On today’s menu:

1. new iPhones…and more

2. Mario Draghi’s report on the EU’s future

3. Waymo and the future of transportation

4. Only Fan’s business model

5. AI detects breast cancer 5 years in advance

Onto the update:

Strategy

Apple’s new stuff: iPhones, AirPods and Watches

Some ideas after seeing the event last night:

1/ At the latest quarterly reports call with investors Tim Cook said that this new line-up will drive up sales compared to a supercycle. Well, will not happen. Why? Because the company hasn’t released its Apple Intelligence capabilities and will only do it gradually, so the supercycle will happen next year with the iPhone 17

2/ So much incremental innovation, but somehow you see the company going after new categories (e.g. hearing deficiencies)

3/ Apple Watch 10 now has a bigger screen than Ultra 2. I imagine many will make the switch, which reminded me of Steve Jobs: “If you don't cannibalize yourself, someone else will.”

4/ The basic 16 model is so compelling that will be a hit. Apple realized now that the best market to go after is just below the ‘PRO"‘ where there are many Android players.

5/ The prices haven’t changed in years. The Iphone Pro model which costs $999 is now $177 cheaper than in 2020 (in real terms). Capitalism will always drive prices down. LINK

…otherwise, we have reached peak smartphone.

Mario Draghi on EU’s future

If someone understands Europe’s problems for sure that one is Mario Draghi. In his 328-page reports, he shows exactly what’s wrong with the EU: overregulation, disastrous ‘green’ plans, high energy prices, lack of common policies on many things, etc. He points clearly that at the core of the EU’s problems is Germany and its business model.

Just a reminder, Germany's business models rely on cheap energy from Russia, cheap workforce from Eastern Europe, and exports (mainly to China). This model is flawed from all points of view.

Here is what I wrote in June after hearing him at the EFMD Annual Conference in June 2024, in Bologna, Italy:

“1/ Europe must concentrate on three main areas to become competitive: defense industry consolidation, economic change, and expansion preparedness. To improve competitiveness, a significant shift in economic policy should be emphasized in the European mandate for the next five years. This entails strengthening investments in infrastructure and research and development (R&D) as well as defending the European market without resorting to isolationism. It also entails completing the single energy market to guarantee accessible, carbon-free energy. These steps are essential to fending off the US Inflation Reduction Act and China's aggressive industrial policies, both of which have damaged Europe's standing in the global economy.

2/ Second, to handle present issues, Europe has to modernize its defense sector. Past efforts to forge a cohesive European defense have fallen short, leaving the continent with disparate and inadequate defense capabilities. The difficulties in providing military assistance to Ukraine highlight the need for improved coordination and expanded manufacturing capabilities within the European defense industry. This does not imply creating a single army but rather strengthening ties between European nations to effectively supply and manufacture military hardware, guaranteeing a prompt reaction to new threats.

3/ Finally, Europe has to ensure security and stability along its borders to be ready for future EU expansion. To do this and keep the single market's advantages while accommodating new member states, the EU will need to undergo substantial budgetary and governance changes. It will be important to implement the reforms recommended in forthcoming assessments on the single market and European competitiveness. In addition, utilizing private funding, public-private partnerships, and bolstering EU resources through customs duties and taxes will help secure the budget required to support ambitious projects, ranging from the reconstruction of Ukraine to the development of artificial intelligence and low-carbon technologies.”

Three hours after the report came out Germany said that it opposed it. It would not end well for Germany. This is what I wrote in Newsletter #89: "

“If Germany goes then it will be together with Austria, Hungary, Slovakia, and maybe the Netherlands. Those who will be somehow fine: Poland, Romania, and Turkey.”

There are only two options for the EU: (1) business as usual where Germany has super powers and (b) new Europe with less power for Germany. We’ll see how Italy and France will play option #2, but overall the party is over.

Everyone in the EU has to change. Report, EFMD, Rejection

Problems in paradise with America’s favorite sriracha brand

There are two lessons from this story written by The Economist:

1/ Supply chain resilience is critical for business continuity. Huy Fong Foods' overreliance on a single supplier for a crucial ingredient led to severe production issues when that relationship ended. Diversifying suppliers and having contingency plans are essential for mitigating supply chain risks.

2/ Brand loyalty has limits in the face of product unavailability. Despite Huy Fong's strong brand recognition and customer base, competitors were able to quickly capture market share when Huy Fong couldn't meet demand. This underscores the importance of consistent product availability and the potential for rapid market shifts when established players falter. LINK

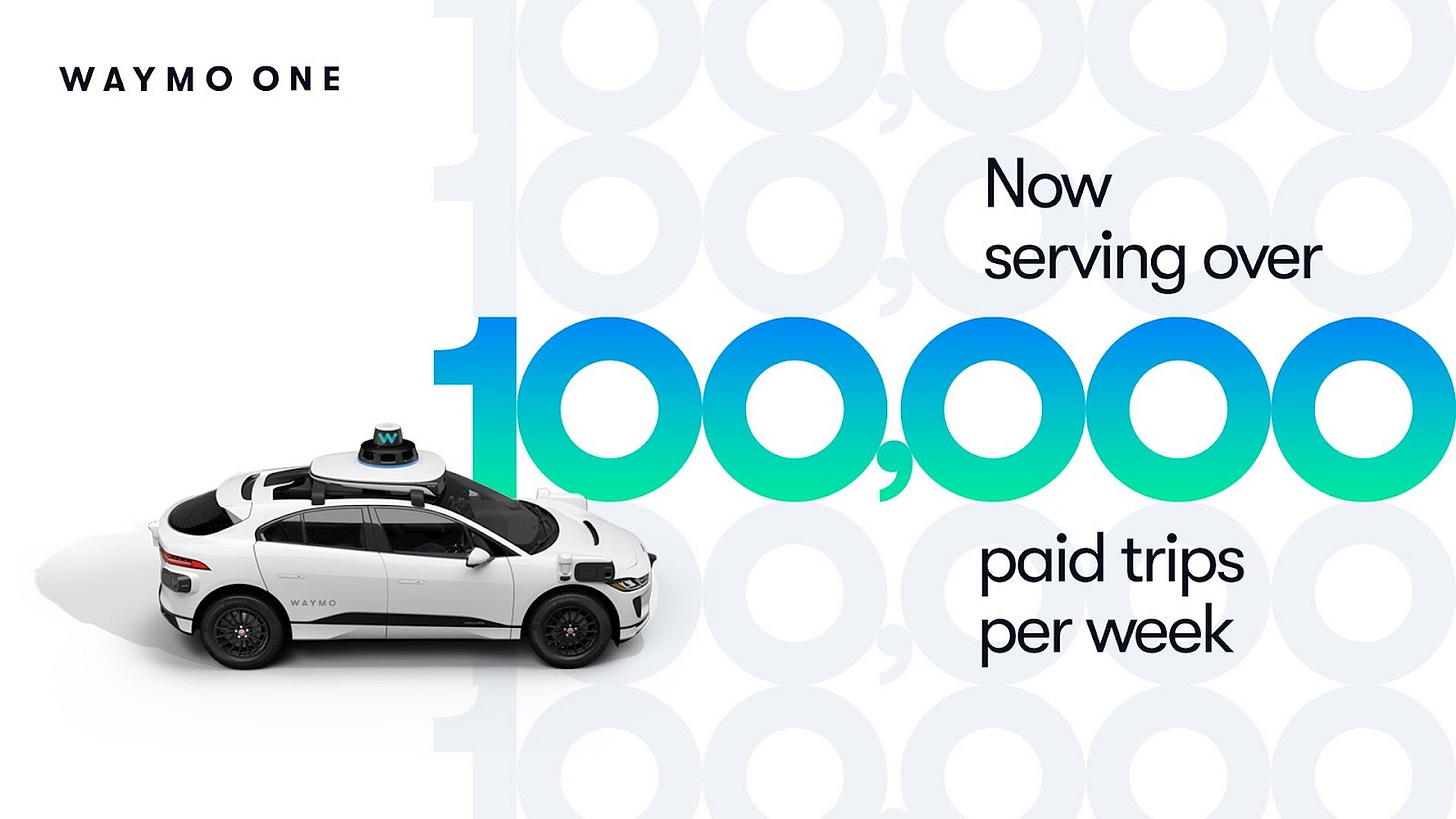

Waymo and the future of transportation

When it comes to autopilot on short distances companies like Waymo will do most of the work by 2030. On top, they will do it more efficiently and safely. Now they have plenty of data to prove it. LINK

So, yes, probably our kids won’t know how to drive. LINK

Cedric Chin on running a fine dining restaurant in a recession

How? Simple:

1/ The 95/5 principle, as proposed by a notable restaurateur, suggests a strategic approach to financial management and customer experience in the hospitality industry. This concept advocates for meticulous control over 95% of operational expenses while allocating 5% for discretionary spending aimed at enhancing customer satisfaction (ie. spend on crazy stuff that will over impress the client and make the place viral).

2/ The core idea is to maintain strict fiscal discipline for the majority of the budget, allowing for precise cost management. Simultaneously, it encourages targeted investments in unique, memorable experiences for guests, even if these investments may seem financially unconventional at first glance.

A practical illustration of this principle can be seen in the implementation of a gelato service. While the overall setup was designed with cost-efficiency in mind, representing 95% of controlled spending, the decision to invest in distinctive serving utensils exemplifies the 5% allocated for creating a standout customer experience (e.g. using blue spoons). This small but impactful choice had the potential to elevate the overall perception of the service, potentially leading to increased customer satisfaction and loyalty. LINK

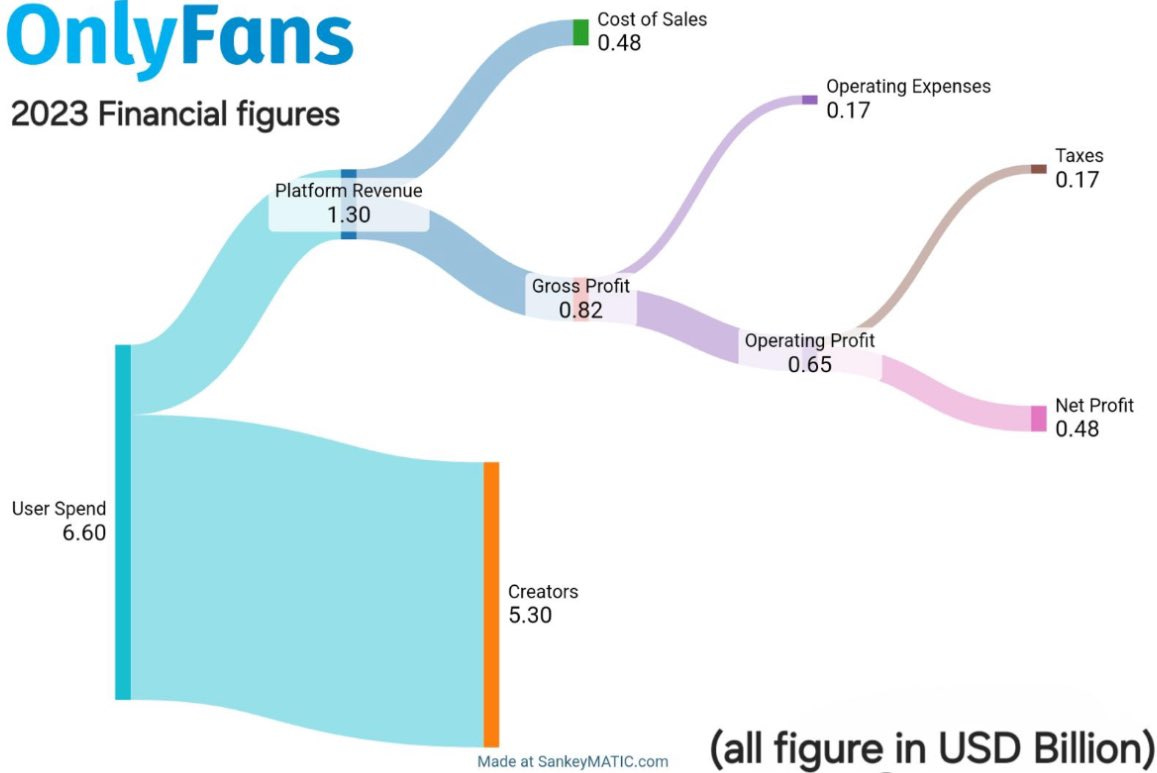

Only Fans is a cash machine

Just take a look at the numbers:

$6.6B in user spend and $5.3B paid out to creators

$1.3B in net revenue, while having $650MM in operating profit

All figures are up ~20% YoY (versus ~17% YoY in 2022)

All of this is without any VC or external funding. Probably the company will look to go mainstream. LINK

Artificial Intelligence

Microsoft introduced AutoGen Studio - a low-code interface for building multi-agent workflows. LINK

AI detects breast cancer 5 years in advance

Things Happen

[Essay] Andrew Chen: The end of the 1 billion active user ad-supported consumer startup. LINK

[Podcast] Jon Hartley with Daron Acemoglu (MIT Economics Prof) on Institutions, Economic Growth, and AI. LINK

Financial Times: Top 100 Masters in Management. LINK

Good news on the batteries front. LINK

Spotify is now fighting fake bands. LINK

Burning Man is struggling to sell tickets. LINK

Industry reports

Roland Bergers’ EV Charging Index 2024. LINK

So many interesting things from Meta’s insights on Llama usage. LINK

TikTok shopping treds. LINK

The Top 100 Gen AI Apps — 3rd edition. LINK

Curiosity corner

27 of the top 30 cities in the USA with the most crimes are run by Democrats. LINK

Jony Ive’s (ex-Apple, now LoveFrom) reinvents the button with Moncler. LINK

ESG undermines Social Welfare:

“So, when we pursue profit, it is always a reflection of an increase in social welfare. Profit isn’t just “making more things.” Rather, it is the allocation of goods and resources to the most urgent economic demands in society. This is done so by the capitalist-entrepreneur who anticipates future desires of the consumers and forwarding present funds for future goods. If they correctly anticipate what society will desire and value in the future, they reap profit. If they do not, they are punished with losses for wasting resources. Those resources are then liquidated and more competent entrepreneurs are able to make use of scarce resources.” LINK

History podcasts are enjoying a golden age. LINK

Scientists: “Horses can plan ahead and think strategically.” LINK

Thank you for being an onStrategy reader!

Interesting newsletters 💡

Work with me

🧑🏻💻 Mostly strategy stuff: consulting, board of advisors, workshops and presentations.

Write me at contact@onstrategy.eu