(#76) The AI Bubble is here; Netflix is the new cable bundle; How ‘red’ Texas became a model for green energy

Have you heard about Pepkor?

Knowledge Partner: ENGIE

“Atunci când am avut în vedere implementarea unui sistem fotovoltaic la sediul RADOX din București, am pus pe tapet mai multe beneficii. Consider că atât eficiența energetică, cât și eficiența costurilor și independența sunt, ambele, la fel de importante. De asemenea, trebuie să fim sinceri că și imaginea noastră și responsabilitatea socială sunt un punct forte. Deși acesta nu este un proiect social, considerăm că ajută la reducerea amprentei de carbon și ne face să fim mai responsabili față de comunitate.”, declară reprezentanții RADOX.

Scăderea costurilor cu energia electrică şi reducerea amprentei de carbon sunt două dintre beneficiile majore ale instalării unui sistem fotovoltaic. Prin captarea energiei solare, afacerile pot deveni parțial sau total autonome din punct de vedere energetic, ȋn funcţie de puterea instalată a sistemului fotovoltaic, contribuind semnificativ la reducerea amprentei de carbon. Această acţiune nu numai că îmbunătățește imaginea companiei, dar și demonstrează angajamentul ferm față de practici sustenabile și responsabilitate socială.

Află mai multe despre povestea instalării unui sistem fotovoltaic la compania RADOX, soluție prin care vor fi evitate anual emisii echivalente pentru 132 de tone de dioxid de carbon. - click AICI.

Strategy

AI Bubble

The Economist has a long piece on what happening in the AI environment, showing the obvious: we are in a bubble.

Some additional insights:

1/ The current AI boom, likened to a modern-day gold rush, has significantly inflated the valuations of numerous companies, large and small. Dell's stock surged by over 30% in a single day amid AI optimism, while Together AI, a cloud-computing startup, saw its valuation more than double to $1.3 billion within months, partly thanks to investments from Nvidia. Nvidia itself has experienced meteoric growth, with its market value soaring from around $300 billion to $2.3 trillion since the launch of ChatGPT in November 2022. This frenzied investment and valuation inflation across the AI industry suggests we may be in an AI bubble.

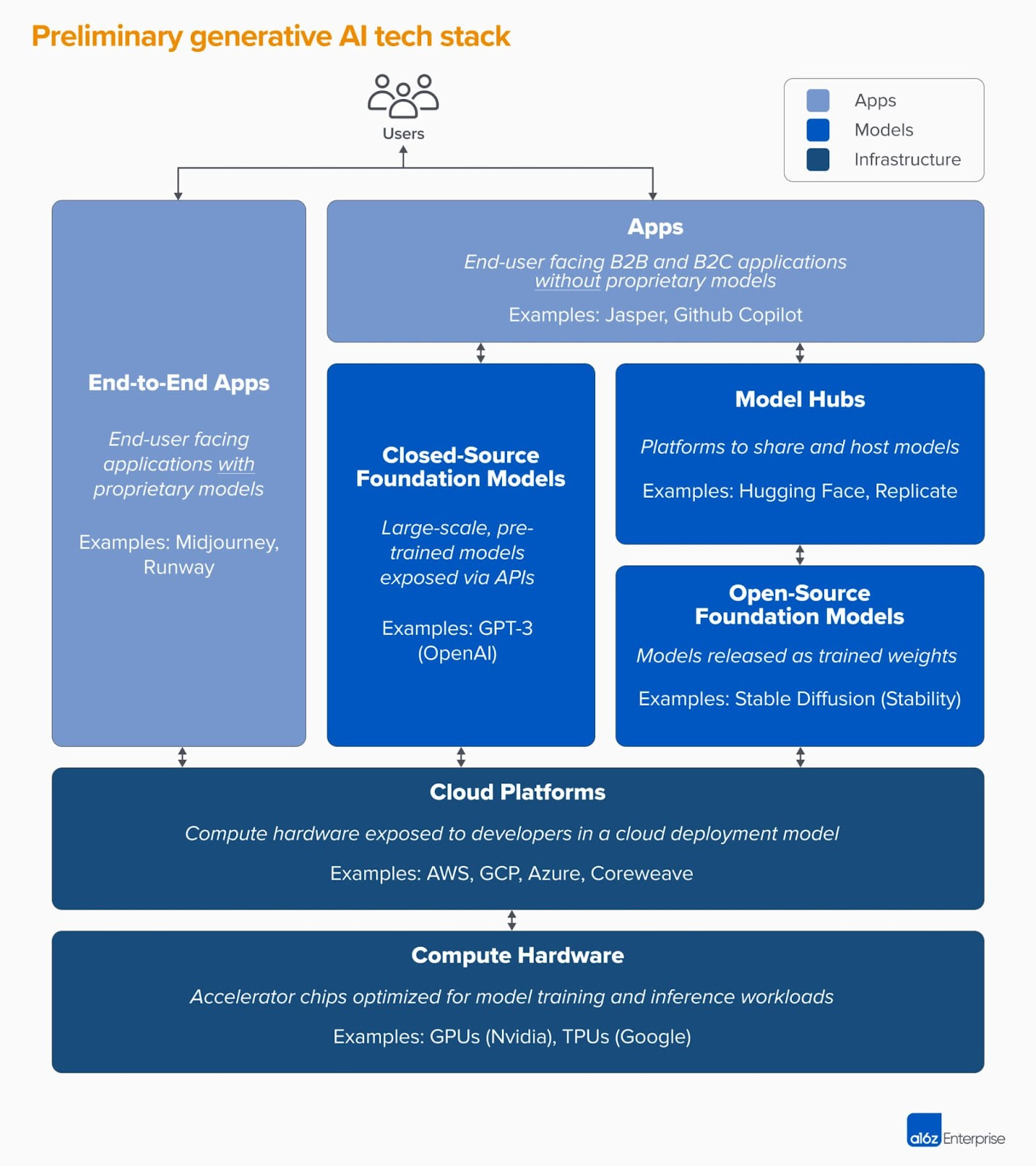

2/ At every layer of the AI technology stack—from hardware to applications—value is becoming increasingly concentrated among a few dominant players. For instance, Nvidia, which manufactures over 80% of all AI chips, has seen its data-center business revenue triple in a year, contributing to 57% of the market cap increase among hardware firms. Similarly, in the cloud computing sector, Microsoft has pulled ahead of Amazon and Google, with its market capitalization now representing 46% of the trio's total, up from 41% pre-ChatGPT. This concentration of value and the rapid escalation in market caps point to heightened speculative investments typical of a bubble.

4/ Moreover, the AI boom has created disproportionate value among hardware companies, which have seen their collective worth rise from $1.5 trillion to $5 trillion since October 2022. This surge mirrors the early internet boom, where initial value creation heavily favored infrastructure providers. Nvidia's dominance in AI chips and networking equipment exemplifies this trend, although competitors like AMD and Intel, as well as startups, are attempting to carve out their niches. Despite these efforts, Nvidia's market stronghold, bolstered by its CUDA software platform, suggests a potential over-reliance on a single company, a hallmark of speculative bubbles.

5/ In contrast to hardware, AI model-makers have experienced substantial proportional gains, with firms like OpenAI and Anthropic seeing their valuations skyrocket. OpenAI, for example, is now valued at $100 billion, up from $20 billion in late 2022. These companies' valuations are based heavily on intellectual property and anticipated future profits, which remain uncertain due to intense competition and rapid technological advancements. The high valuations amidst fierce rivalry and the substantial cost of developing and training models underscore the speculative nature of investments in this sector.

6/ Lastly, the inflated valuations in the cloud layer, despite relatively modest revenue expectations from AI in the short term, further indicate an AI bubble. The market value of Alphabet, Amazon, and Microsoft has collectively increased by $2.5 trillion during the AI boom, far outpacing the actual revenue these companies are expected to generate from AI services. This disparity suggests that investors are banking on long-term dominance and control over multiple layers of the AI stack, a risky bet that often characterizes bubble behavior. The overarching optimism and substantial financial stakes in AI, reminiscent of past tech bubbles, highlight the speculative fervor currently enveloping the industry.

We reached the peak of inflated expectations for Generative AI. The Economist, Gartner, a16z

Yes, Netflix can be free while also being the new cable bundle

I have written extensively about Netflix and its possible free (ad) tier.

Fast forward to today, the company has close to 40 million subscribers on its ad tier. It’s worth a short recap of what happened:

1/ Netflix's announcement that its ad-supported tier has reached 40 million global monthly active users is an impressive milestone, but it also raises concerns about the sustainability and true value of this growth. The sharp increase from 15 million users last November to the current figure suggests rapid adoption. However, the distinction between monthly active users (MAUs) and paying subscribers highlights a potential overestimation of the tier's actual financial impact. MAUs include all account users, not just those directly contributing to revenue, suggesting that the headline number might not fully reflect the economic reality.

2/ The fact that the ad-supported plan accounts for over 40% of all new Netflix sign-ups in markets where it is offered indicates strong initial interest. Yet, this statistic could mask deeper issues. The swift uptake could be driven by cost-conscious users switching from higher-priced plans rather than entirely new customers joining the platform. This potential cannibalization might not lead to a net increase in revenue, undermining the tier's profitability. The lack of disclosed actual subscriber figures or revenue data further complicates the assessment of the ad-supported tier's true success.

3/ Netflix's claim that over 70% of its ad-supported users watch for more than 10 hours a month, 15 percentage points higher than the nearest competitor, is compelling but might be misleading. While engagement metrics are important for attracting advertisers, they do not necessarily translate into sustained long-term growth or loyalty. High engagement figures could be a result of the novelty factor, which might wane over time. Additionally, the reliance on Nielsen data, which has its own set of limitations and criticisms, could skew the interpretation of these engagement levels.

4/ The introduction of a new in-house advertising technology platform and the emphasis on live events, like the upcoming Jake Paul vs. Mike Tyson fight, suggest Netflix is investing heavily in diversifying its ad offerings. While these initiatives could attract significant advertising dollars, they also introduce new complexities and risks. Live events and sports content, for example, come with high production costs and variable audience interest, making it a volatile revenue stream. The success of these ventures is far from guaranteed and depends on execution and audience reception.

5/ Moreover, Netflix's acquisition of streaming rights for NFL games, reportedly at a cost of less than $150 million per game, is a strategic move into live sports content. While various analysts view this positively, seeing it as a way to bolster the ad business, it also underscores the high stakes and significant investments required to compete in this space. Given that Netflix has spent similar amounts on original movies, the question arises whether the return on investment for live sports will match or exceed that of its blockbuster films.

6/ Finally, I suspect that many of those 40 million ad-tier subscribers are those who were affected by password sharing.

Concluding, Netflix has won the streaming war and it looks like they are becoming the new cable bundle, hence the stock price below. 40 million, Passwords

Uniqlo’s challenges in China

Uniqlo, the Japanese fast-fashion retailer, is confronting the challenges posed by China's slowing economy and a more frugal middle class. Historically, Uniqlo has relied heavily on China, a significant driver of its business, contributing $4bn in revenues in Greater China for the past financial year ending August 2023. However, Fast Retailing, Uniqlo's parent company, announced a reduction in its planned store openings in China from 80 to 55 for the financial year, resulting in a sharp decline in share prices as investors reassessed the retailer's prospects. The key question now is whether Uniqlo's affordable basics can appeal to the increasingly cost-conscious Chinese middle class, potentially serving as an indicator for other foreign consumer-facing companies.

Since it entered into China in 2002, Uniqlo has navigated geopolitical tensions and nationalist sentiments successfully, unlike some of its rivals. The retailer’s strategy of combining reliable basics with trendy products has resonated with Chinese consumers. Notable successes include popular items like washable face masks during the pandemic and the recent popularity of its banana bags among Gen Z customers. Despite the geopolitical challenges, Uniqlo's functional and affordable offerings have maintained their appeal, even during times of heightened nationalist sentiment and boycotts of Japanese goods.

As economic growth slows in China, Uniqlo faces uncertainty in its expansion strategy. Fast Retailing's CFO Takeshi Okazaki acknowledged the dual nature of their challenges, citing both internal and external factors, including underperforming stores and a challenging macroeconomic environment. In response, the company plans to close some stores and enhance its e-commerce and livestream commerce efforts, which are popular on Chinese social media apps. While Uniqlo focuses on refining its strategy in China, its ambitions in the US and Europe are becoming increasingly crucial to its overall success and share price, as these markets continue to perform well amidst the uncertainties in China. LINK

Have you heard about Pepkor?

Did you know that Africa’s population is expected to reach 4.2 billion people out of a total of 10 bn by the end of the century? In this context, we will start to see its players everywhere. Here is Pepkor:

1/ Pepkor Holdings Ltd., Africa's largest clothing retailer, is accelerating its expansion in Brazil with plans to nearly double its target of opening 50 outlets annually. Its Brazilian subsidiary, Grupo Avenida S.A., is set to unveil 26 stores by the end of September, adding to the 22 stores opened in the first half of the financial year. CEO Pieter Erasmus noted that Brazilian consumers have responded exceptionally well, with each new store exceeding targets. Avenida’s sales contribution to Pepkor has increased to 5.5% of the company's total revenue, up from 4.4% the previous year. Pepkor aims to open as many as 600 outlets in Brazil over the next five to seven years and is also exploring expansion into three other Latin American countries, including Mexico.

2/ In its home market, Pepkor is repositioning its women’s clothing lines to compete with international fast-fashion brands like Shein and Temu, as well as local competitors such as Shoprite Holdings Ltd. The company plans to open about 50 standalone stores this summer. Pepkor, which owns South African chains Ackermans, Pep, and Tekkie Town, has seen a 9.5% increase in first-half revenue, driven by a recovery in Ackermans, where more items were sold at full price and shipping rates were lower. Retail sales overall rose by 8.6%, and the company's fintech unit experienced a 25% increase in revenue, now accounting for 13% of total sales, primarily due to the rapid expansion of affordable mobile phone sales.

3/ Despite these growth efforts, Pepkor’s shares have dropped by 6.3% this year, with a recent decline of up to 1.8% in Johannesburg. The company, which began operations 100 years ago in rural South Africa, now operates 5,823 stores across nine African countries and Brazil. Previously, Pepkor had exposure in Eastern Europe through Pepco Group N.V., but it is now focusing on expanding its footprint in Latin America, leveraging its success in Brazil to potentially enter new markets in the region. LINK

P.S. Brazil’s economy has more in common with African countries than with European ones and has a population of 200 million inhabitants.

Artificial intelligence

Indonesia has more than 700 languages and some people think that AI will save them

1/ Indonesia, with over 700 languages and nearly 800 dialects, faces a significant challenge in preserving its linguistic diversity. More than 400 dialects are at risk of extinction by the end of the 21st century due to modernization and globalization. In response, efforts are being made to leverage artificial intelligence (AI) and large language models (LLMs) to preserve and revitalize these languages. Companies and government initiatives are focusing on developing multilingual LLMs trained in Bahasa Indonesia and other regional languages, despite the limited availability of high-quality data for these languages. This involves digitizing texts and creating diverse data sources to ensure accurate and inclusive AI outputs.

2/ Various projects are underway to address this issue. For instance, Yellow.AI's Komodo-7B and Singaporean startup Wiz.AI's LLM focus on Bahasa Indonesia and other regional languages, though their primary applications are currently in business contexts. Efforts by individuals like Antariksawan Jusuf, who works on preserving the Using language through publications and digitization projects, highlight the community's role in these endeavors. Additionally, collaborations like Indosat Ooredoo Hutchison's partnership with Tech Mahindra to develop Garuda LLM aim to enhance accessibility and inclusivity in the digital realm by incorporating local linguistic nuances. These initiatives underscore the importance of community involvement and diverse data sources to prevent the loss of Indonesia's rich linguistic heritage. LINK

Nanny AI

Ubenwa Health has developed an AI-powered app called Nanni AI, designed to help caregivers understand the reasons behind a baby’s cry more efficiently. Available for free on iOS and Android, Nanni AI functions like a "Shazam for baby cries," categorizing cries into hunger, discomfort, emotion, and pain. By analyzing a baby’s cry for a few seconds, the app provides likely reasons for the distress along with recommendations for soothing. This technology is powered by extensive training data from real-world baby cries, collected through clinical studies in Canada, Nigeria, and Brazil. As parents use the app and provide feedback, the database continues to grow, helping to refine the algorithms and improve the app’s accuracy.

Co-founded by Charles Onu and Samantha Latremouille, Ubenwa initially focused on detecting neurological disorders through baby cries. The app, released in February, aims to enhance the well-being of both babies and parents by improving sleep and overall care. It also includes tracking tools for sleep, feeding, and diaper changes, aiming to serve as a bridge between parents and pediatricians. Ubenwa's long-term goal is to use baby cries as a vital sign for remote health monitoring, potentially detecting medical abnormalities in infant cry sounds. The startup, backed by a $2.5 million pre-seed financing round, is working towards obtaining regulatory approvals from Health Canada and the US FDA.

Glue AI

Glue is a work chat for the AI era. It’s Slack + AI. Here is a snap from their blog:

“Unlike Slack, the atomic unit of conversation in Glue is a thread rather than a channel. Glue threads can be shared with multiple people or groups – and others can be added later as needed – so threads don’t get stuck in a channel. This subtle but fundamental change means less noise because users don’t need to join every channel to get the information they need. Like threads in ChatGPT, Glue threads are topic-focused and have AI-generated subject lines for easy referencing.

Even before the launch of LLMs, there was a growing consensus that channels don't scale with growing teams. With Glue, we’ve set threads free from the shackles of channels and created the most natural way for AI to work alongside us as a teammate. The result is focused, precise, and productive conversations.” LINK

Things happen

Pet insurance is a big business. LINK

How to build 300,000 airplanes in five years. Lessons for what’s coming in SE Asia. LINK

There is a Secret Congress that moves things forward when needed…in the US Congress. LINK

Tourist destinations worldwide are realizing that tourists are the absolute worst; mass tourism, of course. LINK

EU-China EV tariffs: German carmakers fear backlash. LINK

Boycott, Divest, and Sanctions at Columbia. LINK

A memo from Elon Musk: stop using acronyms. LINK

America's strategic industries depend on continued high-skilled immigration. LINK

Data

LUMA’s report: State of Digital 2024. It comprises market and industry trends (CTV, Commerce Media, The Open Web, Creator Economy, and Creative Tech), and the future of the ecosystem. LINK

Spain had 85 million tourists in 2023, double its population. LINK

How ‘red’ Texas became a model for green energy. LINK

Europe has reached its demographic tipping point. LINK

Outside interest

Stop eating ultra-processed foods. LINK

An Instagram star might soon be mayor of one of Mexico’s wealthiest cities. LINK

First view of B-21 Raider. LINK

Austria is a failed state. Politico has a long piece on how Putin hijacked Austria’s spy service. LINK

Europe’s political divide over the return of wolves. LINK

Thank you for being an onStrategy reader!

Interesting newsletters 💡

I will be a speaker at Techsylvania, held between 26-27 June in Cluj. Use the code SORIN24 to get a 24% discount on your tickets. LINK