(#150) 🚀 Introducing WhereIsMyMoat.com

New website: https://whereismymoat.com/

🤓 Personal update - introducing WhereIsMyMoat.com

- “Hey Sorin, is this company good for investment?”

- “Hey Sorin, what is your stock portfolio structure?”

- “Hey Sorin, please administer my money!” 🙃

-....and many more

Today I’m launching whereismymoat.com - my public investing lab where I map a company’s journey, score its moat, and write what I would do - buy/hold/sell - in the open. Also, I will share my full portfolio structure (which is at +67% Year-to-Date)

What you’ll find:

1/ Two - three weekly analyses delivered Friday - Sunday, when you actually have the time to read them 😅

2/ Moat maps: pricing power, switching costs, and network effects, which is what actually compounds.

3/ Decision logs: the trade, the trigger, the risk, the check-in.

4/ Short, opinionated notes: lessons you can reuse, including from my mistakes.

5/ Scoreboards: clarity over narratives.

If you read my short briefs on LinkedIn or my onStrategy newsletter, you already like strategy in practice. WhereIsMyMoat.com is my ‘skin-in-the-game’.

Have a look and consider subscribing: https://whereismymoat.com

- Sorin

—

Onto the update:

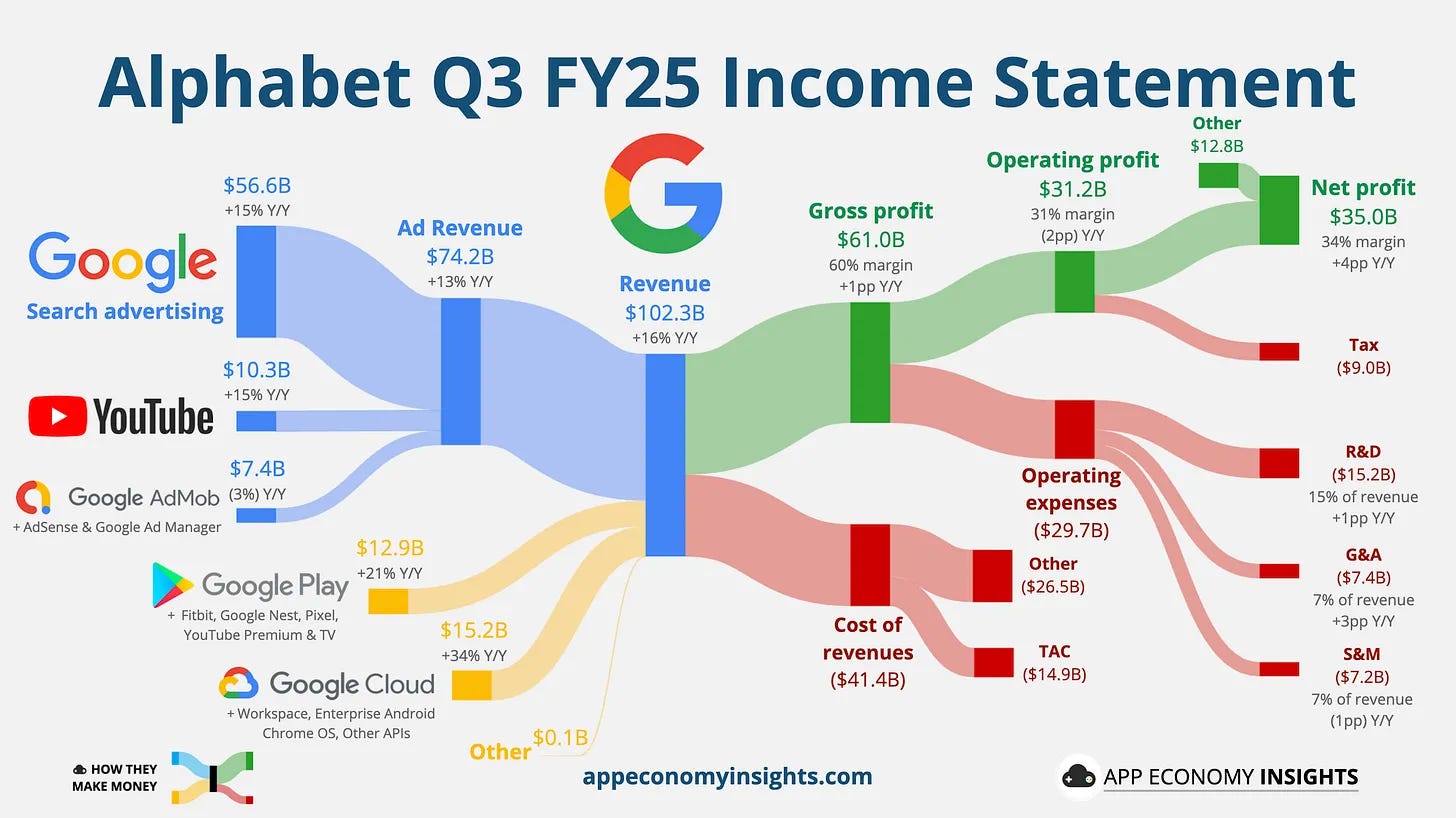

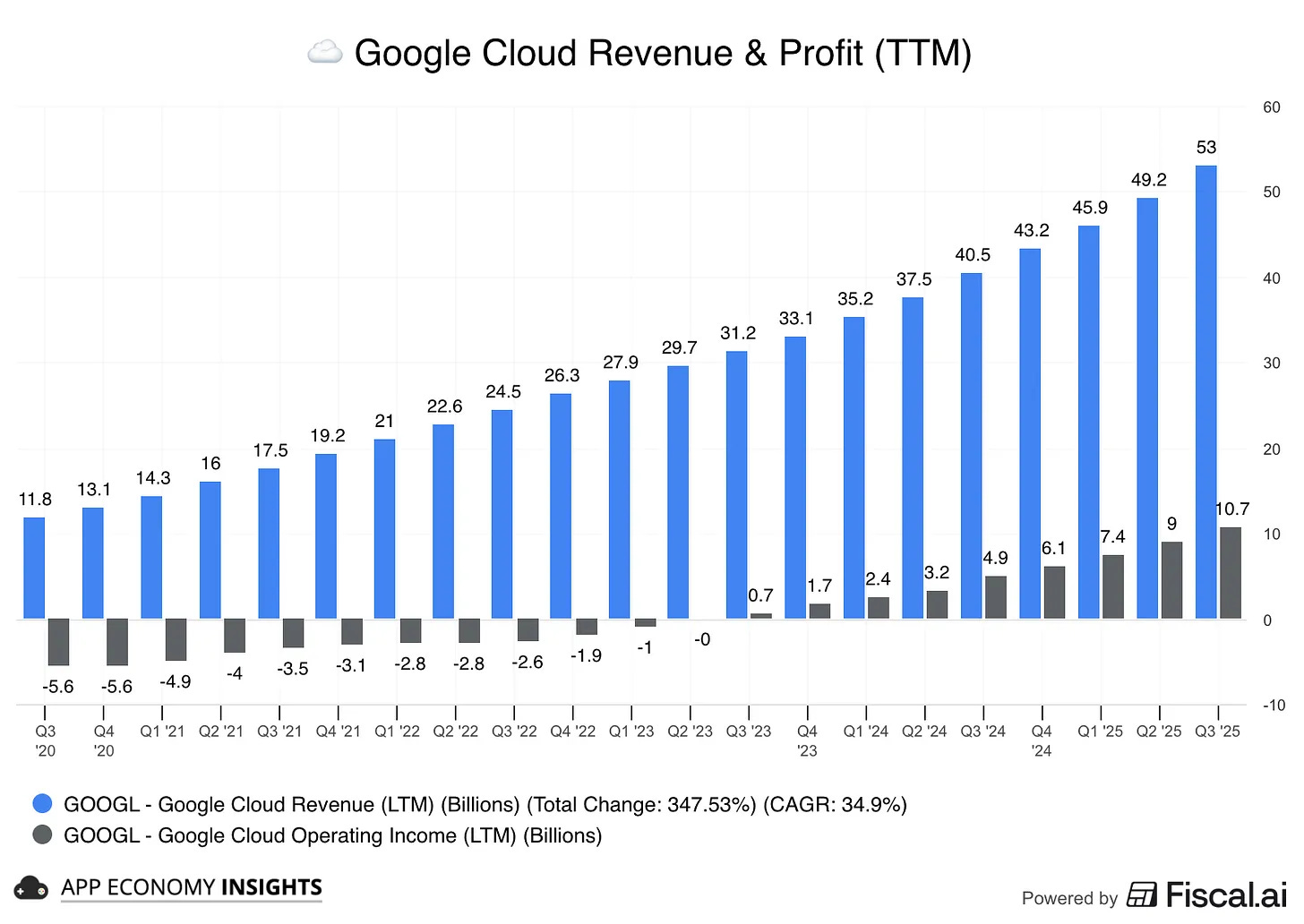

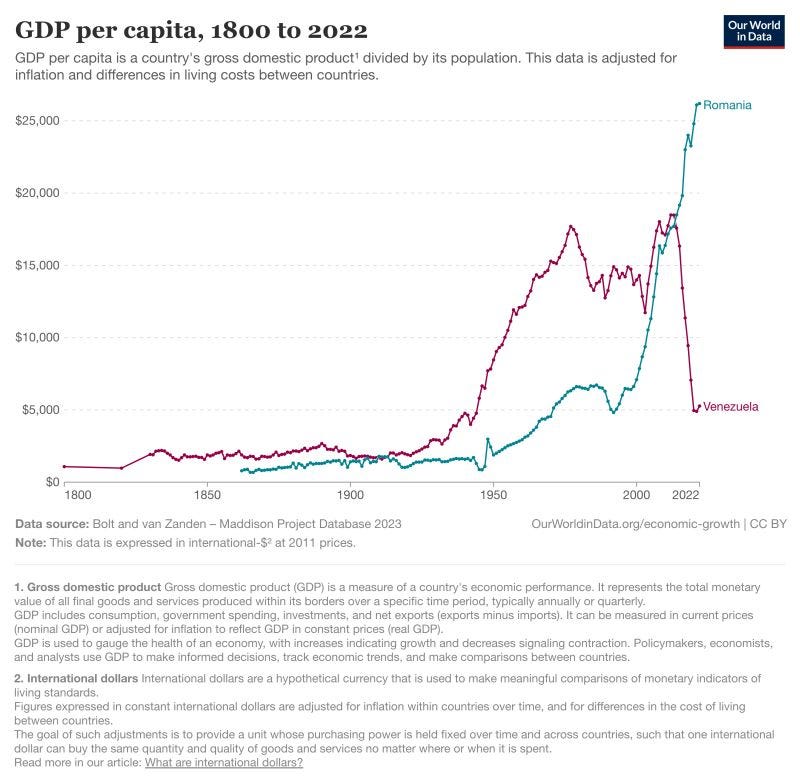

Google’s position in two charts:

….and

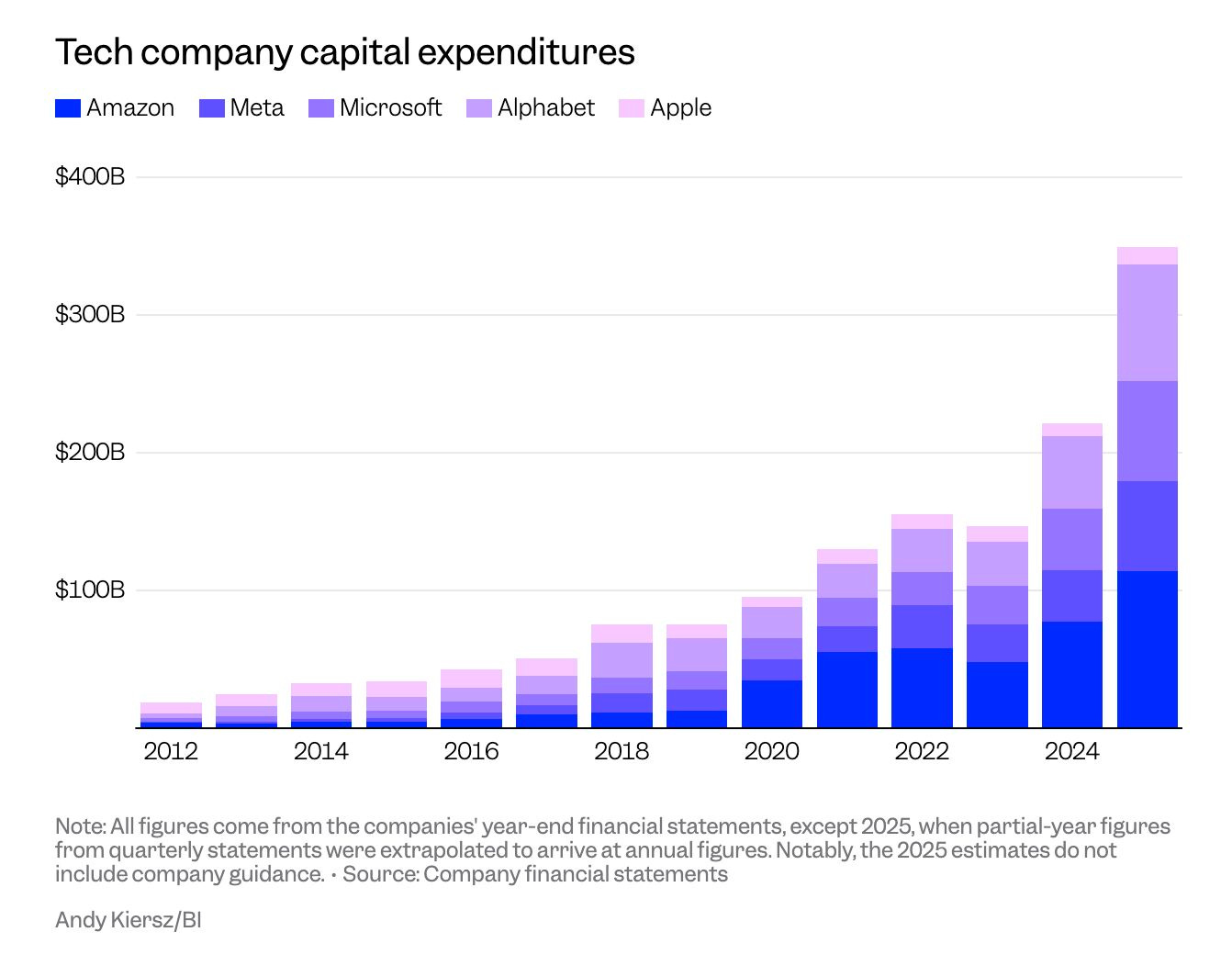

Google’s quarter was the corporate equivalent of quiet luxury, which is, no drama, just record-breaking numbers delivered with terrifying efficiency. They delivered $102.3 billion in revenue (+16%; first time for a quarter to surpass $100bn), $35 billion in net income (+33%), and the most underhyped CapEx explosion on Wall Street this year. CaPex jumped from $52.5B to over $90B, almost entirely to feed the AI beast. Unlike Meta, which has to beg investors to believe in its AI moonshots, Google is just shoveling compute into data centers and watching actual margins go up. The cloud (GCP) grew 34% YoY, but also hit a 24% margin, which is wild when you remember this business was a money pit just 10 quarters ago. This is what it looks like when a company transitions from “search giant” to “infrastructure hegemon” without ever pausing for breath.

Google is not “spending on AI”, but is compounding into AI. The ad business funds the cloud business, the cloud business feeds the model training, and the models get embedded back into the ad products (AI Overviews, smarter YouTube recommendations, etc.) in a self-reinforcing loop. Instead of calling it “Superintelligence” and waving around speculative timelines, they’re just… doing it. This is what happens when a company is structurally boring but strategically flawless. That is, it becomes the default winner in a space where everyone else is still trying to name the game. If OpenAI is building the brain and Meta is chasing the dream, Google is laying the fiber-optic nervous system of the AI economy and monetizing it at 24% margins.WSJ

Meta is burning billions to build the OS of the physical world

Meta just posted a blockbuster top line, $51.2 billion in Q3 revenue, up 26% YoY, but the market didn’t care. Why? Because net income came in at just $2.7 billion, torpedoed by a one-time $15.9 billion tax hit from the One Big Beautiful Bill Act (yes, that’s a real name), and because the company whispered a scary word into the mic: “aggressive”, as in, “aggressive AI infrastructure spending”. Investors promptly sold off the stock, -7% after hours. You don’t get punished for making less money; you get punished for spending it like you’re not afraid of the future. And Meta is very, very unafraid. CFO Susan Li basically said “expect expense growth to accelerate in 2026, with AI talent and compute as the main drivers”. Wall Street, meet capital cycle.

Meta is spending like a government-backed AI superpower, except the budget is fueled by ad clicks. Zuckerberg’s speech about “superintelligence” was basically a thesis pitch for why they’re pouring tens of billions into data centers and custom chips without clear near-term product announcements (ie. is always about the narrative). They’ve raised $27 billion in private debt for a new Louisiana megacenter (Meta owns 20%), are paying AI engineers compensation packages north of a billion dollars (yes, with a “b”), and still won’t give a 2026 CapEx forecast. And when analysts push for answers? Meta shrugs and says: “We’ll build now, figure it out later”, sort of commentary.

If the bet pays off, Reality Labs becomes the iOS of spatial computing. If not, Meta just spent half a trillion dollars training models to boost ad CTR by 0.7%. Either way, it’s the most expensive science experiment in capitalism. WSJ

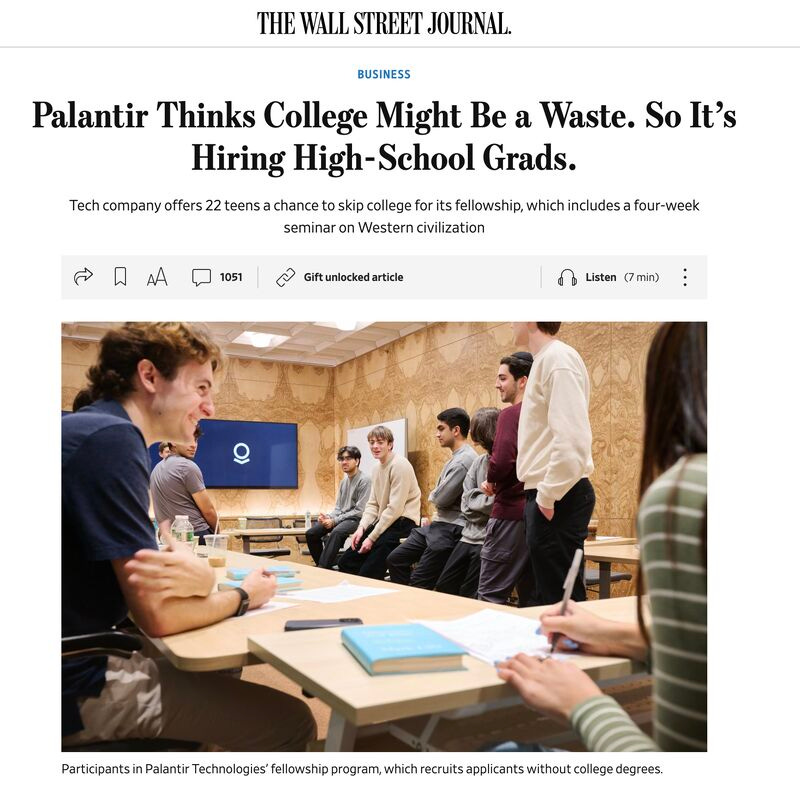

🧑🏻💻👩💻 Companies are creating their own university

Imagine spending hundreds of years building the most prestigious higher education system on Earth, only to throw it all away for some social engineering stuff. That’s essentially the story of US academia over the last two decades: meritocracy got swapped out for DEI statements, tenure tracks filled with ideological conformity rather than intellectual rigor, and admissions morphed into a carefully calibrated diversity puzzle where academic excellence became optional. The result is a growing pipeline of second-class professors, bloated admin overhead, and - critically- mediocre students who talk a big game about “systems of oppression” but struggle to write a coherent email. So when companies like Palantir look at the talent coming out of elite schools and see vibes instead of value, you get… this: a 22-person experiment pulling high school grads straight into real work with real stakes and real expectations.

And it’s working, not because it’s utopian or even scalable.... yet, but because it’s a rational response to a broken trust. If elite universities no longer guarantee elite talent, companies will build their own Ivy League replacements. That means fellowships instead of freshman year, seminars on the West (and classics!) instead of DEI workshops, and live product teams instead of mock case competitions. This is the beginning of a parallel educational-industrial complex, one where the filter is competence, not credentials. And as more CEOs realize that traditional academia is turning out brand liabilities, not assets, expect this model to go from edge-case to blueprint. Universities were supposed to be the gatekeepers of excellence. Now they’re the reason companies are building new gates. WSJ

Socialism and Capitalism work: two case studies

🇷🇴 Romania bought the “messy markets + property rights” bundle and let compounding do its thing.

🇻🇪 Venezuela doubled down on central planning, price controls, and expropriation (i.e., shorted growth and went long scarcity). Capitalism treats information as prices and entrepreneurs as search engines; it tolerates failure so winners can scale.

On the other hand, Socialism treats information as a memo and entrepreneurs as a problem; it fixes prices, then wonders why goods disappear and people follow. The result is visible in the spread, where one line is volatility with upside (policy beta that pays), the other is a controlled descent: first the currency, then the capital stock, then living standards.

Markets aren’t perfect, but they’re the only system that reliably turns ambition and local knowledge into GDP. Planning is perfect only for destroying both. LINK

AI CAPEX is a strategy now

I capex is a strategy now. When compute and power become the scarce inputs, hyperscalers turn dollars into defensible advantage: control of GPUs, energy, and data-center footprint compresses the stack, improves latency, and drops unit costs. In platform transitions, performance drives distribution (integrated beats modular), so the players that own inference economics can bolt AI into existing workflows (productivity, ads, cloud) and raise ARPU while lowering churn. Think of tokens as the new traffic and CAPEX as customer acquisition. The more capacity you control, the more default you become for enterprises that don’t want to stitch together models, infrastructure, and compliance on their own.

But the same spending cuts both ways. Hardware cycles are short, standards are fluid, and power/regulatory bottlenecks are real. Overbuild or obsolescence will crush returns if demand doesn’t materialize or prices race to the bottom.

However, the upside is compelling: capacity-based pricing, sovereign/regulated deployments, and vertical AI products can convert fixed assets into high-margin revenue. Of course, if you measure the right things (utilization, capex-to-incremental revenue, AI gross margin, secured MW).

Winners treat infrastructure as a product, continuously optimized and tightly integrated into experiences customers can’t churn from. BI

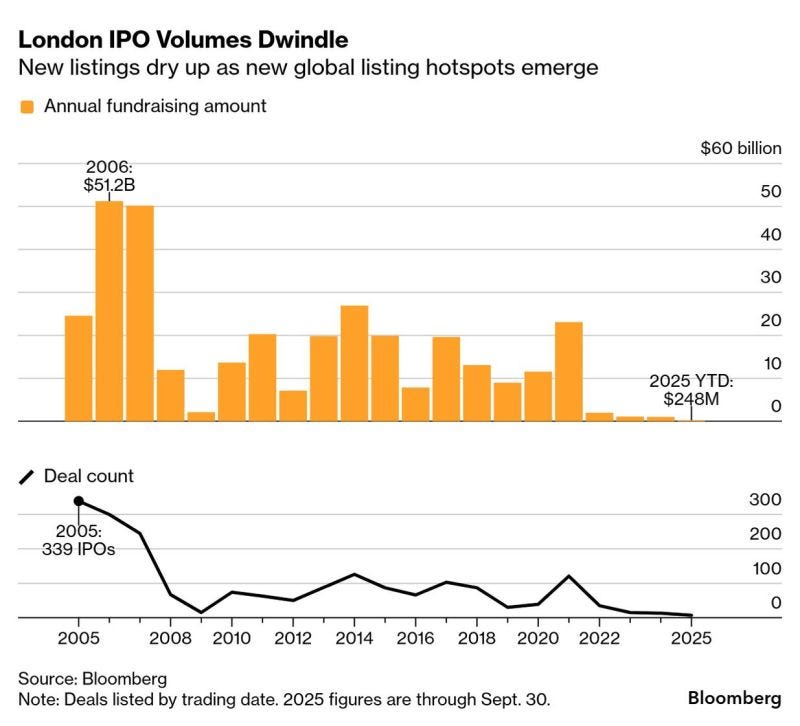

Surprise, surprise: markets work

Hey, London, what is this? 🇬🇧

The London IPO volumes have collapsed from a champagne-popping $51.2 billion in 2006 to a modest $248 million year-to-date in 2025, which is less a “global financial center” and more a “regional fintech meetup with a former empire buffet.”

Apparently, combine Brexit, overregulation, and a generation of founders who’d rather list on the Nasdaq or stay private forever. You don’t get a financial renaissance, but you get… this. London lost the reason companies used to go public there in the first place. It’s like the stock exchange equivalent of a West End theatre that used to run “Les Misérables” and now hosts amateur improv. Bloomberg

🌪️ on climate change

Bill Gates, who not long ago was warning us that climate change would boil our oceans and bankrupt civilization unless we stopped flying to conferences, has decided the vibes are too negative. Apparently, it’s now time to tone down the “doomsday talk” and focus on “human welfare”, like child mortality and agricultural development. Which is weird, because last time, climate was the single axis upon which every other concern was supposed to rotate. But now that the politics have shifted, and the billion-dollar climate funds (and ESG!) aren’t quite returning climate miracles, it’s suddenly about “balance”. This is the climate equivalent of an actor pivoting from “Save the rainforest” to “Let’s be reasonable about logging” 😅

It’s not that his arguments are entirely wrong... yes, tradeoffs matter. But the sudden rebranding of climate urgency into something that sounds like a TED Talk sponsored by Dow Chemical is peak Gates. It’s the same tone shift we get when Hollywood celebrities stop screaming about a cause once the checks stop clearing. When the guy who once said innovation would solve everything decides that adaptation is now the story that means he’s quietly conceding the tech didn’t scale, the economics didn’t work, and the politics got too messy, so now it’s time to move the goalposts and act like that was the strategy all along. Bloomberg, Bill Gates

Key Speaker: GrECo’s Annual Conference

Last week, I had the privilege of speaking at the GrECo Group Annual Conference. A few ideas I have shared:

1/ If I, as a manager, were to hire a young person today, should I expect less loyalty to the company, but more demand for meaning and autonomy? The answer is, clearly, YES.

2/ What type of risk is no longer tolerated by the younger generations? Working in a ‘static’ organization, without technology, without growth opportunities.

3/ How do I integrate into the organizational strategy the fact that the major risk is no longer just external (market, competition), but internal: if employees do not evolve, they become a vulnerability.

—

Want to be a speaker at your company/event? Write me at contact@onstrategy.eu

PRINCIPLE: Focus on fewer things

The ruthless math of focus

The world doesn’t reward nonexperts. It rewards people who go unreasonably deep on a few things and ignore almost everything else. Three to five priorities? Cute. Try two. Maybe even one. The harsh reality is that most of what’s on your plate is either a distraction or a security blanket dressed up as “diversification”.

Why? Because attention isn’t free. Every new priority splits the same finite mental RAM. And worse, most people confuse being busy with being useful. They spread themselves like peanut butter across projects, meetings, and metrics, then wonder why nothing compounds. The people are just allergic to doing too much.

The best hedge is not optionality. It’s depth. Going all-in on a small number of asymmetric bets, where your edge can actually grow. Cut the side quests. Pick your hill. Climb it publicly and when you get to the top, people will say you’re lucky. But really, you were just focused. LINK

Good luck with WhereisMyMoat, my friend!