(#155) 📺 Aggregation wins again: How Netflix outbid Hollywood

🚀 SpaceX is looking for an IPO in 2026

Thank you for being one of the +5,000 minds reading this newsletter

Here is what you’ll find in this edition:

📺 Aggregation wins again: How Netflix outbid Hollywood

🚀 SpaceX is looking for an IPO in 2026

The Porsche vs. Xiaomi moment: End of Germany’s China illusion

on Palantir Technologies

on 🇵🇱 Poland, 🇨🇿 Czechia, 🇭🇺 Hungary, and 🇷🇴 Romania

Onto the update:

Aggregation wins again: How Netflix outbid Hollywood

Netflix didn’t win the Warner Bros. auction because it had the best content library, actually, Warner Bros already had that. Netflix won because it’s an internet company that understands scale, velocity, and aggregation. The legacy Hollywood players like Paramount and Comcast came to the table with old playbooks: bundle the cable assets, merge libraries, and call it synergy. Netflix, on the other hand, pitched distribution, global reach, tech infrastructure, and the ability to monetize Warner IP across 300+ million subscribers. In short, Warner Bros. had the content, but Netflix had the platform. The deal was about what Netflix could do with it.

This reinforces the core lesson of the Aggregation Theory and the Elimination Strategy: once you control demand, suppliers become interchangeable. Warner Bros. was once the upstream king; now it’s an input to a vertically integrated machine.

Netflix’s pitch was basically “we’ll extract more value from your assets than anyone else”. The traditional studio system that once dismissed Netflix as a disruptor is now being absorbed by it. Content is valuable, but being the operating system of attention is exponentially more powerful. (Bloomberg)

More about Netflix and its moat this Sunday on WhereIsMyMoat.com

🚀 SpaceX is looking for an IPO in 2026

SpaceX is going public in 2026, targeting over $30 billion in proceeds and a $1.5 trillion valuation. It is the moment when Elon Musk’s hardware-centric empire of physical-world leverage hits the public markets with the scale, speed, and narrative power of a true tech platform.

What makes this different from other mega-IPOs is not just the scale, but the flywheel. Starlink’s cash flows, already approaching $15–24 billion in annual revenue by 2026, are funding a space-based data center layer, vertically integrated with chips and spectrum. In other words, SpaceX is morphing from a launch company into the backbone of a global compute-and-connectivity stack in orbit.

Starlink is the SaaS of space: recurring revenue, defensible infrastructure, and massive optionality. Add the potential of a Starlink spin-off IPO, and suddenly the financial machinery resembles Amazon in the early AWS days.

For the rest of the space economy (Rocket Lab, EchoStar) this is gravity shifting underfoot. SpaceX’s IPO is the monetization of dominance, not a cash grab. That’s what platform companies do. They scale until you can’t ignore them, then they IPO to cement the moat. SpaceX, in classic Musk fashion, is simply applying that formula at orbital velocity. WSJ

The Porsche vs. Xiaomi moment: End of Germany’s China illusion

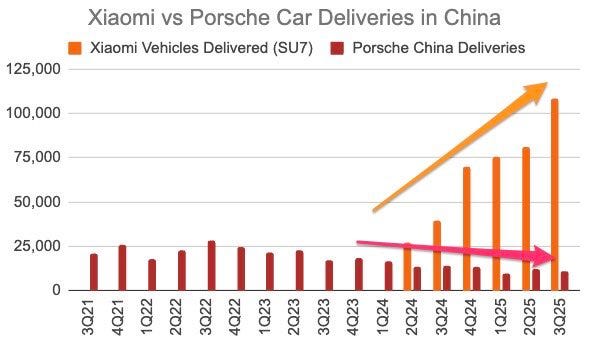

Germany’s industrial strength has always depended on its mastery of the Mittelstand and its dominance in high-end machinery and automotive exports. For decades, China was the ideal partner: an emerging market hungry for German machine tools, willing to absorb exports in exchange for long-term industrial partnerships. But what Berlin mistook for permanent interdependence was, in fact, a strategic stepping stone for Beijing. As China moves up the value chain, replicating and outpacing German technologies while controlling its own massive domestic demand, Germany finds itself disarmed, BUT without a Plan B. The very things it exported to China are now being produced more efficiently, at home, in China.

The chart showing Xiaomi overtaking Porsche reflects the erosion of German soft power through industrial excellence. The lesson, repeated throughout history, is that export empires based on assumed dependency eventually lose to autarkic ones that prioritize strategic self-reliance. China never intended to be a consumer of Western luxury because it intended to become its replacement. Germany now faces an uncomfortable reality: its long-standing strategy of exporting its way to prosperity has run aground against China’s national strategy.

The new global economy is being written in Beijing, not Berlin.

🇪🇺 EU must innovate, not try to overregulate everyone

Here we go again: the European Union, that proud bastion of tech-by-committee, has opened yet another antitrust probe against Google. This time for how it uses AI to summarize the internet.

The accusation is essentially: “You built a better product that users like and content creators hate, so now we’re investigating you”. It’s like being fined for inventing the lightbulb because candle makers weren’t consulted. The EU claims Google may have imposed “unfair terms” on content creators and given its own model an advantage.

Well, yes, that’s what platforms do. They take advantage of themselves. That’s the business model. The entire complaint reads like a slow-motion existential crisis from a continent still hoping innovation comes from whitepapers and fairness doctrines instead of servers and GPUs.

Of course, this is classic Brussels regulatory theater: a technocratic assault on growth masquerading as fairness. While the US and China are sprinting to build AI infrastructure, the EU is busy asking whether the summary text under a news snippet was sufficiently equitable to the original publisher. Never mind that the EU doesn’t really have a large language model worth regulating. Or a chip industry. Or a functioning venture ecosystem.

But it does have regulators. Very well-paid ones. The irony is that the more Europe tries to claw back tech relevance through litigation, the more it signals it has nothing left to build.

GUYS, you can’t outregulate your growth!!! You have to innovate.

For now, the EU seems more interested in fighting gravity than launching rockets.

Palantir is building software and shaping the operational infrastructure of national power. What this interview with CTO Shyam Sankar reveals is that Palantir’s advantage lies in collapsing decision latency across military, industrial, and bureaucratic systems. The company excels where human coordination breaks down, when data overwhelms command. And unlike shiny, consumer-facing platforms, Palantir’s moat is operational because it transforms fragmented, legacy environments into unified decision loops. If data is oil, then Palantir is the refinery, the dashboard, and the fuel injection system, all rolled into one.

This story goes beyond govtech because Palantir makes moral and strategic commitments. It picks sides: Western liberalism over techno-authoritarianism, state capacity over drift, deterrence over idealism. Sankar’s dismissal of AGI doomerism highlights the current bifurcation in tech, that is, build for status and clicks, or build for sovereignty and leverage. Companies like Palantir, Anduril, and SpaceX operate on the second axis.

Europe sits outside this frame, not due to a lack of engineers, but due to the absence of political ambition to integrate software with defense and industrial might. In an era of accelerating conflict and institutional entropy, Palantir is writing the OS for Western deterrence.

I am super bullish on the company and its mission. LINK

on 🇵🇱 Poland, 🇨🇿 Czechia, 🇭🇺 Hungary, and 🇷🇴 Romania

China’s trade model, once a net contributor to global growth, has become zero-sum and increasingly negative-sum for the rest of the world. This is a civilizational shift in how economic leverage operates. Rather than importing more as it grows richer, China is exporting even harder while flatlining its imports.

The new model is “dual circulation”. where China pulls the world’s demand inward, hoards value-added manufacturing, and maintains dominance in both low-end and high-end supply chains. This is trade used as an instrument of industrial consolidation, where scale begets geopolitical power.

The implications for Central and Eastern Europe (CEE) are severe. Poland, Czechia, Hungary, and Romania, which once thrived by absorbing outsourced manufacturing from Western Europe, now find themselves squeezed from both sides.

On one end, Western firms are reshoring back to the US or pivoting to Asia-Pacific; on the other, Chinese overcapacity is flooding global markets with subsidized exports.

According to Goldman Sachs, China’s current trajectory will shave off growth from Eastern European economies over the next four years, reversing the decades-long convergence story.

In simple terms, CEE went from “factory of Europe” to a squeezed middle in a world where China exports more and imports less. The path forward demands a pivot, not toward low-cost manufacturing, but toward sovereign tech platforms (including building the ‘electrical stack’), defensive industrial policy, and strategic alliances that make CEE indispensable to the next layer of the value chain.

Otherwise, they will remain downstream… forever. WSJ

WIMM

If you enjoy my strategy notes on LinkedIn or in OnStrategy, WhereIsMyMoat.com is the deeper, “skin-in-the-game” version: full theses, moat scoring, and clear buy/hold/sell views.

Last week’s analysis:

This week’s analysis:

Consider subscribing: