(#99) Meta is one of the two winners in the Social Media space; SAP has a new moat

No hint of a ‘supercycle’ in Apple’s results

Today’s Insights:

Meta is one of the two winners in the Social Media space

No hint of a ‘supercycle’ in Apple’s results

Starbucks: new CEO, new changes

From the PLUS version (paid):

Ferrari is a European success story (propped by the US market)

Microsoft’s earnings tell a new story: CAPEX investments are here to stay

SAP has a new moat

On to the update:

Strategy

Meta is one of the two winners in the Social Media space

META and TikTok won the Social Media wars. So, that’s I follow up on META regularly. Here are some ideas after their latest earning reports:

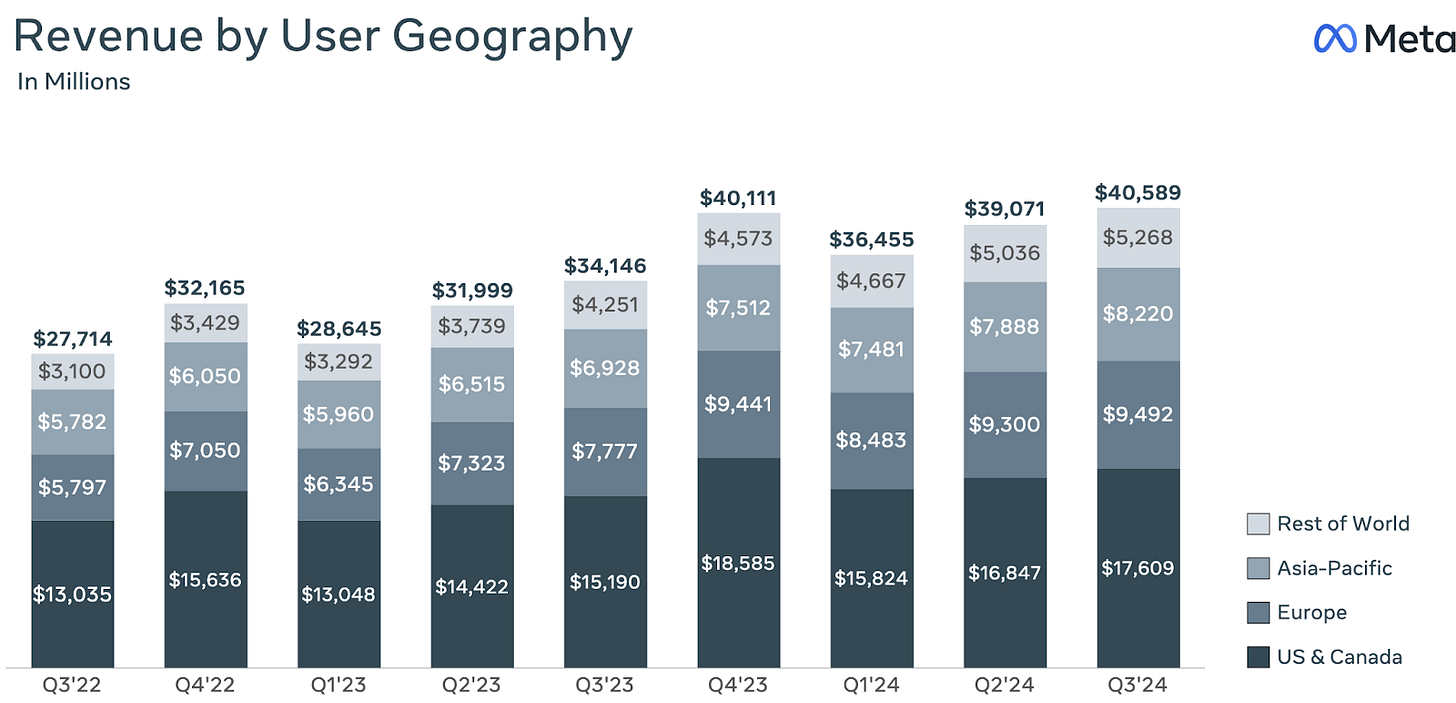

1/ Meta’s Q3 2024 results showed solid performance, with revenue up by 19% and net income increasing by 35%. However, CEO Mark Zuckerberg emphasized that Meta’s significant investments in AI infrastructure would intensify in 2025, leading to rising capital expenditures (a pessimist sign to investors). This commitment reflects Meta’s strategy to use AI as a core enhancer of its advertising and content feed capabilities. While the increased spending on AI infrastructure may worry investors, Zuckerberg’s focus indicates a long-term vision to maintain a competitive advantage in personalized content and advertising, areas critical to Meta’s core business.

2/ Meta’s Reality Labs division, which oversees virtual and augmented reality initiatives, continues to post substantial losses. Despite these challenges, the company is determined to pursue its metaverse ambitions, including products like Ray-Ban Meta smart glasses. Meta’s commitment to Reality Labs, despite its financial burden, suggests a strategy to establish an early foothold in immersive technologies. While these efforts have yet to yield profits, they align with Zuckerberg's vision of future social interaction, though they require investor patience as the returns may only materialize in the long run. I remain skeptical.

3/ Meta is working on consolidating its recommendation models across different products, inspired by the scaling benefits observed in large language models. By using a unified model for video and other content recommendations, Meta aims to improve engagement and reduce operating costs, thanks to better data-driven insights. This strategic move supports Meta’s shift from a network-based content approach to a broader, cross-platform content recommendation system, positioning it better against competitors like TikTok. Over time, this can enhance user retention and ad revenue by delivering more relevant content efficiently.

Overall, I remain LONG on META. LINK

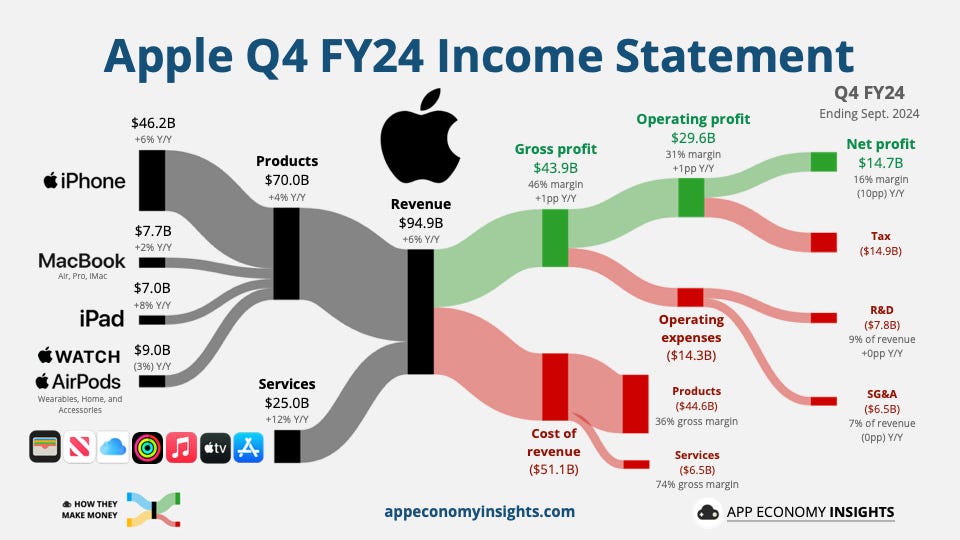

Apple’s results

Everyone’s waited for these results to see if Apple is going through a “supercycle” with its newest iPhone models. Hint: it’s not!

1/ Apple's Services segment grew by 12% to $25 billion, significantly outpacing the growth rates of its hardware categories. This indicates Apple's successful strategy in expanding beyond hardware, building a robust ecosystem of services like iCloud, Apple Music, and the App Store, which provide recurring revenue and help mitigate the cyclicality of hardware sales. As Services contribute high margins and stable cash flow, they’re becoming increasingly central to Apple's financial resilience.

2/ Revenue growth in the Asia Pacific (excluding Greater China) and Europe stood out at 16.6% and 11%, respectively, indicating Apple's solid traction in these markets. However, regional dynamics are emphasizing the importance of geographic diversification for Apple, with specific opportunities for further growth in Asia outside China.

3/ While the iPhone and iPad saw healthy growth of 5.5% and 7.9%, respectively, wearables (including products like the Apple Watch) declined by 3%. This decrease in wearables might be a result of market saturation or economic conditions affecting discretionary spending. The moderate growth in Mac sales (1.7%) also suggests a stable but mature market. Apple's focus on balancing its hardware portfolio growth with strong service expansion demonstrates its strategy to maintain a well-rounded business model.

We’ll have a preliminary conclusion about Apple after the next report. However, I remain bullish. LINK

Starbucks: new CEO, new changes.

The new CEO has started to make some changes. First, by bringing back the condiment bar. Why?

1/ To respond to customer complaints about long wait times and limited customization. This reflects a shift toward customer experience improvement, addressing the need for faster service and personalized options, which are essential in regaining customer trust and satisfaction.

2/ Moreover, Starbucks has pledged not to increase prices in the USA over the next year, despite rising costs. This decision shows a strategic effort to retain customer loyalty amid economic pressures. By stabilizing prices, Starbucks aims to appeal to price-sensitive consumers, maintaining affordability as a key component of its value proposition. A key part of delivering this strategy is also related to the fact that Starbucks is vertically integrated.

3/ With the CEO aiming for faster service times (drinks served within four minutes) and fewer new store developments, Starbucks is refocusing on optimizing existing operations. The long lines at Starbucks should soon disappear. LINK

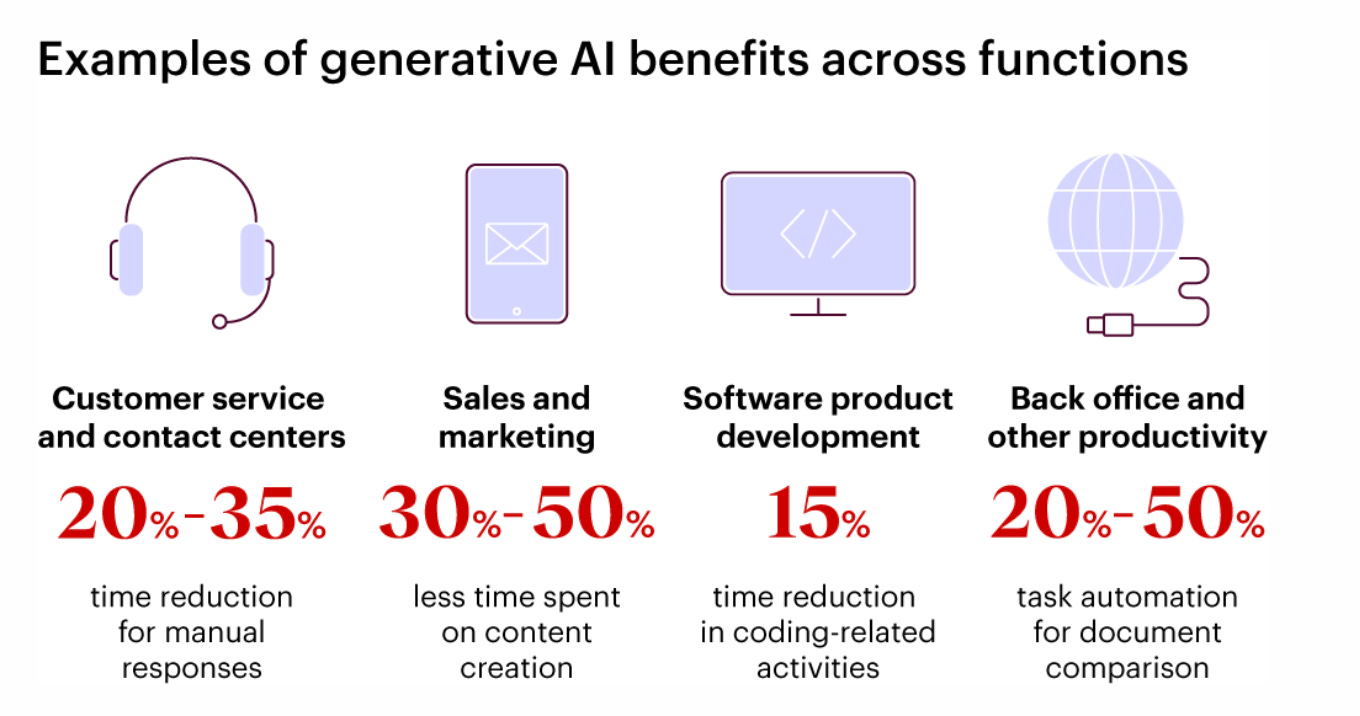

Artificial Intelligence

AI written content is flooding Medium. LINK

Keak is the first AI agent capable of continuously improving your website. LINK

GPT-4o-powered cleaning robot built in 4 days for $250. LINK

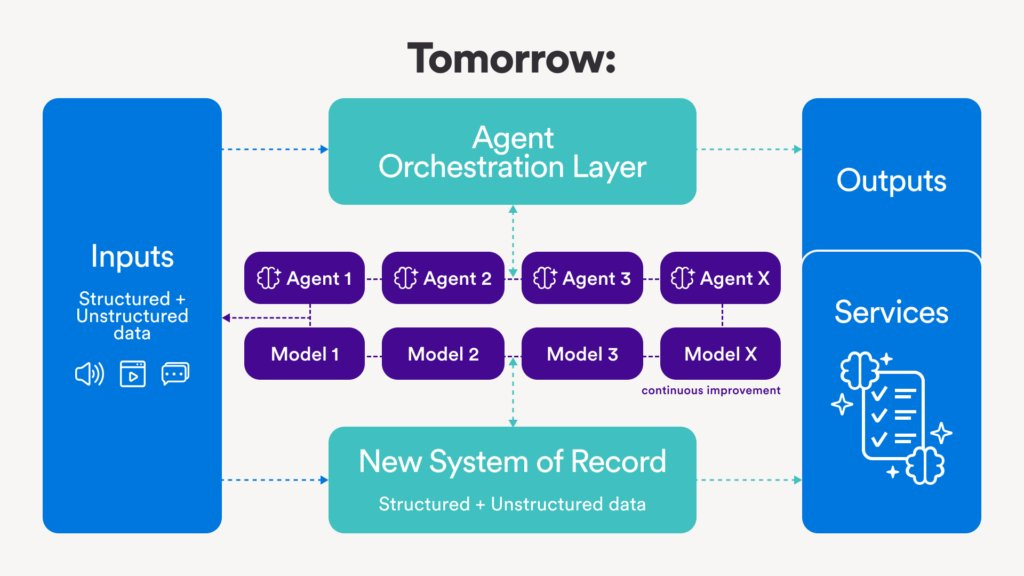

The age of Systems of Agents has begun. LINK

Things Happen

Financial Times: “Is Germany’s business model broken?”. LINK

There is a tomato war between China and Italy apparently. LINK

Deflation continues in China. Stimulus is not working. LINK

A Chinese-built railway station terminal collapsed in Serbia. LINK

Robots are already doing the laundry. LINK

Industry reports

Problems on the horizon from both China and the USA. LINK

The US and Greater China account for more than 80% of the market cap across a dozen standout industries. LINK

Bain Technology Report 2024. LINK

Curiosity corner

Cryptocurrency holders also tend to enjoy other forms of gambling. A recent study indicates that individuals who own digital currencies are significantly more inclined than others to use betting apps. LINK

Apple’s Tim Cook on lessons from Steve Jobs. LINK

Personality profiles of 263 occupations. LINK

Warner Brothers is selling 10 replicas of the Batmobile

Trump won the elections but what is most important detail is that almost everyone voted for him more. LINK

There is one big lesson here: a small but powerful minority tried (and failed) to push a different narrative vs. what people need, hence the dissapoinment for many.

This newsletter continues below with additional strategy insights exclusive to premium subscribers. To unlock them, two annual presentations, and more, simply click the button below.