(#156) 🚀 The cloud goes orbital: SpaceX, Blue Origin, and the next platform shift

A concise Masterplan for 🇪🇺 Europe’s rebirth

Thank you for being one of the +5,000 minds reading this newsletter

Today is the 3rd anniversary of #onStrategy 🎉

I started it for a simple reason: I was reading Financial Times, Bloomberg, and The Wall Street Journal every day, and I kept noticing the same thing: smart people, good writing, but avoidable mistakes. Not because they’re bad at their jobs. Because their job is news. They are journalists, not analysts. They have to explain what happened quickly, in a way that sounds reasonable right now, under the tyranny of the headline and the deadline.

That gap, the space between “here’s what happened” and “here’s what it means”, was my opening. The blog became my place to think in public, to make references, to build a little library of arguments I could reuse, refine, and occasionally contradict (the most honest form of progress). It’s also been the best kind of reminder: why I started, what I actually believe, and what I’m still trying to figure out.

Anyway, 3 “anniversaries” in, here we are. Still reading, still noticing, still writing.

Here is what you’ll find in this edition:

A concise Masterplan for 🇪🇺 Europe’s rebirth

🛰️ Owning the interface: Why Revolut is entering telecom6

🤝 What is behind the deal between OpenAI and Disney?

on Palantir Technologies

🚀 The cloud goes orbital: SpaceX, Blue Origin, and the next platform shift

My 2025 Annual Presentation - “The Compressed Decade”

A concise Masterplan for 🇪🇺 Europe’s rebirth

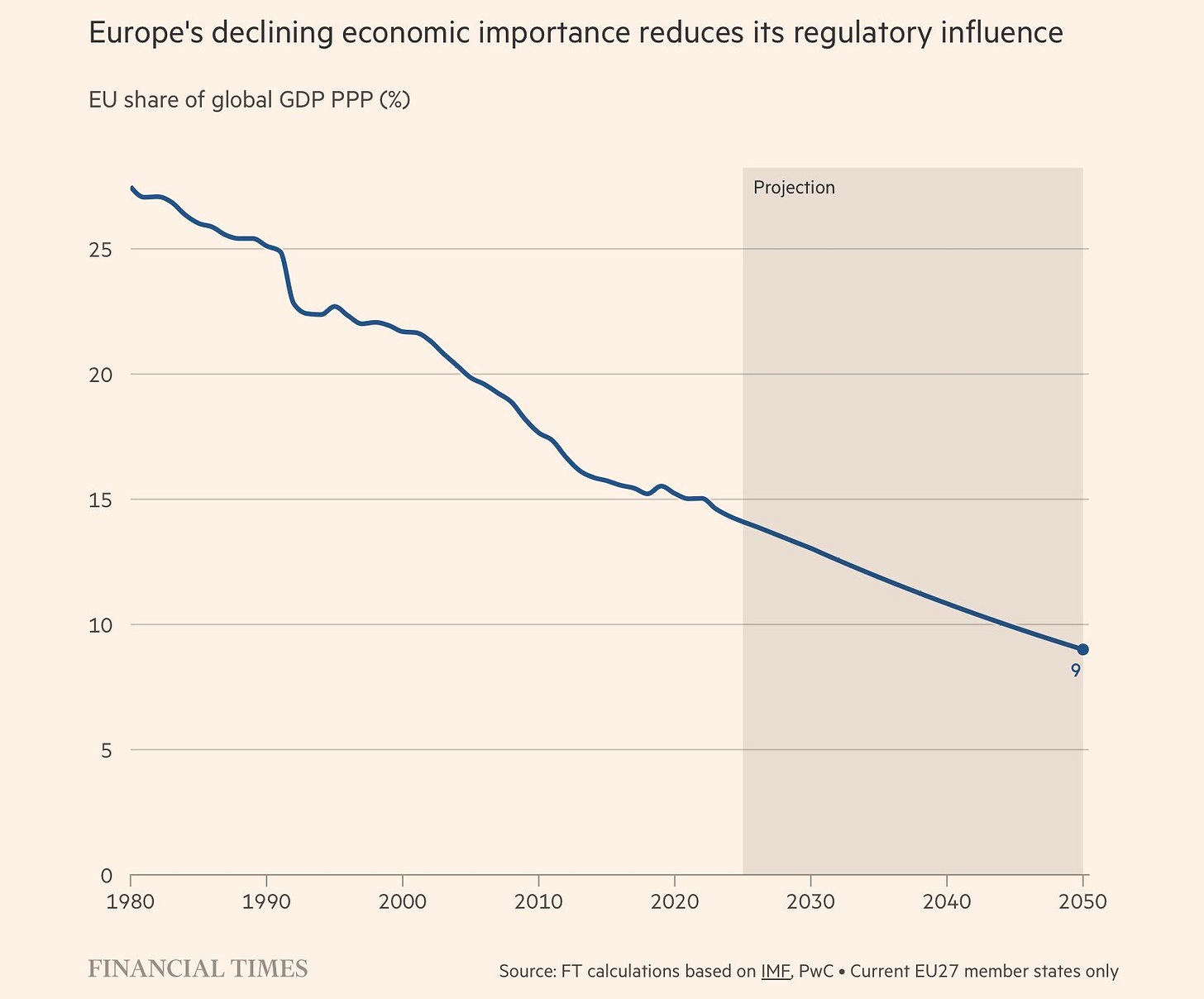

Europe loses because rules are downstream of economic gravity. When your share of global output slides for decades (and the chart is basically a ski slope into the projection zone), you stop being the default market everyone optimizes for, and your “Brussels effect” turns from leverage into paperwork.

Reversing that trend is not a seminar on “competitiveness”. It’s a decision to be a builder civilization again:

1/ ship abundant energy (nuclear + grids + storage + faster permitting),

2/ ship compute (data centers, chips, sovereign cloud that actually scales),

3/ ship AI (less fear-as-policy, more deployment-as-policy),

4/ ship housing (yes, housing is industrial policy and YES, no houses, no babies 👶), and

5/ ship infrastructure (ports, rail, digital, defense production)

....ALL THE ABOVE at wartime speed.

Then: make it stupid-easy to start and scale companies across the EU. For this you need one market, one set of rules, real Capital Markets Union, stock-based compensation, bankruptcy that doesn’t brand founders for life, procurement that buys from European startups instead of subsidized Chinese stuff, and a migration system that recruits the world’s top engineers like it’s the Champions League.

Europe has world-class research, and now it just needs world-class commercialization velocity.

Of course, that means confronting the core mismatch: Europe is trying to regulate its way back to relevance while other regions are engineering, financing, and manufacturing their way forward.

Build an innovation flywheel around three engines:

(1) productivity software everywhere (AI copilots in SMEs, public sector digitization, mandatory interoperability),

(2) reindustrialization, where Europe can dominate (advanced manufacturing, robotics, energy tech, biotech, space, defense), and

(3) scale capital (pensions + insurers as long-term risk capital, deeper public markets, fewer national silos).

If Europe wants to bend the curve, it must choose: be the continent that primarily consumes technology and arbitrates its risks or the continent that creates technology, compounds productivity, and therefore earns the power to set the rules.

The chart below is the bill for decades of under-building. Pay for it with construction, and things will reverse. Let’s build!

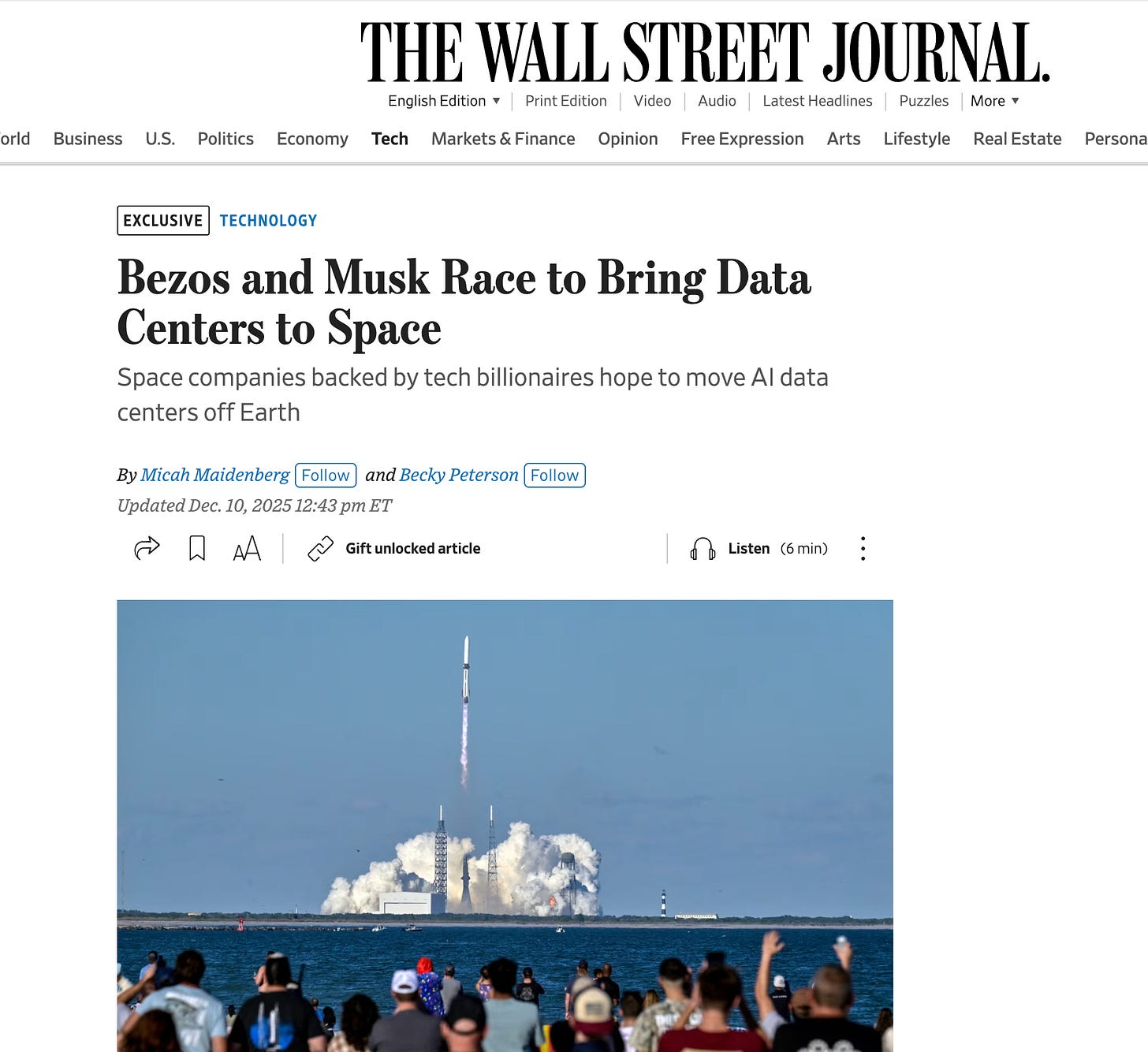

The cloud goes orbital: SpaceX, Blue Origin, and the next platform shift

The idea of space-based data centers once belonged to science fiction, but it’s now morphing into infrastructure strategy… at least for companies like SpaceX and Blue Origin. The reason is structural: on Earth, data centers are running into limits (eg. power, land, regulation). In space, solar energy is abundant, cooling is more manageable (if technically complex), and latency can be reduced if data is pre-processed or regionally mirrored. This makes Starlink and New Glenn more than launch platforms, because they become primitives of the AI economy. It’s the same vertical integration logic we’ve seen from Apple and Tesla, now applied to compute infrastructure: own the hardware, the network, and the AI stack. The chip is the new shipping container, and orbit is the new frontier.

However, there’s another layer here, which is strategic positioning. Musk and Bezos are locking in defensibility. Orbital data centers shift the power balance from hyperscalers like AWS and Google Cloud to platform-native infrastructure firms. SpaceX’s bet is clear: if you can launch satellites at will and power them with sunlight, you don’t need to ask for permission from regulators, landlords, or energy grids. In that context, Starship is a competitive moat. This is not about computing for today; it’s about building the next AWS in orbit, outside the jurisdiction of terrestrial constraints. WSJ

🛰️ Owning the interface: Why Revolut is entering telecom

For GBP 12.50 a month, Revolut users now get unlimited 5G, calls, texts, and global roaming baked into their financial superapp. Revolut is following the same playbook that made Amazon Prime sticky, that is, turn a functional service into a cross-subsidized lock-in mechanism. Mobile service becomes another node in the Revolut ecosystem, increasing daily app usage and reducing churn, all while strengthening the company’s control over the customer relationship.

Revolut doesn’t need to own the infrastructure (Vodafone powers the network), it just needs to own the customer interface. As Klarna and Nubank explore similar diversification plays, the lines between fintech, telecom, and lifestyle services are blurring.

In a commoditized market like mobile, the differentiator isn’t network quality, but integration, and Revolut, by embedding telecom into its financial operating system, is betting that bundling will beat brand loyalty.

The question is whether this will be the ‘default’. That’s the real battle.

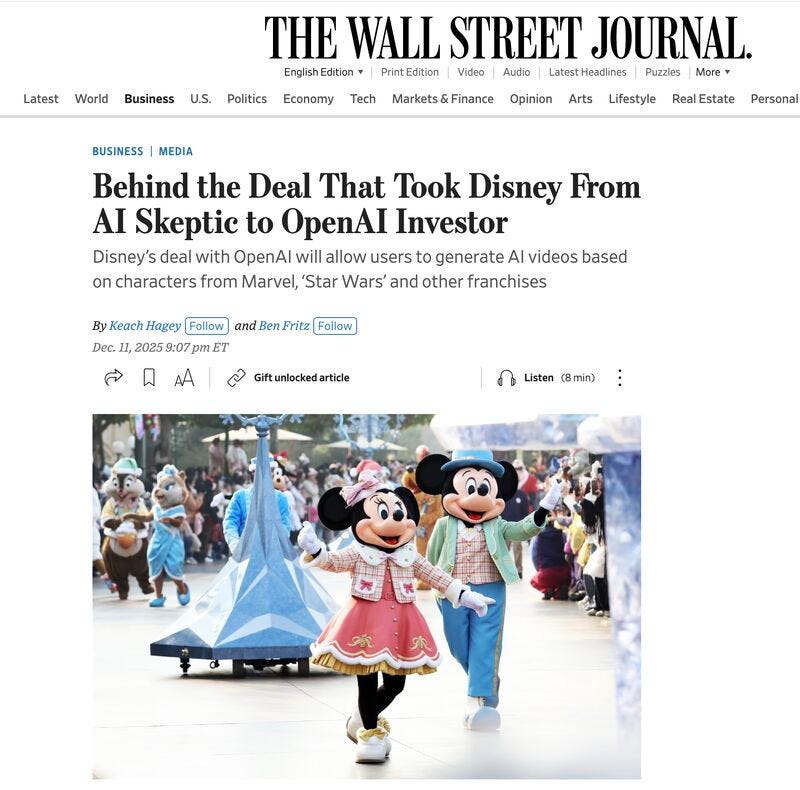

🤝 What is behind the deal between OpenAI and Disney?

The Disney-OpenAI partnership represents a pivotal moment in the convergence of legacy media and modern AI platforms and, perhaps more importantly, a strategic validation of OpenAI’s approach to licensing in contrast to Google’s index-everything ethos. For Disney, this is a calculated bet that in an AI-saturated world where everyone can generate infinite media, its IP (eg Marvel, Star Wars, and Pixar movies) is what anchors user attention.

By licensing 200 characters and props for Sora, Disney is ensuring its IP sits at the center of the AI content economy, content that can be generated on-demand, with no marginal cost, and no dependency on actors, writers, or strike-prone humans 😅

The fact that Disney is investing $1B in OpenAI and getting warrants at a $500B valuation suggests that if content is no longer king, then distribution and modular partnerships are, and OpenAI is proving to be much better at both than the legacy platforms that once thought they could just crawl their way to dominance. WSJ

💡My 2025 annual presentation, “The Compresses Decade”, is now available to anyone on my blog: https://onstrategy.eu/presentation

WIMM - Where is my MOAT?

If you enjoy my strategy notes on LinkedIn or in OnStrategy, WhereIsMyMoat.com is the deeper, “skin-in-the-game” version: full theses, moat scoring, and a clear view of the company’s future performance.

Last week’s analysis:

👓 META - is doubling down on AI to defend a 3.5 Billion-user moat

🍿 Netflix’s vertical integration and the Warner Bros endgame

🛒 MercadoLibre as Infrastructure

This week’s analysis:

Consider subscribing: