(#149) Microsoft 🤝 OpenAI: until AGI will do us apart; Plot twist with Polaroid

The AI boom must continue 🎢

Thank you for being one of the +4,500 minds reading this newsletter

Here is what you’ll find in this edition:

Microsoft 🤝 OpenAI: until AGI will do us apart

Youtube vs. The rest of the world

OpenAI’s plan in 🇮🇳 India

Plot twist with Polaroid

The AI boom must continue 🎢

…and more 👇

Onto the update:

Microsoft 🤝 OpenAI: until AGI will do us apart

1/ The new Microsoft - OpenAI agreement is a clear example of strategic modularity under constraints. What began as a highly integrated, almost captive-style partnership is evolving into something more balanced. Microsoft retains exclusivity over core APIs, access to key research IP (until AGI is verified), and a massive Azure workload. But OpenAI gains new degrees of freedom, which is, joint development with third parties, open weight model releases, and government contracts on any cloud. Both parties are now platform-scale players.

2/ The core insight is that both Microsoft and OpenAI are preparing for a post-foundational model world. Up to now, the play has been about building and commercializing the biggest, most capable models. But going forward, the differentiation will come from distribution (Microsoft), ecosystem integrations (Azure + Copilot), and fine-tuned, agentic workflows (OpenAI). That’s why Microsoft gets long-dated IP rights and product exclusivity (ie. it’s hedging against model commoditization while investing in where the real value will compound: applied usage across its productivity suite and developer platforms.)

3/ The OpenAI side of the deal is equally strategic. Recapitalizing as a public benefit corporation (PBC), with Microsoft holding 27% on a diluted basis, signals a shift in how the company wants to scale. That is, more independence, more optionality, and more enterprise-grade alignment. The fact that OpenAI can now serve national security clients on any cloud and release open-weight models is a recognition that the future isn’t just consumer AI, but infrastructure-level AI governance and access. This sets OpenAI up not just as a model lab, but as a quasi-public utility with geopolitical relevance.

4/ The most important new clause is about AGI. It’s no longer a self-declared milestone. It must now be verified by an independent panel. This may sound like a soft governance point, but strategically, it’s a way to de-risk OpenAI’s control over the trigger event that would rewrite the entire agreement. Until AGI is declared (and verified), Microsoft’s favorable terms (e.g. IP rights, revenue sharing, exclusivity) stay in place. This slows down the rate of disruption, which benefits Microsoft’s go-to-market machinery, while giving OpenAI the runway to scale globally without immediate legal or technical redefinition.

5/ Ultimately, this agreement is about locking in optionality while preserving leverage. Microsoft gets durable distribution control and operational clarity. OpenAI gets more freedom to partner, release, and evolve. And the entire market gets a signal: the platform war is about who controls the workflows, infrastructure, and economic capture in a world where intelligence becomes the interface. This deal outlines the new architecture of the AI economy. LINK

Youtube vs. The rest of the world

Now that it has won the streaming wars, Youtube is playing a different game and still winning the old one. YouTube now commands nearly 28% of US streaming TV time. This is the advantage of its business model. It’s demand-side media, and it scales like software.

The most absurd part? YouTube is still buried inside Alphabet’s financials. One of the most dominant digital platforms in the world, the biggest screen in the house, monetized with Google’s ad stack and distribution flywheel, lives as a line item under “Google Services.” It’s long past time for Youtube to be listed separately, not just for transparency, but because it’s a standalone media empire that’s eating everything from cable to Tiktok to premium streaming.

The streaming war is over. The user-generated algorithm won.

OpenAI’s plan in 🇮🇳 India

OpenAI’s move to offer a free year of ChatGPT Go in India is a classic platform strategy: dominate the demand side, monetize the ecosystem later. By giving away its most affordable tier, OpenAI is building a distribution dominance. India, with its 1.4 billion people, large English-speaking base, and rapidly digitizing population, is the ultimate surface area for LLM deployment. In this case, “free” means a strategic subsidy to lock in attention, interaction, and most importantly, data.

This is also about shaping behavior. Every message sent, file uploaded, or image generated in ChatGPT Go creates training feedback, usage telemetry, and user habit loops. As Perplexity and Google offer similar giveaways through telecom and student channels, what we’re watching is the commoditization of access and the competition for retention. OpenAI’s bet is that whoever wins India will own a massive share of the next billion users, not just for chatbots, but for AI-native services. And with Atlas, agents, and multimodal layers coming next, what looks like freemium is actually a distribution-led land grab for the next operating system of work and knowledge. Bloomberg

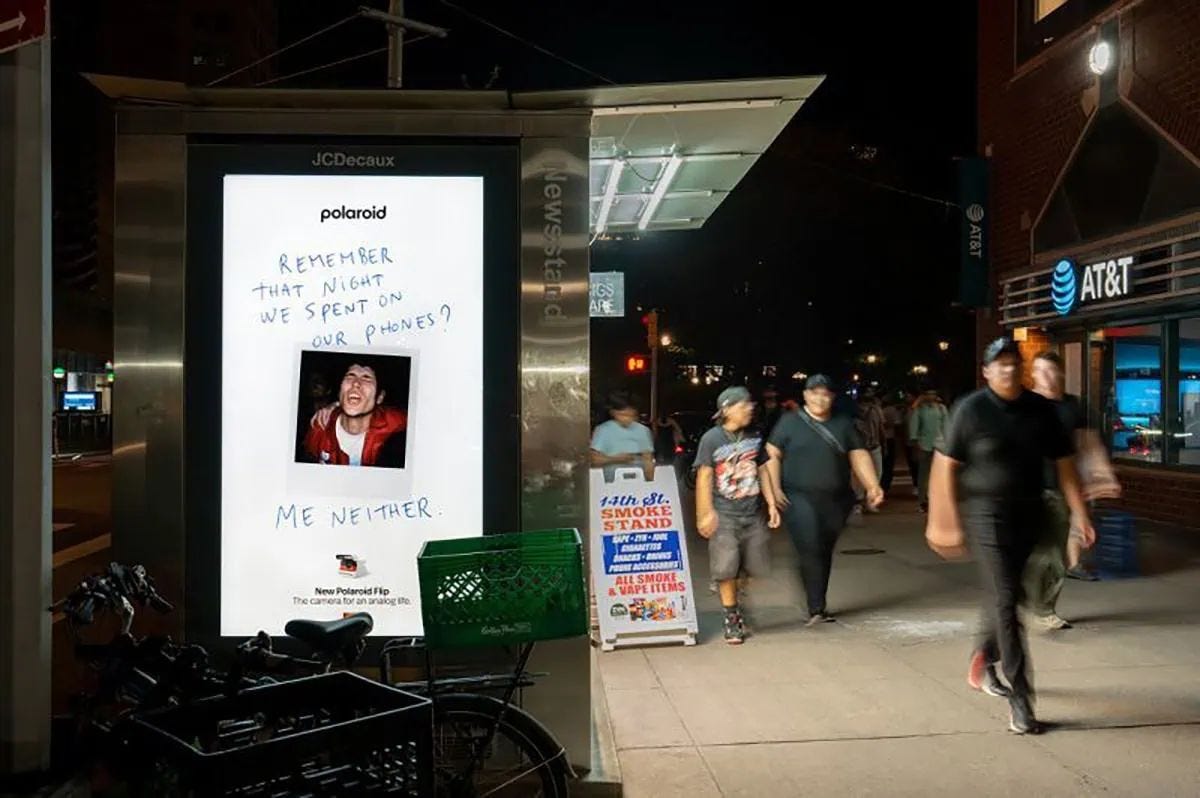

Plot twist with Polaroid

Plot twist

It seems that Polaroid has decided that its unique value proposition in 2025 is… not being AI. The campaign hits like a lo-fi manifesto: “A.I. can’t generate sand between your toes”. “Remember that night we spent on our phones? Me neither”. “Real stories, not stories & reels.” It’s clever, self-aware, and about as subtle as a handwritten note on a bar napkin. Which, of course, is the whole point. Polaroid is selling analog nostalgia as a form of rebellion. In a world where every image can be deepfaked, the blurry, badly-lit, unfiltered Polaroid photo suddenly feels like the most authentic artifact possible.

The campaign is a bet that there’s still a market for things that are messy, imperfect, and unscalable. Polaroid is basically saying: “We know you’ll spend 14 hours a day inside algorithmic feeds, but maybe, for 15 minutes, you’ll want to feel something real”.

The irony is that they’re using billboards and bus stop posters to tell people to unplug. It’s both deeply human and vaguely absurd. Which might just make it the perfect brand move in an age where the only thing rarer than good AI is bad handwriting.

The AI boom must continue 🎢

So the next trillion dollars of AI infrastructure won’t just be in San Jose or Ashburn, Virginia…it’ll also be in Jakarta. Because if you’re going to train LLMs on everyone’s data, you can’t just ship it out of the country like it’s bananas or copper anymore. Enter “AI decolonization”, which is like GDPR but with nationalism and power outages. The idea is that local data should stay local, and if Big Tech wants to train models on your population’s clickstream, it better come with a few billion dollars’ worth of onshore compute. The result? Giant Nvidia-filled warehouses next to rice paddies, built on regulations that look suspiciously like tariffs.

This all sounds very fair, until you realize each megawatt of data center power supports… about one job. So while local telcos dream of digital sovereignty and AI-driven GDP boosts, the real winners are still the same people: Silicon Valley VCs and hyperscalers who now get to call their rent-seeking “foreign direct investment”. Sure, you get some short-term employment and maybe an upskilled data labeling shop or two. But the model is still extractive, just now wrapped in the warm glow of ESG, compliant, diversity-forward, ethically sourced latency. It’s externalization-as-a-service, but with better branding and way more GPUs. WSJ

Europe must own its supply chains: Nexperia

After the Dutch government takes control of Nexperia, a chip company quietly owned by China’s Wingtech, and suddenly, Volvo, VW, and half of Europe’s auto industry are prepping for factory shutdowns. The Chinese subsidiary refuses to recognize the new leadership, the Dutch HQ is warning customers not to trust the China-made chips, and Beijing is threatening Brussels with rare earth diplomacy. Meanwhile, car execs are crossing their fingers and whispering “diplomatic solution” like it’s a magic spell. It’s not. It’s a supply chain fistfight in slow motion, and Europe is stuck in the middle with no chips, no leverage, and no contingency plan.

The lesson here is that Europe never rebuilt the industrial stack it outsourced. For two decades, the EU treated efficiency as a strategy and ignored the idea that sovereignty might someday matter. It is optimized for peace, not resilience. And now, every node of dependence (from chips to energy, and rare earths) comes with a flag. If Europe wants to avoid becoming the world’s most elegantly regulated ghost town, it has to rebuild entire supply chains, not regulate around them. Otherwise, next time it’s not just factories shutting down, it’s whole economies. FT

Case study “Javier Milei”: When the polls lie and the people roar

The thing about democracy is that, every once in a while, the spreadsheet gets it wrong. Pollsters, models, and legacy outlets (e.g. Bloomberg, FT, WSJ) all ran their careful regressions and came up with… a draw. Maybe even a Milei loss. And then the votes happened. 41% to 24%. A political earthquake wearing a leather jacket and quoting Hayek.

It’s not the first time media orthodoxy missed the turn. The bias isn’t always ideological (LEFT), though it often leans that way, but epistemological. The elite assumption is that people prefer managed decline to radical uncertainty. But Argentina’s voters, battered by inflation, deficits, and a peso that evaporates faster than trust in economists, chose the latter. They decided, as the Financial Times put it, to take the “bitter pill”. Except what other pill was there? When your body’s been poisoned by decades of overspending, the cure is never pleasant.

Milei’s victory is not just about Argentina, but it’s a macro-lesson in realism. You cannot print prosperity. You cannot legislate away arithmetic. Eventually, the math wins, and someone stands up with a chainsaw and says: enough. The markets, unsurprisingly, loved it. Bonds surged, stocks soared, and suddenly “austerity” sounded almost romantic again.

The question for Europe is whether we learn the lesson before our own crises force us to. The bitter pill is universal: live within your means, or watch your freedoms shrink under debt. Maybe the world doesn’t need more populists. Maybe it just needs more adults. Freedom, after all, isn’t free...but it’s earned, balanced, and painfully budgeted. FT 1, FT 2, WSJ, Bloomberg.

PRINCIPLE: The inner ring is a trap

One thing I realized quite early in life is that status is a costume.

It looks shiny. It sounds important. But it wears thin, fast.

One day you’re in the A-class office and the next day the room has moved and you weren’t invited.

That’s the inner ring fallacy, ie. the belief that belonging to a certain group, title, or circle somehow means something.

It doesn’t. Not for long.

The real game is substance. Work that matters and loads of it. Problems solved, but not any problem (!). Value created. Real research. Etc.

Do that, and talk about it in public so you can get feedback and close that “feedback loop” faster.

Show your thinking and share your questions. Your questions should be better than your answers.

This is how you build trust, proof…and leverage.

Because status is granted. But substance is owned.

The room you want to be in? It’s the one you’re building.

Brick by brick. Idea by idea. Question by question.

Forget the velvet rope.

Make something worth lining up for. LINK

This weekend, I delivered an “Operations Management” intensive class to the MBA candidates from INDE MBA @ BBS-ASE.

From Apple’s functional design to Temu’s ruthless efficiency machine, the takeaway was simple - alignment matters. You can’t “optimize” your way to strategy. You can only align your operations so that every process, from procurement to product, pushes in the same direction. Strategy decides what to do, but ultimately operations decide how to do it, BUT repeatedly, profitably, and at scale.

Most companies don’t fail because of bad strategy, but because they can’t translate vision into capability. Operations is that translation layer where vision meets variability. The examples from Apple, Tesla, and Meta’s “Year of Efficiency” showed, I think, that great operations compound.

When it works, operations become invisible, like Tesla’s seven-click process or Apple’s seamless supply chain.

Thanks to all my INDE MBA students for diving deep these days. The best companies are the ones that make every move count.