(#87) AirBnB is starting to have headaches; Breaking Google’s monopoly; Apple plans to monetize AI

Harvard Business Review: Inside the First Year as a CEO

Strategy

Buc-ee’s is reinventing the gas station in Texas and beyond

I’ve been to the Buc’ee store back in 2010 and I was really impressed. Fast forward 14 years the ‘gas station’ has reinvented.

1/ Buc-ee's has successfully differentiated itself in the gas station and convenience store market by focusing on exceptional customer experience, particularly through clean bathrooms, diverse product offerings, and a unique brand identity. This demonstrates the power of turning mundane services into memorable experiences.

2/ The company's approach to expansion, moving from a regional Texas brand to a multi-state operation, showcases a deliberate scaling strategy. This includes maintaining consistency in their oversized store format and unique offerings while adapting to new markets. Easy in theory, extremely hard in execution.

3/ Buc-ee's has cultivated a strong brand following, evidenced by large social media groups and merchandise popularity. This demonstrates the potential of creating a lifestyle brand even in an unexpected industry like gas stations.

4/ The use of humorous billboards and viral marketing techniques has helped Buc-ee's build brand awareness far beyond its physical locations. This strategy shows the importance of creative, attention-grabbing marketing in driving customer interest and visits.

5/ As Buc-ee's expands, maintaining consistent quality across all locations is crucial. This challenge highlights the importance of robust operational systems and training programs in preserving brand value during rapid growth phases. LINK

AirBnB is starting to have headaches

Here are my insights:

1/ Airbnb is struggling to adapt its premium-focused strategy to a market that is increasingly demanding budget options. This highlights the importance of continuously reassessing product-market fit, especially in changing economic conditions.

2/ The company faces significant regulatory hurdles in major markets like New York, Barcelona, and Paris. This demonstrates the need for businesses to (1) deal with complex regulatory environments and (2) potentially pivot to new markets (e.g., Asia and Latin America) when faced with restrictions.

3/ Airbnb's ongoing issues with bad listings underscore the challenges of maintaining quality in a decentralized, peer-to-peer platform. This reflects the broader difficulties of scaling while ensuring consistent user experiences in platform-based business models.

4/ Airbnb's increased marketing spending has not yielded proportional returns, leading to investor skepticism. This illustrates the importance of demonstrating clear ROI on marketing investments and managing investor expectations effectively.

5/ Airbnb's shift from a venture-capital subsidized model to a publicly traded company highlights the challenges of maintaining growth and profitability under increased scrutiny. This transition requires a strategic pivot from rapid expansion to sustainable, profit-driven. The end of free money ended two years ago. It’s time for companies to understand this. LINK

Breaking Google’s monopoly

Google loses antitrust case over search. We’ll see what’s next, but breaking the company should be a step further. We had this situation in the past with Standard Oil which broke into 34 companies and some of those companies ended up listing on the NYSE and now have a global presence and a market valuation so large that Standard Oil is just a distant memory.

So, for Google and innovation in general, a break-up is necessary. CNBC, Court ruling

Anduril raises $1.5 Billion to “Rebuild the Arsenal of Democracy

From their blog:

“Today, Anduril Industries announced it has secured $1.5 billion of funding for its Series F round to hyperscale defense manufacturing. This funding will enable Anduril to increase hiring, enhance processes, upgrade tooling, increase resiliency in its supply chain and expand infrastructure. Anduril is also investing in Arsenal, the manufacturing platform for modern warfare. With Arsenal, Anduril’s goal is to manufacture and produce tens of thousands of autonomous weapons systems addressing the urgent needs of the United States and our allies.” LINK

Some insights:

1/ In the last three decades the USA lost a large part of its defense manufacturing (ie. from missiles to ships).

2/ The cost of current defense capabilities cost tens and hundreds of billions of US dollars only in development.

3/ The future of war is moving at the intersection of drones, missiles, lasers, and robots; all with AI capabilities.

Anduril is the best-positioned US company to deliver for the next war that will come, probably in S-E Asia, and will help the USA remain the main power in the 21st century.

The oversupply will eat China

1/ According to a recent Goldman Sachs report, Chinese production is outpacing global demand in multiple sectors. While some industries, such as lithium batteries and solar components, may soon reduce output to align with market needs, other areas like electric vehicles (EVs) and steel are likely to continue experiencing excess capacity.

2/ Goldman's analysis indicates that Chinese solar module production capacity now exceeds global demand by 100%, while lithium battery capacity is approximately 50% higher than required. This oversupply has resulted in significant price reductions, with some products seeing decreases of up to 55% since early 2023, making investments less attractive.

3/ The report suggests that while solar components and lithium batteries may soon reach a turning point, it could take an additional two to three years for EV and power semiconductor supply to balance with demand.

4/ Analysts predict that Chinese market share in international markets could decrease by up to 19% for lithium batteries and solar modules, contrasting with gains of up to 40% observed from 2020 to 2023. However, sectors such as EVs, air conditioners, and power semiconductors might still see modest growth of around 4%, though this represents a slowdown compared to recent years. LINK

The Verge: “Humane’s daily returns are outpacing sales”

If you have forgotten how the Humane AI pin looks like here is a photo reminder:

Here is what I wrote in November 2023, in Newsletter #48:

“ Why I'm skeptical?

While the concept of a frictionless AI experience is alluring, I'm somewhat skeptical. For AI to truly integrate into our daily lives, it needs to perceive the world as we do. It should not only be about effortless interaction; it needs to see what we see, hear what we're saying, and perhaps even understand our surroundings with similar intuition. LINK

👓 Towards a frictionless world:

This leads me to think - wouldn't glasses be a more suitable form factor? Glasses sit naturally at the intersection of our vision and hearing, providing an ideal platform for an AI to engage with our environment more holistically.

This isn't to undermine the potential of the AI Pin. It’s a step towards the future of wearables. But it sparks a conversation: What is the ultimate form of wearable AI? How do we balance innovation with practicality and comfort?”

I was right and up to this date I have nothing to add, beside my general take on AI and devices. My take, The Verge

Harvard Business Review: Inside the First Year as a CEO.

Some insights:

“We asked participants to address three specific milestones:

1/ How long did you wait to make the first change to your team? The average time taken for a transitioning CEO to make the first change to their leadership team was 2.8 months. Every CEO participant had met this milestone.

2/ How long did it take to get right people in place? The average time for a CEO to get the “right people” in place on the senior leadership team jumped to 9.2 months, with much greater variation depending on experience. The fastest participant completed their desired appointments within 4.5 months.

3/ How long did it take for the team to start performing well? The final milestone was most elusive: The average tenure of the CEOs interviewed was 14.25 months, and more than half (55%) said that they were still working to get their team performing well.” LINK

Apple considers a subscription to its Apple Intelligence service

There are three key insights here:

1/ Apple is considering transforming its artificial intelligence features into a paid subscription model starting with 2027, potentially branded as "Apple Intelligence+". Industry analysts speculate this service could be priced at up to $20 per month, either as a standalone offering or as part of an enhanced Apple One subscription package.

2/ The company's services division has seen significant growth, with revenue reaching a record $24.2 billion in the recent quarter. By monetizing AI features, Apple could offset slowing hardware sales, recoup its substantial investments in AI technology development, and potentially offset the search agreement with Google (ie. $20 bn per year)

3/ In the meantime, Apple is making considerable investments in AI infrastructure, including developing proprietary AI servers using its M2 Ultra chip and planning future AI-specific processors. Analyst Ming-Chi Kuo estimates Apple's spending on AI-related hardware could reach $4.75 billion in 2024, underlining the company's commitment to advancing its AI capabilities. Mark Gurman, CNBC, Ming-Chi Kuo

Artificial Intelligence

AI agents are coming after your job

“On average, when agents can do a task, they do so at ~1/30th of the cost of the median hourly wage of a US bachelor’s degree holder." LINK

Mistral AI Introduces Agents!

You can now build and fine tune your AI model. Demo, Paper, Announcement

How AI Changes Venture Capital. LINK

Wardware.ai - Build your AI apps 20x faster with Natural Language Programming. LINK

Things Happen

Amazon sells more retail ads than Google. LINK

The Wall Street Journal: Foreign TikTok networks are pushing political lies to Americans. LINK

How Microsoft spread its bets beyond OpenAI. LINK

Who would have thought that it was so stressful working at the Gates Foundation? LINK

Google DeepMind trained a robot to beat humans at table tennis. LINK

[Essay] The right kind of stubborn. LINK

Are electric cars and trucks too heavy for bridges? LINK

Data

The US Chips Act is a success and should be copied & adapted by the EU. LINK

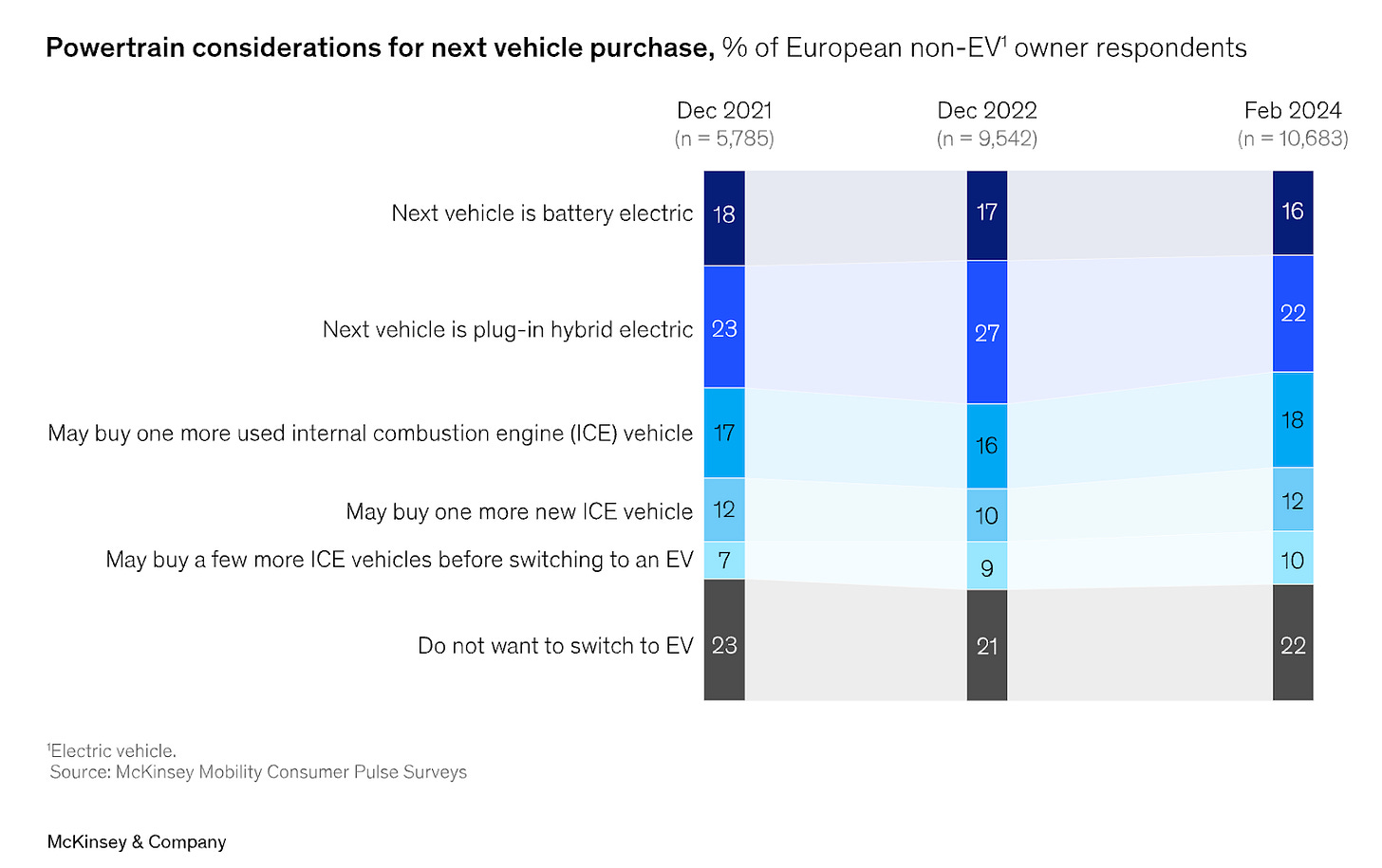

How European consumers perceive electric vehicles. LINK

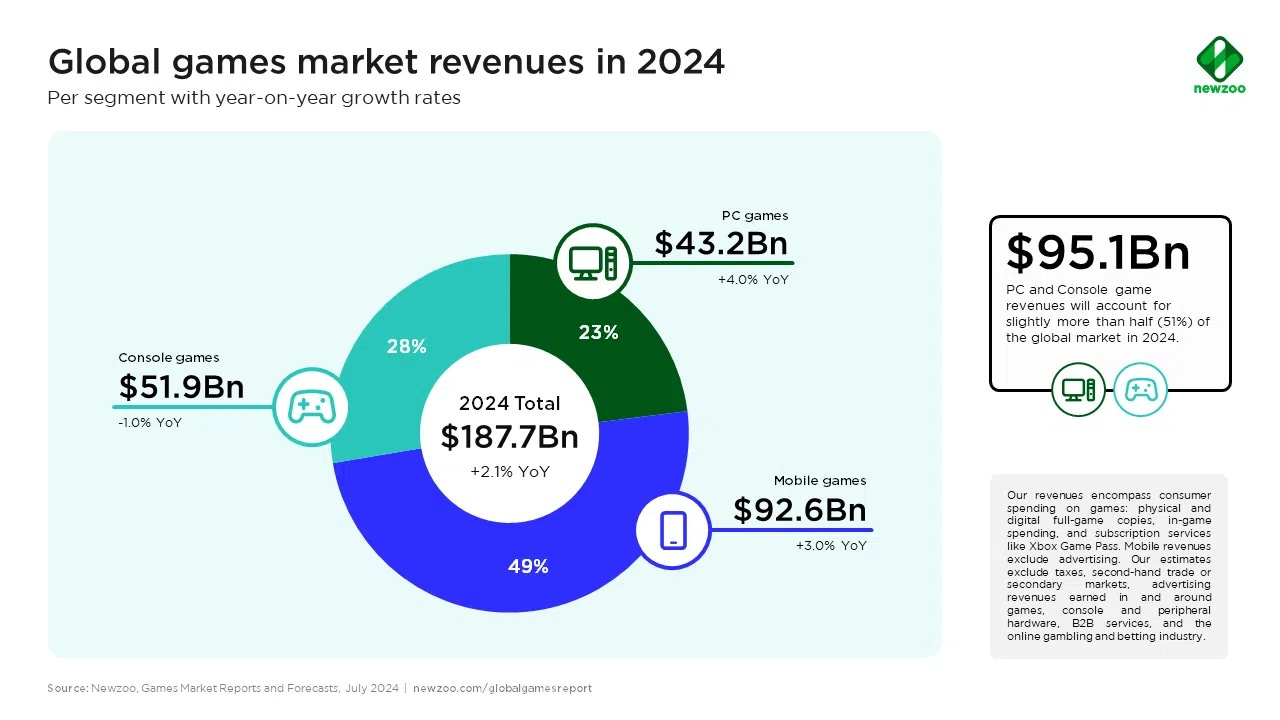

NewZoo: “The global games market will generate $187.7 billion in 2024”. LINK

Outside interest

Book recommendation for parents: The Anxious Generation, by Jonathan Haidt.

From page 290:

1. No smartphones before high school

2. No social media before 16

3. Phone-free schools

4. Far more unsupervised play and childhood independence. LINK

Recent data shows Millennials and Gen X have a higher risk for 17 cancer types compared to Baby Boomers. This increased susceptibility is particularly notable for leukemia, breast cancer, and gastric cancer. LINK

Tim Walz is the VP proposal from Kamala Harris. Walz spent one year teaching in China. More about this experience in the China Talk newsletter. LINK

Air Horse One. LINK

China admits that destroyed key Baltic gas pipeline ‘by accident’. LINK

Thank you for being an onStrategy reader!

Interesting newsletters 💡

Work with me

🧑🏻💻 Mostly strategy stuff: consulting, board of advisors, workshops and presentations.

Write me at contact@onstrategy.eu