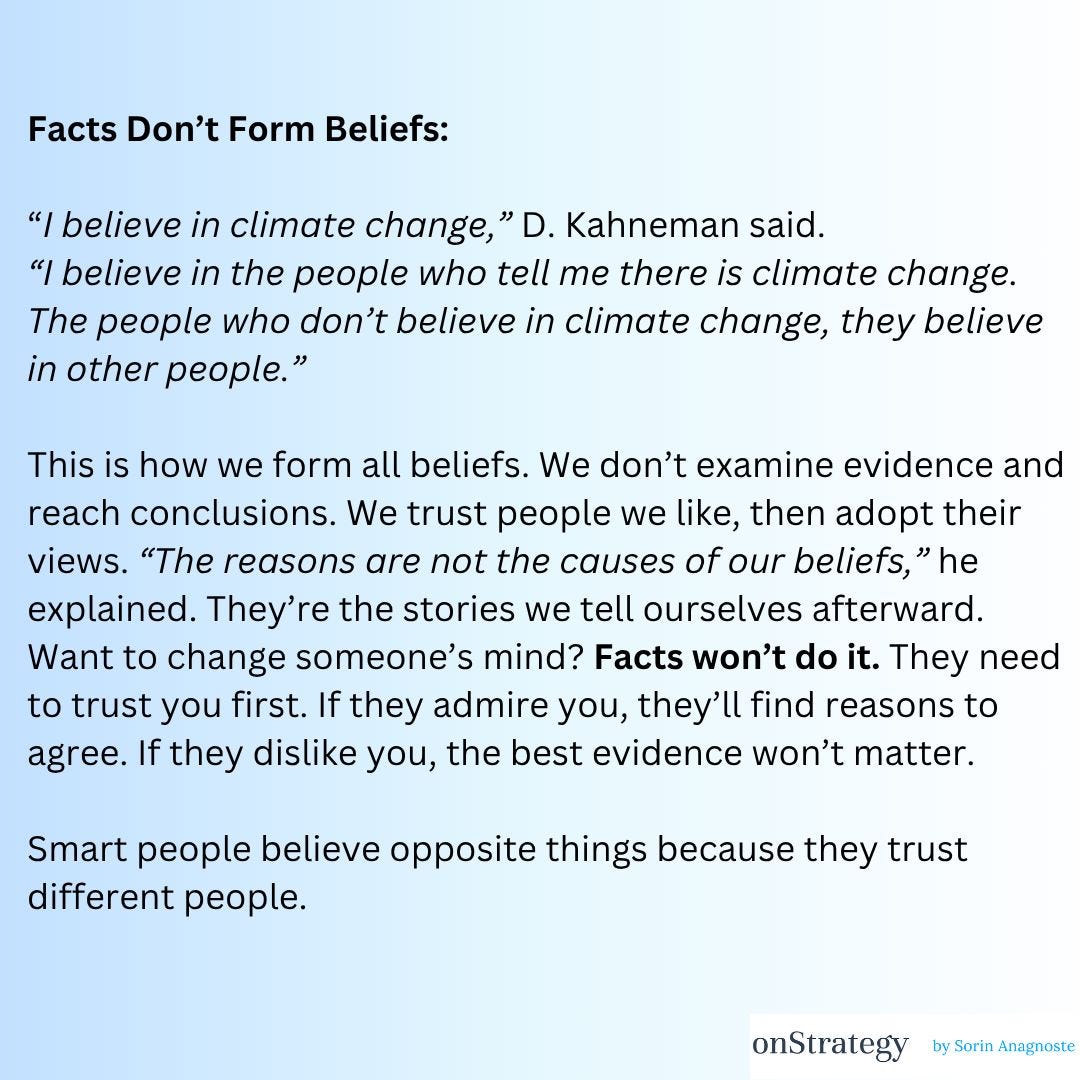

Facts vs. Beliefs

The thing about facts is that they don’t really do anything. They just sit there. I saw this with our canceled presidential election in 🇷🇴 Romania.

Meanwhile, your beliefs? Those are performance reviews for the people you trust. Kahneman’s point, delivered with the kind of dry academic terror that only psychologists can manage, is this: you don’t believe in climate change because of ice core samples or atmospheric CO2 levels, even now are experiencing the hottest summer yet. You believe in it because the people you trust (NPR hosts, Patagonia wearers, maybe your PhD advisor) say it’s real. If Tucker Carlson or Andrew Tate said it, you’d throw your parka in the fireplace.

And this is not only about climate change. It’s crypto. It’s COVID. It’s which AI startup you think will win. It’s whether you think Elon is a genius or a Bond villain with broadband. Facts don’t form beliefs. Loyalty does. Identity does.

The stories we tell ourselves (about our team, our tribe, our heroes) are the scaffolding of our reasoning. So next time you present a 42-slide deck hoping to “change minds,” just remember: if they don’t like your shoes or your haircut, you’re already losing the argument 😉

USA 🇺🇸 🤝 EU 🇪🇺 deal

It’s not every day you watch the world’s largest trading bloc walk into a trade negotiation like it’s a polite garden party and walk out like it just sold its future for $750 billion in liquefied natural gas. But that’s exactly what happened.

The deal? A baseline 15% tariff on EU goods vs. 0% for the US goods, plus a $750 billion for buying American energy and investing $600 billion in the U.S. economy. In other words: please don’t hurt our car exports.

The subtext, though, is where the real drama lives. Europe is tired. Financially weak, demographically shrinking, politically divided, and strategically paralyzed by its dependency on US security guarantees. The continent couldn’t even organize a proper retaliation without first removing bourbon and Parmesan from the list.

Meanwhile, Trump runs the same playbook he used in 2018: escalate fast, threaten harder, and let internal EU disunity do the rest. This is what I call a capitulation with press photos. And the scariest part? Brussels will probably call it a win. LINK

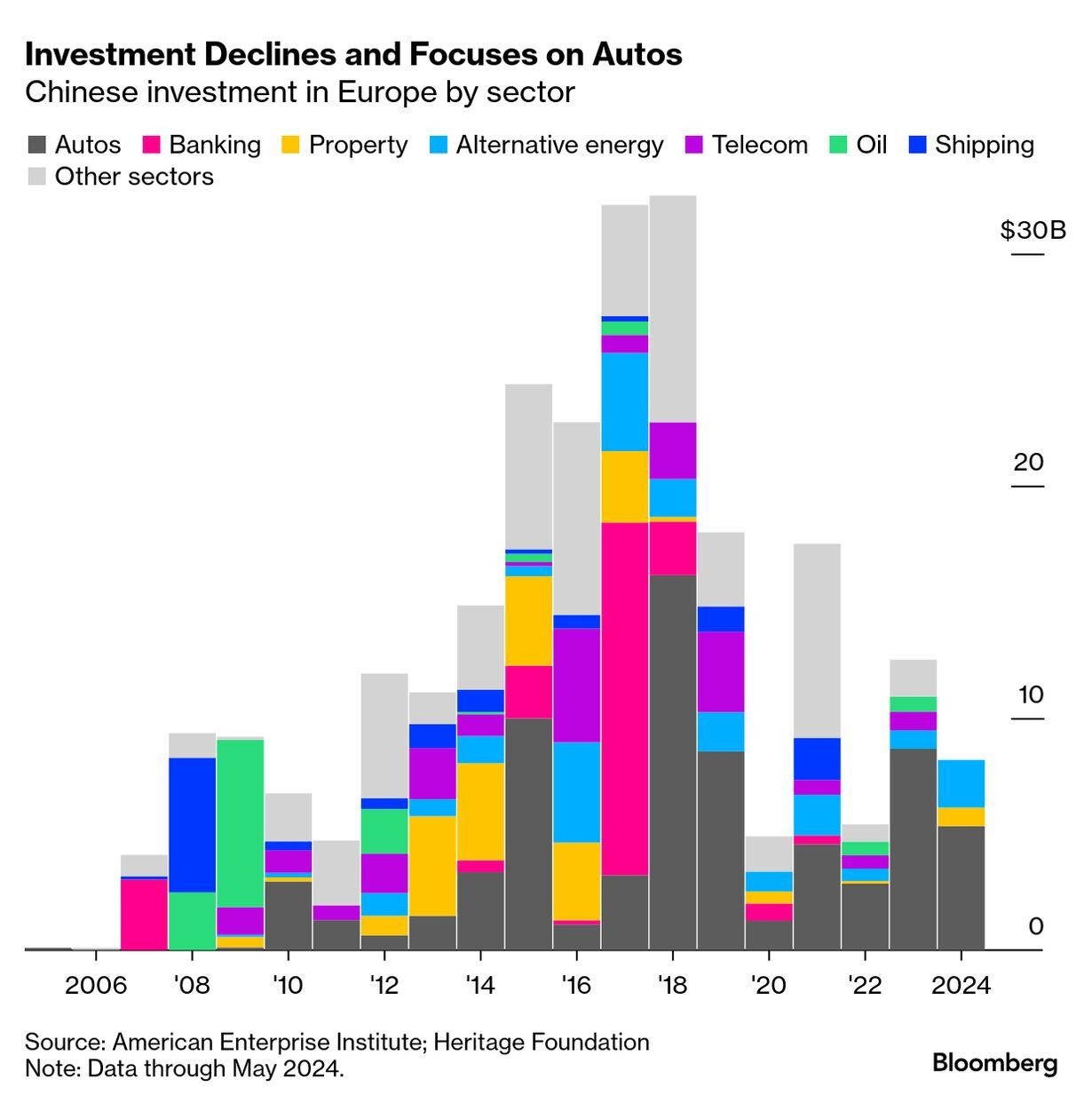

on China’s 2nd shock

China looked at its real estate implosion, saw the social risk, and said: "Okay, let’s subsidize everything that still makes stuff". And thus began the great industrial pivot, not toward productivity, but toward preventative employment.

In the 2010s, Chinese money flooded into Europe like a BRI fever dream; property, banks, energy, you name it. Then around 2019, the lights went out. Except for autos. Autos kept going. Why? Because if you’re Beijing, and you need jobs, exports, and national pride on four wheels, EVs are perfect (including computers and drones). They’re shiny, subsidizable, and conveniently count as innovation.

🔴 So here we are, in the middle of the second China shock. Every province gets a battery plant. Every startup gets a chip fab. Every local government gets to pretend it’s incubating the next BYD, while quietly funneling subsidies into a car that will lose USD 3,000 per unit in Hamburg.

Europe thought it was importing competition. It was actually importing deflation, dislocation, and a surplus of electric SUVs with suspiciously generous price tags. Shock 1, FT, WSJ

PRINCIPLE: -- Don’t network, make friends --

I gave up networking several years ago...when I turned this concept into a personal principle. Here it is:

We all know that networking is weird. It’s like pretending to care about someone’s weekend just so you can maybe ask them for a favor six months later. It’s polite corporate stalking with coffee.

But making friends? Totally different sport. Friends root for you even when there’s nothing in it for them. They send you weird links at 2 AM, tell you your pitch deck sucks before investors do, and show up when it’s time to launch that weird idea you cooked up in the shower.

Writing online is the cheat code here. It’s like standing on a digital hilltop with a neon sign that says, “Here’s what I care about. Come say hi if you’re into this too“. And then people do. It’s amazing.

The truth is, nobody builds big things alone. But they also don’t build them with LinkedIn randos they met once and never heard from again.

They build with people they trust. People they like. Friends.

So if you’re about to “network”, maybe don’t. Just hit publish instead. LINK