(#151) 🤝 Elon extremely hard work begins now; 🇪🇺 Europe's future is artisanship and advance tech

The Chinese EVs tsunami is here

WhereIsMyMoat.com is now live and already busy. 🚀

In the first week, I’ve posted:

🍏 Apple – available as a free sample, so you can see exactly how I think through a position

💉 Novo Nordisk – the GLP-1 king and what its moat really looks like

✈️ Rolls-Royce – from “troubled” to “turnaround?”

📦 Amazon – AWS, retail, and the operating leverage story

☕ Starbucks – brand, pricing power, and the risk of fatigue

This week, paid subscribers will get fresh breakdowns on:

🧮 Berkshire Hathaway – does Buffett’s conglomerate still outperform in an AI world?

🎧 Spotify – aggregator, commodity, or something in between?

🚗 Uber – from burning cash to (supposedly) printing it

If you enjoy my strategy notes on LinkedIn or in OnStrategy, WhereIsMyMoat.com is the deeper, “skin-in-the-game” version: full theses, moat scoring, and clear buy/hold/sell views.

Have a look, read the Apple sample, and if it’s useful, consider subscribing.

– Sorin

—

On to update:

The Chinese EVs tsunami is here

Look, the global EV sales chart is basically a Tesla ad with some BYD seasoning and a few mystery entrants like “Changan Lumin”, which sounds more like a vitamin supplement than a car. Tesla Model Y is lapping the field with 140,904 units in September, and Model 3 holds second. And yeah, BYD has eight cars in the top 15, which is impressive if you grade on volume rather than design language. But let’s be honest, no one in Munich or Milan wakes up dreaming of a BYD Sealion. It’s the IKEA of vehicles: practical, inexpensive, and mildly confusing when you try to explain it to your dad.

Meanwhile, Germany is stuck in a philosophical debate about whether cars should be built from steel or soul. Everyone wants the feel of a Mercedes or a BMW, not a QR code with wheels. The problem is, while Stuttgart polishes its heritage and debates EU emissions credits, the rest of the world is buying cars with weird names, touchscreen dashboards, and range anxiety. If the next Porsche is going to compete with the Changan Lumin, someone in Germany better stop building “driving machines” and start building delivery machines, because plastic or not, the race is being won on scale and speed, not legacy and leather stitching.

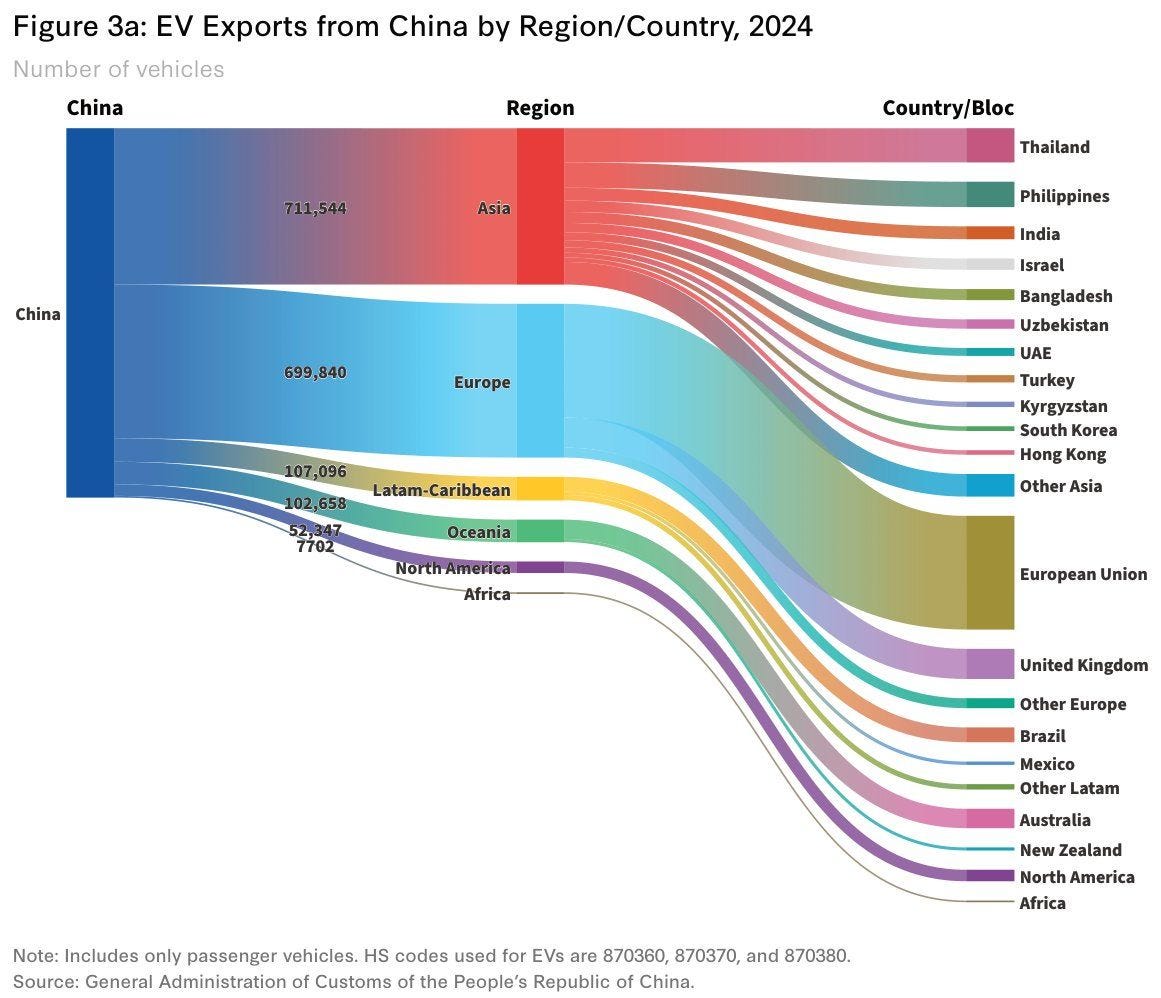

China’s EV strategy: export to Asia and Europe

What that chart really shows is that “China” in EVs is no longer a country, it’s an aggregator of scale. Once you’re exporting 700k+ vehicles to Europe and a similar number around Asia, the learning curves on batteries, motors, inverters, and factory automation stop being linear and start being compounding. Europe can slap tariffs on the finished car, but it can’t tariff away China’s cost advantage on the stack: batteries, supply chain control, and process know-how. In other words, the unit that competes with Europe is not BYD or SAIC individually, but against the entire Chinese production system, totally backed by the Chinese state.

The European “capitulation” scenarios are exactly how this kind of advantage plays out in practice. First, Europe buys the brains (Chinese software, ADAS/”Autopilot”, vehicle OS) because that’s the easiest way for a legacy OEM to ship something that doesn’t feel 10 years behind. Then it rents the muscle (Chinese-owned or Chinese-run factories in Europe) to arbitrage tariffs and politics while still tapping into China’s cost structure and manufacturing playbook. On paper, Europe keeps the jobs and the brands; in reality, it becomes the front-end UX and regulatory wrapper for a Chinese industrial platform running underneath.

Maybe the European premium EVs will have a chance. Just maybe. LINK

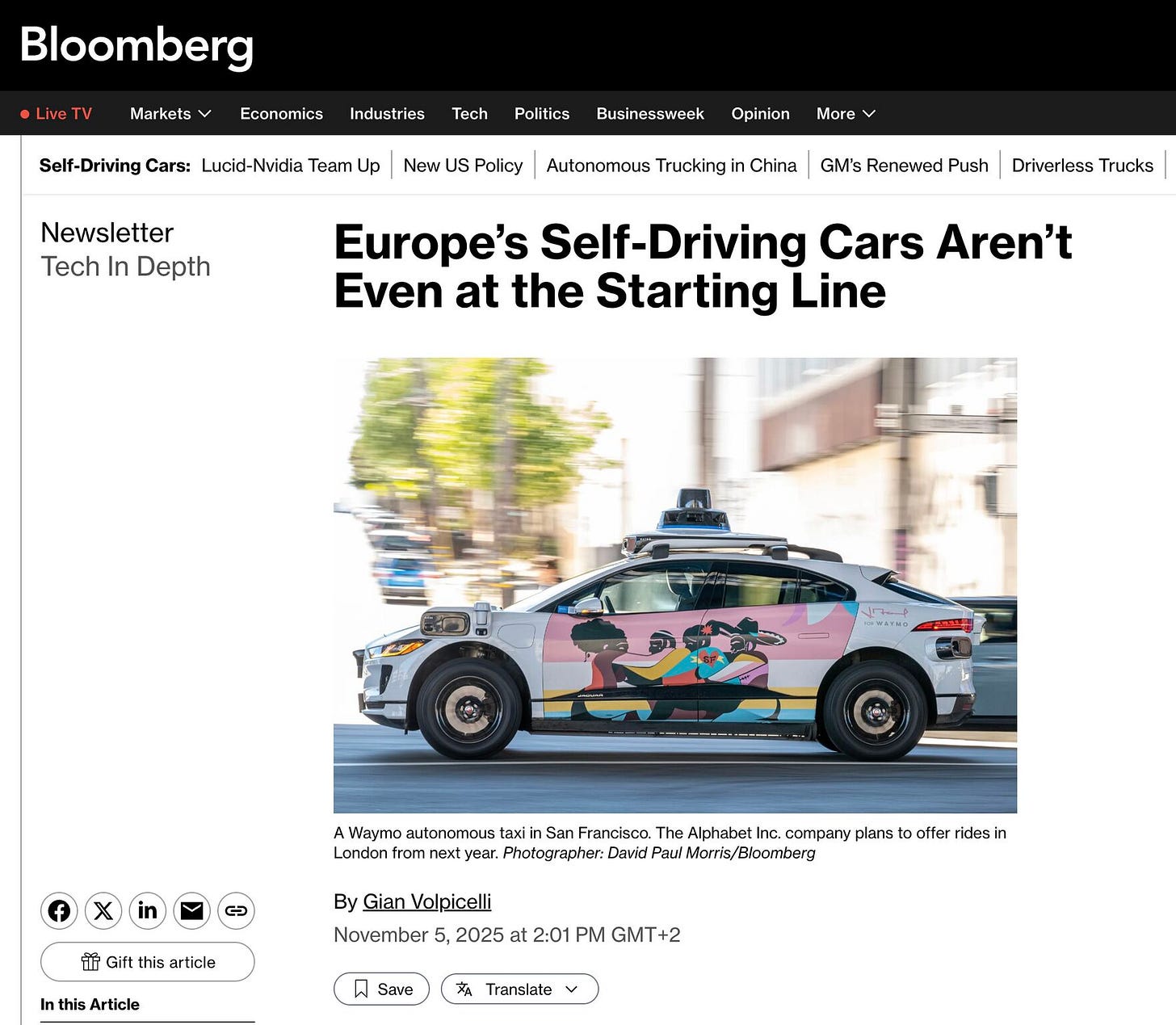

Any chances of having a European self-driving car?

You know things are bad when startup founders in the US start saying, with a straight face, “This company wouldn’t exist if we had started in Europe” [1] ---> not as humblebrag, but as a completely accurate economic diagnosis. Europe totally lost the plot on self-driving cars because it regulates like a nervous librarian, funds like a slow-motion bake sale, and then holds panels on why it’s falling behind. While San Francisco has Waymo and Cruise dueling for robo-taxi supremacy (and China has many more starting with Pony AI), Europe’s most promising autonomous vehicle deployment is still in “development” and probably delayed because Brussels needs three more committees to harmonize parking lot signage.

Now comes the part where some EU commissioner gives a speech in Turin about “tech sovereignty” and “AI gigafactories” while the rest of the world deploys actual, functioning tech at scale. The reality is that you can’t innovate at committee speed, and you can’t build transformative platforms when your national funding schemes cap out at EUR2.3 million and come with 900-page grant applications. Meanwhile, in the US, someone can raise $40 million off a Figma prototype and vibes. Europe’s strategy seems to be “wait until American/Chinese companies are so dominant they open a showroom in Munich, and then complain about fairness”.

Maybe someday Europe will get a real AI car on the road. Until then, enjoy the clean sidewalks and good win, because the future isn’t stopping there. a16z, Bloomberg

Who’s taking our jobs? This:

Someone on Twitter: “i can’t believe this is taking our jobs”

It is pretty funny that “this” is what’s allegedly taking our jobs, because “this” is basically a glorified autocomplete that read the entire internet and then got really good at faking confidence.

For years, the implicit social contract of white-collar work was the following: if you learn the right jargon and can rearrange bullet points in powerpoint at 11 pm, you are doing something mysterious and therefore valuable.

Now, LLMs break the spell by showing that a surprising amount of that “mystery” is just pattern-matching over emails and PDFs. The scary part is that a lot of our work is dumb in exactly the way a model can copy. So when someone says “I can’t believe this is taking our jobs”, what they’re really saying is “I can’t believe my job was basically a well-paid autocomplete prompt”.

The remaining jobs are the ones where you have to pick the problem, own the risk, and be on the hook when things go sideways… at least until someone fine-tunes a model on blame-taking and board presentations.

For Elon, the hard part begins now:

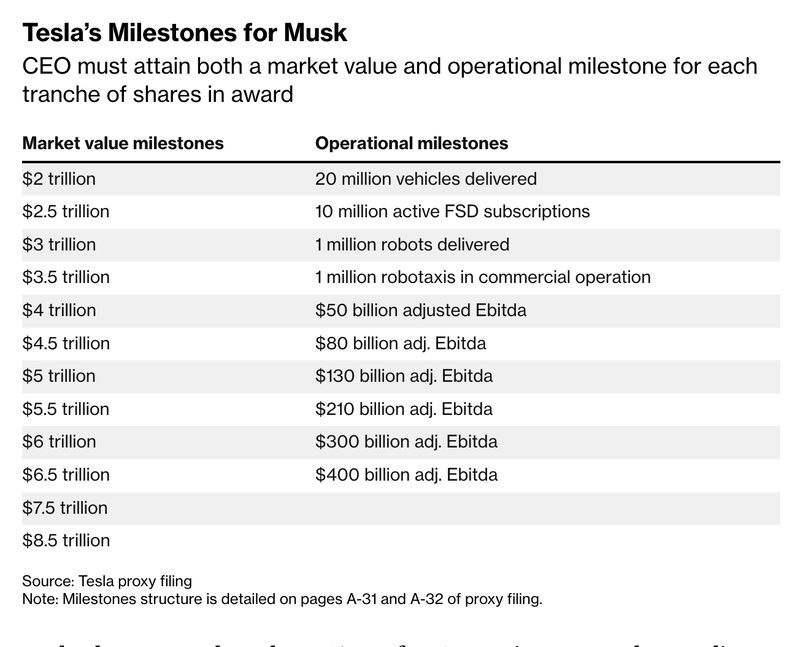

Bloomberg: “Tesla Shareholders Approve $1 Trillion Pay Package for Musk”

Elon Musk just got shareholder approval for a $1 trillion pay package, which is the kind of sentence you expect to end with “…and then the SEC fainted”. But here we are: 75% of shareholders basically said, “Sure, take a shot at becoming the richest human in planetary history as long as you give us robotaxis and $400 billion in EBITDA.”

Honestly, if you’re a Tesla shareholder and you’re not in favor of this, I have questions. Because this is a contractual hallucination of value creation. Musk only gets the cash if Tesla becomes a $8.5 trillion company. That’s a performance art piece about optionality. If he fails, he gets nothing. If he succeeds, you’re rich too. Anyone normally insane should want this deal.

And yes, sure, Bernie Sanders is mad and Norway’s sovereign fund had feelings, but let’s be real. You don’t build Optimus and a terafab chip plant on vibes and committee governance. You do it with a guy who treats EBITDA targets like side quests on his journey to colonize Mars. The real risk for shareholders was that he’d get bored, tweet something insane, and disappear to build flamethrowers and humanoid drones full-time. This deal keeps him tethered to the machine.

And if Tesla hits even half these targets, everyone screaming about income inequality will be too busy riding in self-driving Cybercabs to care. Bloomberg

Preview from WhereIsMyMoat.com

🛍️ on Amazon

Amazon’s AI edge is cornering the scarce inputs and letting everyone else pay the toll. In the full piece, I map the megawatt economics, the Anthropic dependency risk, and the scenarios where overbuild flips from drag to dominance. If you believe AI rewards whoever owns the inputs, not the headlines, this is the playbook. (WIMM)

🥤 on Starbucks

Starbucks’ comeback is an operations story with a brand-sized amplifier. After seven straight quarters of negative comps, the flywheel clicks when you make the line move, like pushing most US stores to 4-minute service, SmartQ sequencing taming mobile/drive-thru chaos, and a 41k-store distribution machine funneled through 34M Rewards members. T

The trade-off is deliberately ugly optics now in exchange for a bigger, faster engine later. Management is explicitly front-loading costs to buy throughput, habit, and ticket.

In the full post below, I quantify how seconds saved convert to basis points, map coffee inflation vs hedge coverage, and scenario-test a China stake sale and union risk, i.e., the boring math behind a very durable moat. (WIMM)

💉 on Novo Nordisk

Novo is industrializing biology. Capacity doubling, APIs scaling, and Catalent integration are turning the GLP-1 boom into a logistics moat. Every vial, pump, and pen adds throughput and time-to-market advantage over Lilly. Management’s bet is clear: front-load CapEx now to own global obesity care later. In the full post below, I map how marginal supply drives pricing power, how regulatory friction reinforces incumbents, and why Novo’s moat may end up bigger than the market it serves. WIMM

🛫 on Rolls-Royce

Rolls-Royce is converting flying hours into margin: contract repricing, time-on-wing fixes, and a data-center boom turning MTU into a profit engine. Civil runs at 25% margins on +8% flying hours and +12% shop visits; the group sits at 19% margin with £1.6B FCF and net cash, while Defence locks in a £18.8B backlog. The trade is simple *but complex): gritty execution and front-loaded CAPEXX now to harden the LTSA annuity and stand up a second engine in Small Modular Reactors (SMR). In the full post below, I tie each point of time-on-wing to contractual margin, show how Power Systems mix lifts group ROIC, and scenario-test narrowbody re-entry vs SMR delays, ie. the boring math behind a moat rebuilt by contracts, reliability, and capacity. WIMM

Essay: Business leaders for 2026

My choices are: Elon Musk, Jamie Dimon, Alex Karp, and Marc Andreessen. Read it all - HERE.

Fascinating. Your deep dives are always so insightfull, especially the market dynamics discussed. Is it hard to numerically 'score' a moat for something like Starbucks, where the risk of fatigue is so central?