(#81) Is Europe transforming into an ‘open-air’ museum?; Revolut is now the Navy, not anymore the Pyrates

Learnings from the Magnificent 7

Today’s menu

Revolut is now the Navy, not anymore the Pyrates

Learnings from the Magnificent 7

Is Europe transforming into an ‘open-air’ museum?

Hydra is probably one of the coolest islands to go in Greece.

China is not Europe’s friend. Bloomberg: “China is developing attack drones for Russia”

Strategy

Revolut is now the Navy, not anymore the Pyrates

Some insights from their 2023 annual report:

1/ Revolut added 11.8 million new customers in 2023, bringing the total to 38 million globally. This growth was accompanied by a 95% year-over-year increase in revenue, reaching £1.80 billion, supported by strong performance across all transactional revenue streams (ie. especially from crypto).

2/ Revolut's revenue diversification strategy proved successful, with no single product stream or region accounting for more than 30% of total revenue. This includes significant contributions from payments, subscriptions, foreign exchange, wealth management, and interest income.

3/ Revolut achieved 'Great Place to Work' certification in eight countries and received numerous accolades, including being named the most popular 'Scale-Up' Graduate Recruiter in 2023. The company also saw 1.9 million job applications, reflecting its strong employer brand and high-performance culture.

4/ Revolut expanded into new markets, including New Zealand and Brazil (Brazil has a population of 200m), and launched significant product updates like Revolut 10. The company also introduced innovative services such as eSIMs and the Ultra plan, which offers extensive benefits across travel, lifestyle, and investing.

5/ Key revenue streams included fee income from cards and interchange (£486 million), foreign exchange and wealth management (£394 million), subscriptions (£244 million), and other income (£85 million).

6/ Gross profit margin improved significantly, growing to 76% in 2023 from 70% in 2022. This was driven by better partner unit costs, reduced fraud losses, and a higher share of high-margin revenue streams

I’m bullish on the company, but once it enters the credit business it will be a European ‘Magnificient’. (small loans and mortgages) LINK

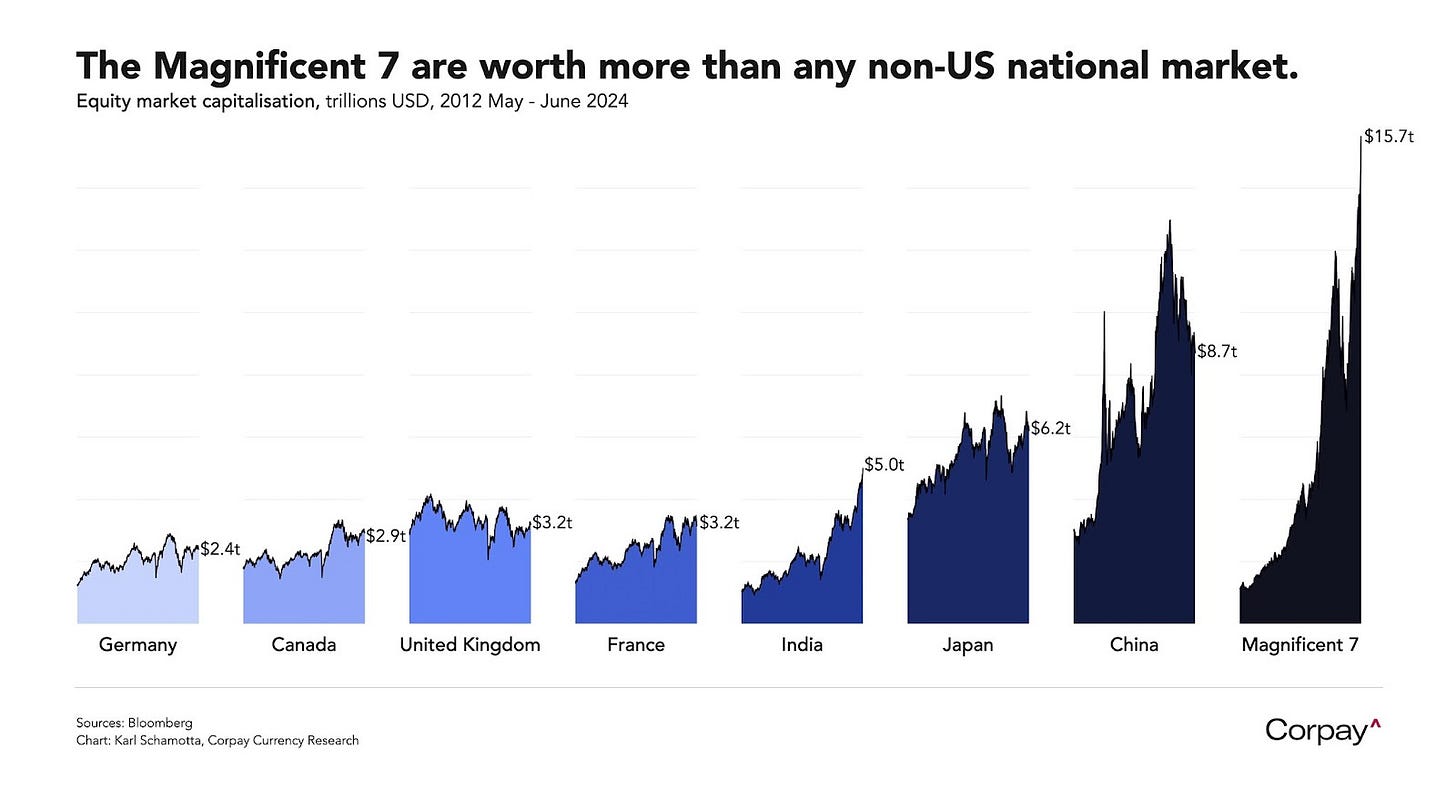

Learnings from the Magnificent 7

Because AI is a sustainable innovation, not a disrupting innovation, the hyperscalers capitalized immensely on this opportunity. McKinsey wrote about this growth and how we can learn:

1/ Companies with enduring competitive advantages develop distinctive capabilities, or "superpowers," integrating people, processes, and technology to outperform competitors. Examples include Toyota's lean manufacturing, Disney's customer experience, and Progressive's analytics-based pricing.

2/ Successful companies build these capabilities using a framework called VECTOR, which stands for Vision, Employees, Culture, Technology, Organizational structure, and Routines. This approach emphasizes a comprehensive, integrated method for developing long-term competitive advantages.

3/ Companies need a long-term vision that articulates the value they aim to create over the next decade. This vision should be linked to the economics of their business models, helping them to continually expand their capabilities and maintain a competitive edge. Examples include LVMH’s commitment to quality and Amazon’s customer-centric vision.

4/ Investing in skill-building for employees is crucial. Leading companies create structured training programs and strategic workforce plans that ensure employees have the necessary skills to support long-term goals. LVMH's comprehensive apprenticeship programs and Netflix's talent management system exemplify this.

5/ A healthy organizational culture that embraces experimentation and innovation is key to long-term performance. Embedding desired mindsets into HR processes, such as hiring and leadership models, ensures that the culture supports the company’s strategic goals. Microsoft’s growth mindset and Netflix’s emphasis on high performance illustrate this.

6/ Successfully integrating technology into core workflows is essential for building a superpower. Companies like Amazon and ASML have embedded advanced technologies into their operations, allowing for rapid innovation and maintaining leadership in their respective fields.

7/ Companies must ensure their organizational structures can adapt and scale their capabilities. This includes creating permanent teams dedicated to sustaining the superpower and establishing routines that embed these capabilities into daily operations. Amazon’s single-threaded leader concept and routine mechanisms for business reviews demonstrate effective structural adaptation. LINK

Is Europe transforming into an ‘open-air’ museum?

Why doesn’t Europe have a trillion-dollar company?

...and here is Nassim Nicholas Taleb:

Some ideas on the topic:

1/ Europe’s future is artisanship (ie. medieval Lindy, as called by Taleb) and advanced tech. I wrote about this here.

2/ Deregulation - the GDPR, the cookies, and many others (especially in the financial industry) have ruined the user experience and brought little to no benefit

3/ Europe’s economy is crappy, but the digital experience is top (= provided free of charge by USA or China). If we make the life harder of these companies they will offer us a crappy internet. (ie. no Apple Intelligence for the EU yet, Threads delayed 6 months, META ‘forced’ to use less targeted ads). What’s 10% of the revenue after all? Not that much. You would want to look at where the future is: Americas, Africa, India, and S-E Asia.

EU, which is governed by bureaucrats, is being transformed into an open-air museum.

Apple in China

1/ Apple’s iPhone shipments in China increased by 40% in May, following a 50% rise in April. This significant rebound is largely due to heavy discounting by major retailers ahead of China's June shopping festival. Overall, smartphone shipments in China rose by over 13%, with foreign brands, predominantly Apple, growing almost four times faster. This recovery comes after Apple experienced a nearly 10% decline in global iPhone shipments in the first quarter, driven by poor sales in China. Apple and its resellers have been cutting prices since early 2024 to regain market share from Huawei Technologies Co., which is gaining ground with nearly a billion active devices on its own operating system.

2/ Apple's aggressive discounting strategy in China, leading to a substantial rebound in iPhone shipments, highlights the competitive pressures in the premium smartphone market and that not even they can’t fight with the price discounts only based on brand… While the immediate results show a positive trend, this approach raises questions about long-term sustainability and profitability. Furthermore, Huawei's growing presence with a robust ecosystem of nearly a billion devices signals a formidable challenge for Apple, emphasizing the need for continuous innovation and strategic pricing to maintain its market position in one of its most crucial markets. LINK

Ford and the transition to EVs

Ford CEO Jim Farley: “If we cannot make money on EVs, we have competitors who have the largest market in the world, who already dominate globally; If we don’t make profitable EVs in the next 5 years, what is the future? We will just shrink into North America.”

How to become irrelevant in 5 steps:

1/ Underinvest in software in the supply chain (eg. battery technology is a must)

2/ Run only a local strategy

3/ Ignore the global market because you are not profitable

4/ Play in the local market

5/ Shrink in size, and innovation, and become irrelevant and/or go bust.

I’m not sure Ford realizes the path has taken. LINK

Artificial Intelligence

Klarna goest turbo AI

From Yahoo Finance: “Bringing more of its campaign creation in house has meant Klarna has cut its spend on external agencies by 25 percent or about $4 million annually. In late February, the company said its partnership with OpenAI had enabled it to create an agent that has the capability to do the work of 700 full-time agents. It cut its ties with some third-party customer service agents, but at the time said it had not parted ways with any internal employees.” (LINK)

Conclusion: A shocking detail from this article is that Klarna's partnership with OpenAI has created an AI agent capable of performing the work of 700 full-time agents, and this is only the beginning.

The tech industry wants nuclear energy for their AI plans. LINK

Things Happen

Ming-Chi Kuo about the AirPods roadmap: “IR Camera-Equipped AirPods to Enhance User-Device Interaction and Strengthen Apple’s Spatial Audio/Computing Ecosystem.” LINK

Apple Watch is becoming doctors’ favorite medical device. LINK

Building the future of genome design. LINK

[Study]: “Wage growth faster in immigrant-intensive industries”. LINK

Vanguard: “70% of wealthy families lose their wealth by the second generation, and 90% by the third.” LINK

How regulation holds back innovation. LINK

China’s global strategy: colonialism by debt. LINK

Data

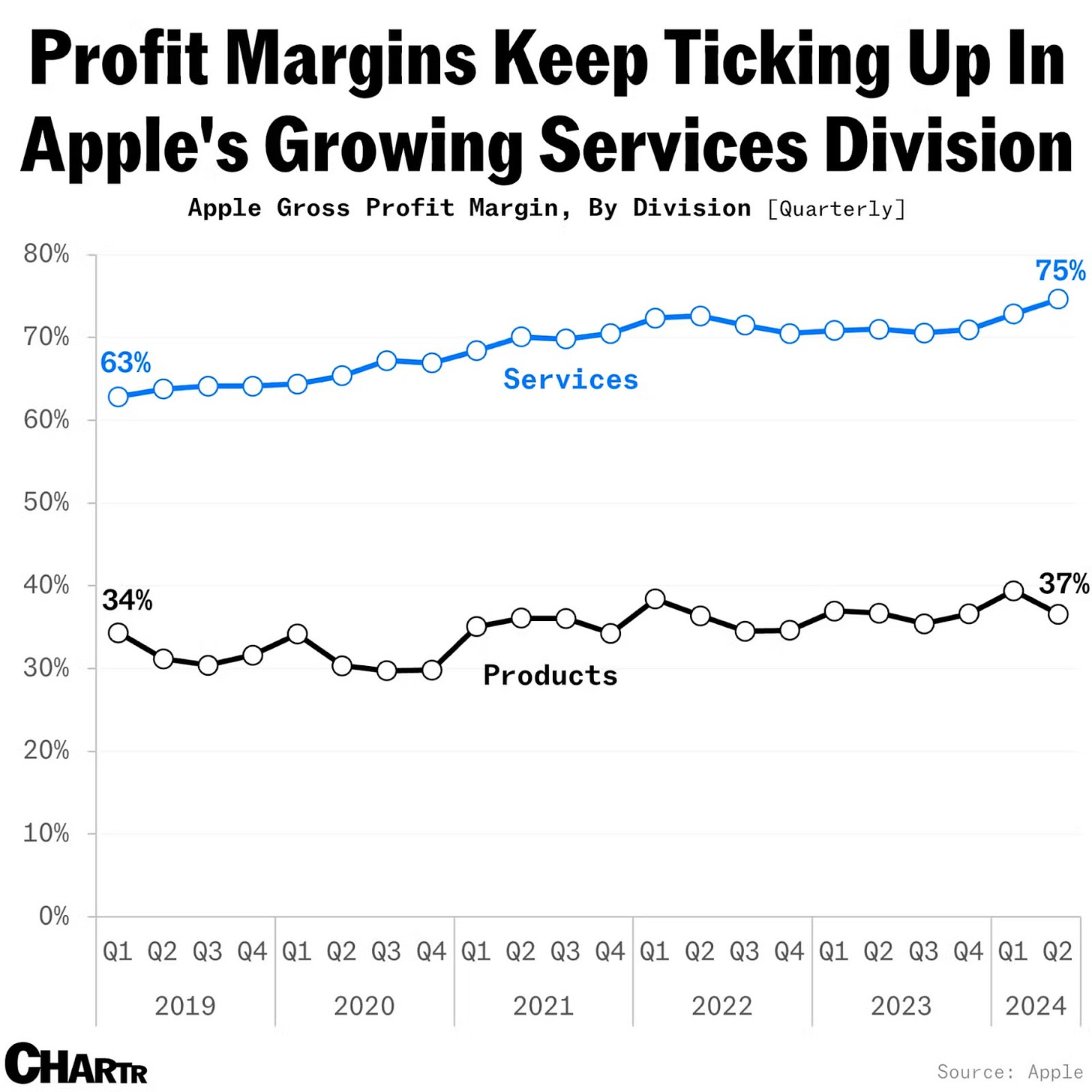

Apple’s margins for products are an envy in the industry. LINK

China’s energy demands are achieved through coal, nuclear, and solar.

Battery packs

Battery pack prices have dramatically decreased. For large quantities, the cost to completely offset a home's peak electricity demand is now roughly $1,500. This enables homeowners to avoid paying for electricity to a large extent. LINK

On AI development

One key takeaway from the last ten years of AI development is that betting against deep learning is always a mistake

Outside interest

Hydra is probably one of the coolest islands to go in Greece. LINK

China is not Europe’s friend. Bloomberg: “China is developing attack drones for Russia” LINK

There is a Fight Club for drones in San Francisco. LINK

Notion launched Notion Sites. LINK

Thank you for being an onStrategy reader!

Interesting newsletters 💡

Work with me

🧑🏻💻 Each year I do a presentation on what's coming next: business, tech, and (new) business models.

This year I focus on the generative AI implications, the new disruptors, aggregators, the macro environment...and more. (80 slides + Q&A, 1h 30 min)

Write me at contact@onstrategy.eu