(#54) Strategic business predictions for 2024

The end of the Pax Americana and the rise of personal AI will be the top topics in 2024

One year ago I had predicted 11 and now we can draw the line: 8 ✅, while 3 ❌. This year I come with 13 predictions. Take your time to read them one by one:

1. Make America make again

The COVID-19 pandemic highlighted the vulnerabilities of global supply chains, especially the heavy reliance on China for manufacturing. The pandemic-induced disruptions exposed the risks of concentrating production in a single region, leading to significant impacts on businesses and economies worldwide. This realization has spurred a strategic shift among companies and nations towards diversification and resilience in their supply chains. In response, there is a growing trend to "de-risk" by reducing dependency on China. This strategy involves moving production to other countries in Southeast Asia, Mexico, and Southeastern Europe, which offer competitive labor costs and are becoming increasingly capable in terms of manufacturing infrastructure and skill sets. Additionally, there's a significant push to bring manufacturing back to the United States, fueled by the desire for more control over production processes and to mitigate the risks associated with long-distance supply chains.

Furthermore, the United States possesses a competitive advantage in terms of energy costs, which can significantly impact manufacturing expenses. With substantial natural gas and renewable energy resources, the U.S. offers comparatively cheaper energy, making domestic production more viable and cost-effective. This advantage is particularly relevant in energy-intensive industries. Additionally, there's an increasing focus on advanced manufacturing technologies, automation, and artificial intelligence, which enhance the efficiency and productivity of U.S. manufacturing facilities, making them more competitive globally. The U.S. government's emphasis on revitalizing domestic manufacturing through various initiatives and incentives also plays a pivotal role. This support includes investment in infrastructure, research and development, and policies designed to encourage businesses to manufacture domestically.

All these factors collectively contribute to a more conducive environment for manufacturing in the USA, marking a strategic shift from the previous decades' outsourcing trends.

2. The End of Pax Americana

There's evidence suggesting a shift away from the globalization that defined the Pax Americana era. The US and its allies have severed economic ties with Russia following the Ukraine invasion, and the Biden administration has retained Trump-era tariffs on China. There's also a focus on domestic production, such as subsidies for American-made semiconductor chips and green-energy technologies. This shift is influenced by a growing realization of dependency on a few countries like China for essential goods and a backlash against mass immigration in Western democracies, realigning electoral politics.

With less focus on the Middle East (= more oil production at home) and Europe (ie. the Ukraine war is left to the EU to be handled) the USA is focusing only on Asia (= China). Hence, more conflicts will arise globally. Bloomberg mentioned that there were 83 conflicts in 2023, “the highest number in three decades”. LINK

The American bloc remains resilient despite these changes and the challenges of a new Cold War-like era with China and Russia.

3. AI to Everyone

AI technology is predicted to grow significantly in 2024, moving beyond niche applications to more mainstream uses. This includes agent-based models for tedious processes like insurance claims and the use of AI in video and audio creation. However, there are also emerging limitations of large language models (LLMs), with a shift towards smaller, more specific models.

AI at work means unlimited interns and at home a private tutor for your kid(s). Both will mean better results.

4. AI-generating content will be the norm, hence influencing the 2024 upcoming elections

The 2024 elections are vulnerable to disruption by AI-generated content, particularly due to the advanced capabilities of AI in creating convincing pictures and videos. This technology, known as deepfakes, can fabricate false narratives and fake news, effectively manipulating public opinion and misleading voters. Deepfakes can be used to create false representations of political figures or events, challenging the public's ability to discern truth from manipulation. The sophistication of AI in generating realistic content makes it difficult to distinguish between authentic and altered media, increasing the risk of misinformation spreading widely.

This threat is amplified by the evolution of social media platforms, which have transitioned from being mere hosts of user content to active shapers of public discourse through algorithmic amplification. As outlined by Sam Lessin, social media's progression now significantly influences what users see and engage with, often prioritizing engaging or sensational content. This environment is ripe for exploitation by AI-generated content, particularly in political contexts where misinformation can sway public opinion and voting behavior. The combination of AI's capacity to generate persuasive false content and social media algorithms' power to amplify such content creates a challenging landscape for maintaining the integrity of the electoral process.

5. Ozempic & Co as Stars

The weight loss drug market, including drugs like Wegovy, Ozempic, and Zepbound, has seen a surge in popularity and is expected to continue growing in 2024. These drugs have already shown significant sales and are projected to increase, with potential expanded uses and approvals in the U.S. and Europe. Despite supply constraints, manufacturers like Novo Nordisk and Eli Lilly are working to expand production capacity. The weight loss drug market is projected to be worth $100 billion by the end of the decade.

6. TikTok Shop Driving Revenue

TikTok experienced significant growth in 2023, surpassing US$13 billion in revenue, and is projected to reach US$25 billion in 2024. This growth is attributed to various revenue streams, including in-app advertising and the newly launched e-commerce feature, TikTok Shop. Despite facing challenges, TikTok has remained influential in shaping global culture and driving user engagement.

So, what do you do with +1 bn users? Instead of partnering with Amazon or Temu, TikTok launched its shop, hence defining the new strategy:

7. The iPhone takes a back seat, while the Vision Pro and Wearables will take the lead

In 2024, the iPhone is expected to take a back seat as Apple shifts its focus to Vision Pro and other wearable technologies. This shift can be attributed to a combination of market saturation, consumer preferences, and Apple's long-term strategic planning.

Firstly, iPhone sales have plateaued, remaining consistent without significant growth. This stagnation is partly due to market saturation; most consumers who want an iPhone already own one, and new models offer only incremental upgrades, which don't justify the cost of upgrading for many users. This incremental design approach has led to a diminished consumer appetite for new iPhones. Each new model, while technologically advanced, doesn't represent a significant leap from its predecessor, making it less compelling for consumers to upgrade frequently. This scenario is not unusual for mature product lines in technology, where initial rapid growth eventually gives way to a stable but less dynamic market phase.

Recognizing these market dynamics, Apple is turning its attention to developing and promoting its newer product lines, like Vision Pro and Apple Watch. These wearables represent a relatively fresh market with substantial growth potential. Apple is well aware that establishing a new product line and achieving market dominance, as it did with the iPhone, is a long-term endeavor. The focus on Vision Pro and wearables aligns with Apple's vision for 2030, anticipating that these products will become as integral to consumers' daily lives as the iPhone once was.

This strategic shift is a classic move by Apple, which has a history of phasing out or reducing focus on older product lines as it develops new technologies that align with future market trends and consumer preferences. The investment in wearables also reflects broader market trends, where consumers are increasingly interested in health, fitness, and augmented reality experiences, areas where devices like Apple Watch and Vision Pro have significant potential.

8. Temu will be the star of 2024

Temu's rise to prominence in 2024 can be attributed to its remarkable performance in the previous year, setting the stage for it to become a star in the e-commerce space. The app's success hinges on several factors, chief among them being its rapid adoption and market penetration in the US.

Firstly, the fact that Temu was the most downloaded iPhone app in the US in 2023 is a significant indicator of its growing popularity and market acceptance (LINK). This achievement reflects not just a high level of consumer interest but also the effectiveness of Temu's marketing strategies and user engagement. Such a high download rate typically correlates with a large, active user base, which is crucial for an e-commerce platform's sustained growth and success. This surge in downloads suggests that Temu has successfully tapped into the American consumer market, appealing to a wide demographic with its offerings.

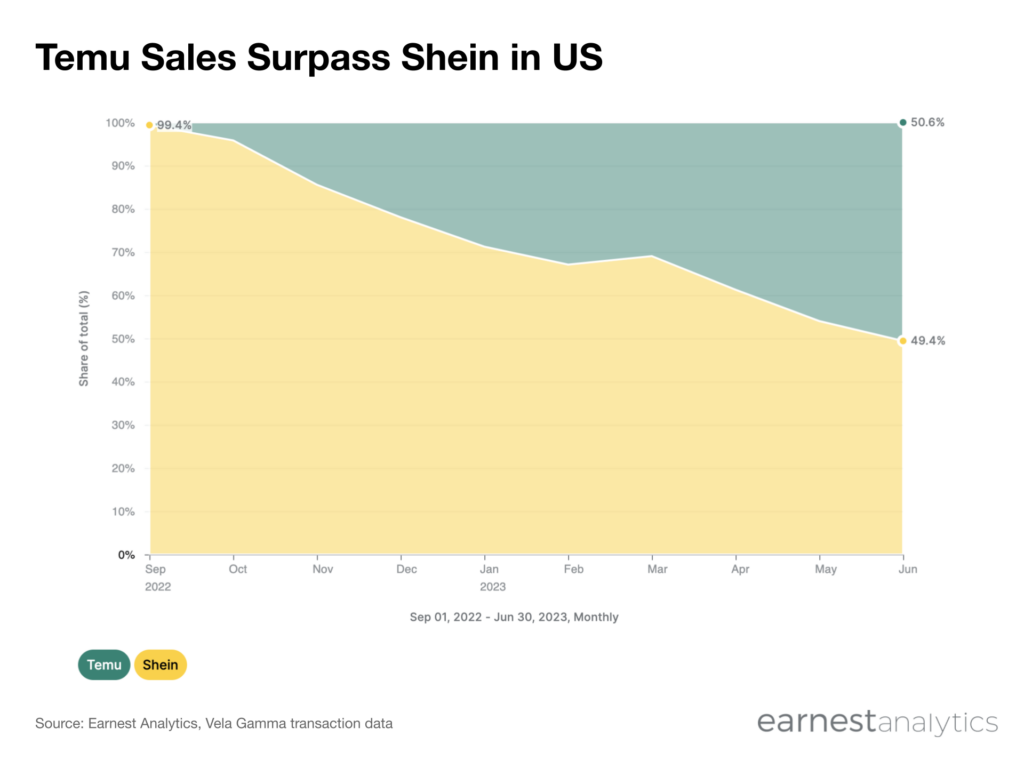

Moreover, Temu's sales surpassing those of Shein in the US is another critical milestone. Shein has been a dominant player in the online fast-fashion industry, known for its affordable pricing and trendy collections. Outperforming a well-established competitor like Shein is no small feat and indicates that Temu has not only managed to attract customers but also convert this interest into tangible sales. This could be attributed to several factors, including a diverse range of products, competitive pricing, effective supply chain management, and a user-friendly platform that enhances the shopping experience. (LINK)

9. Fragmentation of the social media will continue

The fragmentation of the social media landscape is expected to continue in 2024, influenced by various factors and the emergence of new platforms like Blue Sky, Mastodon, Threads, and Lemon8. These trends are:

Diversification of user preferences - Platforms like Lemon8, focusing on specific communities or interests, are gaining traction. This trend will likely continue as users seek more personalized social media experiences.

User autonomy: Platforms offering more control over content and data, such as Blue Sky, are becoming more appealing. This trend is a direct response to the perceived overreach of larger platforms.

Decentralization - the rise of decentralized platforms, like the Twitter alternative Blue Sky, indicates a shift towards more open and less centrally controlled social networks.

Content Moderation: Platforms like Threads may offer different approaches to content moderation, appealing to users dissatisfied with current practices on major platforms

Monetization Models: Different monetization strategies, like those employed by Lemon8, can attract different types of users and creators.

Community Focus: There's a growing desire for more community-driven platforms that foster closer, more meaningful interaction.

This trend will continue.

10. Towards a frictionless world: Glasses + GPT = infinite possibilities

The concept of a frictionless world, where augmented reality (AR) glasses seamlessly integrate with advanced AI like GPT, opens a realm of infinite possibilities, reminiscent of the film "Her". In this envisioned future, the interaction between humans and technology reaches new heights of intimacy and efficiency. AR glasses serve as a visual interface seeing what you see, overlaying the physical world with digital information, while GPT-like AI systems provide intelligent, context-aware assistance. This combination could revolutionize how we access information, communicate, and perceive our surroundings. Imagine walking through a city, with your glasses identifying landmarks, translating signs in real-time, or offering historical insights, all driven by an AI that understands your interests and learning style. This integration could extend to professional environments as well, where complex data can be visualized and interacted with in real-time, greatly enhancing productivity and decision-making processes.

Furthermore, the potential for personalization in this setup is immense, as seen in "Her", where the protagonist develops a deep connection with an AI operating system. AR glasses paired with AI like GPT could offer a similar level of personalized interaction, adapting to the user's preferences, emotional states, and behavioral patterns. This could lead to highly individualized learning experiences, empathetic healthcare assistance, or even companionship. However, this vision raises significant concerns regarding privacy, data security, and the psychological impacts of such deeply integrated technology. The challenge lies in balancing the immense benefits of a frictionless, AI-enhanced reality with the ethical and societal implications it brings, ensuring that this technological leap forward does not compromise our fundamental values and well-being.

Here is a surprising antidote to loneliness: Artificial Intelligence.

11. Shein business model will drive the IPO up

Shein's approach to business is distinctively innovative, particularly in its ultra-fast supply chain model. Unlike traditional fashion retailers like Zara and H&M, Shein has mastered the art of 'speed to market', reducing the time from design to production to just 14 days. This agility allows Shein to rapidly respond to changing fashion trends and consumer demands, outpacing competitors significantly. Moreover, Shein's lean approach to inventory, producing small batches based on real-time data analytics, contrasts sharply with the large-scale batch production of its competitors. This not only minimizes waste but also ensures a constantly refreshed and diverse product offering, keeping the brand relevant and exciting for consumers.

Another key differentiator for Shein is its data-driven design strategy. By leveraging advanced data analytics, Shein closely monitors consumer preferences in app and search behaviors, enabling them to produce highly demanded products with remarkable precision. This approach is a stark contrast to the more traditional, designer-led strategies of Zara and H&M, who rely on larger production batches (ie. 100,000 items vs 100). Shein's strategy not only reduces the risk of unsold inventory but also fosters a closer alignment with consumer preferences, thus enhancing customer satisfaction, and brand loyalty and ultimately driving more profit per item (+30-40%). Additionally, their expansive product range, with thousands of new SKUs introduced daily, dwarfs the yearly new product introductions of Zara and H&M, offering unparalleled variety to consumers.

Furthermore, Shein's manufacturing network and online presence set it apart. Their collaboration with an agile network of manufacturers, integrated through advanced ERP systems, ensures real-time production capabilities and efficient order fulfillment. This dynamic ecosystem contrasts with the more static supply chains of traditional retailers. Moreover, Shein's purely online retail model, devoid of physical stores, allows for significantly reduced overhead costs. These savings are strategically reinvested into aggressive online marketing, enhancing customer acquisition. Their adept use of social media platforms further strengthens their brand presence, particularly among younger demographics. This comprehensive digital-first approach not only aligns with the shopping habits of Gen Z and younger millennials but also positions Shein at the forefront of modern retail strategies.

12. More ads. Each screen becomes an ad network.

The emerging trend of leveraging customer data for targeted advertising is not only a strategic move for companies like Marriott and United Airlines but also represents a significant potential revenue stream across various industries. Marriott’s initiative to launch its own media network, using first-party customer data for targeted advertising within its app and on guest room TVs, exemplifies this innovative approach. With the potential to add hundreds of millions to Marriott's bottom line, this model showcases how companies can capitalize on their unique customer insights. Similarly, United Airlines is considering using its extensive passenger database to offer personalized ads on its in-flight entertainment systems and booking apps, tapping into a captive audience with high engagement potential. This shift towards utilizing inherent customer data is evident across different sectors, with companies like Walmart, Uber Technologies, and Home Depot also leveraging their rich consumer databases for targeted advertising.

The financial implications of such data-driven advertising strategies are profound. For instance, Marriott's venture, with its high occupancy rates and the potential for multiple ad impressions daily, not only promises a significant revenue boost but also offers higher net margins compared to traditional business models. United Airlines, with its extensive passenger base, stands to create a new revenue channel by offering tailored advertising experiences. The trend extends to retail and technology sectors, where companies like Walmart and Uber use customer data to sell personalized ads, capitalizing on the shift in digital advertising dynamics and the growing need for more effective, data-driven advertising strategies.

Moreover, the global applicability of these strategies, especially in lucrative markets like China, emphasizes their vast potential. The ability to navigate varying privacy regulations and offer region-specific targeted advertising further enhances the attractiveness of this model. In essence, this trend not only diversifies revenue streams for companies like Marriott and United Airlines but also sets a precedent for other industries to follow. It highlights the increasing value of customer data as a pivotal asset in today’s digital economy, enabling companies across various sectors to unlock new avenues for revenue generation through innovative, data-centric advertising strategies.

13. Microsoft will become the largest company by market capitalization

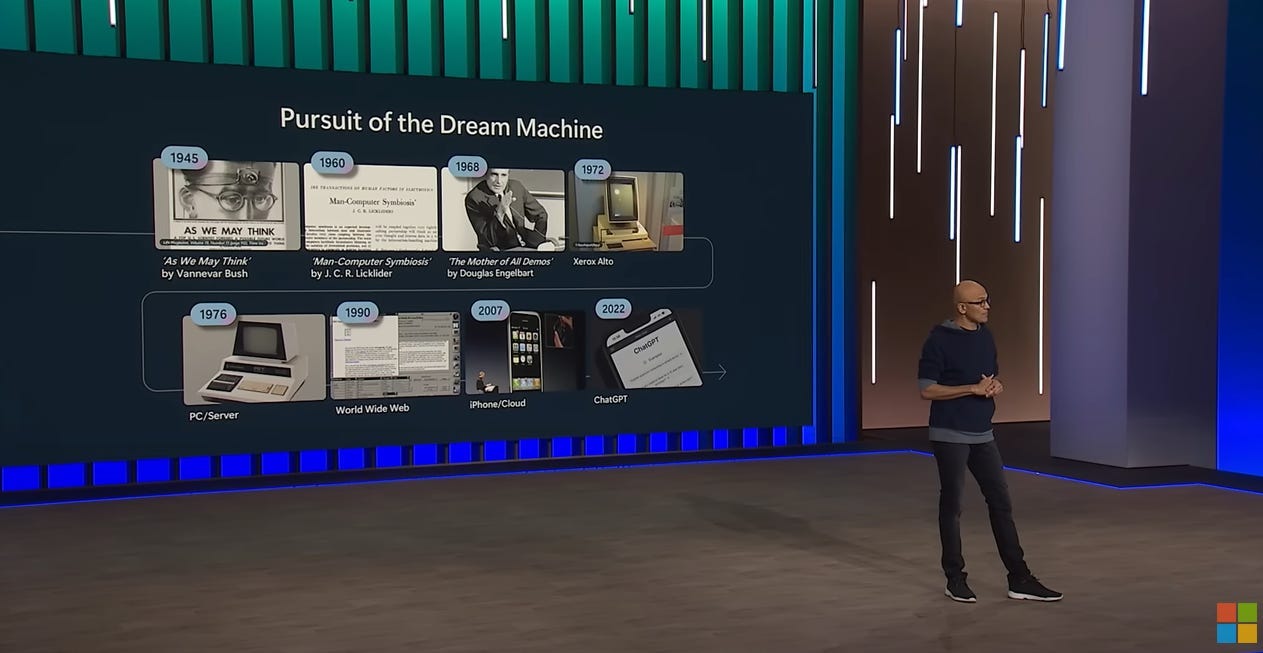

Microsoft's trajectory towards becoming the most valued company in the world by 2024 can be significantly attributed to its deep integration of artificial intelligence across its product range, bolstered by its partnership with OpenAI. This collaboration has enabled Microsoft to embed advanced AI capabilities into its core offerings, from cloud services to consumer software, enhancing efficiency and user experience. The integration of AI is not just limited to surface-level features; it extends to the very foundation of Microsoft's products, ensuring that AI-driven innovation is a key differentiator in its market offerings. This strategic focus on AI, combined with the development of specialized chips for AI training and inference, showcases Microsoft's commitment to leading the AI revolution, a factor that is increasingly critical in the tech industry's future landscape. (Apple lags behind)

Moreover, the pivot of Microsoft to base its operations primarily on cloud services fortifies its position in a rapidly growing sector. The cloud services market is expanding, and Microsoft's Azure platform is at the forefront of this expansion, offering scalable, secure, and robust cloud solutions to businesses globally. This cloud-first approach, combined with AI enhancements and specialized chip development, positions Microsoft as a leader in delivering advanced, AI-powered cloud solutions. Such a comprehensive and technologically advanced offering drives Microsoft's growth in the enterprise sector and sets the stage for it to outperform competitors in market valuation by 2024, as businesses and consumers increasingly rely on cloud-based, AI-enhanced technologies.

Thanks for being a subscriber, and have a great week!

Sharing is caring

☕️ Did you enjoy the newsletter? Buy me a coffee ✅

What is your prediction on the stock market in 2024?