(#79) Elon Musk sees Tesla at 25-30 trillion USD market capitalisation; Will NVIDIA end like Peleton or Cisco?; Europe must prepare for radical change

Discovering ancient medicine with AI

Today’s menu

Europe must prepare for radical change

Some comments on the IEA’s Global EV Outlook 2024

Elon Musk sees Tesla at 25-30 trillion USD market capitalization

Will NVIDIA end like Peleton or Cisco?

Discovering ancient medicine with AI

My Work

Essay: “Europe’s Dual Economic Future: Craftsmanship and Advanced Technology”

“Europe is at a pivotal moment, where its economic future seems to diverge in two promising directions: (1) the enduring tradition of craftsmanship and (2) the rapid progress of advanced technology. These sectors, represented by companies such as LVMH, Kering Group, and L’Oréal in luxury and craft, and ASML, Novo Nordisk, and SAP in advanced technology (including biotech), present a solid foundation for Europe’s sustainability and economic growth.” LINK

Strategy

Financial Times: “Europe must prepare for five years of radical change”

Last week I was at the EFMD Annual Conference in Bologna (Italy) where I had the chance to hear Mr. Mario Draghi, the former president of the European Central Bank, speaking about Europe’s future. Here are some insights:

1/ Europe must concentrate on three main areas to become competitive: defense industry consolidation, economic change, and expansion preparedness. To improve competitiveness, a significant shift in economic policy should be emphasized in the European mandate for the next five years. This entails strengthening investments in infrastructure and research and development (R&D) as well as defending the European market without resorting to isolationism. It also entails completing the single energy market to guarantee accessible, carbon-free energy. These steps are essential to fending off the US Inflation Reduction Act and China's aggressive industrial policies, both of which have damaged Europe's standing in the global economy.

2/ Second, to handle present issues, Europe has to modernize its defense sector. Past efforts to forge a cohesive European defense have fallen short, leaving the continent with disparate and inadequate defense capabilities. The difficulties in providing military assistance to Ukraine highlight the need for improved coordination and expanded manufacturing capabilities within the European defense industry. This does not imply creating a single army but rather strengthening ties between European nations to effectively supply and manufacture military hardware, guaranteeing a prompt reaction to new threats.

3/ Finally, Europe has to ensure security and stability along its borders to be ready for future EU expansion. To do this and keep the single market's advantages while accommodating new member states, the EU will need to undergo substantial budgetary and governance changes. It will be important to implement the reforms recommended in forthcoming assessments on the single market and European competitiveness. In addition, utilizing private funding, public-private partnerships, and bolstering EU resources through customs duties and taxes will help secure the budget required to support ambitious projects, ranging from the reconstruction of Ukraine to the development of artificial intelligence and low-carbon technologies. LINK

AI frenzy makes NVIDIA the world’s most valuable company

1/ With its stock price surging because of the increasing demand for AI technology, NVIDIA has recently become the most valuable corporation in the world. This has prompted parallels with previous firms that have grown rapidly before making major adjustments. Notably, the company's share price has increased by over 170% this year and by around 1,100% from its October 2022 low, causing its market worth to soar to about $3.34 trillion, exceeding that of heavyweights like Apple and Microsoft. The fervor around artificial intelligence's promise for the world economy and NVIDIA's pioneering position in supplying critical technology for AI applications are reflected in this quick ascent.

2/ Several cautionary stories arise when market leaders from the past are compared. A key participant in the dotcom boom, Cisco Systems saw its share price climb to almost $80 in March 2000, marking the height of its market capitalization before the bubble burst. Similar to NVIDIA's AI processors, Cisco's products were seen as essential to the expanding internet infrastructure; yet, the firm faced challenges in maintaining its value due to growing rivalry and market saturation. In a similar vein, Microsoft, which had also topped the market in the late 1990s, had years of stock stagnation after the dotcom crisis before managing to get back on track and reach new heights in the decade that followed. Another past market leader, Exxon Mobil, had a decline in its value due to varying oil prices, demonstrating the unpredictability that may come with a quick ascent to market dominance.

3/ Maintaining its outstanding financial performance and avoiding competition challenges are critical to NVIDIA's future success. In the most recent quarter, the company's net income increased seven times to $14.9 billion, while sales more than tripled to $26 billion. According to projections, sales can more than quadruple to $120 billion in the current fiscal year and $160 billion by 2026. To sustain this course, however, there will need for constant innovation and fortitude in the face of new rivals in the AI market. NVIDIA's future price-to-earnings ratio of 43, which is higher than the S&P 500's ratio of 21 but still modest when compared to its prior peaks, indicates that investors are still bullish. Although strong profitability and growth projections support NVIDIA's present supremacy, the experiences of Cisco, Microsoft, and Exxon Mobil serve as a warning of the possible instability and difficulties that might come with a quick market ascent. LINK

IEA Global EV Outlook 2024

The IEA Globel EV report for 2024 is out. Some insights:

1/ Electric vehicles sold in China are predominantly manufactured locally using primarily Chinese battery cells. This trend is also observed in Europe and North America.

2/ China possesses ten times the lithium-ion battery cell manufacturing capacity compared to Europe or the United States, with Chinese companies like BYD, CATL, and Gotion representing over 50% of this capacity. In Europe, Korean firms, especially LG, dominate with over 50% market share. In the US, the main players are Tesla, Panasonic, SK Innovation, and LG.

3/ In the United States, Hyundai-Kia ranks second in EV sales after Tesla, while Chinese EVs hold a minor share. Europe's EV market remains largely controlled by European manufacturers such as Volkswagen, Stellantis, and BMW. However, Chinese EVs have increased their market share from 5% in 2015 to 15% in 2023.

4/ Chinese electric vehicles have led the shift towards lithium iron phosphate (LFP) batteries over nickel manganese cobalt (NMC) batteries. This transition is now being adopted in the US and Europe as well.

5/ The rapid adoption of EVs in China can be attributed to their cost-competitiveness with internal combustion engine (ICE) vehicles. Currently, most EVs in China are more affordable than comparable ICE vehicles, even without subsidies or tax incentives.

6/ Electric vehicles are projected to constitute 20% of new car sales globally in 2024, a significant increase from 2% in 2018. In China, New Energy Vehicles (NEVs), which include plug-in hybrid electric vehicles (PHEVs), already account for over 40% of total car sales. In 2023, China represented about 60% of global EV sales, with China, Europe, and the US collectively accounting for 95%. LINK

Tesla’s Optimus strategy

Crazy stuff from Elon at the latest round of investor’s calls.

1/ Elon Musk predicts a significant future presence of humanoid robots in various industries, with a potential ratio of robots to humans being at least 2 to 1, and possibly as high as 10 to 1. This suggests a large-scale integration of robots into everyday industrial tasks.

2/ Also, he envisions a production rate of potentially up to a billion humanoid robots per year. If Tesla captures a 10% market share, this could translate to the production of 100 million units of their Optimus robot annually, which is comparable to the current scale of the global auto industry.

3/ Tesla aims to produce these humanoid robots at a cost of around $10,000 each, which is lower than the cost of manufacturing a car. Selling these robots at approximately $20,000 could yield substantial revenue due to the economies of scale.

4/ With the projected scale of production and sales price, Tesla could potentially generate around $1 trillion in profit annually from humanoid robots alone.

5/ Based on earnings multiple of 20 to 25, the market capitalization of Tesla could reach $20 trillion from the Optimus robot business alone, with additional valuation growth from autonomous vehicle advancements. This would make Tesla the most valuable company by a significant margin, possibly achieving a valuation ten times higher than the current most valuable company.

6/ Musk’s statement indicates a bold vision for Tesla's future, suggesting that the development of humanoid robots and advancements in autonomous vehicles could position Tesla as a dominant player in multiple high-growth industries. LINK

Artificial Intelligence

Luma AI dropped their Sora competitor. LINK

AI can and will solve a lot of things, but now is doing this to traffic jams. LINK

Discovering ancient medicine with AI

1/ Extensive research has focused on creating artificial drugs from the ground up. However, scientists at the Colorado startup Enveda Biosciences believe that the natural environment holds potentially life-saving compounds that are yet to be discovered. Remarkably, 95% of the natural world's chemical composition remains unknown.

2/ In their effort to construct a database of 38,000 medicinal compounds, they discovered that drug discovery is deeply connected to human history, with various cultures independently identifying similar remedies for different diseases across the globe.

3/ According to TechCrunch, about 40% of current medications have origins in ancient practices. Enveda believes there are many more such compounds to be found and is leveraging AI technology to uncover them. LINK

AI-powered career coach, from LinkedIn

Every app (platform) and any product company will try to sell you the “AI dream” to grow their business. Here is LinkedIn with a new AI coach that can do the following:

1/ AI coaches are designed to mimic real-life career experts, providing personalized feedback

2/ AI-generated cover letters and resumes tailored for specific job applications

3/ Enhanced search results for easier access to particular colleagues or companies

4/ A tool for recruiters to extend their reach with AI-generated messages to more candidates. LINK

Perplexity AI gets an endorsement from Seth Godin. LINK

Things Happen

Tim Cook’s interviews with…vloggers. No regrets about any decisions. MKBHD, iJustine, SuperSaf

A day in the life of a California fast-food manager. LINK

China's currency is not influential. LINK

7 Chinese solar companies provide more energy than Exxon, Chevron, Shell, BP. LINK

The EU has realized that “The whole supply chain is subsidized” for making Chinese EVs. LINK

Data

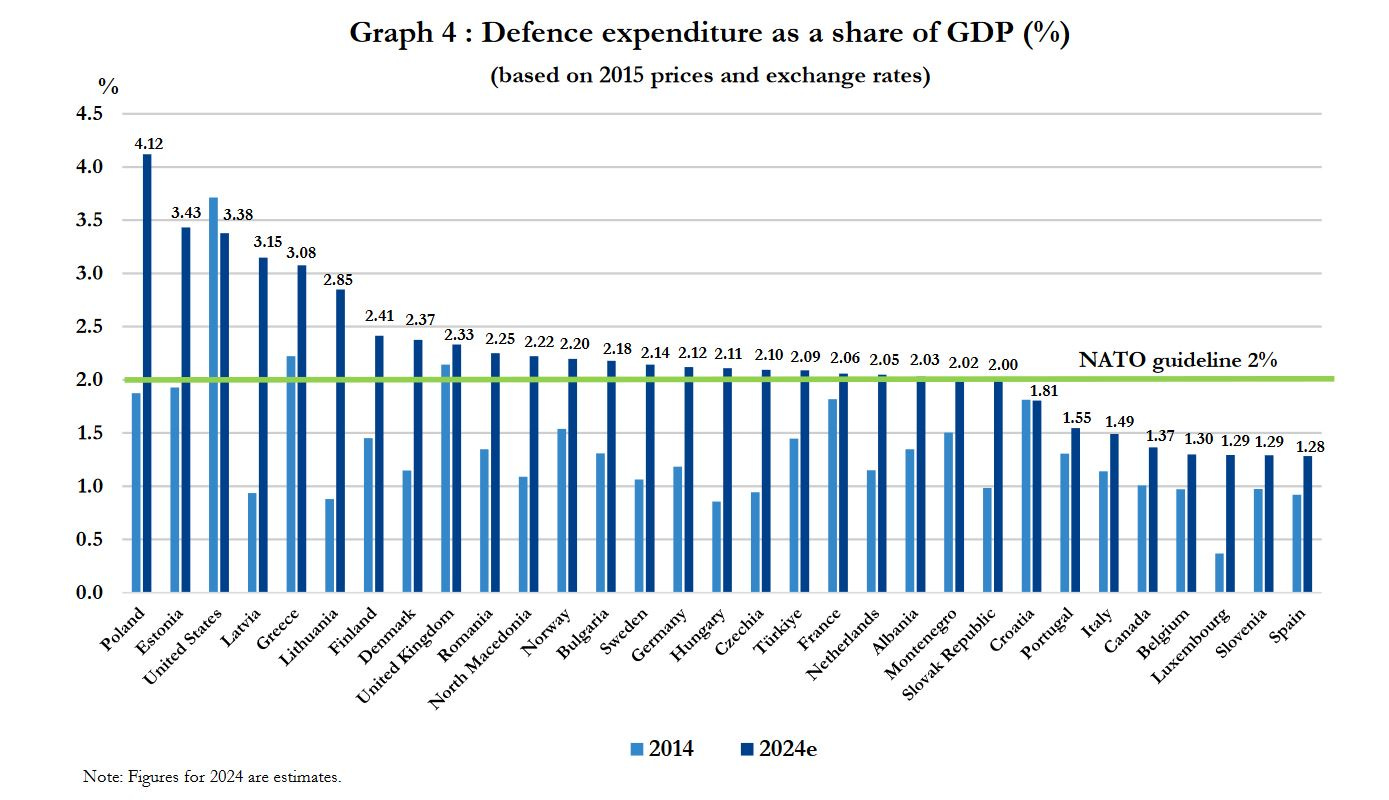

NATO expected spending in ‘24 vs ‘14. LINK

What is harder than a diamond? Selling them. LINK

Cato Institute: “The federal government spends more than $30 billion a year on subsidies for farm businesses and agriculture.” LINK

It’s uncommon to witness several technological revolutions occurring concurrently on a single chart. LINK

Outside Interest

El Salvador is now a model for fighting gangs. Argentine, Honduras

Ecuador suspends visa deal with China as migrants surge. LINK

Keys-To-Go 2 from Logitech, for smartphones, tablets, and laptops. LINK

George R.R. Martin initially didn’t want dragons in the “A Song of Ice and Fire” saga. LINK

Where do the Chinese billionaires move? US, of course. LINK

Thank you for being an onStrategy reader!

Interesting newsletters 💡

Work with me

🧑🏻💻 Each year I do a presentation on what's coming next: business, tech, and (new) business models.

This year I focus on the generative AI implications, the new disruptors, aggregators, the macro environment...and more. (80 slides + Q&A, 1h 30 min)

Write me at contact@onstrategy.eu