(#158) Strategic business predictions for 2026

The electric stack era begins

Dear Reader,

Happy New Year!

I hope you had a great Christmas and a great year-end. 2026 will be full of content and ideas worth sharing, especially from WIMM (Where is my moat?)

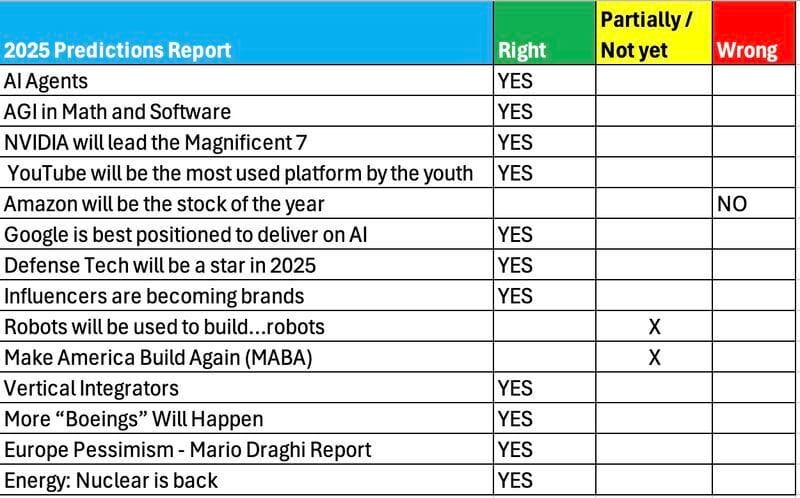

As many of you know, each year I share my (mostly) business predictions. For 2025, I made a short card below with my assessment:

- 11 ✅

- 2 partially / not yet 🟡

- 1 ❌

Tomorrow, I’m going to share my predictions for 2026😎, which I will also make publicly available to everyone:

See my past predictions here:

* for 2025: https://plus.onstrategy.eu/p/108-strategic-business-predictions

* for 2024: https://plus.onstrategy.eu/p/54-strategic-business-predictions

* for 2023: https://plus.onstrategy.eu/p/newsletter-4-predictions-for-2023

Strategic Business Predictions for 2026

1. AI stock correction (less revenue + cheaper Chinese models).

2026 is when “AI” stops trading like a mood and starts trading like a… P&L 🙃. Public-market multiples compress for companies that can’t translate inference into recurring revenue, and the benchmark quietly shifts from “model quality” to “unit economics”. Cheaper, increasingly competitive Chinese models (and open-weight alternatives) act like a global price cap on intelligence. Translation: great for adoption, brutal for margins. The winners look less like “the smartest model” and more like “the best distribution + data + workflow lock-in”, plus clear proof that AI reduces costs or sells more stuff. (80% of start-ups at A16Z are using Chinese open source models; also, large companies like AirBnB)

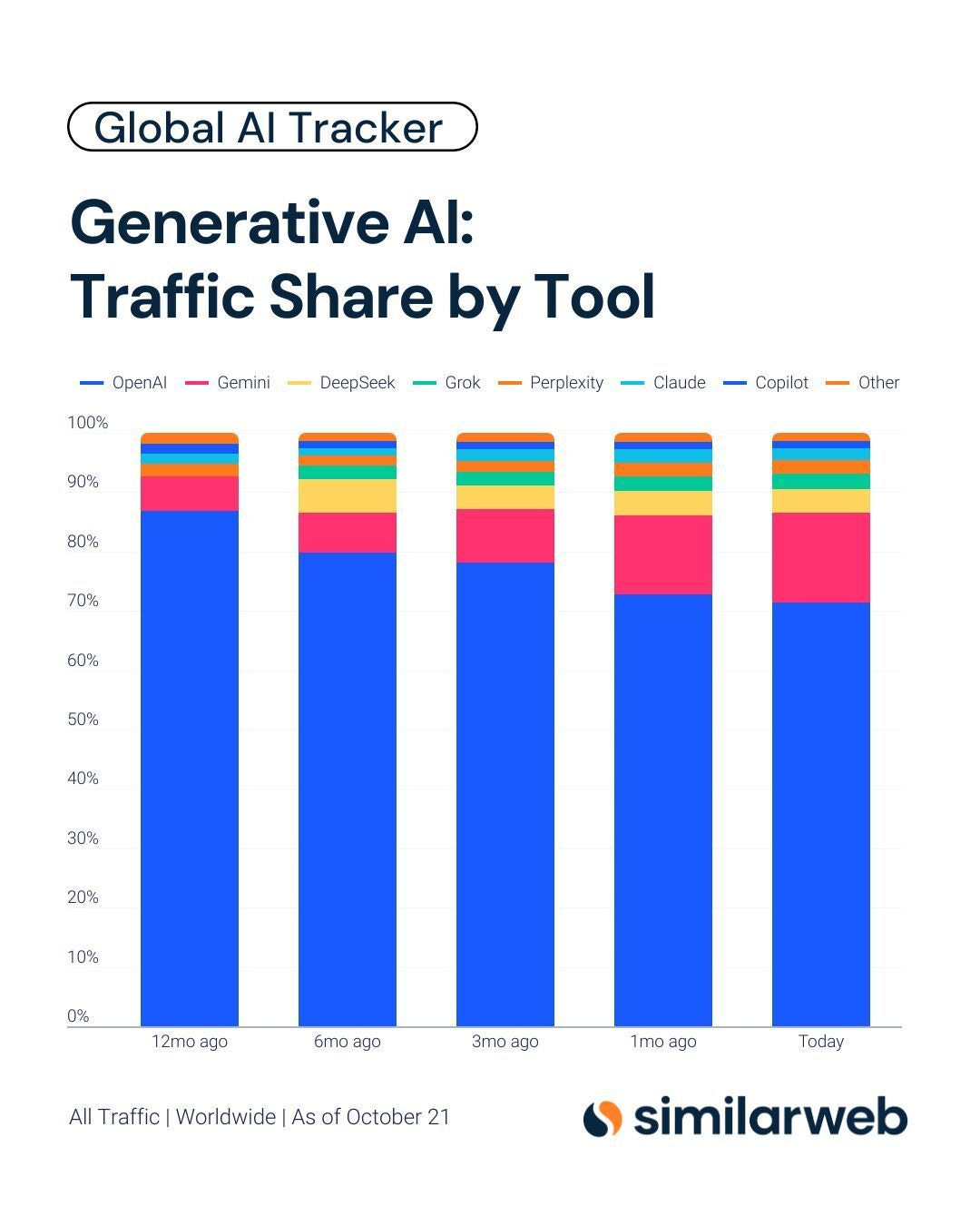

2. Gemini catches up with ChatGPT (MAUs).

If Gemini closes the MAU gap, it won’t be because it’s dramatically “better”, which truly is, but because it’s everywhere by default: Search surfaces, Android entry points, YouTube, Gmail/Docs, and enterprise bundles. 2026 becomes a distribution war, not a model war and “one-click” integration into daily habits. ChatGPT keeps cultural mindshare and power-user intensity, but Google can win MAUs through frictionless access and enterprise procurement. The key metric is minutes per user and how deeply the assistant sits inside workflows.

3. SpaceX is expected to have the largest IPO of 2026.

A SpaceX IPO would be the year’s defining capital-markets event because it’s a rare combo: dominant private company, strategic infrastructure, and a story that spans defense, telecom, and space logistics. The market would price it less like “a rocket company” and more like an integrated platform with multiple cash-flow engines (launch, Starlink, services). It also becomes a referendum on “real assets + frontier tech” after years of software-first narratives. If it happens, expect it to suck oxygen from other listings and reset what “growth at scale” looks like. (WSJ, Ars Technica)

4. A small US year-end recession, tied to Democrats winning the mid-terms.

The mechanism wouldn’t be “Democrats win —> recession”, but “election outcome —> policy expectations —> confidence + capital spending”. A midterm result for the Democrats signals that more regulation, higher effective taxes, or tighter oversight can nudge businesses to pause hiring and investment, especially if consumers are already stretched (credit, housing, delinquencies). Layer in lagged effects of monetary policy and you get a mild, late-year downturn without a crisis headline. The tell will be softening capex guidance, slowing job creation, and a risk-off rotation that looks “rational”, not panicked.

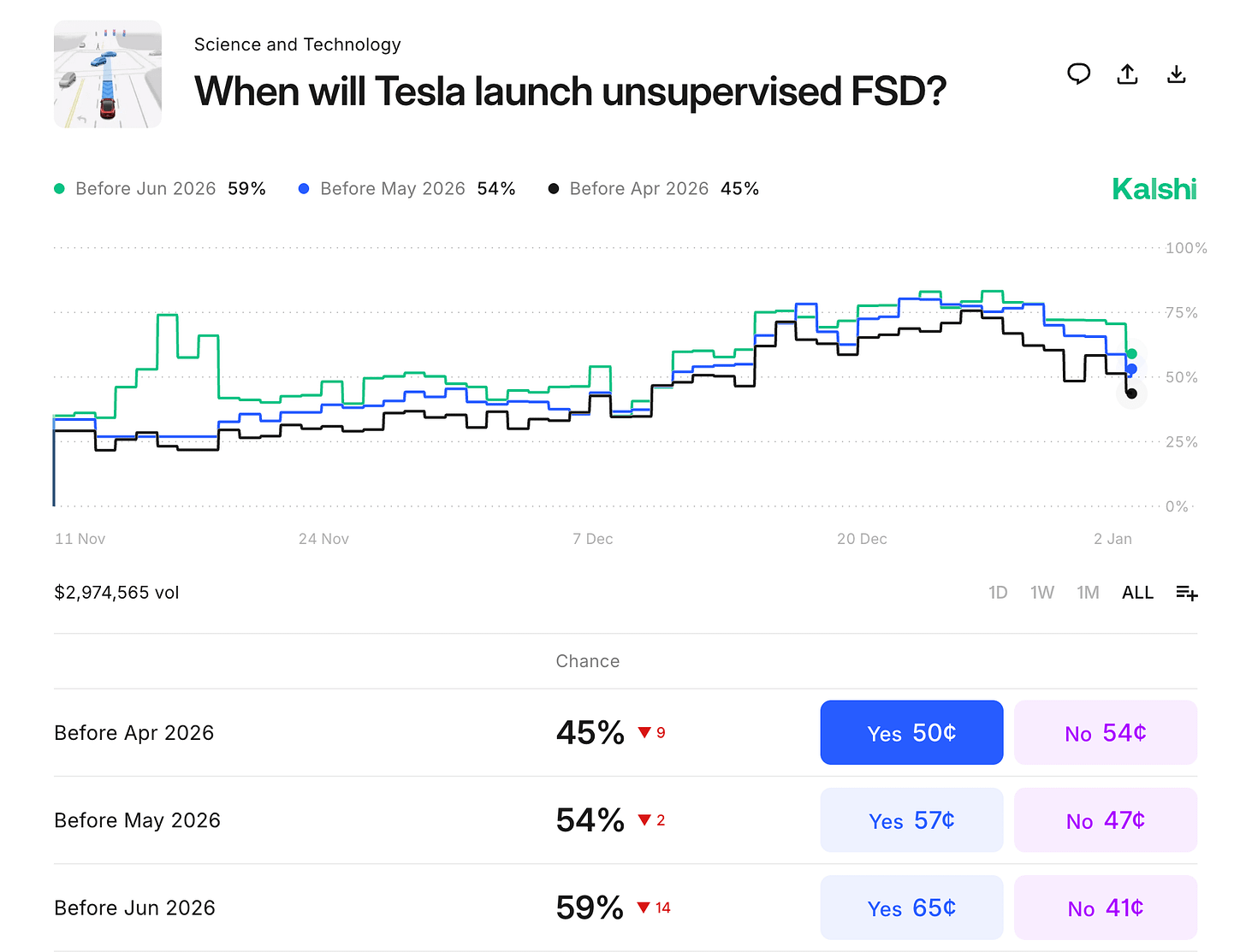

5. Tesla will get FSD

2026 is the year Tesla either turns “FSD” into a genuinely defensible autonomy product (safety, reliability, and clear regulatory permissions) or the market reclassifies it as a perpetual beta narrative. “Getting FSD” in the meaningful sense means scalable hands-off operation in defined conditions, consistent intervention rates, and liability frameworks that don’t collapse under edge cases. If Tesla crosses that bar, it unlocks new revenue shapes (subscriptions, licensing, fleet economics) and re-rates the story from EV maker to autonomy platform. If it doesn’t, the hype discount widens and the burden of proof rises sharply.

6. Kalshi / Polymarket

Prediction markets have a simple pitch: replace “hot takes” with prices. In 2026, if regulation and liquidity keep maturing, they will become the default dashboard for elections, macro releases, and even corporate outcomes, an always-on consensus that updates faster than analysts. The strategic wedge is distribution, where trading rails embedded in media, finance, and social are turning news into an interactive market. The risk is existential due to legal constraints, manipulation of narratives, and the fact that “being right” isn’t the same as being allowed. If they thread that needle, they graduate from curiosity to infrastructure.

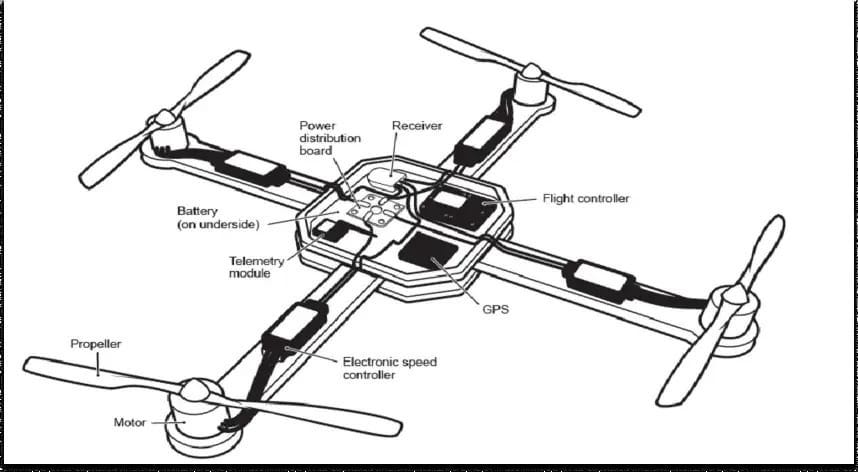

7. The US and EU start developing the electrical stack.

China’s advantage is not one product, but it’s an integrated stack: batteries, motors, power electronics, supply chains, and the industrial capacity to iterate fast. In 2026, the US and EU will start treating this like semiconductors and will look for strategic autonomy, subsidies, standards, and industrial policy that aims at systems not pilots. The shift is from “EV incentives” to “grid + storage + manufacturing + permitting”, because electrification fails without throughput in the real world. Expect more capex in battery materials, recycling, transformers, and power components. This is boring, essential, and geopolitically central, hence Pax Silica.

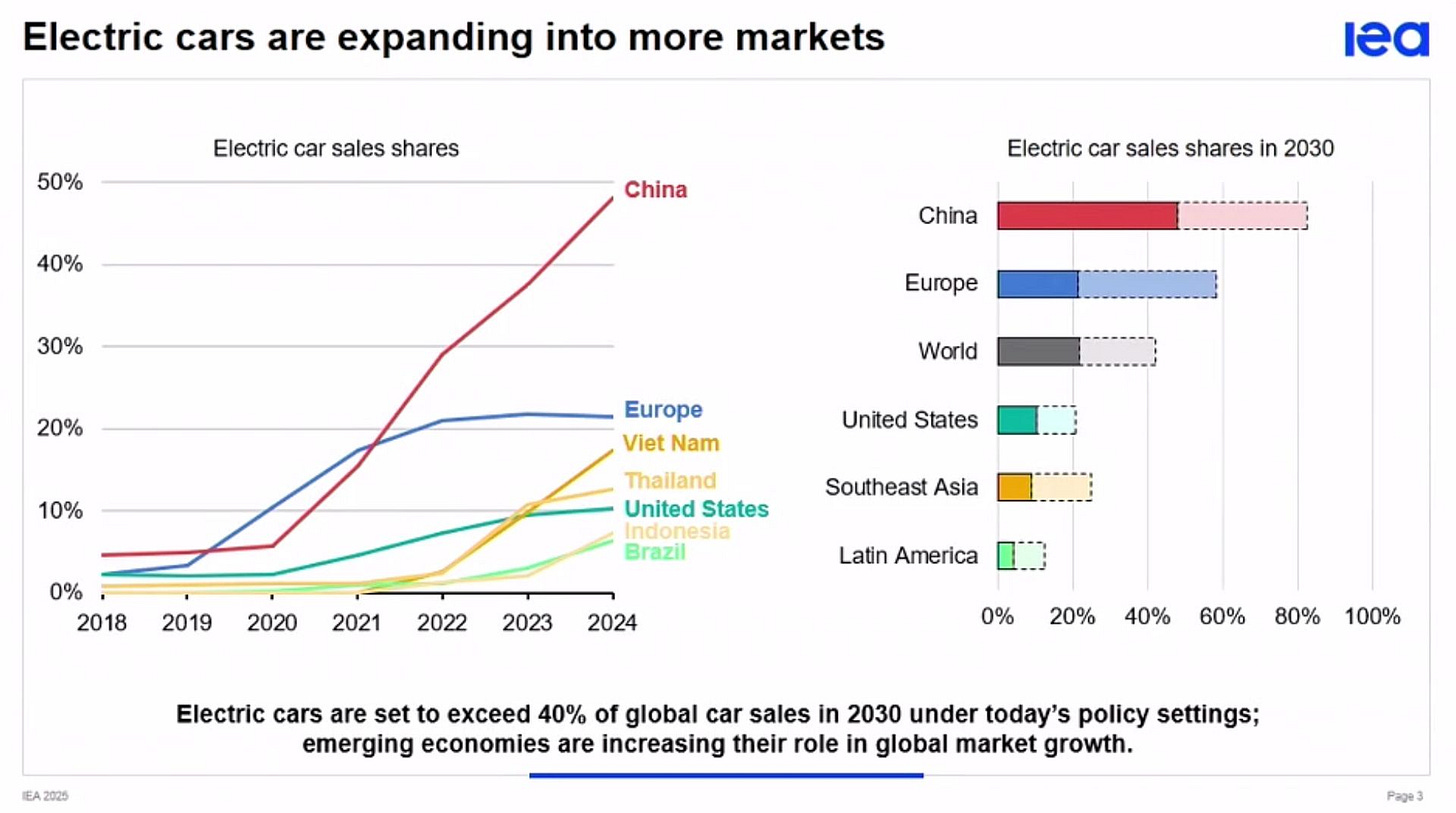

8. EVs become mainstream (>30%).

Crossing 30% it’s a tipping point where EVs stop being a niche identity choice and become the default option in many segments. That happens when three frictions fall: price parity (or financing parity), reliable charging, and used-EV confidence (degradation transparency, warranties). In 2026, the market’s center of gravity moves from early adopters to pragmatists, which rewards manufacturers who nail cost, service, and availability, not just range theater. The second-order effect: suppliers, repair, insurance, and grid operators all get pulled into the transition whether they like it or not.

9. Multi-player AI eats single-player AI.

Single-player AI is “help me write this email”/ Multi-player AI is “coordinate the whole workstream across my team, tools, and timelines”. In 2026, the value migrates to systems that understand roles, permissions, shared context, and organizational memory, because that’s where real productivity lives. This shift favors platforms that sit at collaboration choke points (docs, chat, tickets, CRM) and can enforce governance. The losers are standalone tools that can’t plug into the messy social reality of work.

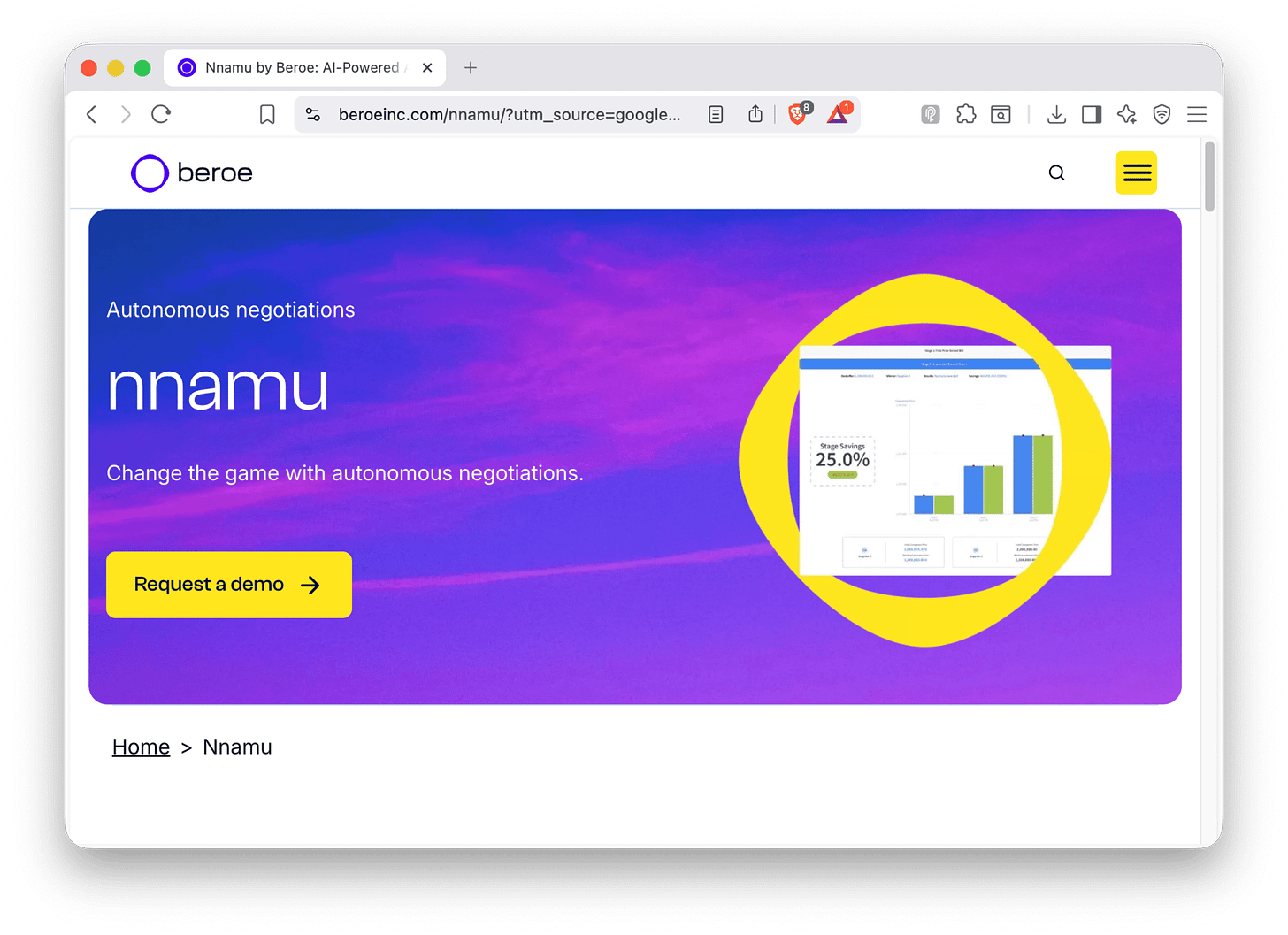

10. AI agents doing stuff for us, including negotiating

Agents become real when they can take actions safely: with constraints, approvals, audit trails, and clear reversibility. By 2026, you’ll see agents that routinely handle procurement, scheduling, customer support resolution, and yes, basic negotiation (price matching, refunds, contract redlines) within guardrails. The real breakthrough is how is operating: APIs, identity, payments, and policy layers that let an agent act like a junior employee. The business implication is profound because companies either redesign processes around agentic workflows or watch competitors run the same playbook at half the cost.

11. First AI hardware

The first credible AI hardware wave won’t replace the smartphone overnight, but it will carve out specific jobs where voice + context + fast access beats screens. Think “always-available assistant” optimized for capture, triage, and action (eg. meetings, tasks, shopping, travel, and home). By the way, home is the only place where the smartphone is not dominant. The winners will nail three hard things: latency, battery life, and trust (privacy, on-device processing, and not being embarrassing in public). In 2026, expect early hits and many misses because hardware is unforgiving, but the category’s existence becomes undeniable.

12. AI is the new UI: SaaS UX moats under pressure.

If users can just ask for outcomes, the UI becomes a thin skin over workflows rather than the moat itself. In 2026, SaaS companies feel margin pressure as AI layers abstract away dashboards and menus, turning differentiation into data, integration depth, and execution reliability. The best SaaS players respond by becoming the system of record + system of action: owning the workflow, permissions, and auditability behind the AI. The worst ones get “unbundled by prompt”, watching customers stick with the platform but abandon the interface.

13. Apple comeback.

Apple’s comeback thesis is classic: not “first”, but “best integrated”. In 2026, if Apple ships AI that is private by design, deeply embedded across devices, and genuinely useful without being creepy, it can reassert product leadership in a world where assistants are commoditizing. Apple’s advantage is the stack: silicon, OS, hardware, services, and distribution, plus the brand permission to say “this runs on-device”. If they execute, it won’t look flashy, but it’ll look inevitable, and competitors will hate how sticky it becomes.

14. Waymos everywhere.

“Everywhere” in 2026 won’t mean global ubiquity, but it will mean visible, expanding coverage in multiple major metros that makes robotaxis feel normal. The playbook is incremental and focused on geofenced expansion, safety metrics, partnerships with cities, and operational scaling (cleaning, maintenance, routing, customer support). As deployments grow, the narrative flips from “can it work?” to “how fast can it scale and at what cost?”

The long-term implication is that urban mobility is getting rewritten around software + fleet operations, and once riders trust it, the habit change is surprisingly hard to reverse. I imagine sending my kid to school in a Waymo (or something related), but not in an Uber with an “unknown” person. (of course, the Uber/Bolt driver is known, but I can’t trust it!)

What do you think? Any predictions that should have been on this list? Write me at sorin@whereismymoat.com

Btw, this post was sent initially to the subscribers of my paywalled platform

https://whereismymoat.com/ —> Consider subscribing.