(#153) 🔵 Meta, 🔴 Google, and the fragmentation of the AI compute stack

🍿 From ‘Disruptor’ to ‘Distributor’: Netflix’s Hollywood ending

Thank you for being one of the +5,000 minds reading this newsletter

Here is what you’ll find in this edition:

🔵 Meta, 🔴 Google, and the fragmentation of the AI compute stack

💸 Klarna’s stablecoin bet: Fintechs are becoming infrastructure

🍿 From ‘Disruptor’ to ‘Distributor’: Netflix’s Hollywood ending

🧑🏻💻👩💻 Cartoon meetings and the death of a trillion-dollar idea

🇷🇴🇵🇱 When arbitrage ends: Poland, Romania, and the AI curve

Onto the update:

🔵 Meta, 🔴 Google, and the fragmentation of the AI compute stack

The implications of Meta considering Google’s TPUs go far beyond chip sourcing. Nvidia has dominated the AI compute stack by being both the best general-purpose accelerator and the ecosystem default. But Meta, after years of investing in its own silicon (e.g. MTIA), is signaling that the real strategic risk is over-dependence on one supplier, both in pricing and availability. If Meta commits to Google’s TPUs, it would give the AI platform war a second front: one where ASICs (custom-built for AI tasks) challenge the universal utility of GPUs. This also reflects how the economics of large-scale AI are changing. Inference at scale rewards efficiency, not just raw horsepower. Google has spent nearly a decade perfecting this exact niche.

For Google, this is less about selling chips and more about extending the platform. Cloud is the go-to-market layer and more profitable from quarter to quarter. TPUs are the performance enabler. Gemini is the proof point. Suppose Meta joins Anthropic and others in deploying TPUs for inference or training. In that case, it gives Google not just a revenue boost, but a strategic validation that its closed-stack approach is working.

The broader story here is that AI infrastructure is undergoing vertical integration, where platform control comes from owning distribution (cloud), performance (chips), and content (models). Nvidia is ahead because it built a horizontal ecosystem. But Google, with Meta as a partner, is building an end-to-end vertical pipeline. If this deal goes through, it won’t just chip away at Nvidia’s dominance but will redraw the AI platform map entirely. WSJ, FT

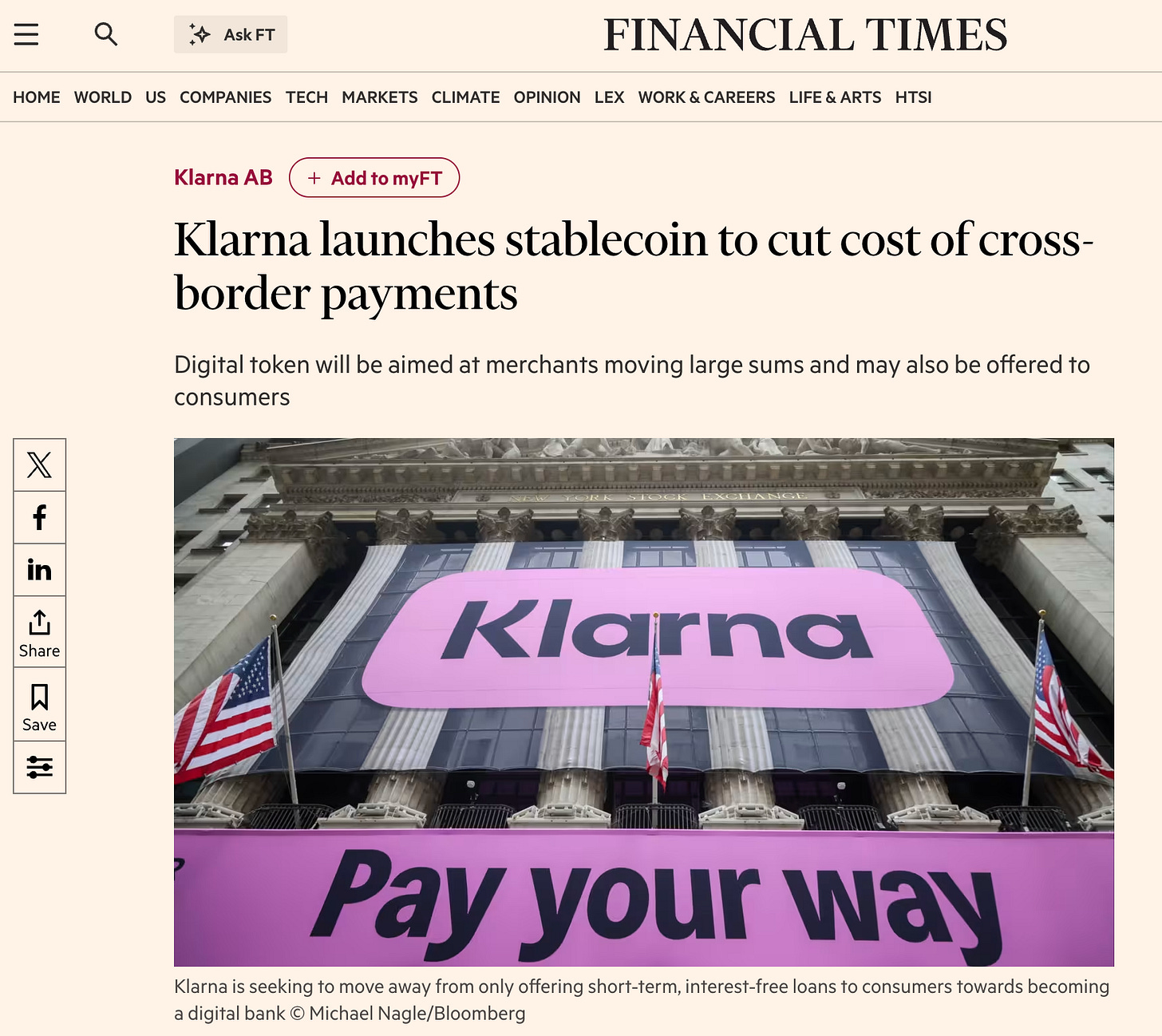

💸 Klarna’s stablecoin bet: Fintechs are becoming infrastructure

Klarna’s launch of KlarnaUSD, a Stripe-backed stablecoin, is a fascinating shift in the fintech playbook, not because it’s revolutionary tech, but because of who is doing it and why now. Klarna, best known for gamifying credit into “buy now, pay later” dopamine loops, is now confronting the cold reality of operating as a global digital bank: cross-border money movement is expensive, regulated, and glacial. Stablecoins, in theory, solve that by cutting out SWIFT and banking intermediaries, enabling near-instant settlement and low-fee transfers across geographies. Klarna is no longer positioning itself as a consumer credit company with millennial aesthetics, but rather as an infrastructure for global payments, and it’s willing to break its own anti-crypto stance to achieve this.

The broader implication is that we’re entering a phase where fintechs and neobanks aren’t competing just on UX or lending margins, but they’re competing on protocol. Klarna joining PayPal, Stripe, and potentially Revolut and Wise in launching proprietary stablecoins is less about crypto ideology and more about control of the underlying rails. It’s AWS-style vertical integration for money movement, designed to escape legacy infrastructure and reduce dependency on card networks and correspondent banks.

In this new world, whoever owns the payment layer can re-bundle credit, identity, and commerce on top of it. Klarna just made a big move to stay in that game and the question is whether regulators (and consumers) will follow. FT

🍿 From ‘Disruptor’ to ‘Distributor’: Netflix’s Hollywood ending

Netflix, the company that once treated movie theaters like Blockbuster fossils and built a culture manual with the tone of a tech cult, now wants to buy Warner Bros to get its hands on “The Sopranos” and a ‘few’ Batmans 😅.

This is like the kid who hacked the school system to avoid gym class suddenly applying for a job as a sports teacher. The same Netflix that bragged about building instead of buying is now preparing to onboard thousands of traditional studio employees, embrace theatrical releases it used to ignore, and possibly license content to third parties, which it has avoided for two decades, because it finally got tired of being the streaming platform with the best UI and the worst IP shelf.

Congratulations, disruptor: you’ve become the thing you disrupted!

The shareholders are unimpressed, mostly because they understand mergers in media tend to go like rom-coms in reverse. You start idealistic and lean, then one day you wake up co-owning Looney Tunes and answering antitrust subpoenas from Congress.

If Netflix wants to spend $60 billion on vertical integration rather than, say, building the next Disney from scratch or buying every anime studio in Japan, that’s fine. But let’s drop the pretense. Netflix cracked the code once by doing everything Hollywood would not do. Now it’s trying to win the next round by doing everything Hollywood already did. That’s a tough sequel to sell. Bloomberg

🧑🏻💻👩💻 Cartoon meetings and the death of a trillion-dollar idea

The metaverse began as a marketing rebrand and somehow turned into a trillion-dollar hallucination about cartoon meetings and virtual t-shirt shopping. You would create an avatar, go to a digital concert, buy a shirt with crypto, wear it to your VR office, and then lend it to your colleague’s daughter so she can flex in Roblox. This experience requires full asset interoperability across platforms, smooth real-time rendering, fast wireless networks, and users willing to spend their day in a headset pretending to care about a pixelated coffee machine in a virtual breakroom. It’s an enormous amount of effort to recreate the mall experience from 1998 inside a game engine, with fewer teenagers and more latency.

The promise always sounded like Ready Player One, but the reality feels closer to Second Life with enterprise software integration. People do not ask for this. They ask for group chats that work and online orders that arrive. Most users have responded by ignoring it completely. Meanwhile, Meta continues to pour billions into this digital Atlantis, hoping that someday, maybe, users will get over the nausea and existential dread long enough to attend a 3D webinar about HR compliance.

The metaverse imagines a future where work and play fuse into a seamless immersive environment. So far, that future mostly consists of laying off the team that was building it. Bloomberg

🇷🇴🇵🇱 When arbitrage ends: Poland, Romania, and the AI curve

🇵🇱 Poland’s and 🇷🇴 Romania’s economic rise was built on a seductive premise: absorb Western capital, offer educated but affordable labor, and become Europe’s back office. It worked, until it didn’t. Krakow, once the golden child of business services outsourcing, now feels like a time capsule for the last era of globalization. The very things that made it attractive (ie. predictable processes, English-speaking grads, reliable infrastructure) are exactly what large language models do better, faster, and cheaper. Shell, Heineken, HSBC, and others are pulling back, quietly replacing back-office roles with AI or sending jobs to even lower-cost hubs like India.

The implications stretch beyond Krakow’s empty office buildings and retreating corporate logos. A wage boom driven by skilled labor has met its replacement curve, ie. automation. This is the classic innovator’s dilemma playing out at city-scale. Poland is trying to pivot with AI courses at Jagiellonian, promises of “Krakow will not become Detroit”, but the structural risk is clear.

When your GDP is tied to labor arbitrage and that arbitrage collapses, you either leap to the next tech platform… or become legacy infrastructure. Europe, once again, will be forced to ask, “Are we ready to build, or just optimize someone else’s models?” Bloomberg

WIMM

If you enjoy my strategy notes on LinkedIn or in OnStrategy, WhereIsMyMoat.com is the deeper, “skin-in-the-game” version: full theses, moat scoring, and clear buy/hold/sell views.

Last week’s analysis:

🚀 Rocket Lab – Space without the drama

🍔 McDonald’s - Value and the Grind

💿 The NVIDIA Tax on the AI Future

This week’s analysis:

Consider subscribing:

Love this perspective on the AI compute stack, but I'm still a bit skeptical if custom ASICs can truely outpace the continuous innovation and versatility of GPUs across all emerging AI applications, not just inference.