(#73) Apple's strategy for 2024; Tesla's decisions are somehow bad; Ericsson chief says overregulation ‘driving Europe to irrelevance’

Microsoft’s AI Copilot is beginning to automate the coding industry

Knowledge Partner: EY

Shape the Future: Share Your Insights in Our Survey!

Share your insights on the importance of upskilling and reskilling in the AI era. Our survey aims to better understand the dynamics and barriers of today's agile workplace.

Your input is essential for our study and the survey takes only 7 minutes to complete.

Click here to start the survey.

Thank you for your time!

Strategy

Apple’s strategy

In a recent announcement, Apple unveiled its first AI-focused iPad and accompanying accessories + the ultra AI-capable M4 chip. As we've discussed in previous newsletters, Apple derives the majority of its revenue from iPhones, accounting for over 50% of its sales. The company has a consistent strategy of charging premiums for upgrades, such as increasing memory from 8 GB to 16 GB. Historically, software updates haven't significantly attracted waves of new or returning customers. However, the introduction of enhanced AI capabilities could potentially change this dynamic.

Looking ahead to the events of June (i.e., WWDC 2024) and September (i.e., the iPhone 16 launch), here are my predictions:

1/ Enhanced AI integration on devices. Expect to see improvements in Siri and on-device AI capabilities, which will facilitate more efficient handling of routine tasks. Apple has been notably active in this area, having presented at least eight papers last month.

2/ Anticipated price increase. Apple typically adjusts its pricing every three years, and we are due for this adjustment.

3/ Restricted features for older models. A continuation of Apple's strategy to limit certain functionalities to newer models, similar to what we observed with the 'double tap' feature exclusive to the Apple Watch Series 9 and Ultra 9, will likely persist. Older models, despite having the necessary hardware, often miss out on these new features.

These strategies are likely to boost sales and Apple's stock value, potentially reinstating it as the most valuable company globally.

P.S. I occasionally find myself pondering the possibility of an iPhone Ultra. Could we see such a model in the next 2-3 years? Only time will tell. Ipads, Double tap, Papers, M4 chip

📈 First Reddit numbers are in

On Tuesday, Reddit announced a quarterly revenue forecast that surpassed Wall Street predictions in its debut earnings report as a publicly traded entity, fueled by robust user engagement and a recovery in the advertising sector.

The stock of the online community platform soared 17% in after-hours trading.

Reddit anticipates its revenue for the second quarter to range from $240 million to $255 million, exceeding the average analyst forecast of $223.8 million, based on LSEG data.

This positive outlook follows impressive performances from competitors like Snap and growing enthusiasm among investors that advertisers are increasing their budgets this year, following a downturn in the advertising market in 2023 due to persistent inflation and economic uncertainties. Additionally, Reddit is expanding its revenue streams by licensing its vast user-generated content for AI training purposes. Earlier in the year, it secured a lucrative $60 million annual contract with Google. As I said in the Newsletter #63, I remain bullish on Reddit. LINK

🚗 Tesla is playing in dangerous waters

Three on Tesla:

1/ The stock has plummeted by 28% this year, driven by a confluence of factors including stiff competition in China, a slowdown in the electric vehicle market, and various other micro and macroeconomic challenges.

2/ Against this backdrop, Elon Musk announced a 10% workforce reduction, mirroring a 10% decline in year-over-year quarterly sales. The takeaway here is instructive: a mere 10% drop in sales often necessitates a deeper cut of 15-20% in the workforce to realign costs and operational efficiency.

3/ In a bold move to capture market attention and traction, Elon Musk recently visited China to unveil a new partnership with Baidu, known for its dominance in the Chinese internet ecosystem, to enhance its autonomous driving technology. However, this venture is fraught with familiar risks: likely, the Chinese government will eventually transfer this technology to local competitors. This pattern has repeated itself often, particularly with Tesla, sparking curiosity about why Musk continues to pursue these agreements despite the predictable complications. Going to China to solve your (sales) problems means just one thing: desperation.

In the meantime, the company has scheduled a Cybertruck tour in Europe and Middle East. Layoffs, Sales, Baidu, Cybertruck.

🚚 Food delivery is ending together with the end of free money

Getir's decision to withdraw from the US, UK, and European markets to concentrate on its domestic market in Turkey, a move affecting over 6,000 jobs.

This shift marks the end of an ambitious expansion phase for Getir, which had rapidly grown to a near $12 billion valuation through significant acquisitions and venture capital investment.

However, these markets contributed to only 7% of its revenues, indicating a strategic refocus rather than a complete retreat. The instant delivery market's downturn, which has also affected other companies like Flink, signals broader industry challenges. Despite the layoffs and market exits, Getir is securing new investments to bolster its operations in Turkey, suggesting an adaptive strategy to survive in a volatile economic environment and potentially turbulent sector. LINK

Artificial Intelligence

Microsoft’s AI Copilot is beginning to automate the coding industry

Microsoft’s AI Copilot, developed by GitHub and powered by OpenAI technology, is redefining the role of coding assistants within the software development industry. When initially released in 2021, Copilot showcased its potential by automating simple coding tasks, hence completing code lines efficiently. Fast forward to 2024, the integration of GPT-4 has significantly enhanced Copilot's capabilities, allowing it to handle more complex tasks such as translating code across programming languages and automating substantial portions of coding for corporate systems. This transformation is particularly evident as Copilot now aids in creating software for critical systems at major corporations, highlighting its evolution from a simple coding aid to a critical development tool.

Despite its advancements, Copilot is not without its challenges and limitations. Users have noted instances of the AI generating outdated or buggy code, and there's a continual risk of introducing security vulnerabilities. However, GitHub emphasizes that Copilot is intended to augment, not replace human programmers, advocating for careful usage and adherence to robust guidelines. The broader industry implications are significant, with Copilot being seen as a testbed for further AI integrations across Microsoft’s suite of products. Meanwhile, the landscape remains competitive, with startups and tech giants alike developing their own AI coding tools, pushing the boundaries of what these assistants can do and setting the stage for a future where AI could potentially transform coding into a more universally accessible skill. LINK

AI startups aren't making money…yet

Despite the immense influx of venture capital and comparisons to the rapid success of firms like OpenAI, most AI startups have yet to establish profitable business models. Key issues highlighted include the difficulty these companies face in competing with tech giants and their need to manage massive financial outlays against uncertain future revenues.

This situation sparks debate over whether the AI sector is in a bubble that might burst similarly to the dot-com crash. However, industry experts believe that even if there is a downturn, the consequences won't be as severe as those experienced in the late 1990s because AI technology already demonstrates substantial revenue potential, unlike the early internet. The consensus is that while the AI "hype" may diminish, the technology itself will continue to develop and integrate into society, albeit more slowly and perhaps less dramatically than some investors currently anticipate. LINK

Tech leaders need to rethink talent strategy for GenAI

BCG estimates that 90% of tech jobs will be directly impacted by generative AI. LINK

Things Happen

Ericsson chief says overregulation ‘driving Europe to irrelevance’. LINK

The Ozempic effect: how a weight loss wonder drug gobbled up an entire economy. LINK

Cheap solar gives the desalination industry a hand. LINK

LVMH says champagne sales are down because people aren't partying like they used to. LINK

The first 24 key hotels were selected by the new MICHELIN guide. LINK

Data

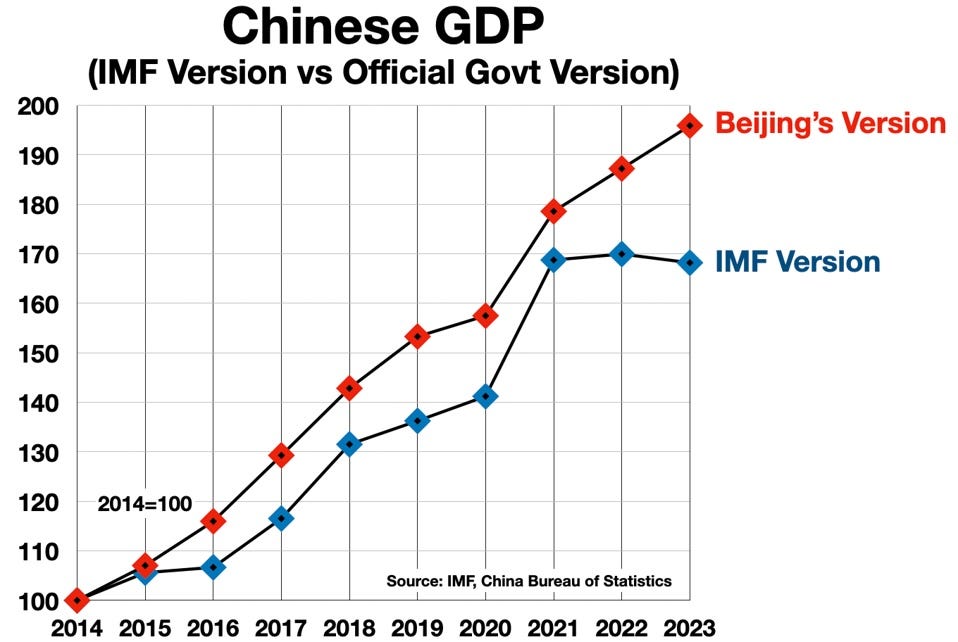

There is now a silent consensus that China had a mild recession in 2023, and not +5% as they claimed. LINK

Europe has made its energy-intensive industries uncompetitive after the “Russian break-up”. LINK

Global Innovation Index 2023 rankings. LINK

Cybercrime Index, by the University of Oxford. LINK

Outside interest

The giant Manta Ray underwater drone. LINK

Bottega Veneta’s Matthieu Blazy: ‘If I do just fashion, I will go cuckoo’. LINK

An orangutan in Indonesia has self-medicated to heal a wound on his face. LINK

What ancient Roman wine tasted like. LINK

China is cheating in awaiting the Paris Olympics. LINK

Yes, smartphones are bad in school, and overall, for kids. LINK

I will be a speaker at Techsylvania, held between 26-27 June in Cluj. Use the code SORIN24 to get a 24% discount on your tickets. LINK