(#67) Amazon has a Shein/Temu strategy; The decade of the Second China Shock; BlackRock just filed with the SEC to launch a tokenization fund; A whisky distillery with two Michelin stars in Scotland

OpenAI goes to Hollywood: business first

Knowledge Partner: ENGIE

The efficiency of a photovoltaic system is influenced by several factors: the orientation of the photovoltaic panels, the tilt angle of the photovoltaic panels, the shading of the photovoltaic panels, the region where the photovoltaic panels are installed, etc.

With almost a decade of experience in carbon reduction measures, ENGIE Romania offers its customers a wide range of customized photovoltaic panel solutions. To request a quote, please visit their dedicated website.

Today’s menu

Amazon has a Shein/Temu strategy

The end of the luxury rally?

The decade of the Second China Shock

OpenAI goes to Hollywood: business first

BlackRock just filed with the SEC to launch a tokenization fund

A whisky distillery with two Michelin stars in Scotland

Strategy

Amazon is ready for a fight with Shein and Temu|

Amazon is recalibrating its competitive strategy to address the rise of Temu and Shein, two e-commerce platforms with roots in China, which have recently outpaced traditional rivals like Walmart and Target in Amazon's strategic considerations.

How?

1/ Temu, in particular, has launched an aggressive advertising campaign, becoming the top advertiser on Meta Platforms in 2023, showcasing its ambition and financial muscle. Amazon is responding by doubling down on its strengths: customer trust and speedy delivery. The company is working to expand its same-day delivery offerings and is planning promotional campaigns highlighting its reliability and quick delivery times, aiming to maintain its competitive edge in these key areas.

2/ Amazon's approach to competition is not new; the company has a long history of aggressively countering threats from upstarts and established players alike, often through price cuts, acquisitions, or replicating successful strategies. However, Temu and Shein present a unique challenge with their slower delivery models based on direct shipping from China, appealing to customers willing to trade time for lower prices. Amazon believes its massive warehouse network, fast delivery, and customer service will keep it ahead. Yet, as Temu opens its marketplace to U.S. and European sellers and Shein emphasizes its on-demand manufacturing model, Amazon may need to further innovate to retain its market leadership.

3/ Moreover, the rise of these Chinese companies in the U.S. market underscores the global nature of e-commerce competition, requiring Amazon to not only innovate within its home market but also consider its strategy on a global scale. As consumer behaviors evolve, with a growing openness to longer wait times for lower prices, Amazon's response will be crucial in maintaining its position as a leader in online retail. LINK

The end of the luxury rally?

The luxury sector, once buoyed by a post-pandemic spending wave and general market trends, is now facing a stark reality highlighted by Gucci's recent downturn. Kering, the French conglomerate that owns Gucci, issued a sales warning predicting a significant drop in first-quarter sales, with Gucci's sales expected to plummet nearly 20%. This downturn has sparked fears across the luxury sector, with stocks of LVMH, Richemont, and Dior also taking hits amid concerns about the slowing luxury market in China. However, it's important not to hastily attribute this slump to broader market trends or a decline in Chinese consumer spending, which has shown resilience. Instead, the focus should shift to individual brand performance, where Gucci's difficulties seem more a result of internal missteps rather than external economic pressures.

Gucci's current predicament underscores a critical lesson for the luxury industry: brand momentum is crucial, and revitalizing a brand's image and sales, particularly in a softening market, is a formidable challenge. The brand's attempt to transition its aesthetic under new creative direction has yet to yield significant positive results, as evidenced by declining sales and store desirability.

This situation serves as a cautionary tale for other luxury brands like Burberry and Ferragamo, emphasizing the importance of individual brand strategy over-reliance on sector-wide trends. For investors, the era of betting broadly on luxury's upward trajectory seems over, necessitating a more discerning approach that evaluates each brand's unique position and potential for growth or recovery. LINK

Apple’s WWDC 24: all in on AI

Here are my takes:

1/ Apple’s stock suffered in the last months: from EU fines and DMAs to the DoJ antitrust case to a slump in sales in China. The stock has not remained indifferent and penalized the company accordingly.

2/ Apple is gearing up for its Worldwide Developers Conference (WWDC) 2024, scheduled from June 10 to June 14, with a keen focus on artificial intelligence (AI) amidst widespread anticipation regarding its strategy in the rapidly evolving generative AI space. While Apple has historically utilized the WWDC platform to preview upcoming software updates and unveil new hardware, this year's event is particularly shrouded in speculation about the tech giant's AI ambitions. Reports suggest Apple is intensively training its AI models, possibly collaborating with news outlets for content, and contemplating partnerships with major AI entities like Google, OpenAI, Anthropic, or Baidu in China. Speculation is rife about Apple potentially allowing deep integration of AI features by various developers into its ecosystem, a move that would mark a significant shift from its traditional approach of emphasizing on-device machine learning. Some of these capabilities will be integrated into its devices, so there will be no inference costs.

3/ Beyond AI, the WWDC 2024 is expected to follow Apple's tradition of announcing updates across its operating systems including iOS, iPadOS, macOS, and watchOS, along with potential hardware introductions. Rumors hint at user-friendly interface upgrades, new accessibility features, and the launch of two new AirPods models alongside an updated version of the AirPods Max. This follows the previous year's trend of significant announcements such as the Vision Pro headset, a widget-centric overhaul of WatchOS, and the introduction of the M2 Ultra chip in the Mac Pro and Mac Studio.

4/ The focus on AI, coupled with the usual array of product and software updates, positions this year’s WWDC as a potentially pivotal moment for Apple, as it seeks to assert its prowess in the competitive tech landscape while addressing consumer and developer expectations in the era of generative AI. LINK

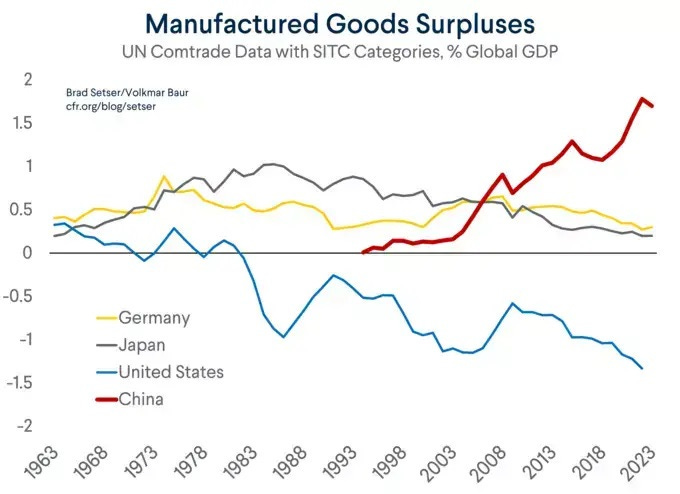

The decade of the Second China Shock, by Noah Smtih

The "Second China Shock" represents a crucial economic narrative for the 2020s, driven by China's aggressive manufacturing and export strategy that threatens to reshape global trade dynamics significantly. This development follows the disruptive "First China Shock" of the 2000s, a period characterized by China's rapid integration into the global economy, which resulted in severe job losses within the American manufacturing sector. The term, coined by economists David Autor, David Dorn, and Gordon Hanson, highlighted the profound impact of Chinese trade on the U.S. labor market, challenging the previously unshakable consensus among economists regarding the benefits of free trade. While the initial shock was thought to have subsided around 2010, recent trends indicate that China's manufacturing surplus relative to the GDP of its trading partners has not only continued to grow but has surged, suggesting the onset of a new, potentially more impactful phase.

The foundation of the Second China Shock lies in China's economic policies and the global response to its manufacturing dominance. Unlike the early 2000s, when China's economic liberalization and foreign investment incentives led to its unbeatable "China price," the current shock arises from a combination of China's shift towards manufacturing due to a declining real estate sector and the strategic decisions by Xi Jinping's administration to double down on manufacturing output. This strategy includes directing state-controlled banks to prioritize loans to manufacturing sectors and substantial subsidies to industries like semiconductors and electric vehicles. The expected result is an export boom, further intensified by cheap currency and reduced environmental and labor standards, positioning China as a formidable competitor on the global stage.

As China ramps up production across various sectors, it inadvertently pressures the profitability of its companies and the sustainability of global manufacturing diversity. The country's overwhelming production capacity, bolstered by state subsidies and a strategic disregard for economic efficiency in favor of employment and strategic industry buildup, stands to outcompete manufacturers worldwide. This has led to widespread concern among global players, with some countries considering strong protectionist measures to safeguard their industries. The European Union and the United States, among others, are contemplating tariffs and non-tariff barriers to counter the flood of Chinese exports, signaling a shift towards more adversarial trade relations and a potential unraveling of the global manufacturing landscape.

The response to the Second China Shock will undoubtedly shape the future of international trade, with significant implications for multinational companies, high-tech industries, and consumers worldwide. While protectionist measures may offer temporary relief for domestic industries, they also risk igniting a trade war with far-reaching consequences. As nations grapple with the challenge of balancing economic interests with the need to maintain a diverse and competitive manufacturing sector, the global community must navigate the complexities of this new economic landscape. The unfolding story of the Second China Shock underscores the need for strategic policy responses that address the root causes of market distortions while fostering an environment conducive to sustainable growth and innovation. LINK

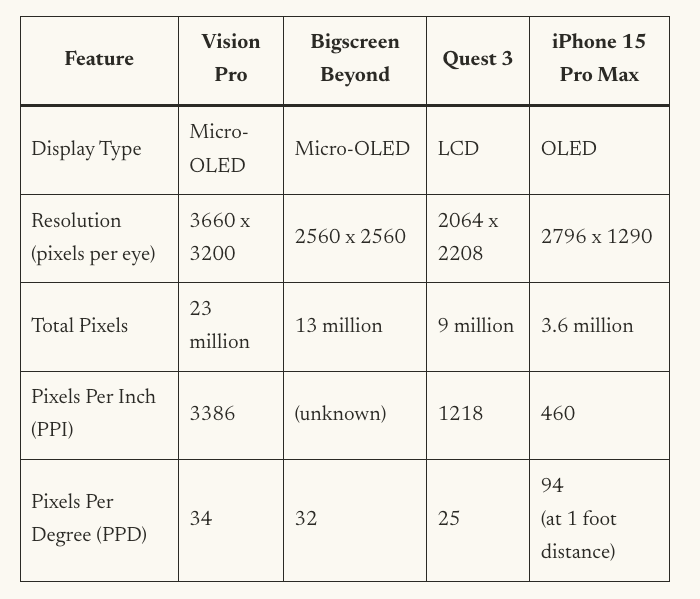

Hugo Barra, the Head of Oculus, on Vision Pro: over-engineered hardware, the software behind, too heavy (hence no product-market fit), supply chains are building for everyone, and not ready to replace the Mac or the iPad. A must-read! LINK

Artificial Intelligence

OpenAI is looking for clients…in Hollywood

1/ In an ambitious move to infiltrate the movie industry, OpenAI has organized meetings with key players in Hollywood, aiming to foster partnerships that integrate its innovative AI video generator, Sora, into filmmaking. The company has taken a methodical approach to its Hollywood outreach, initially with COO Brad Lightcap showcasing Sora's capabilities. These demonstrations revealed Sora's ability to produce realistic videos from textual prompts, capturing the attention of both Hollywood and Silicon Valley even before its public release. Sora, still in its nascent stage and inaccessible to the general public, has been selectively available to prominent figures in the film industry, signaling OpenAI's strategic entry into this creative domain.

2/ The presence of OpenAI's CEO, Sam Altman, at Los Angeles events during the Oscars weekend further underscores the company's commitment to engaging with the entertainment sector. This engagement is part of OpenAI's broader strategy of iterative deployment, aimed at ensuring safe and collaborative technological advancements with the creative industry.

3/ However, the integration of AI in Hollywood is met with mixed reactions. While some in the industry see the potential of AI to revolutionize pre-production and post-production processes, there's considerable apprehension regarding its impact on the livelihoods of creatives, including illustrators and voice actors. The concerns have been so significant that they contributed to strikes by screenwriters and actors demanding protections against the unfettered use of AI technology. Negotiations have since led to some safeguards, reflecting the industry's cautious approach to embracing these innovations.

4/ OpenAI's venture into Hollywood doesn't occur in isolation; it's part of a competitive landscape where giants like Meta and Google have already demonstrated text-to-video capabilities, and other AI startups like Runway AI Inc. are making significant strides. Runway, in particular, has reported widespread use of its text-to-video service for various production purposes, indicating a growing acceptance of AI tools in creative workflows. LINK

BBC has its AI plans

The BBC is venturing into artificial intelligence by planning to develop its own AI models and negotiating with major tech companies for the use of its extensive content archives. These discussions focus on the potential to train generative AI models, which can rapidly produce text, audio, and code, utilizing the broadcaster's vast trove of journalistic content. This move aims to create in-house tools to aid journalistic efforts and explore the commercial viability of its archives. The uniqueness of the BBC's archives lies in their perceived unbiased nature, making them a valuable asset for training AI models that require neutral data sources. Additionally, the BBC is exploring the possibility of leveraging open-source AI models for its research and development activities, signifying a step towards diversifying its income streams beyond the traditional national license fee.

Despite the opportunities, the BBC faces challenges, including concerns that AI companies might already be using its content without permission, given its wide availability online. The broadcaster's executive team is considering various approaches, including partnerships or independent development of AI capabilities, emphasizing the need for a cost-effective strategy. The BBC is also cautious about the potential biases in AI models trained on skewed datasets and is actively investigating ways to mitigate such risks. Experimentation with AI in news production is underway, with strict guidelines to ensure human oversight remains integral to the editorial process. This initiative reflects the BBC's broader strategy to innovate while safeguarding the integrity and impartiality of its content in the era of AI-driven technologies. LINK

More AI means more electricity need

According to the chief of National Grid Plc, the UK's data centers will experience a sixfold increase in electricity consumption over the coming decade due to the surge in artificial intelligence, necessitating enhanced computational capacity. LINK

Spianch.io

Spinach joins meetings, takes notes, and captures actions in your existing tools to help you ship faster. LINK

Things Happen

Neuralink's first (successful) implant. LINK

Scenarios for the transition to Artifical General Intelligence (technical paper). LINK

Experts warn that Chinese-made EVs could be used to spy or even shut down remotely by Beijing. LINK

Formula 1 team Williams uses an Excel file to track and manage 20,000 car parts. LINK

BlackRock just filed with the SEC to launch a tokenization fund. LINK

Data

2024 Gartner top 10 strategic technology trends. LINK

PPPs for GDP in 2023

Winner: Romania. Losser: mainly Hungary. LINK

This chart says so much about climate change.

Outside Interest

A whisky distillery with two Michelin stars in Scotland. LINK

Javier Milei, Argentina’s new president, started a large campaign on restructuring the public sector and the state-owned companies. LINK]

How a tunnel boring machine works. LINK

We can now shrink brain cancer. LINK

The UK has 500,000 redwood trees. LINK

Dallas is looking for a design that can tackle loneliness. LINK

Thank you for being an onStrategy reader!

Interesting newsletters 💡

Work with me

🧑🏻💻 Each year I do a presentation on what's coming next: business, tech, and (new) business models.

This year I focus on the generative AI implications, the new disruptors, on aggregators, the macro environment...and more. (80 slides, 1.5h)

Write me at contact@onstrategy.eu