Today’s insights:

Meta goes after Apple with AR Glasses

SAP’s boss considers regulation in the EU a danger to the entire continent

Classic strategy move: TEMU is disappointing its vendors

Stellantis shocks the stock exchange, but not the onStrategy readers

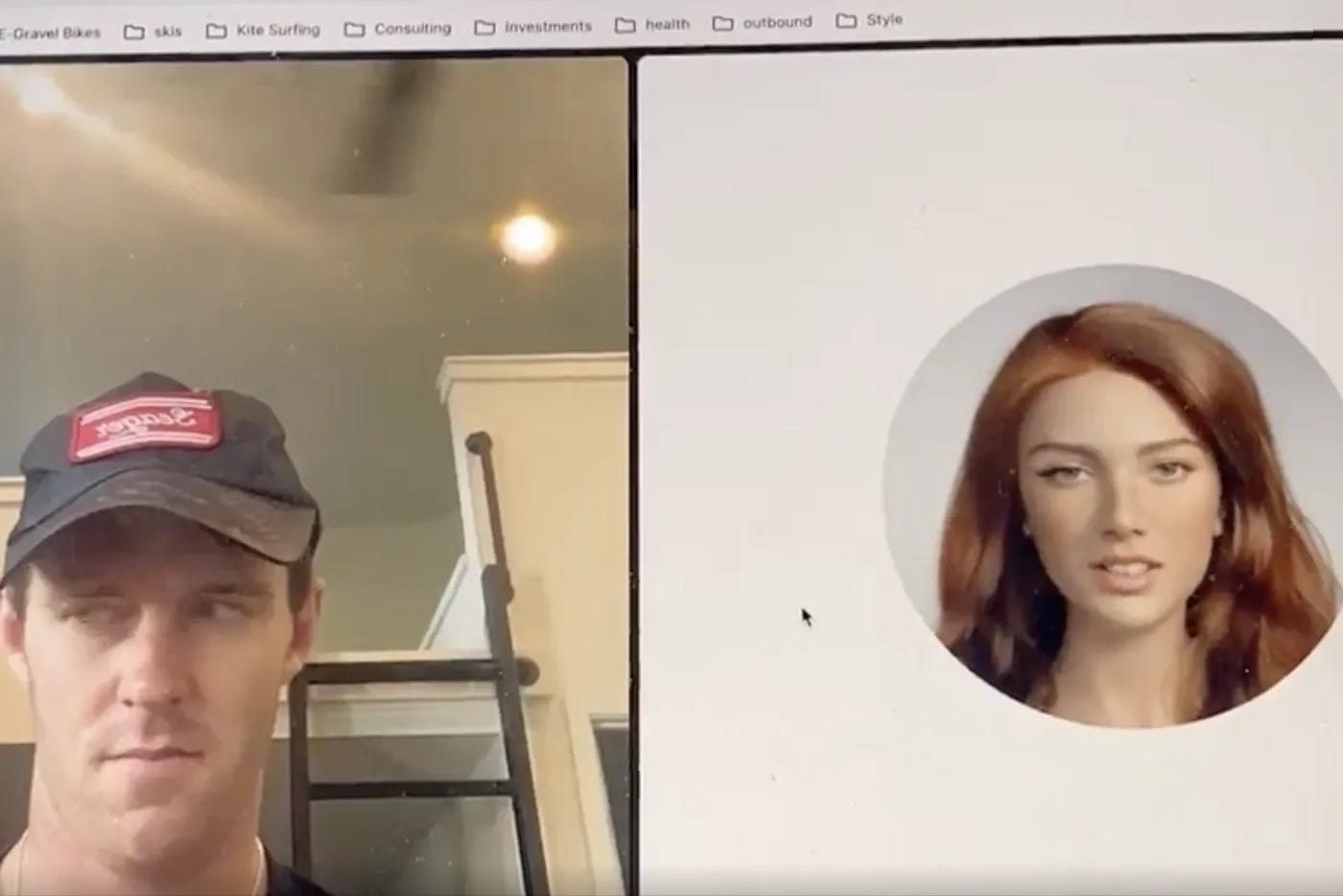

AI avatars are interviewing you for jobs now.

Onto the update:

Strategy

Meta introduced Orion, its first true Augmented Reality glasses

Why Augmented Reality glasses? Here is META:

1/ They enable digital experiences that are unconstrained by the limits of a smartphone screen. With large holographic displays, you can use the physical world as your canvas, placing 2D and 3D content and experiences anywhere you want.

2/ They seamlessly integrate contextual AI that can sense and understand the world around you in order to anticipate and proactively address your needs.

3/ They’re lightweight and great for both indoor and outdoor use, and they let people see each other’s face, eyes, and expressions.

I agree that glasses are the right form for the next platform. I am not going to enter into details like “Why it have a puck?”, “Why the battery lasts only 2 hours?”, “Why the puck is not a phone/smartphone (META phone)?”, “Why did it cost 10,000 USD?” etc and say straight forward what it really matters:

1/ META is trying really hard to build its platform and not depending on Apple’s platform (and limitations)

2/ At this point META is providing Apple a roadmap on AR technology, putting more pressure to work on a similar product. With more options available, more chances that Meta’s platform to succeed as an Apple alternative

3/ The 10k USD price will go down in 3-5 years when the product is shipped.

Add AI to glasses and you will get the perfect frictionless platform. META, Mark Zuckerberg

Volvo has abandoned its ambition to sell only fully electric cars by 2030

Why?

1/ Market demand is lagging behind expectations. Customer interest in EVs has been declining, with slower sales growth than originally predicted. A recent survey showed only 22% of new-vehicle shoppers were "very likely" to consider an EV for their next purchase, down 4.2% from the previous year.

2/ Volvo's head of sustainability, Vanessa Butani, points out that governments are withdrawing incentives for EV purchases, and charging infrastructure is not being rolled out fast enough to support widespread EV adoption.

3/ The Biden administration's proposed tariff increase on Chinese-made EVs is forcing Volvo to shift production of its compact EX30 SUV from China to Europe, delaying its US launch until late 2025.

4/ While Volvo remains committed to electrification, it's adjusting its timeline to better align with current market conditions. Instead of going fully electric by 2030, Volvo now aims for "90 to 100 percent electrified models" by that date, including hybrids.

New realities, new strategy. LINK

SAP’s boss considers regulation in the EU a danger to the entire continent

There are three main takeaways from this article:

1/ Christian Klein, CEO of SAP, Europe's largest software company, has cautioned against over-regulating artificial intelligence in the EU. He argues that excessive regulation would harm European competitiveness, particularly in comparison to the US. Klein emphasizes the need to regulate the outcomes of AI rather than the technology itself, highlighting the ongoing discussions in Europe about balancing regulation with innovation.

2/ SAP is investing €2 billion annually in AI development, focusing on practical business applications rather than competing with Big Tech companies in frontier AI research. The company is developing a chatbot called "Joule" that can perform various tasks, from writing code to identifying business inefficiencies. SAP is also expanding its presence in the US by opening labs near major universities and investing in AI startups like Anthropic and Cohere.

3/ The AI pivot is part of SAP's broader transformation from a traditional software licensing model to a cloud-based subscription service. While only about a third of its 400,000 customers have transitioned to the cloud so far, the company is seeing increased revenue and customer retention from this shift. Despite facing some internal challenges, including a recent restructuring affecting up to 10,000 employees, SAP's market value has nearly doubled under Klein's leadership, making it Europe's fourth-largest listed company. LINK

Classic strategy move: TEMU is disappointing its vendors

🛒 Chinese vendors are lamenting about Temu's practices. Well, they probably don't read the onStrategy newsletter and they don't know that:

1/ Initially, platforms focus on attracting users, fostering growth as more individuals join. Over time, as the user base matures, platforms shift towards extracting value from their users & vendors.

2/ Platforms start by cooperating with complements like developers, creators, and businesses. This cooperation fosters ecosystem growth, as more third-party offerings enhance the platform's value. As the platform matures and dominates, it may shift towards competition with these complements. Over time, it may seek to capture more of the value created by complements, which can lead to tension or competition that risks stalling growth if not managed carefully.

Chris Dixon made this graphically:

Sources: Frankfurter Allgemeine Zeiting, Chris Dixon

Stellantis shocks the stock exchange

1/ Stellantis, Europe's second-largest volume car manufacturer, has significantly downgraded its financial targets for the current fiscal year, expecting an adjusted profit margin of 5.5% to 7% instead of the previously projected 10% or more. Cheap EVs from China are hurting Stellantis’ sales.

2/ Stellantis is facing challenges in both the European and North American markets, with particular concerns about declining market share for its US brands like Jeep, Chrysler, and Dodge.

3/ The company plans to respond to these challenges with initiatives to increase productivity, including cost and capacity adjustments, especially in North America where high inventory levels are a significant issue.

4/ There are indications of potential leadership changes at Stellantis, with reports suggesting that Chairman John Elkann is dissatisfied with the situation in North America and has begun searching for a successor to CEO Carlos Tavares, whose contract ends in early 2026. LINK

Artificial Intelligence

AI avatars are interviewing you for jobs now. LINK

Leadership lessons and the future of AI from Michael Dell. LINK

Another nuclear plant is opening after being initially closed.

The Palisades nuclear power plan is set to reopen in Michigan. Why? AI energy demands…LINK

Hugging Face surge past 1 million milestone in AI models. LINK

Things Happen

LVMH buys a stake in Moncler. LINK

Defense-tech startups need a sew supplier: anyone but China. LINK

How to secure your supply chain lines. Proposal for America. LINK

[Great read] How the US lost the solar power race to China. LINK

How to fix Britain’s economy. LINK

Industry reports

Bloomberg NEF’s study on electric trucks. LINK

4 out of 10 Americans are regularly getting news on TikTok. LINK

Curiosity corner

How Israeli spies penetrated Hizbollah. LINK

Scientists identify new blood groups after 50 years. LINK

Hotel prices in the USA are extremely high. LINK

The deserter. A story of war and love. LINK