(#139) Six Chinese automakers just ate the global EV market

Apple won’t let Siri die

Thank you for being one of the +4,500 minds reading this newsletter

Here is what you’ll find in this edition:

on beating the market 🤓

Chinese EVs are eating the world

Perplexity loses its focus

Apple won’t let Siri die

Green energy without batteries and nuclear is not working

…and more 👇

Onto the update:

on beating the market 🤓

--> YTD performance of my portfolio: +50.6%

--> S&P 500: +8.88%

--> Bitcoin: +29.9%

--> Gold: +31.2%

Not to brag (well, maybe a little 😎), but this isn’t a one-off. For years, my portfolio has consistently outperformed the market, of course, using only public data, independent research, and my own analysis. No secret sauce. Just the discipline of asking the right questions and running the numbers until they make sense.

As Snoop Dogg once said: “I want to thank me for believing in me.”

That said, I’m seriously considering starting a weekly Three-Company Analysis - diving deep into fundamentals, strategy, and market positioning - and giving each a “Buy,” “Hold,” or “Sell” rating. All under a paywall. Because quality insights are valuable 😎

Markets reward preparation, not prediction. And preparation? That might be my edge 🤓

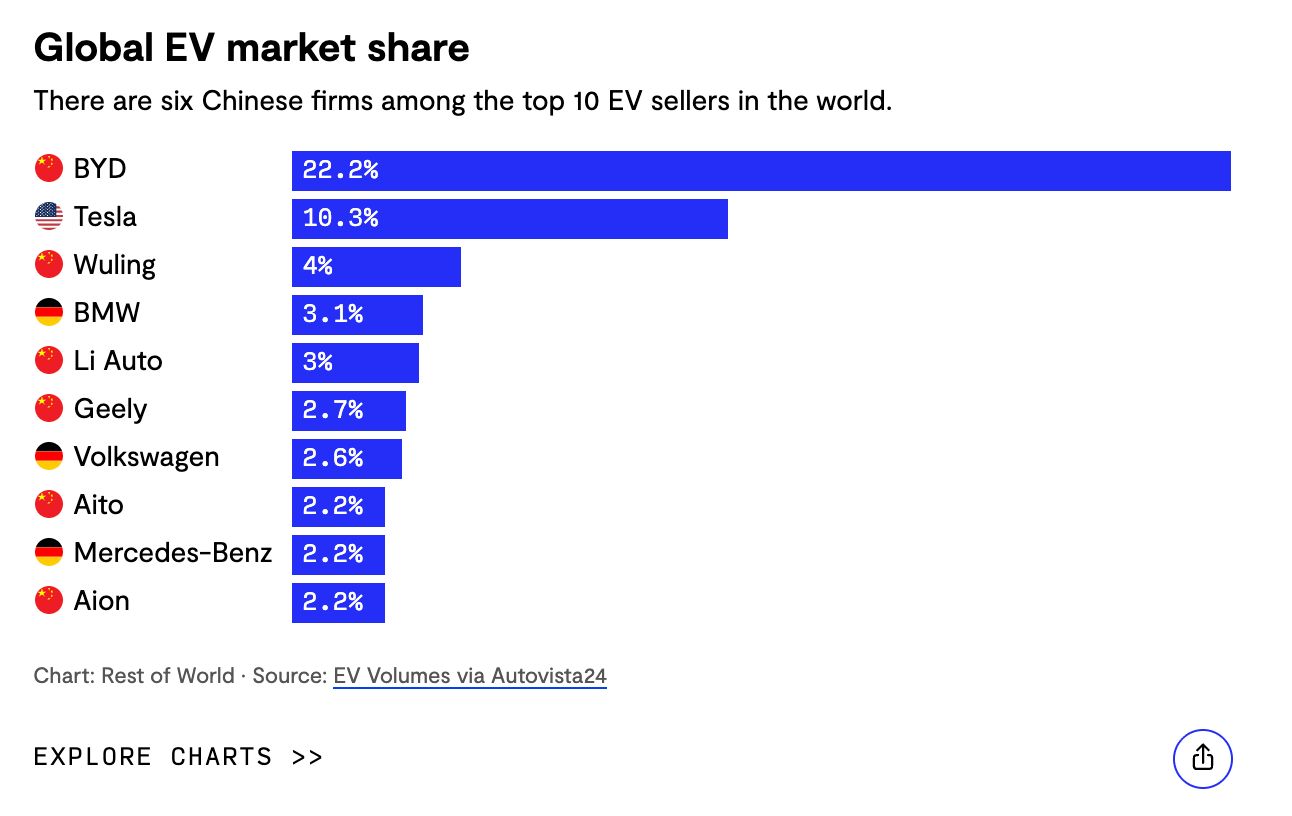

Chinese EVs are eating the world

Six of the world’s top 10 EV sellers are Chinese and they’re not just dumping cars in ports. More than that, they’re setting up factories, R&D centers, and service networks in Brazil, Thailand, Hungary, you name it. It’s vertical integration plus localization, wrapped in a cost structure Western automakers can’t touch. And because their product cycles are 18 months versus the West’s four years, they’re basically iterating cars the way Silicon Valley iterates apps.

For Europe and the US, this is the nightmare scenario: Chinese EV makers controlling 70% of global production, capturing 85% of some emerging markets, and doing it while your legacy brands are still prototyping their next EV crossover. The competitive pressure is driving prices down, compressing timelines, and forcing the rest of the industry into a choice: adapt or die. This expansion is partly survival for Chinese firms in a cutthroat home market, which means they’ll be even more aggressive abroad. The question isn’t whether they’ll take market share, but it’s whether anyone else can keep up without completely rethinking how they design, build, and sell cars. LINK

Perplexity loses its focus

Paying (or willing to pay) $34.5 billion for Chrome without Google’s user base is like buying a Ferrari after the engine’s been repossessed. Browsers are a fully commoditized product, built on open-source Chromium, interchangeable, and competing in a market where the switching cost is two clicks.

Chrome’s value is in the default status and the massive funnel into Google Search, Ads, and data collection. Strip that away, and you’re basically left with a pretty UI shell and a logo. So, unless Perplexity thinks it’s buying 3.5 billion users (spoiler: it’s not), this is either a very expensive PR stunt or a bet that they can somehow turn a free, open-source commodity into a $35 billion profit center. Which is… bold. LINK

Apple won’t let Siri die

Siri was supposed to be Apple’s friendly little AI concierge, the one you could ask to book dinner, send a text, and maybe find that PDF your accountant emailed you three months ago. Instead, for the last decade, it’s been more like a polite but slightly confused intern: eager to help, but liable to misunderstand "Find photo from Paris trip" as "Play Pharrell’s Happy" 🙃. Now Apple’s rumored "App Intents" upgrade is aiming to fix that, ie. letting Siri directly operate apps, click buttons, fill out forms, and generally do everything without you touching the screen.

If it works, this is quietly massive. It’s the difference between voice control as a parlor trick and voice control as the interface. No more "Sorry, I can’t help with that" when you try to log into your bank. No more clumsy "opening app…" pauses before you inevitably take over and do it yourself. The problem, of course, is that if Apple’s AI bench keeps losing talent to Meta’s “Superintelligence Labs” like it’s a free-agency fire sale, and Siri’s track record is… let’s call it “optimistically inconsistent.”

But if Apple nails this, they won’t just have a better assistant, but they’ll have quietly turned your iPhone into an AI-powered universal remote for your digital life. If they miss? Well, we’ll be back to asking Siri for the weather and getting directions to Weatherford, Texas. LINK

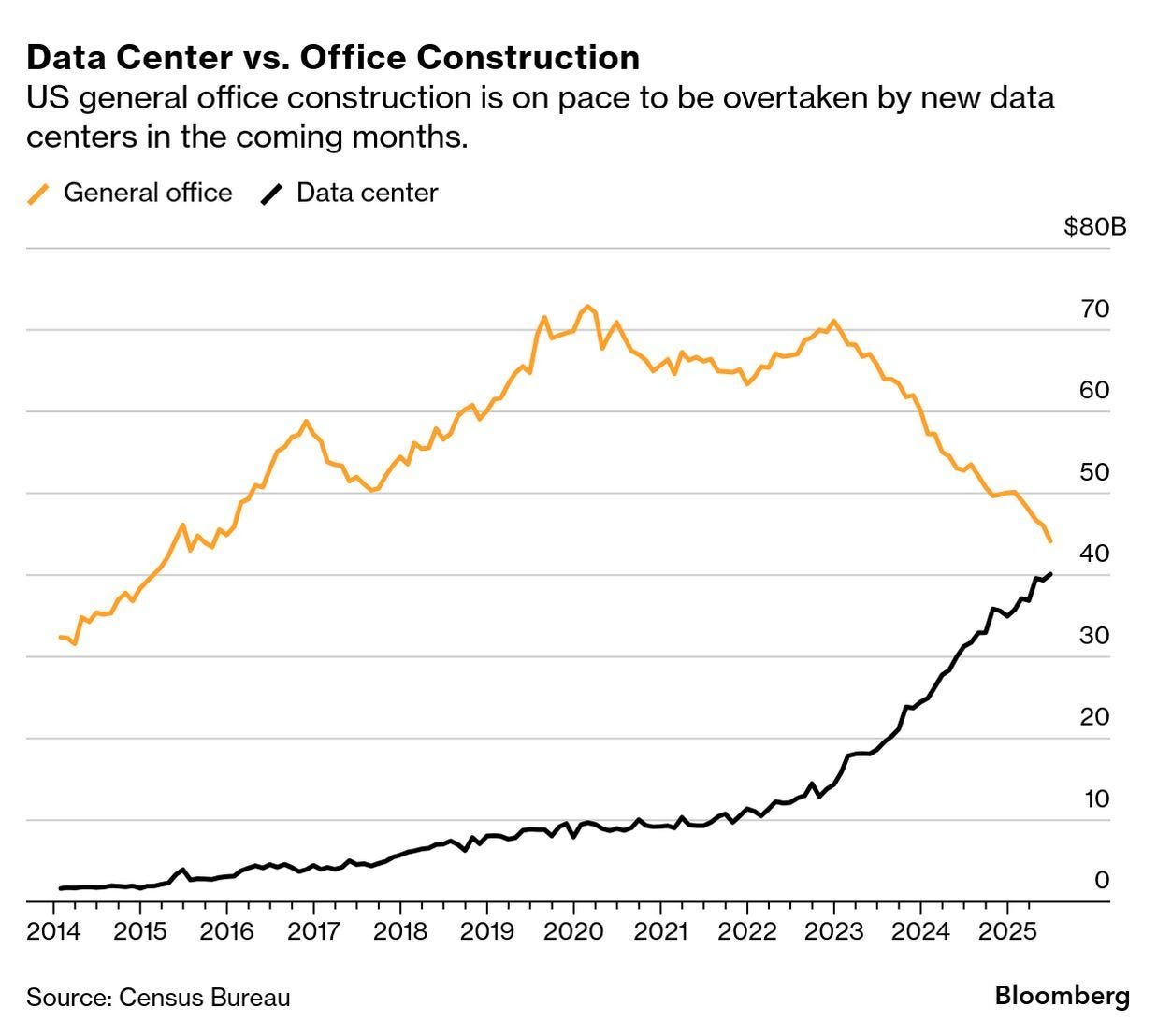

Everybody is building a data center nowadays

For decades, America built temples to the gods of middle management: glass towers with corner offices, espresso machines, and awkward elevator small talk 😅. Now? They're building temples to the gods of GPUs. We’re swapping cubicles for server racks, whiteboards for liquid cooling systems, and the break room for a backup generator.

Offices were where people talked about doing things; data centers are where machines actually do them. AI training doesn’t need a 401(k) or ergonomic chairs ... it needs megawatts and fiber lines. So yes, this is the end of the "office as the cathedral of work" era. The new cathedral hums at 65 decibels, smells faintly of ozone, and its only employees are there to make sure the blinking lights keep blinking. LINK

Green energy without batteries and nuclear is not working

🏴 Scotland just pulled off the renewable energy equivalent of hiring Lionel Messi and paying him to sit on the bench. Nearly 40% of potential wind output was shut off in the first half of the year, not because the turbines were broken, but because there’s no way to get the electricity to where it’s needed (!!)

The grid can’t handle it, so operators literally pay wind farms to stop generating, then pay gas plants somewhere else to fire up. It’s like buying caviar for dinner and then ordering McDonald’s because you forgot the forks.

And here’s the thing: it's not a grid problem, but a storage problem. You can only waste this much clean power if you’re allergic to batteries. Build serious large-scale storage (lithium, flow batteries, hydrogen, whatever works) and those “constraint payments” turn into export revenue, or at least lower bills.

Instead, the UK has mastered the art of simultaneous abundance and scarcity. You’d think by now policymakers would realize that in the renewable era, electrons are like money: it’s not enough to make them...you need somewhere safe to keep them until you actually want to spend them. LINK