(#42) More AI means less frictions; Birkenstock's IPO; Why Peloton failed and how to be 18 yrs old again

On the EV front the "Chinese era has begun"

Clothing sponsor for women: Ema T - Concept Store

🛍️ Use the code 'onstrategy10' and get a 10% discount when you shop at

The Internet is the greatest friction remover that humans invented.

In the vast tapestry of human history, few inventions have reshaped the way we live, work, and interact as profoundly as the internet. Born from a vision of interconnected computers in the late 20th century, the internet quickly grew from a niche technological experiment to the backbone of modern society. At its core, the internet's most transformative power lies in its ability to remove friction. Where once information, communication, and commerce were constrained by physical boundaries and limitations (ie. power on the supply), the digital highways of the internet have obliterated those barriers.

Transactions that once took days and $$ now happen in milliseconds cost 0, the knowledge that was once confined to physical libraries is now accessible with a click, and people from opposite ends of the globe can collaborate in real time. This frictionless environment has not only accelerated our capabilities but has also ushered in an era of unprecedented innovation and opportunity. With this introduction in mind let’s dive in a little more detail on what Meta has revealed last week.

Onto the update:

Strategy

Meta’s AI long game

For those new to the newsletter is worth making a short recap: Meta’s strategy in the last 5+ years was to find a way to build a platform and not to depend on anyone (ie. iOS, Android, etc.). They realized that the price to pay was high (ie. $10bn impact from Apple’s ATT) and started spending immense amounts on building a new platform: the metaverse.

How much money has Meta lost so far with Reality Labs?

So, Meta Connect 2023 started with the usual suspect: Meta Quest 3. Besides the yearly incremental updates and some things ‘borrowed’ from Vision Pro…nothing new. What was truly interesting were the AI announcements:

AI Chatbots - +20 chatbots impersonating Dwyane Wade, Kendall Jenner, MrBeast, Snoop Dogg, Paris Hilton and more. They will help you in discussions from music to fashion and cooking.

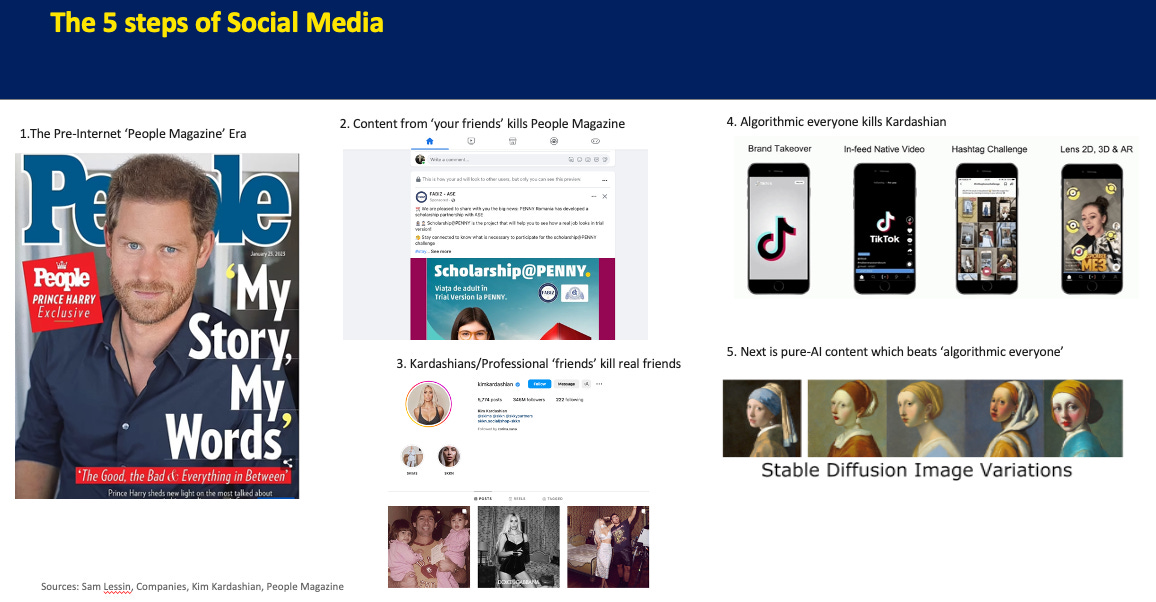

Over time they will adapt better to your needs and we’ll be companions on the web by generating content you can watch/engage. So, we’re indeed entering in the 5th stage of Social Media: AI-generated content

So, at this technological point, someone at Meta said: “Let’s put LLMs (llama 2) on Meta glasses” and the result is this:

So, now you can interact by talking with the glasses just like in the movie Her. What’s really the most important thing is that starting next year the glasses we’ll understand the environment: what you see, they will see. So, this is what the removal of friction looks like. So, the metaverse is indeed dead and we are entering the AI stage. It took some time for Mark to figure this out too. Here is an except with Alex Heath from The Verge:

“When I was thinking about what would be the key features for smart glasses, I kind of thought that we were going to get holograms in the world, and that was one. That’s kind of like augmented reality. But then there was always some vague notion that you’d have an assistant that could do something.

I thought that things like Siri or Alexa were very limited. So I was just like, “Okay, well, over the time period of building AR glasses, hopefully the AI will advance.” And now it definitely has. So now I think we’re at this point where it may actually be the case that for smart glasses, the AI is compelling before the holograms and the displays are, which is where we got to with the new version of the Ray-Bans that we’re shipping this year, right? When we started working on the product, all this generative AI stuff hadn’t happened yet…

Again, this is all really novel stuff. So I’m not pretending to know exactly what the key use cases are or how people are going to use that. But smart glasses are very powerful for AI because, unlike having it on your phone, glasses, as a form factor, can see what you see and hear what you hear from your perspective.

So if you want to build an AI assistant that really has access to all of the inputs that you have as a person, glasses are probably the way that you want to build that. It’s this whole new angle on smart glasses that I thought might materialize over a five- to 10-year period but, in this odd twist of the tech industry, I think actually is going to show up maybe before even super high-quality holograms do.” - LINK

Take 10 minutes to see the resume of the event:

“The era of Chinese automobiles has come,” Wang Chuanfu, founder of BYD

We have discussed in previous newsletters that with EVs the competitive advantage moves to scale and a new skillset (ie. software), apart from design and distribution. When you remove complex proprietary engines, you have to figure out at least two hard thighs: batteries and software, supposing you have the money.

Through a combination of subsidies from the Chinese government, access to supply chain (e.g. rare minerals), and talent (ie. software developers) it was not hard for at least one Chinese manufacturer to break the charts. This is the story of BYD, China’s Tesla. LINK

Birkenstock seeks $9bn valuation in IPO at NYSE

Birkenstock's impending IPO is poised for success, and there are strong indicators that suggest it will be a triumphant move for the iconic footwear brand. Much like how Nike and Adidas have carved out and dominated specific categories in the athletic footwear market, Birkenstock has the potential to do the same within its niche. Most of their revenues come from the US and Western Europe, so there is huge potential in other markets, especially Asia.

Over the years, Birkenstock has established itself as a household name synonymous with quality and reliability (= Made in Germany). The combination of its legacy, product differentiation, and the new avenues an IPO can open up positions in Birkenstock for a successful market debut and future growth.

Peloton’s last remaining co-founder is leaving. LINK

The first time I saw Peleton I taught: a bicycle with an iPad. Remember: selling consumer products is extremely challenging. Look what’s happening with the heating iPhone 15 and the past crises Apple and Samsung had to face (e.g. bending phones, exploding phones, etc.). Now, what went wrong with Peleton?

1/ Pandemic demand spike and subsequent slowdown.

2/ Supply Chain issues which eventually led to excessive inventory

3/ Product safety concerns: in 2021, Peloton recalled its Tread and Tread+ treadmills after several accidents, including one that tragically resulted in a child's death. The negative publicity from these incidents hurt the brand's image and trust.

4/ High product cost & competition: the premium pricing of Peloton's products made them inaccessible to a broader audience. While there's a segment of the market that's willing to pay a premium for the Peloton brand and experience, it also limits the potential customer base, especially in economic downturns or amid growing competition (from the Chinese competitors).

On top of that, there were also some management and operational bad decisions that affected the overall company. It’s weird to think now that Scott Galloway saw at some point this company reaching ‘the trillion dollar’ club. LINK

Las Vegas new star: a sphere

Some data behind this interesting development:

$2,4 bn to be built

$450k per day in revenue

Estimated daily impressions: 300k physical, 4.4m on Social media

19,000 sits theater

600 events per year. LINK

It seems that will become an attraction generation billions in revenue for the city & local businesses. Good for them.

Sponsorship opportunity: Want to reach +2,000 intelligent subscribers?

Artificial Intelligence

Lex Friendman’s discussion with Mark Zuckerberg in ‘the metaverse. Not impressed. LINK

JPMorgan CEO Jamie Dimon says AI could bring a 3.5 day workweek.

Sure, I agree that is possible, but what we’ll do with that free time?! Why we haven’t moved to a 4-day work week yet? LINK

Amazon invests in Anthropic

Amazon and Anthropic have announced a significant strategic collaboration to advance the field of generative artificial intelligence. Under this partnership, Anthropic has chosen AWS as its primary cloud provider and will leverage AWS Trainium and Inferentia chips for the development, training, and deployment of its future foundational AI models.

These models will harness the advantages of AWS’s high-performance and cost-efficient machine-learning accelerators.

Furthermore, Anthropic will give AWS customers special access to its foundation models via Amazon Bedrock, a fully managed AWS service.

This collaboration promises unique features for model customization, proprietary data use, and fine-tuning capabilities for AWS users. In a testament to the scale and potential of this partnership, Amazon plans to invest up to $4 billion in Anthropic, securing a minority stake in the company. This move ensures that Amazon developers can seamlessly integrate Anthropic's generative AI technologies into various applications, leading to innovative customer experiences across Amazon's business spectrum.

Data

“America is in decline”. No, is not. It still has 25% of the global GDP today, just like in the ‘80s or mid-90s.

Derisking from China

This will mean taking a hit financially on capex, and lower cash flow, which will lead to lower profits. This will cause a lot of stress to the European economies but if this is the price to pay for having secure supply chains then it’s worth it.

Norway loves EVs:

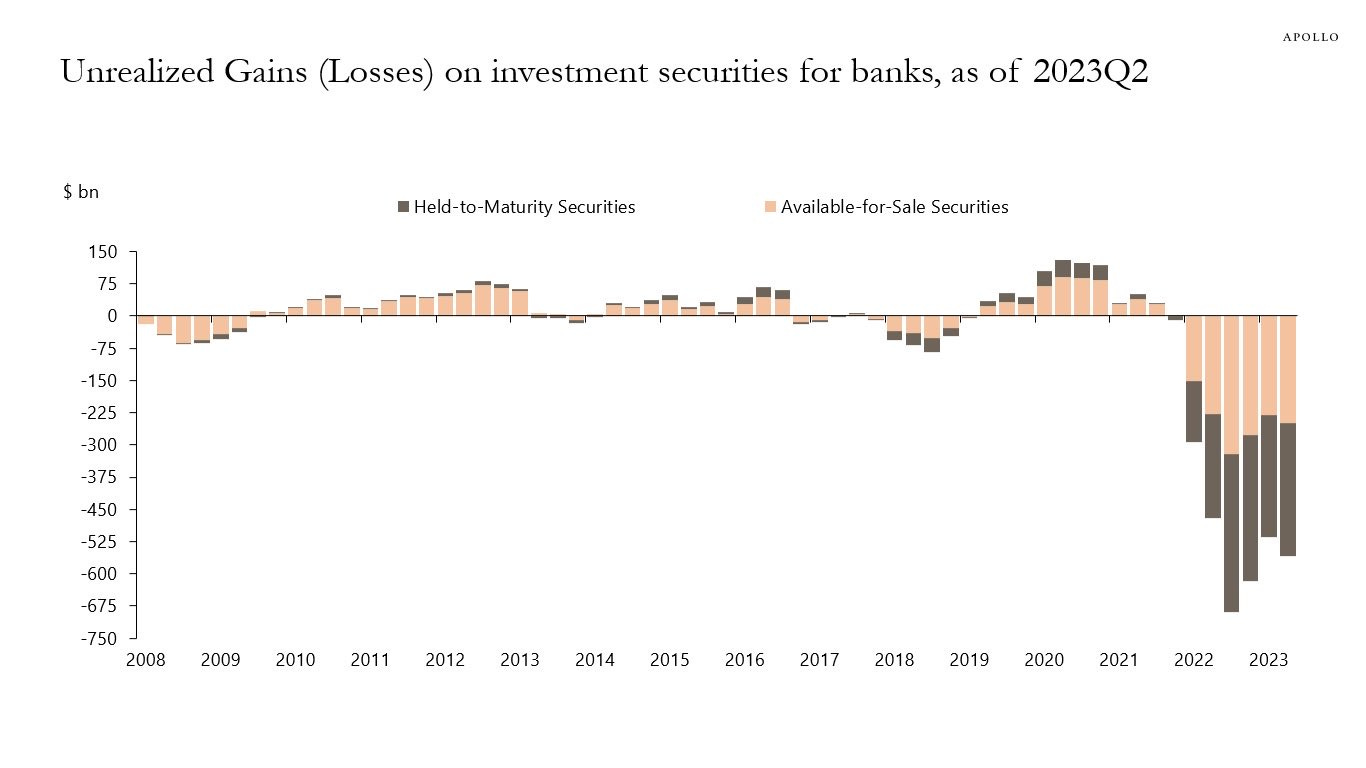

Unrealized losses on investment securities for banks are skyrocketing. LINK

Being profitable as an EV producer: mission impossible

Outside Interest

Yesterday started the trial of Sam Bankman Fried (SBF), FTX’s crypto boss, accused of stealing +$8bn of customers' money. Matt Levine from Bloomberg imagined what his defense might look like and The Wall Street Journal gave a profile of Caroline Ellison, his ‘right hand’, who pleaded guilty to fraud, money laundering, and conspiracy. SBF, Caroline Ellison

EU estimates Ukraine is entitled to €186 bn after accession. LINK

A courageous woman jumps from plane to plane to mid-air to change a landing gear (1926). LINK

Why most tennis players struggle to make a living. Short documentary exploring the challenges tennis players face in earning a livelihood. It seems becoming a professional footballer might be a more straightforward path. LINK

How to be 18 again. Bryan Johnson and his team of 30 doctors say they have a plan to reboot his body…for $2m per year. Fascinating story. LINK

Interesting newsletters 💡

The Weekly Blend (by Laurentiu Vana) - Financial education, stock market, macroeconomics & more

Product evolution (by Bulent Duagi) - Here you will find a curated mix of resources that your Product team can use to level up.

Sharing is caring

☕️ Did you enjoy the newsletter? Buy me a coffee ✅