(#144) 👩💻🧑🏻💻 Oracle cashes in; Elon is back…at Tesla 🚗

Why is China rejecting the best AI chips in the world?

Thank you for being one of the +4,500 minds reading this newsletter

Here is what you’ll find in this edition:

Why is China rejecting the best AI chips in the world?

Oracle cashes in

👩💻🧑🏻💻 on management consulting in the AI era

Elon is back…at Tesla

How people use ChatGPT

…and more 👇

Onto the update:

Why is China rejecting the best AI chips in the world?

China just told its tech giants (ByteDance, Alibaba, Baidu) to stop buying Nvidia’s custom AI chips. Which is funny, because the whole point of Nvidia designing the RTX Pro 6000D was to tiptoe around US export bans by making a “China-only” version that wasn’t quite as good as the stuff sold in the West. Beijing’s response is basically: “Thanks, but no thanks. We’ve decided Huawei and Cambricon are “good enough” now”. The signal is clear. If you’re building AI in China, you’re building it on Chinese silicon, even if you’d rather use Nvidia.

The implications are huge. For Nvidia, this is the nightmare:. You go from selling tens of thousands of chips to Chinese hyperscalers to zero, overnight. For China, it’s the clearest sign yet that “decoupling” is policy now. And while the US export ban was supposed to slow down Beijing’s AI progress, in practice it forced China to pour money and urgency into domestic fabs. Now the CAC is saying those chips are “comparable” to Nvidia’s watered-down offerings, which means the protectionist loop is closing. China bans Nvidia to grow Huawei, and Huawei grows precisely because the US banned Huawei from Nvidia. Everyone loses market share, except the local champion. Which is, of course, the point. LINK

Oracle cashes in

Oracle stock went orbital: up 36–43% in a single day, adding more than $100 billion to Larry Ellison’s net worth. Why? Because the company quietly turned itself into the TSMC of AI clouds. They signed multiple multi-billion-dollar contracts (including a $300 billion, five-year deal with OpenAI) to provide the kind of GPU-first infrastructure that everyone else is rationing. Oracle doesn’t make GPUs or builds models, but it just optimized networking and memory access for scale, and (oops!) accidentally built the perfect AI training cluster. The market finally realized the easiest way to invest in OpenAI (a private company) was to buy Oracle (a public one).

But the implications are wild. Oracle was late to cloud, mocked for its clunky database empire, and now it’s suddenly positioned as the neutral arms dealer in the AI wars. The catch is that it’s all debt-fuelled. Oracle’s cash flows can’t cover the $500 billion in data center build-outs they’ve promised, so they’ll have to borrow heavily. That cracks the old oligopoly (ie. where Microsoft, Amazon, and Google funded AI infra with free cash flow) and turns it into a leverage-driven arms race. Which smells a lot like the early 2000s telco bubble: too much capacity, too much debt, but also the infrastructure that makes the next 20 years of innovation possible. Oracle just won the quarter, but it also lit the fuse on the AI bubble. LINK

👩💻🧑🏻💻 on management consulting in the AI era

Consulting’s sales pitch used to be simple: we’ll hire the smartest kids in the room, grind them for a decade, and a lucky few will make partner and get the keys to the country club. Now the rumor mill and the numbers say the funnel is shrinking at both ends. Job postings peaked in 2022 and have fallen since. Entry-level inflows were down ~54% year-over-year in June, and manager inflows fell ~22%. Firms talk up hiring, but analysts call that "PR positioning", while IBISWorld sees hiring growth slowing to ~1.4% by decade-end. Also, roughly 45% of consulting activities are "AI-exposed", which is corporate for "we’ll automate the junior work first" 🙃. If your brand is "we recruit the best", and the internet suspects you aren’t, the best won’t apply. That’s a reputation problem compounding at venture speed.

And the carrot at the top is getting smaller. McKinsey minted about half as many partners in 2024 as in 2021; Deloitte UK cut partner promotions ~25%; Bain says it’s "refining" for more "technical curiosity". Translation: fewer seats, higher bar, longer wait. The old promise was "give us 12 years and you’ll be partner" but now, per industry vets, "that ain’t going to happen", or at least not at the historical rate. If it takes more than a decade to maybe arrive, while the apprenticeship work is being eaten by AI and margins, talented twenty-somethings will go build products, not slide decks. The up-or-out pyramid is morphing into a fat middle with thin ends.

Unfortunately, ambition lives at the ends. LINK

Elon is back…at Tesla

He just pulled off the classic Musk trade: spend $1 billion to buy Tesla stock, goose the price 6%, and wake up $17 billion richer. It’s the only place in finance where you get a 1600% one-day return, as long as you don’t think too hard about the fact that you can’t actually sell the stock without reversing the whole thing. But that’s not the point. Musk doesn’t play the game to cash out, he plays it because moving markets is fun.

And then there is his tweet, "Daddy is very much home". Red-eye to Austin, lunch with the kids, then "deep technical reviews for the Tesla AI5 chip", a Monday walkthrough of Colossus II to check transformers and power output, and 12 hours of back-to-back meetings on Autopilot, Optimus production, and vehicle delivery. I can't imagine any European CEO doing something like that. In this respect, all carmakers look like Nokia in 2007.

And the market gets the message. With Musk, attention is an operating asset: the same person who can review AI silicon on Saturday can also move the stock on Monday. Governance types will grumble that you can’t "dial up this bit and dial down that bit", but that’s the bargain. Tesla is a levered bet on Musk’s time allocation. If he’s sleeping on the factory couch again, inspecting switchgear, and pushing Optimus out of the demo reel and into production, shareholders will pay up for optionality (ie. chips, robots, datacenters, robotaxis).

Whether or not those futures fully arrive, the near-term impact is clear. He’s signaling war footing, and the stock still trades on the belief that when "Daddy is home", physics bends a little.

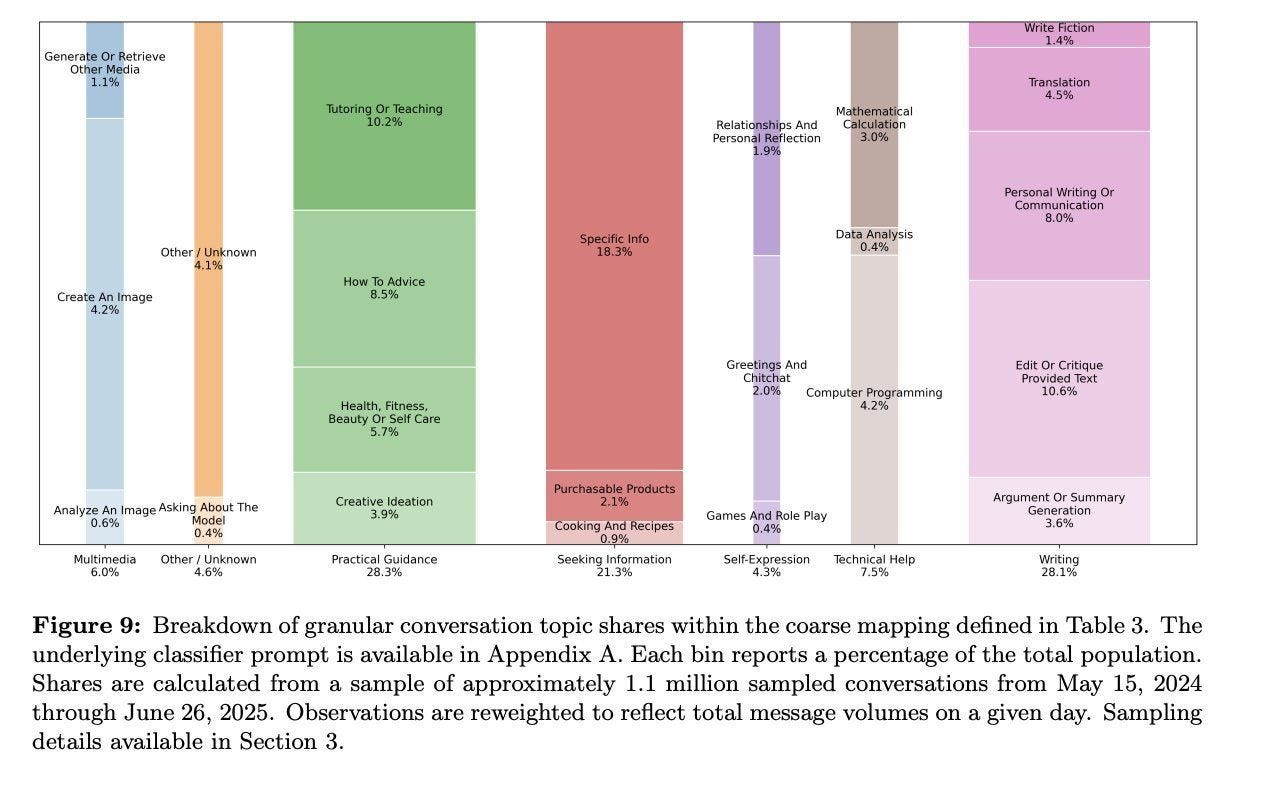

How people use ChatGPT

Everyone said Chat GPT was going to replace lawyers, consultants, and programmers, but what it’s actually replacing is your English teacher. The single biggest category of use is writing (28.1%), which is really just people asking the bot to make their emails sound less dumb, their essays sound more profound, or their Slack messages sound less like Slack messages. It turns out the killer app for AI right now is ghostwriting your performance review.

Then you see "Practical Guidance" (28.3%) - tutoring, how-to advice, self-care tips - which is basically the bot becoming everyone’s unpaid life coach. "Specific Information" (18.3%) is just Google with better bedside manner. And then at the bottom you get the stuff everyone thought would be huge: programming (4.2%), data analysis (0.4%), or therapy/companionship (1.9%) (this last category contradicts the Harvard study I shared last month!).

Apparently people don’t want a therapist bot or a code-writing bot as much as they want a slightly less embarrassing version of themselves.

The real story is that ChatGPT is about helping people look like they’ve done work. Two-thirds of writing tasks are editing or improving existing text rather than generating something new. In other words, AI isn’t replacing jobs yet; it’s just covering up our rough edges so bosses and professors don’t notice. Think of it less like "artificial intelligence" and more like "autocorrect for life".

And of course, the market loves this. Decision support, tutoring, and cheap editing at scale. Economists will write papers about productivity gains, but the lived reality is millions of people outsourcing "please don’t make me sound stupid" to a statistical parrot. Which, honestly, might be the most human application of AI imaginable. LINK

Paper: Why LLMs hallucinate and how to stop this

An OpenAI paper lays out strong reasons why hallucinations stick around and practical ways to reduce them.

In post-training, we should avoid punishing models for admitting uncertainty and stop rewarding confident guesses. Cutting hallucinations could unlock major gains for enterprise uses in law, finance, healthcare, and more. If progress continues, the impact would be huge. LINK

on the pension systems in Europe

🇫🇷 France and 🇮🇹 Italy have built economies where retirees live better than workers, kids are poorer than their grandparents, and any politician who even whispers about reform is chased out of office. The UK’s triple lock guarantees pensions grow faster than wages. In France, over-65s now out-earn the working population. Meanwhile, deficits balloon and debt piles up.

If you’re working today, your pension is basically Schrödinger’s cat: you might get it, you might not, but you’ll definitely contribute. Maybe you’ll receive 20 - 30% of what you paid in, maybe nothing at all. Add in collapsing demographics and rising longevity, and it only gets worse. At some point, younger generations will revolt.

Governments know this, but their "solutions" are worse than the problem. Stimulate birth rates? They’ve tried - it doesn’t work, and you can’t legislate romance. Import migrants? Sure, but that often produces parallel societies rather than integrated workforces (see most Western countries!). Which leaves the oldest trick in the book: print money. Call it QE, call it fiscal stimulus, call it "monetary innovation". But at its core, it’s just debasing the currency to keep promises they can’t afford. And yes, they will print like never before.

The real Ponzi scheme is in our pension systems. And the liquidity event is coming. LINK

PRINCIPLE: On the long term

“Long-term strategy” is basically accrual accounting for vibes.

Weekly progress is cash flow.

You can carry your plan at cost for years, but the market prefers marks.

If nothing is shipped this week, you’re holding a Level-3 asset: unobservable inputs, mostly hope.

Boards love five-year slides, but the reality loves Tuesday releases.

Close the books every Friday (ie. demo, ship, learn, repeat) and your “long-term” will take care of itself.

Bring receipts, not narratives.

Like Elon uses to ask: “What did you do this week?“. LINK