(#93) AI Agents are here; How Netflix won the streaming wars

Antarctica's ozone hole is healing and set to recover fully by 2066

Knowledge Partner: ENGIE Romania

Soluţiile de decarbonare aduc beneficii financiare.

Investițiile în sustenabilitate nu doar reduc amprenta de carbon, ci generează şi economii semnificative pe termen lung, traducându-se în avantaje economice concrete.

3 soluții cheie pentru reducerea emisiilor de CO2 oferite de ENGIE Romania:

1. Audit energetic - Primul pas necesar este acela de a măsura emisiile totale de CO2 ale companiei şi de a determina de unde provin acestea. Un audit energetic și de emisii poate identifica domeniile cu cel mai mare impact și poate oferi recomandări concrete pentru reducerea acestora. Solicită aici o ofertă personalizată pentru realizarea unui audit energetic de către experții ENGIE.

2. Înlocuire echipamente depăşite tehnic - Utilizarea unor echipamente mai eficiente, de nouă generație, ce consumă mai puțină energie şi au un cost de mentenanță redus, contribuie la reducerea costurilor pe termen lung şi, implicit, a emisiilor de CO2. Obține aici o ofertă personalizată de la ENGIE, pentru înlocuirea echipamentelor.

3. Tranziție către energie regenerabilă - Investițiile în surse de energie regenerabilă, cum ar fi energia solară sau eoliană, pot reduce dependența de combustibilii fosili și pot contribui la diminuarea emisiilor de CO2, reducând, în acelaşi timp, costurile lunare cu energia. Află aici cum poți face tranziția la energie verde cu ajutorul soluției complete de panouri fotovolatice de la ENGIE.

Strategy

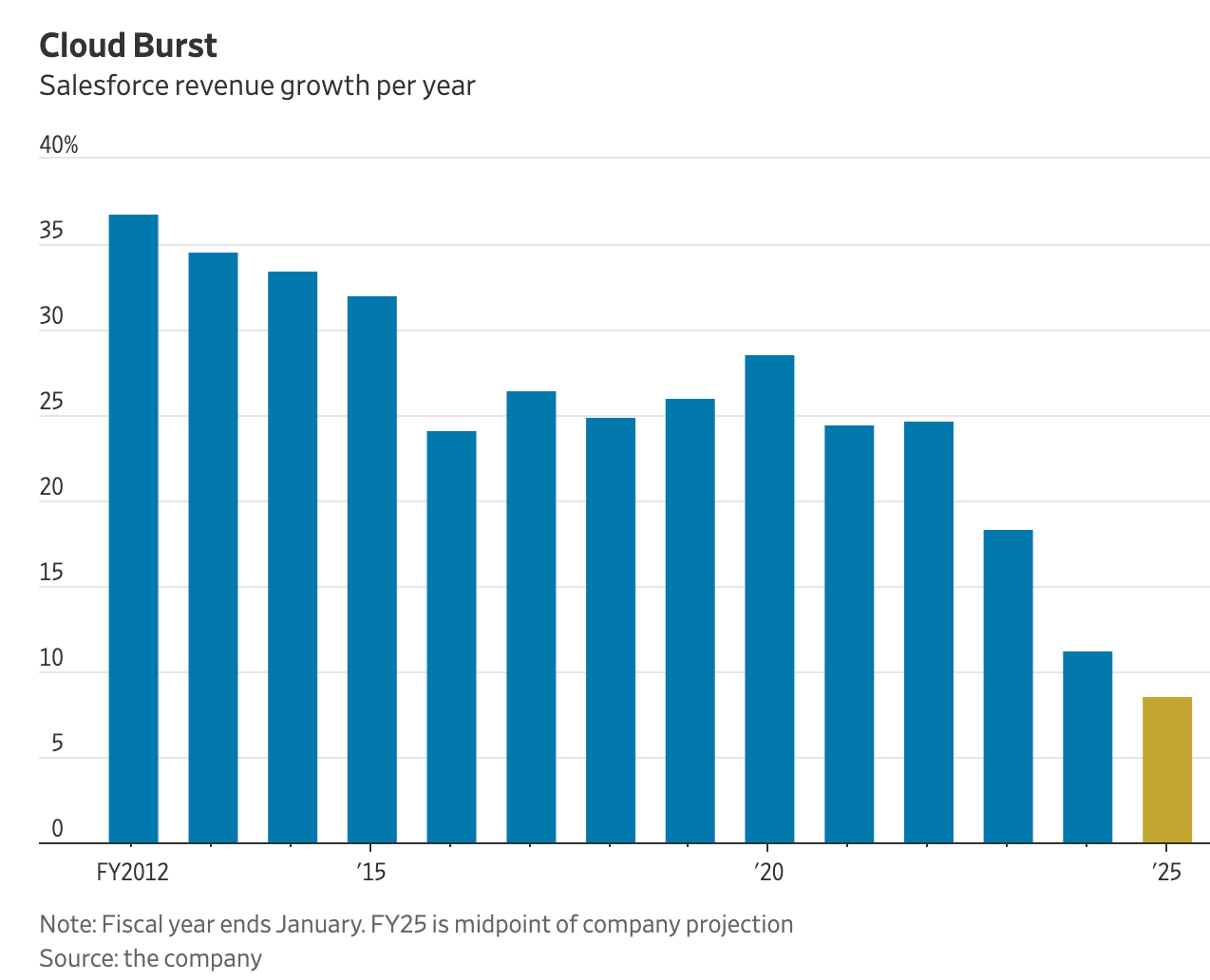

Salesforce goes full-on AI with Agents

Few remember that SalesForces started directly in the cloud. You didn’t have to install any software. +26 years later the company is looking for a new drive: AI Agents

In their annual presentation its CEO, Mark Benioff, presented several hints about where the company is heading:

1/ Salesforce is shifting its AI strategy from human-assisting tools to autonomous AI "agents" that can handle tasks like customer service without human supervision. This represents a significant change from their previous "human in the loop" approach.

2/ The company is introducing a new pricing model for AI services, charging $2 per conversation with AI agents. This move aims to protect Salesforce's revenue if AI leads to job losses among their customers, as their traditional per-user subscription model could be impacted.

3/ Salesforce openly acknowledges the potential for AI to replace human workers, with CEO Marc Benioff stating that the new AI agents will allow companies to increase workforce capacity without hiring additional full-time employees.

Every tech stock that is increasing these days is mostly due to AI advancements. And deploying AI Agents is one step further in white-collar automation, as described in Newsletter #83. WSJ, Bloomberg

Snap Spectacles are a distraction for the company that is losing money

I lost count of how many hardware initiatives this company had so far. Do people at Snap understand what are their strengths and weaknesses? I don’t think so…

Why spend time, money, and energy to build something that is not in your core skills? This only takes attention from the real problems this company faces. And what are those problems? Well, their CEO, Evan Spiegel, said it in a public letter to its employees:

“You may be wondering why, with all of the progress we’ve made in our business over the last year, our share price performance has lagged the overall market. The answer is simple: our advertising business is growing slower than our competitors. The growth of our digital advertising business is one of the most important inputs to our long-term revenue potential, and investors are concerned that we aren’t growing faster. [...] In Q2, even as our upper funnel brand revenue declined by 1%, our lower funnel direct response revenue grew by 16%.”

Focus, man! You need to focus! Spectacles, Letter

Ford’s CEO is scared about Chinese competition

Well, there is no surprise here. I have written dozens of times on the topic, so here are some ideas from The Wall Street Journal after Ford’s CEO's visit in China:

1/ Chinese EV makers have rapidly evolved from imitators to innovators, challenging established global automakers with superior technology, cost structures, and especially state subsidies.

2/ Ford's strategic pivot, including refocusing on commercial vehicles in China, demonstrates the inability to have a compelling product for the main category of cars.

3/ Chinese manufacturers' ability to produce high-quality EVs at significantly lower price points is forcing Western automakers to radically rethink their cost structures and production methods.

4/ By leveraging government support and a focus on EVs, Chinese automakers have surpassed traditional car companies in key technologies, particularly in-vehicle software and user experience.

5/ Chinese EV makers are using a phased approach to international expansion, starting with developing markets and Europe, before potentially targeting the heavily protected U.S. market (through opening plants in Mexico and other key markets).

6/ Ford CEO Jim Farley's hands-on approach to understanding and responding to the Chinese EV threat shows the importance of executive-level engagement in applying their agreed strategy.

But, how did Chinese EV makers succeed so fast in becoming market leaders? Well, though a series of actions, as better described by Noah Smith in his article “Why China is defeating Tesla”:

1. A multinational company puts its factories in China, lured by some combination of cheap production, big contracts, and the dream of huge market opportunities.

2. China appropriates the multinational company’s technology, through some combination of joint ventures, acquisitions, reverse engineering, and espionage.

3. The appropriated technology makes its way into the hands of Chinese domestic companies.

4. The Chinese companies squeeze the multinational company out of the Chinese market.

5. The Chinese companies go overseas and outcompete the multinational company in world markets.

The future in EVs will be American, Chinese, and maybe European (premium sector). WSJ, Noah Smith

Netflix won the streaming wars

Netflix’s turnaround strategy will probably be a Harvard case study at some point. Financial Times had a long piece on this, but here is where I think I made a difference:

1/ Netflix's swift response to the 2022 subscriber loss crisis, including password sharing crackdowns and introducing an ad-supported tier, demonstrated agile leadership and resulted in substantial subscriber growth and stock price recovery.

2/ By capping its content budget and leveraging the "Netflix effect" on licensed shows, the company optimized its content strategy, maintaining growth even during industry strikes and reducing dependence on expensive original productions. Some of the productions moved to cheaper places…like Europe and Asia.

3/ Netflix's tech-savvy leadership, exemplified by Greg Peters, enabled rapid implementation of new initiatives like password sharing controls and building an in-house advertising platform in record time, outpacing traditional media competitors.

4/ Netflix solidified its position as the leading streaming service, capturing 8.4% of US screen time compared to its nearest rival's 4.8%, while expanding into new areas like live events and sports to maintain its competitive edge.

5/ While Hollywood studios struggle with profitability in streaming, Netflix has demonstrated superior financial performance, allowing it to invest in strategic initiatives and maintain its market leadership position.

A strategy well executed. Chapeau bas! LINK

The Art market is tanking

One of the safest bets over time was investing in art. It seems now that Sotheby’s is having some problems due to some factors:

1/ Sotheby's is grappling with a $1.8 billion debt load, nearly double its pre-acquisition level, straining its financial flexibility amid a cooling art market.

2/ The auction house is delaying payments to vendors and employees, indicating severe liquidity issues as it awaits a $1 billion lifeline from Abu Dhabi's ADQ fund.

3/ A global art market slowdown, exacerbated by China's economic troubles and geopolitical uncertainties, has hit Sotheby's particularly hard, resulting in a $115 million loss in the first half of 2024.

4/ Despite expansions into luxury real estate and high-end car auctions, Sotheby's aggressive dividend payouts and costly renovations have left it vulnerable in a contracting market. Bad strategy!

5/ Key executives have departed amid compensation restructuring and delayed payouts, potentially weakening Sotheby's ability to secure high-profile consignments and maintain collector relationships.

Conclusion: A restructuring awaits. LINK

Artificial Intelligence

“BIG tech” is going nuclear

Interesting times we are living in the energy sector:

1/ Microsoft Corp. has agreed to purchase the entire energy output of the shuttered Three Mile Island nuclear plant in Pennsylvania in exchange for a $1.6 billion investment. This move is part of Microsoft's efforts to secure carbon-free electricity for data centers to fuel the artificial intelligence boom.

2/ Nuclear energy and data centers are an ideal combination for two reasons. The most apparent is that data centers require continuous power, which nuclear energy sources provide. The less apparent aspect is that nuclear power must operate continuously; it does not degrade. Nevertheless, data centers are an entirely predictable power consumer.

3/ Amazon is now recruiting nuclear engineers to work on Small Modular Reactors for powering their data centers, signaling a clear trend.

This trend will continue because there is no real other solution for AI energy demand. Microsoft, Amazon

META vs the EU

Meta is starting a deregulation move in the EU. I started it several years ago but it’s never too late to join the movement. LINK

a16z: Vertical SaaS: Now with AI inside

Angela Strange and James da Costa:

“As Software eats Labor -- Roles where human connection isn’t a key benefit, delivering on a core product, or differentiation to the business -- will be augmented, in some cases replaced, by AI. AI powered VSaaS will take on marketing, sales, customer service, finance, operations.“ LINK

AI will eat Hollywood

Well, not all of it, but a large chunk.

From The Wall Street Journal:

“The entertainment company behind “The Hunger Games” and “Twilight” plans to start using generative artificial intelligence in the creation of its new movies and TV shows, a sign of the emerging technology’s advance in Hollywood.Lions Gate Entertainment has agreed to give Runway, one of several fast-evolving AI startups, access to its content library in exchange for a new, custom AI model that the studio can use in the editing and production process.

he deal—the first of its kind for Runway and one that could become a blueprint in the entertainment industry—comes as creatives, actors and studio executives debate whether to use the new technology and how to protect their copyright material. Advocates say generative AI can enhance creators’ work and help a cash-strapped industry save time and money.

Michael Burns, vice chairman of Lionsgate Studio, expects the company to be able to save “millions and millions of dollars” from using the new model. The studio behind the “John Wick” franchise and “Megalopolis” plans to initially use the new AI tool for internal purposes like storyboarding—laying out a series of graphics to show how a story unfolds—and eventually creating backgrounds and special effects, like explosions, for the big screen.

“We do a lot of action movies, so we blow a lot of things up and that is one of the things Runway does,” Burns said.” LINK

Things Happen

[Video] Tyler Cowen interviews Tobi Lütke (Shopify). LINK

[Video] Dwarkesh Patel interviews Daniel Yergen, author of The Prize. LINK

[Study] Small beer pints to deal with alcoholism in the UK. LINK

Revolut prepares for India launch next year. LINK

It seems Qualcomm wanted to buy Intel. [My two cents: it will not happen] LINK

[Academic paper] What is Entropy? LINK

[Elon Musk] “Starlink began 10 years ago and is now 2/3 of all of Earth’s satellites”. LINK

European Commission President Ursula von der Leyen specifically calls for the creation of a new, EU-wide corporate legal framework. This would essentially establish a '28th regime' for companies, alongside the existing 27 national corporate law systems of EU member states; Delaware, but in the EU. LINK

Industry reports

Waymo released its report on safety and impact. LINK

on China

I’ve said for long that they are faking their GDP figure. The situation is worse than the graph below. LINK

Curiosity corner

Book recommendation: 4,000 weeks, by Oliver Burkeman. LINK

Antarctica's ozone hole is healing and set to recover fully by 2066. LINK

Previously unknown Mozart music was discovered in a German library. LINK

Mark Zuckerberg emails WhatsApp cofounder on April 6, 2013. LINK

Bertrand Russell's 10 commandments for the freethinkers. LINK

1: Do not feel absolutely certain of anything.

2: Do not think it worthwhile to produce belief by concealing evidence, for the evidence is sure to come to light.

3: Never try to discourage thinking, for you are sure to succeed.

4: When you meet with opposition, even if it should be from your husband or your children, endeavor to overcome it by argument and not by authority, for a victory dependent upon authority is unreal and illusory.

5: Have no respect for the authority of others, for there are always contrary authorities to be found.

6: Do not use power to suppress opinions you think pernicious, for if you do the opinions will suppress you.

7: Do not fear to be eccentric in opinion, for every opinion now accepted was once eccentric.

8: Find more pleasure in intelligent dissent than in passive agreement, for, if you value intelligence as you should, the former implies a deeper agreement than the latter.

9: Be scrupulously truthful, even when truth is inconvenient, for it is more inconvenient when you try to conceal it.

10. Do not feel envious of the happiness of those who live in a fool’s paradise, for only a fool will think that it is happiness.