(#147) 💿 Broadcom joins the AI roller coaster; 🐣 Crocs' moat

🎶 Vinyls are back

Thank you for being one of the +4,500 minds reading this newsletter

Here is what you’ll find in this edition:

💿 Broadcom joins the AI roller coaster

Spotify + Netflix = ❤️

Crocs has a defensible business model

🎶 Vinyls are back

🇫🇷 on France’s debt

…and more 👇

Onto the update:

💿 Broadcom joins the AI roller coaster

This deal between OpenAI and Broadcom is basically Sam Altman saying, “Fine, if Nvidia’s the casino, I’ll build my own chips”. OpenAI is co-developing 10 gigawatts worth of custom silicon (ie. enough compute to power two New York Cities) to feed its LLM appetite. Broadcom gets a multibillion-dollar contract and a new story for its trillion-dollar valuation. OpenAI gets what it really wants: control over the hardware bottleneck that defines its cost structure and speed (btw, Google has an advantage here with its TPUs). This is what happens when a software company becomes an infrastructure one out of necessity.

At a strategic level, this is Altman’s version of vertical integration. I think he got inspired by his ‘friend’…Elon. In the same way Tesla couldn’t scale EVs without making batteries, OpenAI can’t scale reasoning models without owning the chips. Nvidia’s GPUs are great for flexibility, but OpenAI doesn’t need flexibility. It needs efficiency at scale. It already knows the workload, the latency, the model architecture. Broadcom is essentially the foundry for a new class of “XPUs”, ie. AI chips custom-built for reasoning rather than graphics.

But the financial math is brutal. OpenAI’s revenue is around $13 billion (5% paid users!), and it’s signing hardware contracts worth hundreds of billions. This is the moment when a startup starts to look like a sovereign project: half technology company, half infrastructure ministry. The bet is that intelligence will monetize faster than it burns electricity. If it works, OpenAI becomes the Intel-plus-AWS of the AI age. If it doesn’t, Broadcom will still have sold a lot of chips, and the rest of us will inherit a planet with the smartest chatbots and the highest electricity bill in history. WSJ

Spotify + Netflix = ❤️

Spotify partnering with Netflix looks odd at first. The company built on sound now wants to live inside a video app. But this is about fighting gravity. Youtube owns the attention economy for creators, and Spotify knows it. Over a billion people now “watch” podcasts each month and most of that time is spent inside Youtube, not Spotify. By moving its flagship shows like The Bill Simmons Podcast and The Rewatchables to Netflix, Spotify is borrowing distribution from a bigger screen while keeping YouTube at bay. It’s a defensive alliance wrapped in a content-sharing deal.

For Netflix, it’s the easiest kind of growth: free programming that keeps people in-app longer. Spotify gets credibility in video, Netflix gets cheap watch time, and both get to position themselves as something other than YouTube. The irony is that Youtube remains the invisible middleman because every clip, reaction, and meme from these shows will still circulate there. The platform tax doesn’t just come from ads anymore; it comes from culture. Even when creators leave Youtube, the conversation still happens there.

Strategically, this partnership is an admission that Spotify can’t outspend Youtube, and Netflix can’t out-algorithm it. But together, they can try to outcurate it, hence resulting in a premium video podcasts for premium attention. It’s a smart short-term play that looks long-term fragile. Because YouTube’s real moat …is time. And until someone builds a product that competes with that, every alliance like this one is just another rerun of the same show: everyone versus Youtube, and Youtube still winning. Bloomberg

Crocs has a defensible business model

If you think that you have crazy ideas, just remember this:

in 2024, Crocs’ Jibbitz generated around $260 million in revenue (over 6% of the company’s total sales), while delivering exceptionally high profit margins.

Interestingly, Crocs had purchased the original Jibbitz maker for only $20 million. LINK

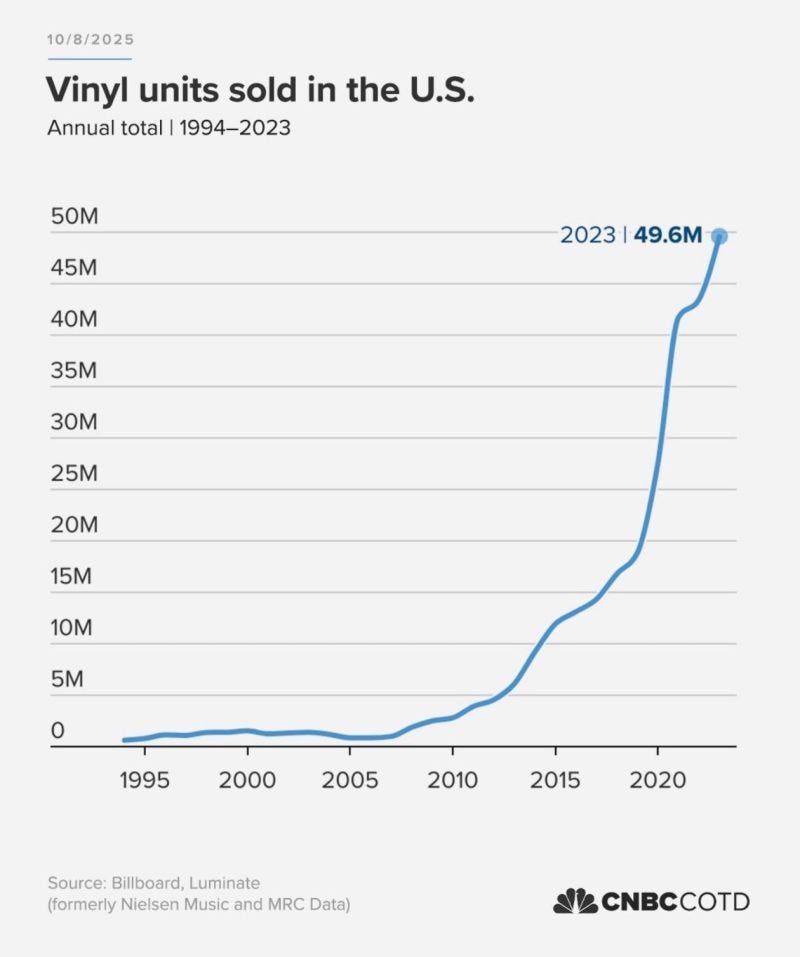

🎶 Vinyls are back

It’s somewhat remarkable that in 2023, humanity collectively decided that the best way to enjoy digital music was… to buy 50 million vinyl records that play, on average, 22 minutes per side, if you don’t bump the needle.

I can literally imagine a founder somewhere in Silicon Valley pitching ‘Spotify, but less convenient’, and calling it ‘nostalgia-as-a-service.’

This seems to be something related to identity. Streaming made listening frictionless, but it also made it invisible. Nobody sees your playlist. Vinyl brings the friction back, and with it, proof of taste.

As a result, vinyl sales are booming. But maybe that’s because the more digital life gets, the more we crave the analog inconvenience that reminds us we’re still human. That’s a market broader than vinyls, hence more business opportunities.

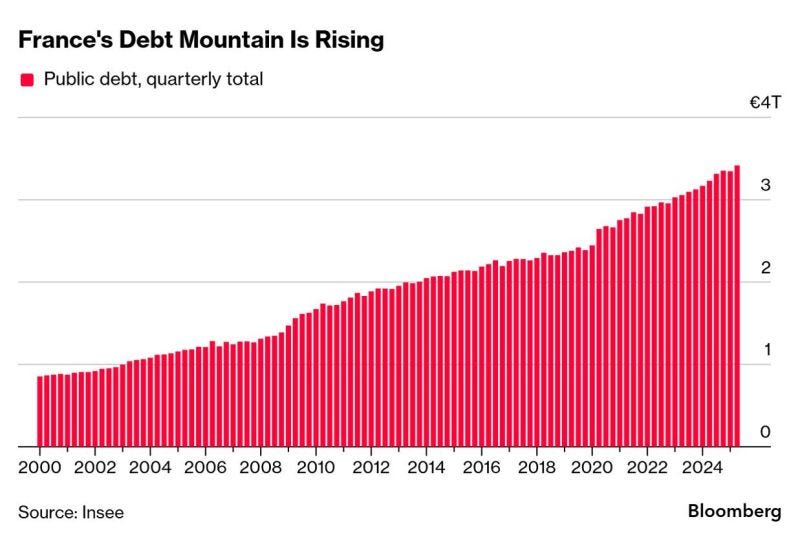

🇫🇷 on France’s debt

This is classic late-stage European politics where debt is going vertical and governments are going horizontal.

Every crisis, from the eurozone to Covid to inflation, gets solved with the same prescription: more spending, more promises, more state. What used to be Keynesian counter-cyclical stimulus has quietly become permanent statecraft.

Macron’s “rinse-repeat” cabinets are just a political reflection of that fiscal pathology. Each prime minister arrives with reformist language and departs buried under the same mountain of entitlement costs. Pension reform was supposed to be the signal that France could still act like an adult economy inside the euro. Its suspension shows the opposite. Politics has overruled arithmetic.

At 3.3 trillion euros of debt and counting, France is betting that Europe’s collective credibility will always foot the bill. The right and far left both promise more spending for different tribes, while the “center” defines itself by the ability to delay collapse gracefully. Macron’s government is now the managerial class of the inevitable, where technocrats administer entropy.

This is financial nihilism with good manners. The state can’t default politically, so it defaults spiritually through inflation, stagnation, and the soft expropriation of savers.

In a decade, when the debt hits €4 trillion and everyone blames populists, remember it wasn’t the right or far left that broke the system. It was the comfortable middle that refused to do math. LINK

👩🎓🧑🏻🎓 on learning

Everyone wants to “hack” learning the way traders try to “beat” the market. 10-minute TikTok tutorials instead of long, boring hours of reading, thinking, failing, and trying again.

But knowledge, like alpha, doesn’t exist without effort.

Learning is supposed to feel like work. The neural networks in your head only update when they’re sweating. Yet we’ve built a world optimized for engagement, not understanding. The pressure on professors is the following: lessons must be fun, professors must be influencers, and parents don’t want any pressure (due to intellectual effort) on their kids.

Sure, we can play this game, which is exciting, but it doesn’t pay because we’ll lie to ourselves.

Real learning feels like a workout: heavy, focused and, most of the time, uncomfortable. And that’s exactly why it works.

Sharp. 'Software company becomes infrastructure one out of necessity' really nails the strategic shft.