(#33) Netflix' ladder strategy; Alphabet confirms my TGV theory; ...and some hints were Meta is aiming

Apple is pursuing more and more a healthcare strategy for another division

In this newsletter, I cover the following topics:

📺 Netflix strategy

👩🏻💻 What Meta announced this week

🩺 Apple is pursuing more and more a healthcare strategy for another division

🌝 Alphabet (Google) Moonshot projects

…and two articles I (co)wrote lately.

Onto the update:

My work

Essay

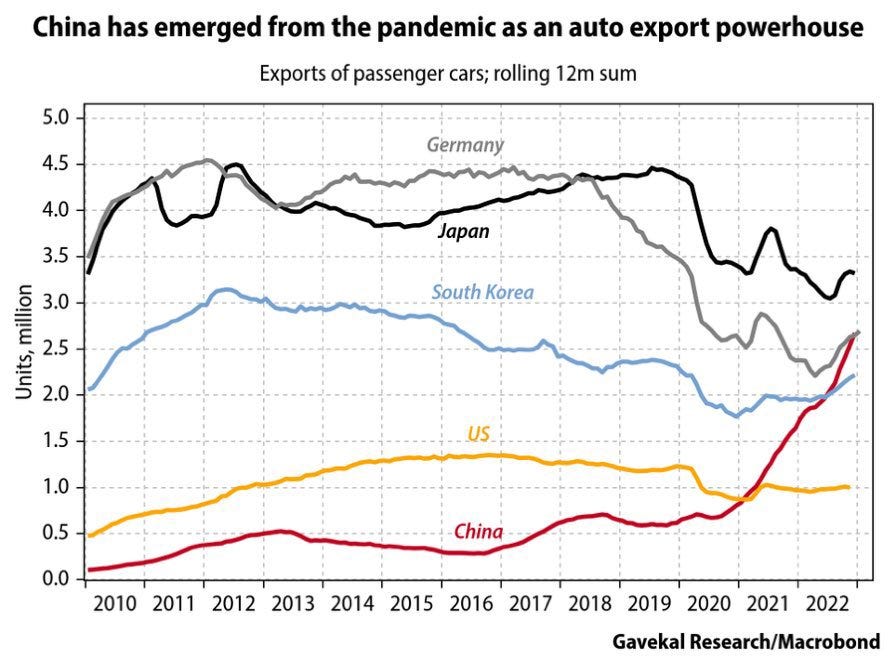

What does the transition to electric cars actually mean for the automotive industry?

Hint! Scale, Design, Distribution, and new skillset (ie. software). LINK

Academic research

Article: The Role of Business Students’ Entrepreneurial Intention and Technology Preparedness in the Digital Age (by Isabelle Biclesanu, Marco Savastano, Cătălina Chinie, and Sorin Anagnoste. LINK

Strategy

Netflix’s strategy

Anyone can have a strategy, but to deliver on it it’s totally another thing. Netflix has done both in the last ~ 26 years. Here was their strategy:

1/ Netflix began its journey by offering content that was easily accessible (DVDs) to differentiate itself from the established competitor, Blockbuster. This approach allowed Netflix to attract a wide user base and gain recognition in the market.

2/ As Netflix's user base grew and its financial strength increased, it strategically acquired streaming rights, which disrupted the traditional model of linear television networks. This move further expanded their user base and enhanced their brand, while also giving them more purchasing power in the industry.

3/ With a well-established brand, a large user base, and significant financial resources, Netflix ventured into producing original programming, which challenged the conventions of traditional content buyers. Creators were given greater creative control, and they were guaranteed the freedom to produce entire seasons at once. Initially, creators also retained the rights to their creations, allowing them to use their work elsewhere.

4/ When reached the full potential of ad-free subscribers they launched their ad-service plan. Guess what? Ads can bring you a lot of money. How? Well, at this point between 35$-45$ per 1,000 views, which is in line with what some other subscription video services charge. And yes, Netflix with ads can at some point be free. (2$ or 4$ with ads will still be considered free)

I remain bullish on Netflix’s potential. LINK

P.S. On the 29th of August, the company will celebrate its 26th anniversary.

Alphabet’s Moonshot project

“Do you want to sell sugar water for the rest of your life or come with me and change the world?” — Steve Jobs to John Sculley while trying to hire him from Pepsi

At the end of the day, both Meta and Alphabet (Google) make (most) money by selling ads. So, you can’t really change the world by selling ads. But you can when you invent something new.

Back to the topic of the week: Google’s moonshot projects lost +$24bn (with a B) in the last 4 years. (Meta lost around +40 billion in the last 5 years. LINK)

The party can go on because the amounts are still insignificant compared to the company’s revenue. Three main takeaways here:

1/ So, I guess that they want to be modern Bell Labs, except that they don’t invent much

2/ The transformer (which is the core of the Chat GPT & co) is not an invention of the Google Moonshot projects

3/ Although inventions happen, they don’t get adopted fast enough because Google doesn’t want to kill its cash cow (ie. traditional search). That’s why Google was behind in coming up with a competitor to Bard.

Here is a statement from one of the transformer’s inventors given to the Financial Times:

“The reason why I left Google was that I actually didn’t see enough adoption in the products that I was using. They weren’t changing. They weren’t modernising. They weren’t adopting this tech. I just wasn’t seeing this large language model tech actually reach the places that it needed to reach,” LINK

What I’m trying to say is that this proves again my TGV theory (TGV - Train de Grande Vitesse): large companies are cash cows that can go from point A to point B and never to C. The best way to deal with the stockpile of cash is to give it back to shareholders who can invest back in start-ups dealing with those challenges Meta & Alphabet are trying to solve. Disrupting innovation will come from start-ups.

Apple and healthcare

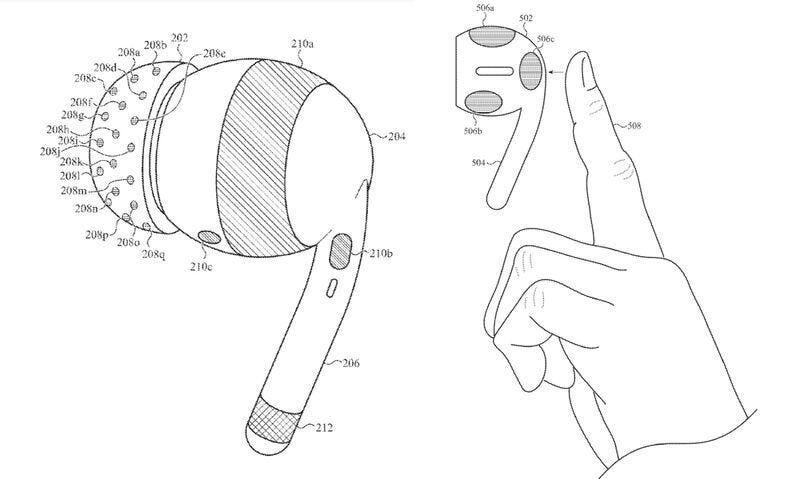

One of the best pivots I’ve seen at Apple was how they repositioned the watch from a lifestyle device to a healthcare device. It seems that recently they register a patent for the AirPods to detect the brain’s activity. This system involves incorporating active and reference electrodes into the housing and tips of the AirPods. These electrodes are designed to measure biosignals and electrical activity from the user's brain. The biosignals measured could include various types such as electroencephalography (EEG), electromyography (EMG), electrooculography (EOG), and more.

In the patent background, Apple explains that traditionally, brain activity monitoring has been done using electrodes placed on the user's scalp. However, the proposed innovation suggests placing the electrodes inside or around the outer ear, which offers several advantages. These benefits include improved device mobility and reduced visibility of the electrodes compared to traditional methods that require electrodes to be placed on visible areas around the scalp. LINK

The hardware event of the year: iPhone 15

For those reading the #onStrategy newsletter probably know by now that Apple will better differentiate their PRO iPhone models because:

1/ They can increase the price

2/ They will make the non-Pro models more attractive

Slowly, but surely, the iOS platform is becoming dominant in most developed markets. CAPABILITIES, Market share

Twitter is dead. Long live X

I stopped to cover in my work on Twitter for years because the company has been managed so poorly, that hardly delivered anything. Now, it seems that everything I said back then is confirmed by a former employee. LINK

I remain bullish on X with the following amendments:

1/ No, they can’t build a supper app la WeChat (e.g. not the same market conditions, nor the legal competition conditions). Foreign Policy (!) has written about this topic too. LINK

2/ No, they can’t replace Visa/Mastercard (hint! To deliver a new payment system you should be at least 5x better)

3/ Text as a medium is a limited place to be. (many have tried Twitter and decided that it’s not for them). By “many” I mean “+1 billion”.

4/ Bringing a hardware person (ie. Elon) to run a software company is harder than it seems. With harder, you can have crazy ideas but at the end of the day, you will be limited by physics law. With software, you can do everything, hence the good and the bad stuff that happened in the last 9 months at Twitter.

Meta’s earnings

Just three key takes:

1/ As long you deliver on your main revenue stream you can get away it the billions you pour into the Reality Labs

2/ The problem with Reality Labs is as Mark Zuckerberg stated at the investor’s call meeting:

“At a deep level, I understand the discomfort that a lot of investors have with it because it’s just outside of the model of, I think, even most long-term investors, how you would think about this. And look, I mean, I can’t guarantee you that I’m going to be right about this bet. I do think that this is the direction that the world is going in. There are 1 billion or 2 billion people who have glasses today. I think in the future, they’re all going to be smart glasses. And all the time that we spend on TVs and computers, I think that’s going to get more immersive and look something more like VR in the future. And I think that what we’re seeing is richer ways for people to communicate across even the mobile apps that we have going from text to photos to videos, just a continual trend towards being more immersive. So like all of these trends line up to make me think that this is the right thing. I think we’re going to be happy that we did this. So that’s kind of how I think about it, both from kind of a mission and product perspective, a business perspective, an investment time frame perspective. But I also understand the discomfort that some folks have with something that I can’t put exact numbers on a near-term time horizon around.” - Mark Zuckerberg

This summarized exactly what I said for the year: give the money back to shareholders and they can invest in start-ups that are following this path (if any interest)

3/ Do you remember those CAPEX investments at META? (mainly for AI product deployment). Now we have a new category coming in: AI chatbot for business/personal

“And then the one that I think is going to have the fastest direct business loop is going to be around helping people interact with businesses. You can imagine a world on this where over time, every business has as an AI agent that basically people can message and interact with. And it’s going to take some time to get there, right? I mean, this is going to be a long road to build that out. But I think that, that’s going to improve a lot of the interactions that people have with businesses as well as if that does work, it should alleviate one of the biggest issues that we’re currently having around messaging monetization is that in order for a person to interact with a business, it’s quite human labor-intensive for a person to be on the other side of that interaction, which is one of the reasons why we’ve seen this take off in some countries where the cost of labor is relatively low. But you can imagine in a world where every business has an AI agent, that we can see the kind of success that we’re seeing in Thailand or Vietnam with business messaging could kind of spread everywhere. And I think that’s quite exciting.” Mark Zuckerberg

Knowledge Partner: INDE MBA

Are you exploring starting an MBA? Participate on campus to get a sneak peek at some classes on the 13th of September.

The program has a double certification (ASE Bucharest and CNAM Paris) and is AMBA Accredited. Register for the sneak peek HERE.

More information about the program: https://inde.ro

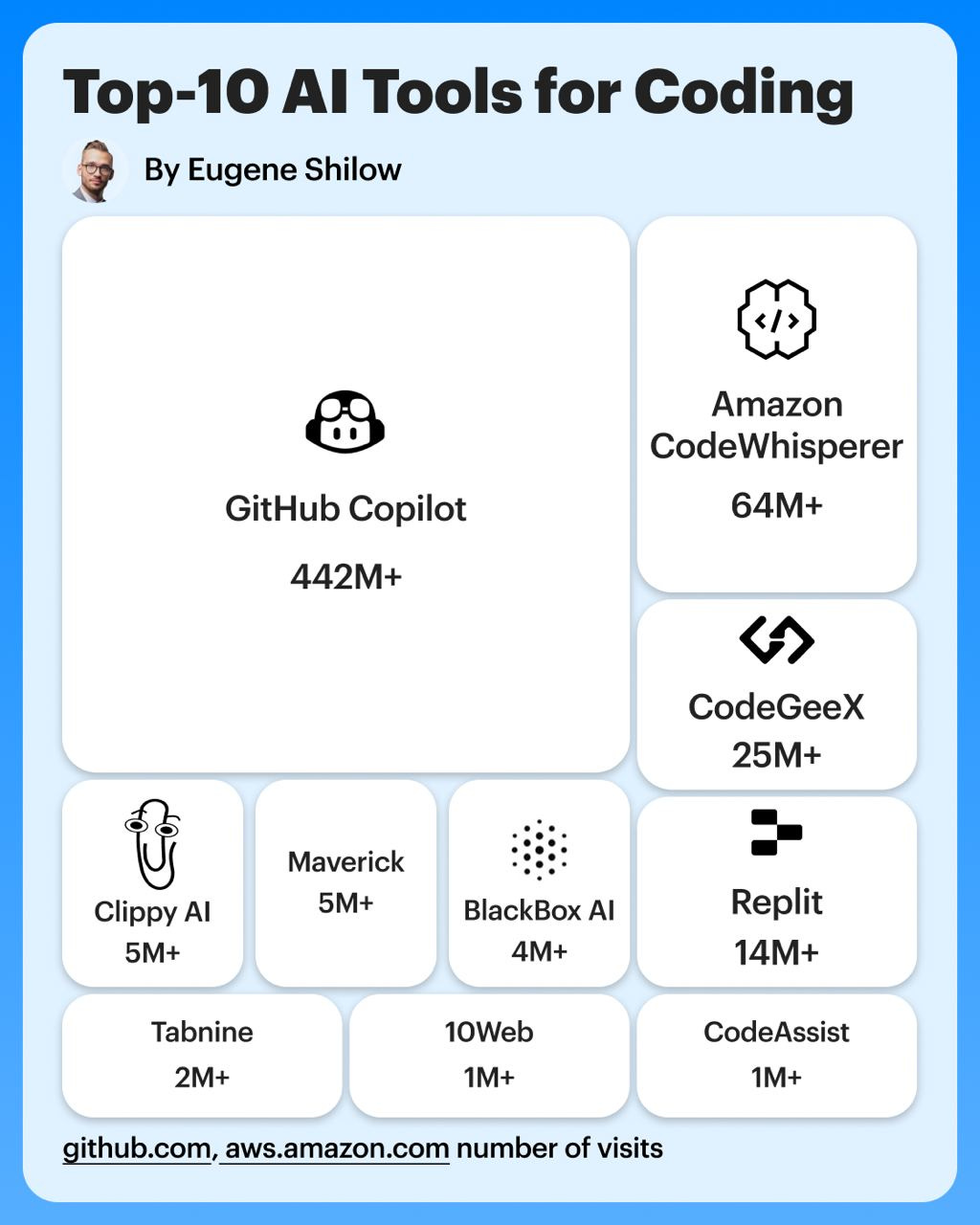

Artificial Intelligence

Top AI tools for coding, by Eugene Shilow. LINK

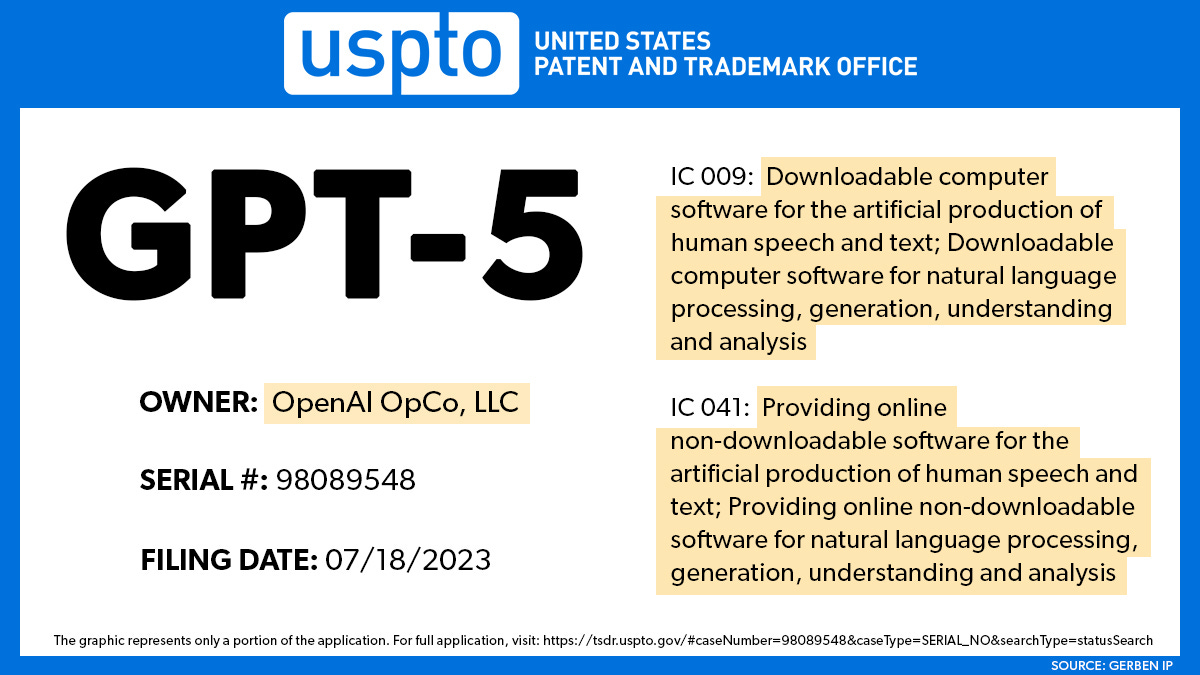

OpenAI Files Trademark Application for GPT-5. LINK

Data

Top Trends for Tech Providers for 2023, by Gartner. LINK

Americans' confidence in higher education down sharply. Hint! New learning opportunities online. LINK

Tesla continues to install more Chargers than all other networks combined.

Outside interest

46,000-Year-Old worms revived from Siberian permafrost started having babies. LINK

When did people stop being drunk all the time? LINK

There’s a new avocado variety - The Luna. LINK

People are hiring D-List celebrities to deliver their bad news. LINK

It seems that if you use the moon emoji that can be also a security fraud. Ryan Cohen vs. Bed Bath & Beyond. LINK

☕️ Did you enjoy the newsletter? Buy me a coffee ✅