(#154) 📱on Motorala's reinvention; 🛍️ TikTok’s new luxury loop

Robotaxis are (mainly) a non-EU game (🇨🇳 vs 🇺🇸 vs 🇪🇺)

Thank you for being one of the +5,000 minds reading this newsletter

Here is what you’ll find in this edition:

📱 How to survive an iPhone punch in the face? Ask Motorola

🛍️ TikTok’s commerce engine: Distribution, Demand, and Designer bags

The Wall Street Journal: “Europe’s Green Energy Rush Slashed Emissions—and Crippled the Economy”

Robotaxis are (mainly) a non-EU game (🇨🇳 vs 🇺🇸 vs 🇪🇺)

No chips, no power

Onto the update:

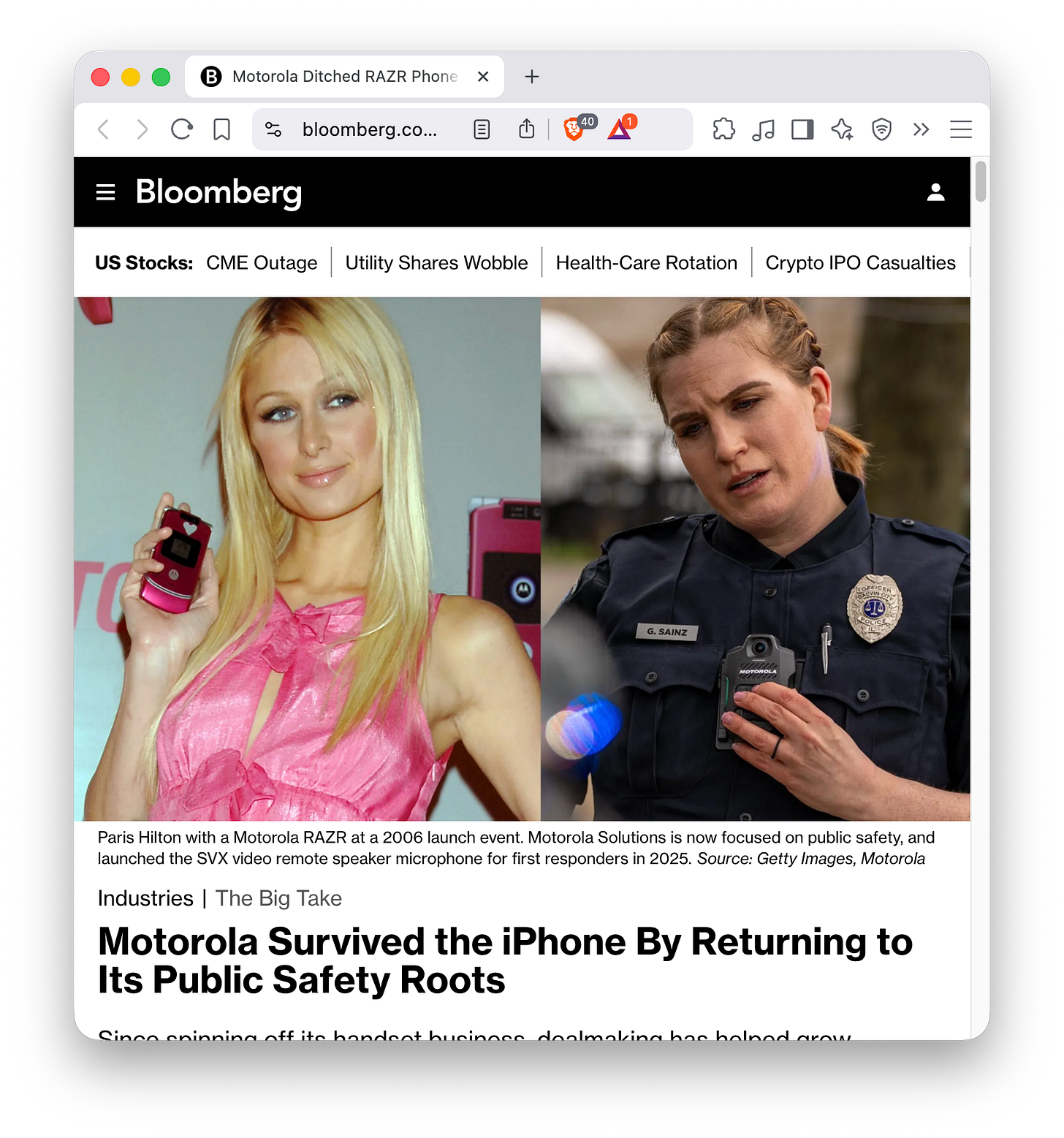

📱 How to survive an iPhone punch in the face? Ask Motorola

Motorola’s transformation into a $60B enterprise by ditching the consumer RAZR and doubling down on critical communications is the type of strategic pivot that’s so obvious in hindsight but painfully rare in practice. This is the Netflix-in-2007 moment of industrial tech. A legacy player staring into the abyss of disruption (ie. iPhone in Motorola’s case) and making a clean, conviction-led break from its past. Instead of competing on camera bumps and celebrity endorsements, Motorola Solutions became a full-stack B2G (business-to-government) platform, integrating radios, AI bodycams, battlefield networks, and high-margin software into one essential bundle for state actors. The result? Over 1,000% shareholder return since the spin-off, with Greg Brown executing one of the quietest but most effective business turnarounds of the last two decades.

Motorola focused on the one market where latency, reliability, and security matter more than user experience: public safety. While Europe was busy trying to regulate every byte of AI, Motorola was building “AI nutrition labels” for its products, launching battlefield mesh networks, and signing billion-dollar deals with global police and military. It’s a playbook that regulators in Brussels wouldn’t understand, because they don’t build anything anymore. Motorola’s resurgence shows the power of strategic clarity: pick a customer (in this case, governments), become mission-critical, and expand horizontally with M&A only when it tightens the bundle. Greg Brown out-executed everyone in a niche market that suddenly became geopolitically sexy…again. Bravo! Bloomberg

🛍️ TikTok’s commerce engine: Distribution, Demand, and Designer bags

TikTok’s expansion into luxury resale is less about handbags and more about platform dynamics. By selling $11,000 Hermes and Chanel bags, the company is signaling its ambition to move beyond low-margin impulse buys and toward high-value commerce. With TikTok Shop, the platform owns attention, distribution, and now the point of sale. The resale layer adds trust and expands market scope. AI-based authentication tools like Entrupy give the whole thing credibility. This is full-stack commerce in motion—attention becomes discovery, which becomes transaction, all within one app. TikTok isn’t trying to beat Amazon at logistics. It’s replacing the mall by embedding shopping into the entertainment feed.

This is what happens when you treat commerce as a function of media, not inventory. TikTok is turning livestreams into personalized storefronts, and influencers into high-frequency auctioneers. The product doesn’t need to be new, only verified and virally packaged. European platforms remain tangled in regulatory debates about who should sell what, while ByteDance executes a vertical integration play across content, commerce, and conversion. The biggest lesson is that when distribution is free and entertainment is native, you can sell anything—even luxury—at scale. TikTok isn’t just reshaping e-commerce. It’s redefining the funnel. Bloomberg, Capital One Shopping

The Wall Street Journal: “Europe’s Green Energy Rush Slashed Emissions—and Crippled the Economy”

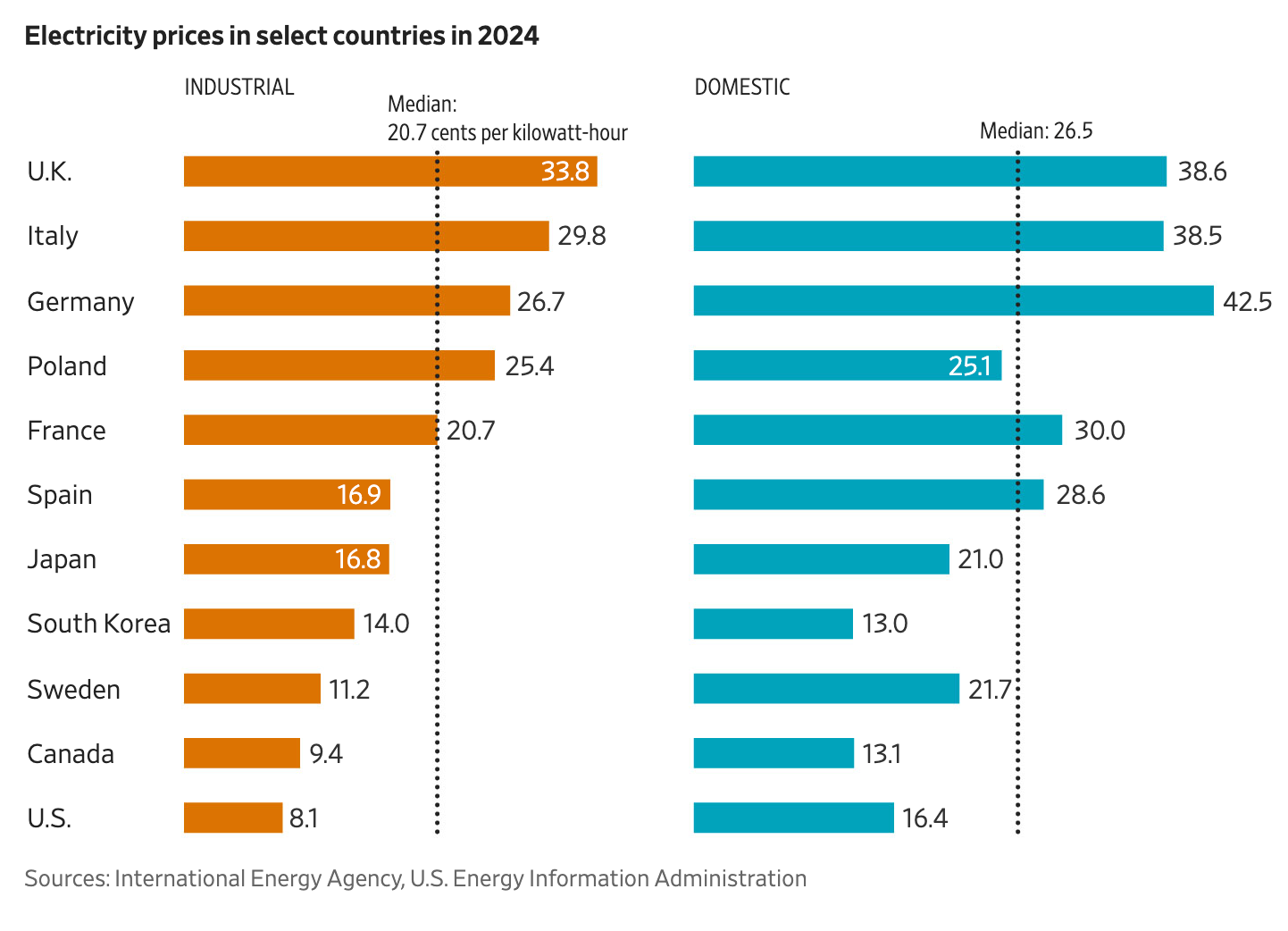

🤓 What have I been writing here for years? The Wall Street Journal brought the data (see above)

The grand European green transition was sold as a “win-win”: save the planet and boost the economy. In reality, Europe traded energy abundance for ideological purity and ended up with the highest electricity prices in the developed world and a structurally uncompetitive industrial base. Germany’s domestic electricity costs hit 42.5 cents/kWh, compared to just 16.4 cents in the US, while industrial rates across the EU remain roughly double those in the States.

There can’t be any competition in these conditions. Energy-intensive industries are shutting down or relocating. AI data centers are capped in Ireland. Exxon and Ineos are packing up. Even the poster child of Europe’s new economy, the green hydrogen boom, is on pause. When your factories are gone and your AI infrastructure can’t plug in, “net-zero” becomes more of a GDP number than a climate goal.

The core problem is strategic. Europe pursued an “or” strategy, hence replacing fossil fuels with renewables, while the US and China embraced an “and” strategy with renewables and more capacity across the board. It closed baseload sources before new infrastructure was ready. And now it pays billions a year to not use wind power because the grid can’t handle it. The UK, for example, shelled out £2.7 billion last year just to “balance” the grid, with expectations to hit £8 billion by 2030 (!!). This is institutionalized inefficiency. Meanwhile, countries like 🇫🇷 France and 🇸🇪 Sweden that kept nuclear power are faring better. Overall, the continent as a whole is locked into a system that demands more capacity, more investment, and more taxpayer subsidies to stand still.

The solution? Drop the ideology. Re-embrace energy realism. Build gas peakers. Extend 10x the nuclear reactors. Focus on solar + batteries. Stop forcing consumers to fund intermittent dreams while China and the US race ahead with hybrid energy portfolios that actually work.

The atmosphere doesn’t care where CO2 is saved, but your economy definitely cares where energy is cheap. WSJ

Robotaxis are (mainly) a non-EU game (🇨🇳 vs 🇺🇸 vs 🇪🇺)

China is overtaking the US by scaling abroad. While Waymo operates robotaxis on a handful of American roads, Chinese companies like Baidu’s Apollo Go, WeRide, and Pony.ai are expanding globally, running real, live services in cities like Dubai and Singapore, and planning deployments in the UK and Germany.

The difference? Strategy and scale. China is leveraging its manufacturing base, government policy, and global partnerships to turn robotaxis into an export industry, something like a mobility ‘Belt and Road’ initiative. By subsidizing a national vision for AV (autonomous vehicles) dominance and offering cheaper vehicles built with a mature EV supply chain, Beijing is doing with robotaxis what it did with solar panels and EVs: drive cost down, push product out, and let Western markets regulate themselves into irrelevance.

Europe, meanwhile, is stuck in a twilight zone between ambition and paralysis. Chinese AV firms are launching pilot programs in EU cities, often with fewer local rivals, because Europe managed to produce neither national champions nor credible AV startups of its own. Years of over-regulation, bureaucratic fragmentation, and state-funded mediocrity have left the continent structurally incapable of competing in next-gen mobility. The idea that Germany, birthplace of the automobile, will soon import robotaxis from Shenzhen should be a wake-up call. But instead, the EU will probably call another roundtable on AI ethics while Baidu rolls out lidar-equipped, voice-massaging, sub-$30K autonomous vans across its cobblestone streets.

The race is on, but Europe hasn’t even bought the shoes. Bloomberg

No chips, no power

The chart is a big warning for the EU 🇪🇺

While the US pushes the AI frontier with Nvidia and AMD, China is quietly stacking a second-tier chip ecosystem that could, by 2026, be “good enough” to run domestic LLMs and edge AI at scale. Huawei, Hygon, and Cambricon are building vertically integrated alternatives across compute, memory, and systems.

We know the strategy: when China decides to localize a tech stack, it doesn’t need to beat the best, but it just needs to be fast, cheap, and everywhere. Think EVs, solar panels, 5G base stations. AI chips are next. And with export controls locking them out of Nvidia’s top silicon, these firms now have geopolitical oxygen to scale behind a walled garden.

And Europe? Europe is too busy regulating what it hasn’t built. No serious AI chipmakers. No scaled AI labs. No platforms. The continent has become a spectator to the two-player game between Silicon Valley and Shenzhen.

Instead of fostering industrial policy that might produce a European alternative to TSMC or Nvidia, Brussels churns out position papers on AI ethics and digital sovereignty, while licensing their digital infrastructure from American hyperscalers and now, possibly, Chinese fabs. The chip wars are reshaping the economic map of the next decade. Europe is thinking of its last “success”: rethinking the GDPR cookies and other failed projects. The Economist

⚡️ no cheap energy, no industry, no money

In five years, OpenAI alone is on track to consume more electricity than the 🇬🇧UK or 🇩🇪Germany... and to overtake 🇮🇳 India within eight. Short reminder: that’s the footprint of a single company (!)

So remind me: how exactly are the UK and Germany supposed to “save the planet”? And is it really rational to kill their industries and cut jobs under these conditions?

Hahaha 👇

Imagine you’re the world’s most powerful arms dealer, and one of your best customers just made their own rifle. Instead of panic, you send out a congratulatory tweet saying, “Nice trigger, by the way, we still sell the bullets”. That’s basically what NVIDIA just did.

Google just showed off its fancy new AI chips, and NVIDIA, instead of going defensive, issued a warm note of admiration, followed by a very subtle flex: “We’re a generation ahead. Our stuff runs every model. On every machine. And by the way, unlike those charming little ASICs of yours, ours work everywhere and do everything.” This is corporate diplomacy mixed with humblebrag energy levels typically reserved for Olympic gold medalists congratulating silver medalists.

Jensen Huang’s team just patted Sundar on the back while reminding everyone who built the roads. LINK

Personal confession

Watching “professional” fund managers pile money into bonds and ultra-conservative products (because regulation says so!) was eye-opening. On paper, the returns looked fine. In reality, they barely kept up with official inflation.... and we all know official inflation is usually the polite version of what we feel in our pockets.

That’s when I decided to do something both simple and uncomfortable: take responsibility for my own capital and build my own thesis at Where is my moat?

Translation: Read the reports, understand the moats, listen to the earnings calls, say “No!” to doomed markets & companies, etc. Eleven months later, this Interactive Brokers screenshot says +55.9% YTD.

Two quick reflections:

1/ Some people still tell me it’s just “luck”. Maybe. A real market correction (next year or in two) will separate skill from luck for all of us. I’m very aware that drawdowns are part of the game.

2/ This feels similar to what happened in my academic life: I had to write my own strategy book because the post-pandemic business world no longer fits the old textbooks. The same is true for investing. The world changed; many of the default options didn’t.

I don’t know yet whether this journey will end with me running a fund (😎) or simply being a diligent steward of my family’s savings. However, I do know this: in a world where systems are optimized for compliance rather than performance, you either build your own playbook or you silently accept “inflation-adjusted poverty” as a strategy.

PRINCIPLE: Solve for adaptability

Most strategic problems aren’t static, because they always mutate. By the time your perfectly modeled solution is ready, the problem has already shape-shifted. What looked like a supply chain issue becomes a market timing issue. What felt like a pricing problem turns into a product mismatch. So what do most teams do? They double down on analysis, seeking “the” answer to a moving question.

This is cargo cult strategy: borrowing the rituals of rigorous thinking without noticing the terrain has already changed. The illusion is that enough thinking will solve the problem. The reality is that most of the value comes from becoming adaptive enough to keep pace with the problem as it evolves. Strategy, like software, benefits from being iterative, not perfect.

The real edge is not clairvoyance, it’s calibration. Build teams, tools, and processes that notice faster, react cleaner, and learn in public. Don’t obsess over the best move and optimize for the fastest learning loop. When in doubt, move. When overwhelmed, simplify. When stuck, shift your timeframe. Strategic agility beats static genius, every time. LINK

WIMM

If you enjoy my strategy notes on LinkedIn or in OnStrategy, WhereIsMyMoat.com is the deeper, “skin-in-the-game” version: full theses, moat scoring, and clear buy/hold/sell views.

Last week’s analysis:

💻 Microsoft - building the AI factory

📈 Interactive Brokers - and the Industrial logic of finance

🚗🛒 Uber’s Hybrid Future

This week’s analysis:

Consider subscribing: