(#159) Why META bought Manus AI; Lessons from Google’s comeback

Autonomy without borders: London as AV ground zero

Dear Readers,

I take this opportunity to present the “Where is my Moat?” platform that I have developed to share my insights and knowledge on the market. I sometimes consider it a mini MBA in business.

What you get:

2 analyses per week on the most important business news and why it matters

2 company analyses per week (this week you’ll receive about AirBnB and Ferrari)

My stock portfolio performance and ratios, which in 2026 had a +62,51% (main portfolio) and 61.82% (second portfolio)

..and some surprises along the way.

On to the update:

Why META bought Manus AI (a Chinese start-up)

Meta’s $2 billion acquisition of Manus is a pretty explicit admission that the company’s open-source, all-things-to-all-people AI strategy wasn’t scaling fast enough into enterprise-grade applications. Manus had what Meta didn’t: millions of paying users, $100 million in ARR in less than a year, and a product that was actually being used for something other than AI memes. While Meta was busy making Llama dance on WhatsApp and Instagram, Manus quietly built a functional AI agent platform for research, coding, and custom web tools.

The geopolitical subtext matters too. This is one of the first big US tech acquisitions of a startup with deep Chinese roots (founders, staff, early infrastructure) and it shows how American platforms now need to look abroad, not just for users, but for product-market fit. Manus started in Beijing and Wuhan, but pivoted to Singapore to skirt regulatory heat, shut down its China business, and now lives inside Meta’s AI division. This is the “elimination theory” in action: the internet rewards companies that integrate distribution, monetization, and technology into a single stack. Meta needed velocity, users, and a working business. So it bought them. WSJ

Lessons from Google’s comeback

Google’s resurgence in AI is a story of platform leverage and strategic patience. While OpenAI captured the public imagination with ChatGPT, Google methodically pulled the levers only a tech giant with infrastructure, distribution, and capital can pull. It combined DeepMind’s research edge with Brain’s engineering power, built its own custom silicon (TPUs), and created a cross-functional initiative to reimagine search itself with Project Magi. And unlike OpenAI, which had to balance fundraising and deployment, Google was able to fund its Gemini comeback with its own cash flows, all while preserving its golden goose: search ads. The payoff? Gemini not only caught up but briefly surpassed GPT models, and the newly released AI mode is already shifting user behavior.

But the deeper lesson is about platform maturity. Gemini’s image generator (Nano Banana), its 650 million monthly users, and its in-house chip advantage (Ironwood) illustrate what happens when an internet-scale company finally applies its full weight to a competitive vector. Google’s slow start let OpenAI define the consumer narrative, but its scale, integration into search, and hardware stack now define the enterprise narrative. The real disruption is that Google is turning AI into a margin-expanding layer atop its dominant platforms, while rivals are still figuring out monetization. This is what “being the platform” looks like. WSJ

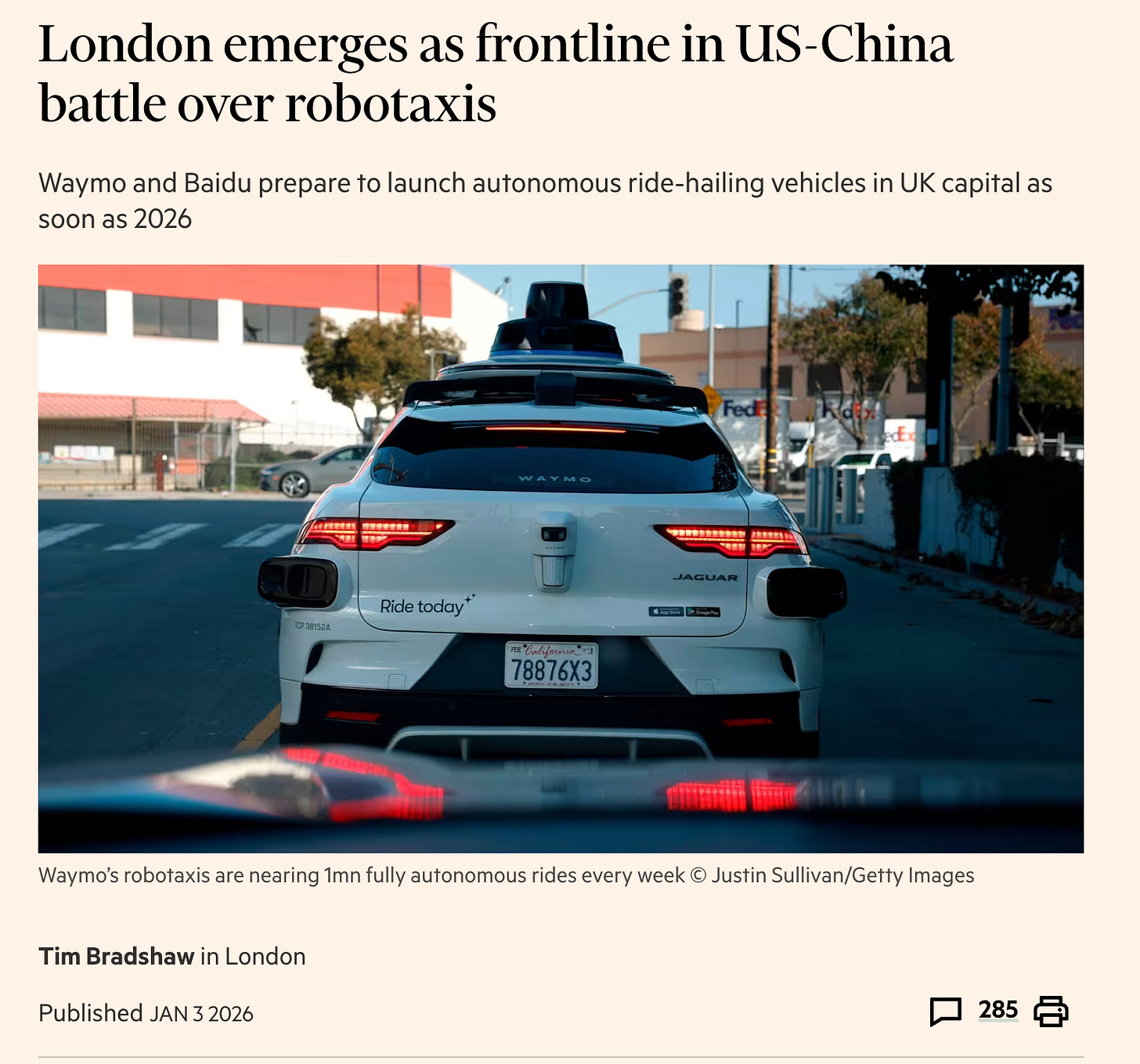

Autonomy without borders: London as AV ground zero

The robotaxi showdown in London is less about cars and more about code. On one side, you have Waymo, backed by Alphabet, boasting nearly 1 million fully autonomous rides per week in the US. On the other, Baidu, with 17 million cumulative rides and a growing footprint through partnerships with Uber and Lyft. The UK government’s green light for commercial trials in 2026 makes London the first true global arena where US and Chinese AV titans can battle it out on neutral ground.

London is attractive not because it’s a car hub, but because it’s a regulatory middle ground between the “Wild West” of Silicon Valley and the surveillance-heavy “Wild East” of Beijing. The US bans Chinese AVs, China doesn’t let US firms in, but Europe still plays nice with everyone. And so, it becomes the stage where this AI cold war gets a steering wheel. Whether the winners master zebra crossings or just data compliance first, the real takeaway is that mobility is being redefined by software infrastructure, not engines or legacy car brands. FT

Black clouds for Adidas?

Oh no, sneakers with suits might be over. Bank of America gave Adidas a rare double downgrade, citing the “end of casualization”, a 20-year societal arc where pajama pants left the house, sweatpants got rebranded as “athleisure”, and sneakers snuck into the boardroom. This whole aesthetic shift made Adidas a lot of money, apparently too much, and now that people are allegedly dressing like grown-ups again, it might all unravel. Not because Adidas did something wrong, mind you, but because cultural trends are fickle and you can’t short vibes until someone at BofA decides it’s time to wear a belt again.

Meanwhile, Nike is out here going full meme stock, with a boomerang CEO and Venezuelan geopolitical cameos, threatening to eat what’s left of Adidas’ market share. Sure, Messi might still sell a few t-shirts at the World Cup, but according to BofA, once the dopamine wears off, Adidas goes back to its existential fashion crisis. But look, if you’re a sports commentator who likes wearing a hoodie under a blazer, enjoy it while it lasts because apparently, Wall Street wants you to tuck your shirt in. Business Insider