(#152) 🛍️ TikTok Shop and the rise of content-native commerce

Harvard Business Review: “Stop running so many AI pilots”

Thank you for being one of the +4,500 minds reading this newsletter

Here is what you’ll find in this edition:

🛍️ TikTok Shop and the rise of content-native commerce

Harvard Business Review: “Stop running so many AI pilots”

👻 on Kpop Demon Hunters & the Asian pop culture

The Wall Street Journal: “Why CEOs get paid so much?”

Apple’s unique relationship with Google

…and more 👇

Onto the update:

🛍️ TikTok Shop and the rise of content-native commerce

TikTok Shop is emerging as a new type of e-commerce platform. It has reached 15 billion dollars in annual sales in the United States, placing it alongside eBay on the global stage. Its growth comes from integrating product discovery directly into entertainment. Instead of relying on search or reviews, TikTok drives purchases through algorithmic recommendations, creator endorsements, and continuous engagement. People watch videos, follow creators, and encounter products in context. Shopping becomes a part of the content experience. This approach treats distribution as a core function of the platform rather than a separate commercial layer.

The strategy works especially well for unbranded products and spontaneous purchases. TikTok Shop does not require strong brand identity to achieve high conversion. It relies on price appeal, creator influence, and the speed of content-driven trends. Consumers are influenced by trust in creators and the immediacy of the feed. eBay focuses on intent and listings. TikTok focuses on discovery and engagement. The model represents a shift in how younger generations interact with commerce. Videos, creators, and short-form narratives guide purchase decisions. This is a framework for the next generation of marketplaces, shaped by attention and content flow rather than catalog and search. WaPo

Harvard Business Review:

Corporate AI right now is basically those two paintings, that is, a bunch of very expensive concentric squares where everyone insists they’re “exploring use cases” but nothing ever leaves the frame (see also the study form MIT where 95% of AI pilots brought zero return).

You get an AI pilot for churn, an AI pilot for pricing, an AI pilot for HR, each with its own steering committee, consultant(s), and carefully non-committal KPIs, and then they all end up stacked in some “innovation portfolio” deck like modern art in a storage unit.

The annoying truth is that models actually become effective only when you identify one ugly, operational problem, wire the thing into real systems, let it break things, and then fix it for 18 months. However, that’s challenging and politically risky, whereas running ten pilots that never reach production is very safe and looks great in the annual report.

The HBR article below is basically saying, “stop painting more colorful squares, pick one, cut a hole in the wall, and let it lead somewhere.”

Finally, he real question is not “Which AI use cases should we test?” but “Which P&L line are we willing to re-architect, politically and technically, around a model?”. If you can’t name one, you don’t have an AI strategy... you have AI-themed market research. HBR

👻 on Kpop Demon Hunters & the Asian pop culture

What is happening with Asia’s pop culture machine, especially in South Korea, is more than a cultural export. I’d say it’s more about owning the intellectual property stack from the first viral hit all the way to the global toy aisle. Whether it is Pinkfong’s Baby Shark empire going public on the strength of 16 billion Youtube views (!!), or Netflix turning KPop Demon Hunters into the most watched animated film in platform history, the model is clear. These creators are launching culturally specific content that delivers universal emotional resonance, and then allowing distribution platforms to do the scaling (translation = you want to partner with Netflix, not Disney+). This is not the old Hollywood model of top-down global appeal. It is bottom-up franchise construction, built natively for Youtube, TikTok, Meta, and Netflix algorithms.

The strategic implications are significant. In a world where attention is fragmented (but mostly owned by META family apps) and loyalty is earned in seconds, Korean content creators are showing that they can launch massive franchises without legacy gatekeepers. Pinkfong’s trajectory, from a simple children’s song to an IPO and global expansion is more than just an ‘anomaly’. It resembles the Pixar model rebuilt for the platform age (e.g. low production cost, high viral potential, and global reach through digital distribution). Netflix’s experience with KPop Demon Hunters shows how the algorithm can not only discover the hit but create post-launch momentum that even theatrical releases struggle to match. The competitive edge now lies not just in owning intellectual property, but in owning the feedback loops and data infrastructure that amplify it.

The next phase of this evolution is about merchandising. With companies like Mattel and Hasbro rushing to develop Demon Hunters toys for 2026, this playbook becomes also clear: video leads, fandom follows, and consumer products turn engagement into cash flow. Netflix, caught off guard by the film’s explosive success, had no toys ready for this holiday season, which highlights how quickly this new model can shift value. Monetization no longer starts with products. It begins with distribution at scale, followed by monetization through cultural resonance. Asia’s entertainment leaders have figured out that modern global success does not require selling cultural identity. It requires translating emotional universality through local creativity, then letting the algorithms carry it across borders. Financial Times, onStrategy

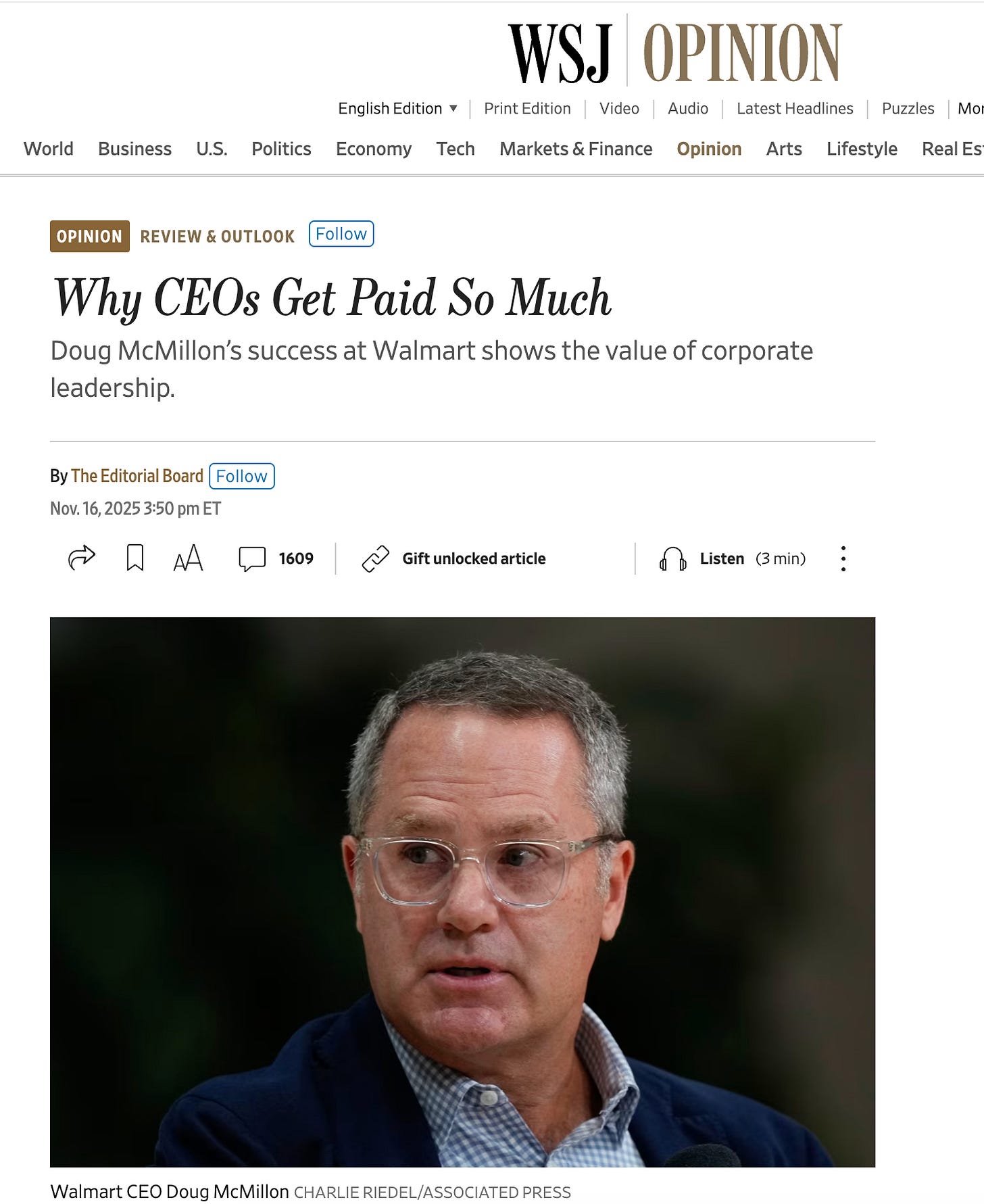

The Wall Street Journal: “Why CEOs get paid so much?”

Doug McMillon, President and CEO at Walmart, started out stocking plants in a Walmart garden center and ended up delivering $681 billion in annual revenue, 310 percent shareholder return, and a business model that can absorb tariffs, deploy AI, and still pay 2.1 million people. The conversation about CEO pay usually involves moral fog, generational outrage, and someone on TikTok explaining why socialism would fix everything. But if you squint past that, you find a man who operated a global logistics empire like a capital compounder, integrated e-commerce into a truck-based retailer, and competed with a company that literally named itself after the rainforest. That level of competence creates value that shows up in earnings calls and tuition checks.

The role of a modern CEO resembles a hedge fund manager crossed with a data scientist and layered with diplomatic instincts. McMillon pulled it off with a Midwestern accent and no viral podcast clips. Government budgets drift, infrastructure crumbles, and congressional hearings go viral for the wrong reasons. Meanwhile, Walmart continued to sell dish soap in 10,000 zip codes and quietly build one of the largest AI footprints in retail. Comparing McMillon’s compensation to the average wage does not tell the full story. Comparing it to the output he managed across decades offers a cleaner framework: shareholders, employees, and vendors all made money while the company avoided collapsing under its own scale. That sounds like a pretty good trade. WSJ

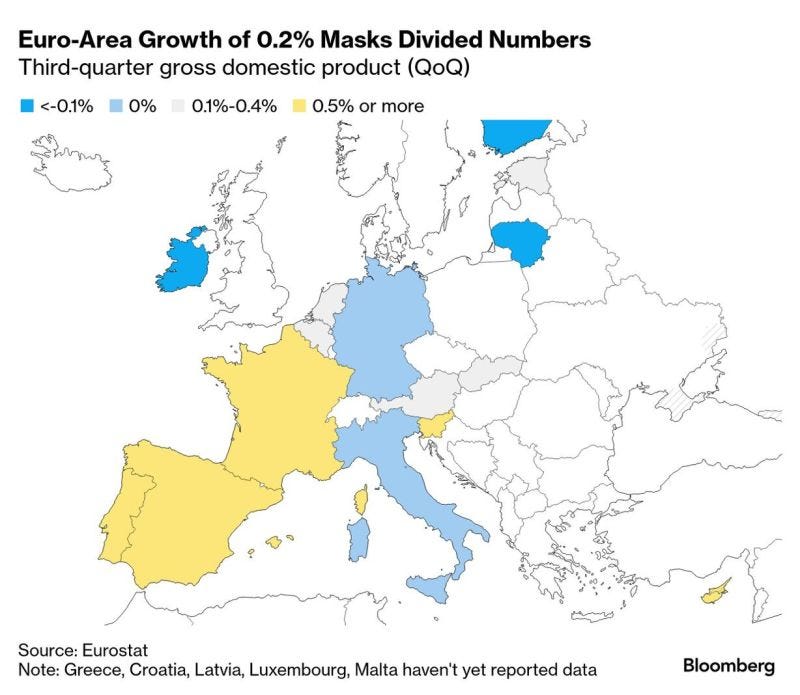

EU - the land of degrowth

🤔 Tyler Cowen (Economist):

“People in the EU are super wise. You have a meal with some sort of French person who works in Brussels—it’s very impressive. They’re cultured, they have wonderful taste, they understand all these different countries, they know something about Chinese porcelain. And if you lived in a world ruled by them, the growth rate would be negative 1%.

So there’s some way in which all these things have to balance. I think the US has done a marvelous job at that, and we need to preserve that.

Apple’s unique relationship with Google

I saw this meme at Linas Beliūnas and I couldn’t refrain myself.

This meme perfectly captures the absurd asymmetry of the Apple - Google relationship where the world’s richest tech company paying $1 billion to use Gemini, Google’s LLM, while Google turns around and pays Apple more than $20 billion just to remain the default search engine on Safari. It’s the definition of coopetition at platform scale, where Apple holds the keys to mobile distribution, and Google holds the crown jewels of search and AI, but it’s Apple that’s running the toll booth.

How things work:

1/ Apple gets paid for not competing in search, and now it pays a fraction of that to get access to Google’s best AI models… which improves Apple’s UX, which increases iPhone usage… which drives more search traffic… for Google.

2/ What this really exposes is just how dependent Google is on Apple’s distribution monopoly (for now) and how ruthlessly Apple is capitalizing on it. Google can build the best LLMs, but if Siri or Spotlight reroutes users to ChatGPT or Claude instead of Google Search, they’re dead in the water.

As Apple experiments with bringing Gemini inside the house (for only one billion), it’s slowly inching toward the moment where it says, “Thanks for the training wheels, we’ve got this now”. The +$20B “protection money” from Google is the fragile moat around Google’s core business model. And Apple’s starting to charge rent from both sides. Somehow, for Apple, not playing in the AI game seems a “lose-lose” decision. Indeed, it’s a weird relationship.

Book review: BOOM - Bubbles and the End of Stagnation

The core insight from Byrne’s Hobart book (”Boom”) is that when the world believes something crazy, and enough money flows toward making that crazy thing real, the world can actually change. Financial bubbles, especially what Hobart and Huber call “inflection bubbles”, serve as cognitive load balancers. They make it socially and economically safe to take career-defining risks, to invent things prematurely, and to try stupid-sounding ideas en masse. Sure, most of it burns out in frothy hype. But the 1% that survives (e.g. fiber optic cables from the dotcom crash, x86 server stacks from early web scaling, asynchronous Javascript from the browser wars) compounds forever.

This is why AI’s current bubble may be the most productive since the internet because it is reordering both financial incentives and human ambition. It’s not just about models. It’s about chip fabs, power grids, entropic hardware experiments, and startup founders quitting their jobs because someone else just raised $50M to reinvent photolithography. These investments would have never been funded in a ‘sober’, stagnation-optimized world. Bubbles punch through institutional risk aversion not because they are wasteful, but because they waste capital in the exact places where coordination failure normally strangles innovation. They frontload the buildout of infrastructure, both physical and intellectual, that a rational spreadsheet would defer forever.

In that sense, Boom is a manifesto against stagnation. Bubbles are like some reset buttons, executed through mass delusion and FOMO, in a world allergic to permissionless creation. Without them, you get five Big Tech firms harvesting margins off last decade’s ideas. With them, you get unknown founders building reality-warping tools, funded by hedge funds and pension capital desperate not to miss the next inflection.

Will the AI bubble pop? Of course. But if we’re lucky (and smart) it will leave behind an electrified grid, a compute stack that’s unbundled, and a generation of builders who now know what’s possible when the world loses its mind for just long enough.

Great read! Highly recommended. (Stripe Press)

[Essay] The “Attention economy’s” trillion-dollar question: Why OpenAI must embrace advertising

For all the justified excitement about ChatGPT’s unprecedented growth trajectory, with 800 million weekly active users represents one of the fastest consumer adoption curves in technology history, OpenAI faces a problem that should be familiar to anyone who has studied the evolution of Internet business models. That is, they have aggregated demand without monetizing it.

The numbers tell a stark story. With approximately 40 million premium subscribers at $20/month, OpenAI has built a $10 billion annual run-rate business. Impressive, certainly. But that represents only 5% of their user base. The remaining 760 million weekly active users cost money to serve, significant money, given the computational intensity of large language models, while generating zero revenue. For a company reportedly seeking a $150 billion valuation and eyeing a path toward becoming a trillion-dollar enterprise, this is a vulnerability. (Continue reading HERE)

WIMM

If you enjoy my strategy notes on LinkedIn or in OnStrategy, WhereIsMyMoat.com is the deeper, “skin-in-the-game” version: full theses, moat scoring, and clear buy/hold/sell views.

Last week's analysis:

🧮 Berkshire Hathaway – does Buffett’s conglomerate still outperform in an AI world?

🎧 Spotify – aggregator, commodity, or something in between?

🛍️ Follow-up on Amazon

This week’s analysis:

Consider subscribing: