(#72) Rabbit's R1 AI potential; BYD's vertical integration; on new platform shifts; TikTok valuation

MIT Technology Review: “Almost every Chinese keyboard app has a security flaw that reveals what users type.”

Knowledge partner: ENGIE Romania

Printre parteneriatele de succes încheiate de ENGIE Romania în domeniul energiei verzi, se numără cel încheiat cu SWISSCAPS Romania, companie membră a grupului AENOVA, unul dintre liderii mondiali din domeniul producției contractuale Business to Business pentru industria farmaceutică şi de asistență medicală.

ENGIE Romania a preluat întregul proiect de eficientizare energetică, de la consultanță și proiectare personalizată până la instalarea centralei fotovoltaice şi asigurarea serviciilor de mentenanță şi monitorizare a acesteia.

"În toți aceşti ani, colaborarea noastră cu ENGIE a fost foarte eficientă. Ne înțelegem reciproc nevoile, ENGIE ne cunoaşte bine, ne înțelege infrastructura, ceea ce ne face colaborarea uşoară. A fost un proiect de mare succes. Recomand ENGIE şi altor parteneri pentru că echipa ENGIE oferă servicii complete şi au experiență, tot ce e nevoie.”, declară reprezentanții SWISSCAPS.

Află mai multe despre implementarea despre ce înseamnă o implementare cu succes, aici.

Strategy

Rabbit R1’s reviews are here and look promising

Let’s go back first to a classic article on disruption innovation from Professor Clayton Christensen:

“First, a quick recap of the idea: “Disruption” describes a process whereby a smaller company with fewer resources is able to successfully challenge established incumbent businesses. Specifically, as incumbents focus on improving their products and services for their most demanding (and usually most profitable) customers, they exceed the needs of some segments and ignore the needs of others. Entrants that prove disruptive begin by successfully targeting those overlooked segments, gaining a foothold by delivering more-suitable functionality—frequently at a lower price. Incumbents, chasing higher profitability in more-demanding segments, tend not to respond vigorously. Entrants then move upmarket, delivering the performance that incumbents’ mainstream customers require, while preserving the advantages that drove their early success. When mainstream customers start adopting the entrants’ offerings in volume, disruption has occurred.” LINK

Rabbit R1 is a product that everyone ignores because it looks like a toy, but has the chance to be the tip of the AI devices. The first reviews are here and the feedback looks pretty promising.

From the review of the Rabbit R1, several intriguing conclusions can be drawn about its impact and potential in the realm of AI-assisted devices:

1/ The Rabbit R1 distinguishes itself from other AI devices through its integration of the Large Action Model (LAM) alongside a standard Large Language Model (LLM). This combination not only allows the device to understand complex requests but also to perform actions based on those requests, such as making reservations or processing documents. This capability suggests a shift towards more proactive and interactive AI systems that can seamlessly integrate into everyday tasks and workflows, offering a more hands-on, practical utility than existing smart assistants.

2/ With a pricing strategy significantly lower than other AI-driven hardware, such as the Humane AI pin and Ray-Ban Meta smart glasses, the Rabbit R1 positions itself as an accessible option for a broader audience. At $199, it is presented as an impulse purchase, which could democratize access to advanced AI technologies and encourage widespread adoption. This strategy could significantly influence market dynamics by setting a new standard for pricing and performance in AI-assisted devices. I still wonder how they will pay the cloud bills without a monthly subscription.

3/ The Rabbit R1's unique capabilities and approach suggest it could carve out a new niche in the tech ecosystem. It is explicitly not designed to replace smartphones but to complement them by efficiently handling tasks that smartphones are typically used for but may not be optimally designed to perform, such as time-intensive administrative tasks. This could lead to new user behaviors and potentially shift how consumers engage with technology, balancing entertainment and productivity in new, innovative ways. The Verge, Tom’s Guide, Marques Brownlee

New platform shift, new challenges

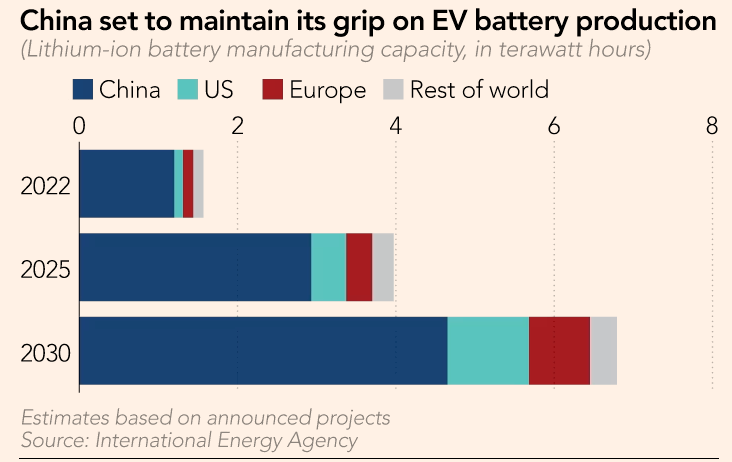

Japan's small to mid-sized electric vehicle (EV) battery suppliers are facing significant challenges as they strive to keep up with the rapid growth and investment demands in the EV market. These companies, which are crucial components of the supply chain for larger automotive brands like Toyota and Tesla, are struggling to expand their production capabilities swiftly enough to avoid creating bottlenecks. With the global surge in EV demand, Tokyo is encouraging these companies to form alliances to bolster their competitive edge. However, many are hesitant to do so for fear of losing technological autonomy and control over their unique innovations.

Financial constraints are another major hurdle for these Japanese suppliers. For instance, a small company that manufactures factory equipment for producing EV batteries decided against further expansion due to the high costs and risks associated with borrowing. The company president highlighted the dilemma of needing substantial collateral for loans, which could jeopardize their existing assets. To manage growth, another company, Kataoka from Kyoto, is planning to increase its production capacity threefold by 2027 through new factories and additional rented space, even considering public funding options like an IPO to secure the necessary capital.

Amidst these local challenges, Japanese suppliers are also facing increasing competition from foreign companies, particularly from China and South Korea, where companies have grown through mergers and acquisitions, thus able to offer a broader range of production equipment at competitive prices. The Japanese government is responding by proposing subsidies and encouraging collaborative efforts among smaller companies to streamline production processes and enhance their capacity to take comprehensive orders. This strategy aims to preserve the domestic supply chain integrity and respond more adeptly to both domestic and international market demands. LINK

TikTok’s valuation

Some analysts think that the bid should start from $20 billion for the USA operations and $100 billion for the global operations. My estimation that the Chinese government will not sell any part of it and prefer to operate where is possible. LINK

On China

Caixin Global: “China industrial profits drop as demand from overseas stalls.”. LINK

The Second China Shock does not yield profits for Chinese firms, contrasting with the economic expansion of the 2000s. This time, the objective is to compel global deindustrialization rather than pursue growth. Hence, tariffs and barriers are coming. LINK

BYD - how far can you integrate vertically?

From the Financial Times:

“BYD owns stakes in mines in at least six countries across three continents, guaranteeing long-term access to lithium, the material crucial to its batteries. The Chinese group produces its own computer chips, has its own construction subsidiary for building new factories and develops its own software for increasingly sophisticated vehicles and energy systems.”

The concept of vertical integration, exemplified by BYD's business strategy, brings several key advantages that can be critical in today's competitive and fast-evolving markets:

1/ Vertical integration allows a company to control its entire supply chain, from raw materials to final products. This can reduce dependency on external suppliers, decrease risks associated with supply disruptions, and often lower costs. For BYD, owning stakes in lithium mines ensures a steady supply of crucial raw materials for battery production, which is central to its electric vehicle (EV) offerings.

2/ By controlling multiple stages of production and distribution, companies can achieve greater economies of scale and reduce costs. BYD's approach to building its factories and producing its own batteries and other key components like computer chips allows it to maintain a cost advantage over competitors who must procure these from third parties.

3/ Vertical integration facilitates tighter quality control and a faster feedback loop from end customers to manufacturing. This control can drive innovation, as improvements are continuous feedback in the production process. BYD’s development of “cell-to-body” technology, which integrates the battery cell directly with the vehicle chassis, illustrates how vertical integration can spur innovation while improving product performance and reducing manufacturing costs.

4/ Being vertically integrated allows companies to respond more to changes in consumer preferences and market conditions. They can adjust production processes and outputs without the need to renegotiate terms with multiple suppliers, leading to quicker adaptation to new opportunities or challenges.

5/ BYD's integrated approach allows it to keep many of its technological innovations and efficiencies proprietary. This integration builds a strong barrier to entry for potential competitors and can provide a competitive edge in the marketplace.

6/ As BYD expands globally, being vertically integrated allows it to replicate its business model in new markets more easily. It can establish production facilities abroad, thus reducing logistics costs and tariffs while also tailoring its products to meet local market demands and regulatory standards.

7/ Vertical integration reduces reliance on external firms and market conditions for critical components and materials. This strategic independence is particularly crucial in industries like renewable energy and automotive, where geopolitical tensions or trade policies can abruptly affect supply chains.

BYD’s ambition to not just produce EVs but also control the production of batteries, solar panels, and even the software and AI that integrate these systems into a broader energy ecosystem demonstrates a strategic use of vertical integration. This approach not only supports its growth in the EV market but also positions it as a leader in the broader transition towards renewable energy and sustainable transportation solutions. LINK

Artificial Intelligence

AI in Apple products

Apple is actively re-engaging with OpenAI and exploring other partnerships as it prepares to introduce a series of generative AI features in June, positioning itself in a market already bustling with activity since the emergence of ChatGPT in 2022. Unlike its competitors who quickly adopted AI tools, Apple plans to differentiate itself by integrating these features seamlessly into its iPhone operating system, with a strong focus on enhancing user privacy and security. The upcoming enhancements, which include AI-driven text writing, article summarization in Safari, and notification recaps, are part of Apple's broader strategy to infuse AI across its ecosystem using its internal AI model, Ajax. However, despite the hype surrounding AI, Apple remains cautious, aware of the possibility that these features might not achieve widespread user adoption, mirroring the fate of other less popular features in its history. Google remains also in the cards for some of its capabilities.

Lesson: Apple realized that is a hardware company and is better to leave the others to do the (advanced) software, or AI in this case. However, the company publishes papers on this topic too. Maybe it’s just a matter of time before they will be 100% independent, but for now, they are laggards. OpenAI, Apple

Things Happen

US overtakes mainland China as Taiwan’s main export market, a sign of ‘strategic shift’ amid tech decoupling. LINK

MIT Technology Review: “Almost every Chinese keyboard app has a security flaw that reveals what users type.” LINK

Japan is having a currency crisis. LINK

BYD has BIG plans. LINK

Exposure to microplastics was found to decrease the expression of genes associated with brain development and induce behaviors indicative of depression and anxiety in mice. LINK

How China's carbon-intensive heavy industry powers its clean tech industry. LINK

How far Trump would go. LINK

The Chips Act has been surprisingly successful so far. LINK

Data

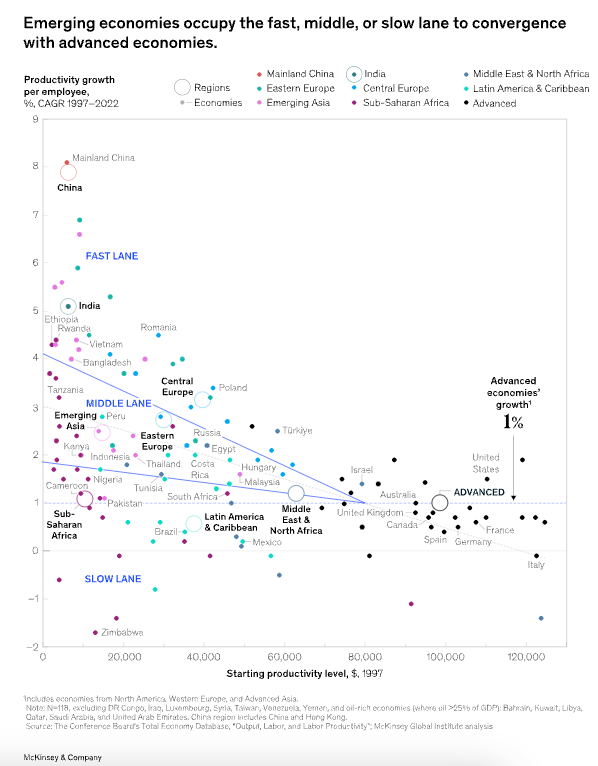

Romania and Poland are on the 'fast lane' regarding the convergence with advanced economies. LINK

If you read my newsletter you know precisely when that will happen.

Asset Tokenization, by Defactor. LINK

USA uber Alles!

America’s economy is and will be number one for at least 3 more decades. LINK

Electric vehicles are transforming the aluminium demand. LINK

Outside interest

Why the real estate is cheap in Japan. LINK

The mysterious Roman dodecahedron. LINK

Source: Norton Disney History and Archaeology Group

There is a ‘silent fight’ between The New York Times and the White House. LINK

You can now build your crypto business with Stripe. LINK

Thank you for being an onStrategy reader!

Interesting newsletters 💡

I will be a speaker at NFT Bucharest 2024, held between 8-9 May, with a topic on the future of tokenization. Get your tickets and let’s change some ideas together: