(#146) New social apps: OpenAI vs. Meta Vibes; AI and Accenture

🚖 on Uber and ride-sharing

Thank you for being one of the +4,500 minds reading this newsletter

Here is what you’ll find in this edition:

Open AI Social App vs. META Vibes

🚖 on Uber and ride-sharing

on gold ⚱️

AI and Accenture

Implications for shopping in Chat GPT

…and more 👇

Onto the update:

Open AI Social App vs. META Vibes

OpenAI released Sora the app, a seemingly simple video-sharing platform that allows users to remix and post AI-generated videos using Sora. It’s TikTok meets Runway, with a dash of Discord’s chaotic community energy.

But this is not a product launch. It’s a distribution honeypot for fine-tuning the taste of the crowd. OpenAI doesn’t need to compete with TikTok. It needs the kind of video interaction dataset that only a real-world product can generate. Training a generative video model is expensive. Training users to prompt better is even harder. Sora the app does both.

The long game? Turn AI into infrastructure and rent-seek off culture.

—

Meanwhile, Meta is launching ‘Vibes’

The company is shipping Meta Vibes, a protocol for how people will express identity, emotion, and presence in a spatial internet. It’s not another headset launch. It’s a bet on cultural liquidity. Think of Vibes as the social primitive that replaces “likes” and “follows” in the embodied web.

Meta Vibes is bullish for one reason: distribution + hardware + habit formation. Zuck is embedding Meta’s control into the stack that GenAI depends on. Meta’s real moat is the data feedback loop from immersive social interaction. While others try to synthesize reality, Meta is trying to own how reality feels.

—

Why Meta wins?

OpenAI builds impressive models, but it rents distribution (Apple, Microsoft, Reddit, StackOverflow, etc.). Meta owns it. Every user flicking through Reels is already nudging a billion-node recommender engine that feeds directly into Meta’s LLM training corpus. If Meta Vibes catches on, it creates a new data modality that no other AI firm has: how people feel in context.

Zuck is not building apps. He’s building synthetic culture protocols, and that’s an unbeatable position if you think AI is about meaning, not just accuracy.

—

Instead of ‘Conclusion’

Sora is a beautiful Trojan horse, a product disguised as a dataset disguised as a toy.

Meta Vibes is the vibes layer of the internet, a bet that AI won’t just think, but it will feel, and when it does, Meta will be the one piping that sentiment into the LLMs of tomorrow. If Sora is the demo, Meta Vibes is the infrastructure.

Bullish Meta. Quietly terrified of OpenAI’s distribution ambition.

And as always, the question isn’t who builds the best model, it’s who controls the interface between culture and compute. Bloomberg , OpenAI

🚖 on Uber and ride-sharing

Uber’s new thing: you can now prepay for 5, 10, or 20 rides along the same route at a discount, now framed as “loyalty”. The ‘working hypothesis’ is that your daily commute is the same (and it is!). Uber would like to turn that into a subscription revenue stream, but without the surge pricing. Why? Because customers hate paying $30 for what was $19 yesterday, and drivers hate sitting idle between rides. Lock both sides in, sell some “certainty”, and suddenly the messy ride-hailing business starts to look like cloud computing: pay less if you’re willing to reserve capacity in advance.

The implications are fun. For customers, it’s a hedge against price spikes. For Uber, it’s a hedge against churn. For drivers, it’s a choice between being a volatility trader (chasing a surge) or a bondholder (steady but capped returns). And if you squint, this is the endgame of every “on-demand” business model: start by promising infinite flexibility, then discover that the economics work better when you quietly reintroduce fixed schedules, bundles, and contracts. It’s still the same app, but increasingly, it’s behaving like an airline or a data center operator, where your spontaneity is priced at a premium. The Verge

on gold ⚱️

Central banks are quietly shifting back toward gold as if it’s 1971 again, while US Treasuries (ie. the supposed bedrock of the financial system) are looking more like a risk asset than a reserve. That’s the problem when your national debt has gone from $427 million in 1972 to $37 trillion today. At some point, everyone realizes the “risk-free” asset is only risk-free because you can print the money to pay yourself back.

The end of Bretton Woods launched 50 years of hyper-financialization: bubbles, LTCM, dot-com, subprime, Covid stimulus, rinse and repeat. A whole era of paper wealth divorced from productivity. Now, after decades of telling the world that “dollars are as good as gold”, the US seems to be devaluing its own IOUs in slow motion via inflation, via deficits, and, in the latest twist, via stablecoins that act as a backdoor way to monetize US debt. The Fed issues Treasuries, crypto turns them into yield-bearing tokens, and suddenly the line between hard money and meme money looks very thin.

Of course central banks are buying gold again. Not because they suddenly love gold, but because when even your fridge shows you ads and your safest asset has a ticker, you start thinking the barbarous relic might actually be the least financialized thing left. Financial Times

AI and Accenture

Accenture’s $1.8 billion in new “generative AI” bookings is a useful data point, less for what it says about Accenture than for what it says about the consulting business model. When a big trend arrives, the first thing large enterprises do is call consultants to tell them what it means. Consultants are less interpreters of reality than mirrors of client anxiety. If boards want to know how AI will change their industry, Accenture can always sell them an answer, whether or not the underlying technology is ready. The bookings are real, but the substance will vary, because some projects will be genuine automation opportunities, others will be slide decks that let executives tell shareholders they’re “AI-first”.

The layoffs are equally instructive. 11,000 people is 1.4% of Accenture’s headcount, small in absolute terms but narratively oversized. By framing routine restructuring as “we’re eliminating roles that can’t be upskilled to AI”, Accenture converts a cost-cutting exercise into a story about technological inevitability. It’s less about saving money than about aligning the brand with the future. AI is the reason the company itself is changing.

In that sense, the real product Accenture sells is relevance. AI gives them a fresh way to package both growth and contraction as evidence that they’re indispensable in the new paradigm. FT

Implications for shopping in Chat GPT

OpenAI’s rollout of Instant Checkout inside ChatGPT is the beginning of a platform shift in e-commerce. Instead of sending users to Etsy or Shopify, OpenAI is building an AI-native retail layer, where shopping becomes a background task rather than a destination. This fundamentally rewires consumer behavior. Search, discovery, comparison, and transaction are collapsed into a single interface -the prompt - which is now monetizable. By releasing the Agentic Commerce Protocol, OpenAI is building the foundational rails for agent-based commerce, where your AI does the buying, not you.

The implications are massive. Amazon built an empire on owning the e-commerce funnel. OpenAI is quietly inverting the funnel, starting with intention and outsourcing fulfillment. Merchants will trade loyalty and brand presence for access to demand generated by LLMs. Stripe handles the payments, OpenAI handles the interface, and Shopify becomes plumbing. In the long run, this creates a power shift: whoever controls the AI agent controls the transaction. The future of commerce might not be a website, but it might just be a conversation. WSJ

on pursuing a PhD 📚

I was yesterday in two PhD commissions and seeing & assessing the work after 4-5 years, it made me think: is it worth it?

So I wrote 5 main reasons for pursuing a PhD:

1/ You want to teach. Teaching is the best distribution channel for ideas: a live, recurring A/B test with built-in feedback loops and a captive audience that self-selects for curiosity. If you do it well, you compound across cohorts, your explanations become infrastructure other people build on, and the reputational spillovers are real.

2/ You want to be a researcher. A PhD is subsidized R&D for your curiosity, with access to datasets, tools, and a peer-review QA stack that forces your claims to survive contact with reality.

3/ You have loads of ideas. Most are bad; a doctorate gives you a lab to kill them efficiently.

4/ You like solving big problems that span years. This is persistence arbitrage. Markets overprice speed and underprice stamina. A PhD lets you amortize years of attention over a single question until the switching costs work in your favor and the competition times out.

5/ You want to learn a topic to the very best.

There are more, but I guess these are the main ones...

Investing in emerging markets: Central and Eastern Europe

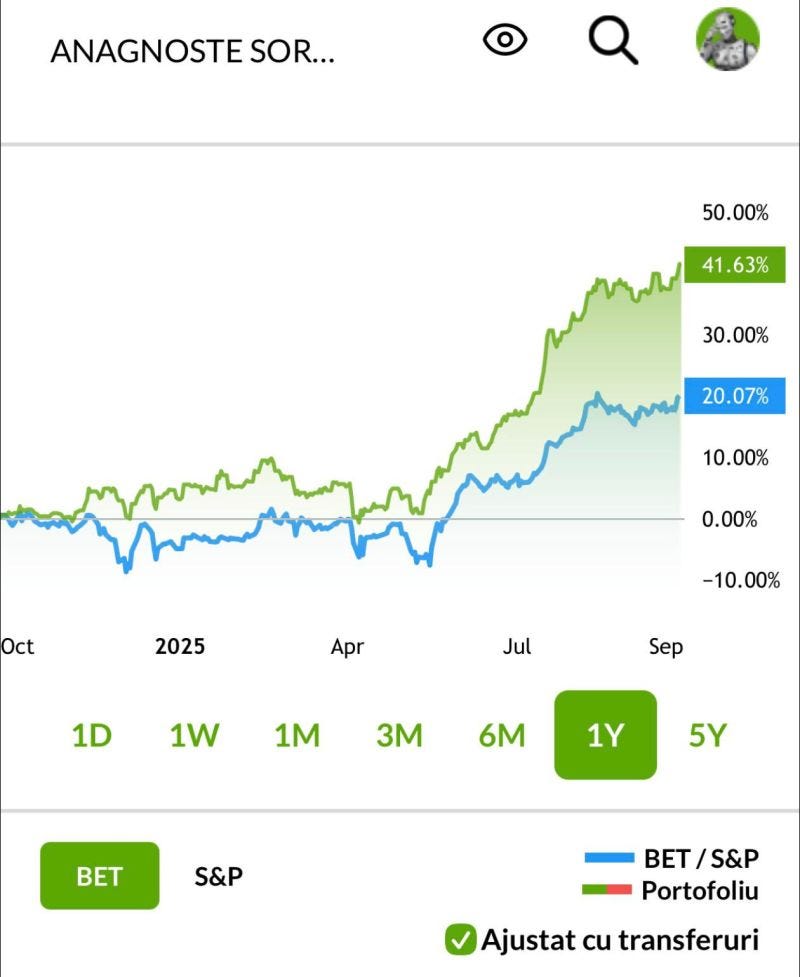

📈 My investment thesis is simple: I put a small part of my revenue into equities in emerging markets, mainly Romania 🇷🇴 and Poland 🇵🇱.

Here’s the thing: the S&P gave you ~16% over the past 12 months, which is fine. Congratulations, hope that keeps the lights on 😅.

Meanwhile, my Central & Eastern Europe portfolio printed ~42%. That is 2.5x…just the compounding effect of growth moving eastward.

Short reminder: you can buy the index and be okay, but if you actually pick 3–4 companies with fundamentals, you can be super fine. Think of it as the difference between renting the whole apartment building and owning the penthouse. Same market, different upside.

Some reasons for this performance: demographics, productivity, capital inflows, ie. all trending toward CEE. The West is saturated, while the East is catching up. The real inefficiency is that global investors still treat Romania and Poland like those weird cousins from the countryside instead of the growth engines they’ve quietly become.

P.S. Starting late October, I’ll share the specifics - companies, sectors, the playbook - in a dedicated newsletter. Until then, consider this graph a polite reminder. Emerging markets stay “emerging”… until one day they don’t.