All in on AI; Apple had mixed results; Snap will never reach profitability

Some analyst thing that an AI bubble is building, but other think that everyone will have an AI-copilot. Maybe will have both.

Is flu season, so #onStrategy was affected too, being delayed by one day. Now, onto the update:

The Chat GPT frenzy continues and many think, including myself, that AI can be the personal assistant to everyone.

Strategy

All in on AI

Microsoft announced their integration of Chat GPT in the Bing browser. Short reminder: 90% of the search market is dominated by Google. So, after playing with the new tool I see that we are actually having an even better version of Chat GPD. It think this is 4.0 and here are some results on what it can do:

Here are my takes on what this means for Microsoft:

1/ What is even more impressive is now it adds sources to the generated text so you can do your own search & homework, if needed.

2/ Satya Nadella told Joanna Stern from WSJ: “The last time I checked Search was the most profitable category there is on Planet Earth, so all I need is a few more users, and someone else I am competing with has to keep all of their users and all of their gross margin. I’m looking forward to that…There is enough surplus that goes to one place, and I think it would be nice if it were evenly distributed.“.

Ok, now the translation: I don’t know if we’ll get extra users, but I know that I want to take a part of that 90% market share that Google has. LINK

3/ At the Microsoft conference from 7th February the team had some interesting comments:

There are 10 billion quarries a day and 40% of the people can’t find what they want

Surprisingly, search works better if you give it fewer keywords

75% of all searches are three keywords or less.

He is a slide from Microsoft’s presentation:

Source: Microsoft

Well, no matter how much some companies build vertical search engines, Google survives and thrives. Why? Please see below 👇

Google and its mess

So the company rushed to show their own answer to Chat GPT and they called it Bard. You might want to read the letter introducing it from Sundar Pichai, Google and Alphabet’s CEO. LINK

Key details from the conference:

1/ Google recycled many ideas and messages from the Google I/O conference ‘22, from 8 months ago. They rushed to show something in response to Microsoft and the result was a total mess. LINK

2/ Bard cannot be used for now. It will be in the future, but not now…and people want it now.

3/ Bard's first answer below contained a factual flub. LINK

4/ The demo went wrong….

5/ …and the market penalised the company with…$166 bn. The most expensive mistake in history? Probably.

6/ The company has proved many times that it can handle competition. Ben Thompson from Stratechery brings in front a blog post from Microsoft from 2010 announcing their partnership with Facebook to take on Google:

“What I will do in the next few minutes is to share some thoughts, to tell you about how we think about search and how we will take Bing forward. And the purpose is to set the contest for today’s announcement. We take fundamentally a broad holistic view about search. To us search at its very core, it’s about understanding user intent and to bring information and knowledge to help fulfill the intent. And the intent here is defined broadly to meet the purpose of a user.” LINK

What happened? Pretty much nothing. And now it is because of Android, which has at least 70% global market share. (others look at 90%). Bill Gurley’s has a great articole about what it means Android for Google:

“Android, as well as Chrome and Chrome OS for that matter, are not “products” in the classic business sense. They have no plan to become their own “economic castles.” Rather they are very expensive and very aggressive “moats,” funded by the height and magnitude of Google’s castle. Google’s aim is defensive not offensive. They are not trying to make a profit on Android or Chrome. They want to take any layer that lives between themselves and the consumer and make it free (or even less than free). Because these layers are basically software products with no variable costs, this is a very viable defensive strategy. In essence, they are not just building a moat; Google is also scorching the earth for 250 miles around the outside of the castle to ensure no one can approach it. And best I can tell, they are doing a damn good job of it.” LINK

Every company should read the entire article and think: How do I build my moat and how am I going to defend it? They can start by just studying Google and Android.

Wall Street loves META (shares) again

When the company announced their results for the last quarter they also mentioned that 2023 will be “The year of efficiency”. This message can be translated as:

1/ We are quite done with our investments in the metaverse, which accounted for $13,7 bn in 2022

2/ Most of the CAPEX investments necessary for building a moat around AI was done in 2022. See my chart from several months ago:

3/ Mark Zuckerberg is the only CEO from a tech company that did not announce any transition from his leadership. So, instead of bad stock market results and complaints from investors it is better to relax with all these ambitious projects that don’t bring traction. LINK

Expensive money, big troubles

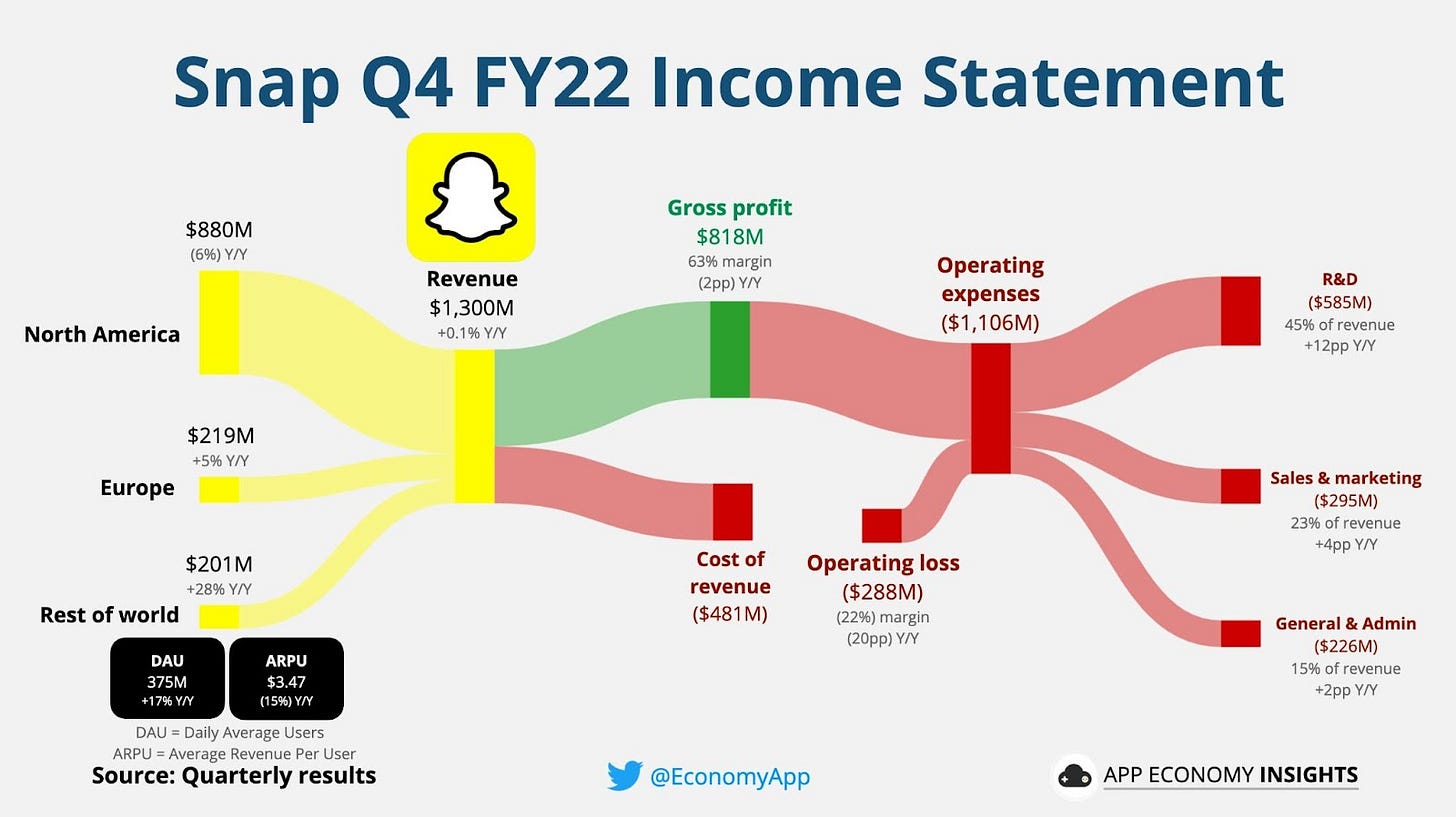

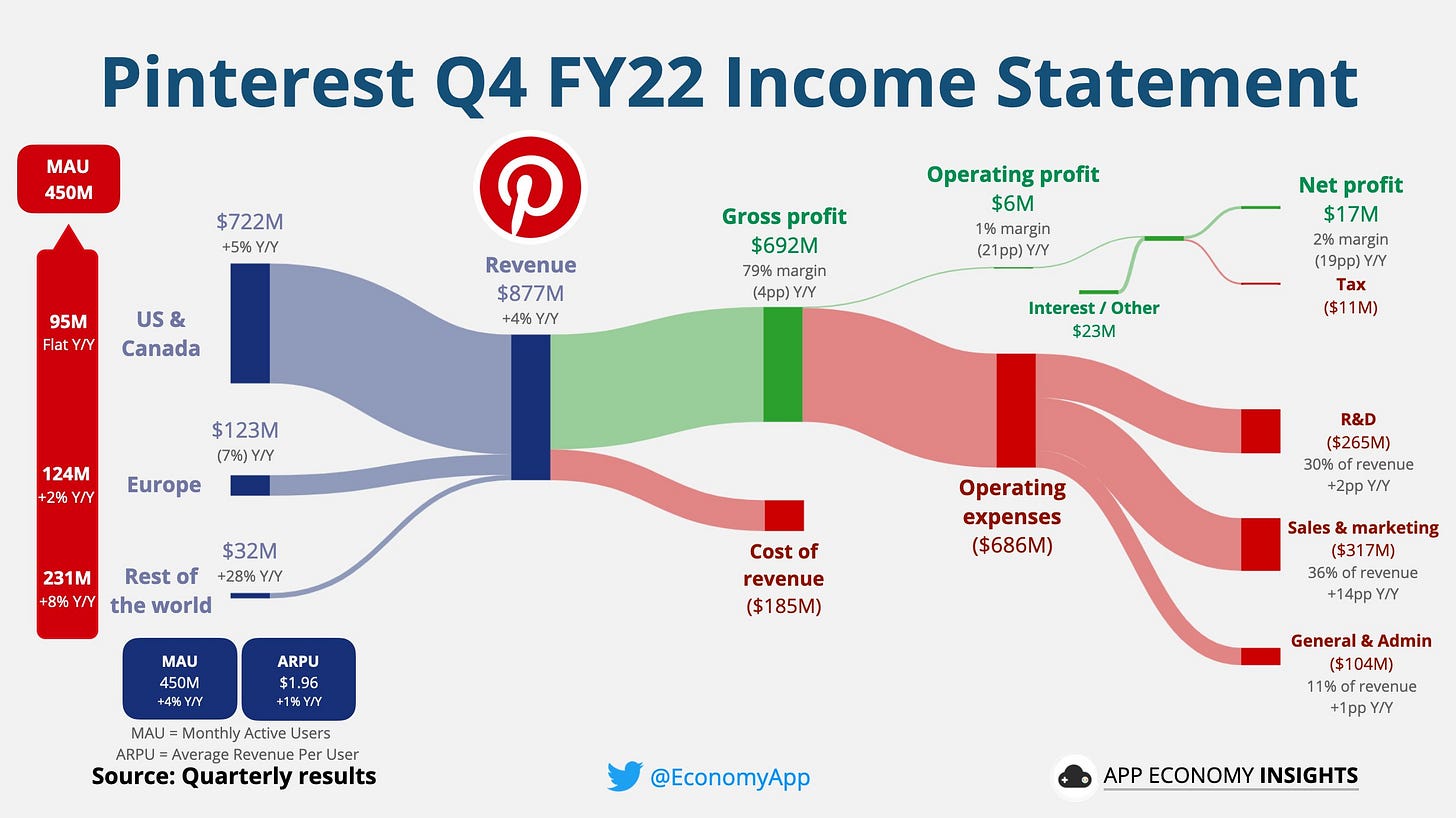

What do you do after you have invested billions of dollars in companies like Snap or Lyft and they still lose money and no better plan to solve this? Snap even told investors that they may never reach profitability. Here are to quarterly results from Snap and Pinterest, both company with +300m and +400m DAUs:

Automotive consolidates. China continues expansion

Ford is reportedly in discussion to sell the plant from Germany to BYD, a Chinese EV producer. Ford wants to focus on the most profitable markets (ie. North America) and sell, divest and transfer their European plans to others. BYD wants to be associated with “made in Germany” so the move is natural, following Tesla’s move in the country several years ago. LINK

Algorithms are the news superpower

…and you don’t even need those NVIDIA powerful chips. TikTok is a dopamine machine. LINK

iPhone goes Ultra

Bloomberg is reporting that Applyis considering the introduction of iPhone Ultra. The move was explained several times by me that the move is natural and the line-up will be:

iPhone 15

iPhone 15 Pro

iPhone 15 Ultra

The dynamic island on iPhone 14 helped Apple understand that people will always strive for the most expensive problem, hence the weak sales of iPhone 14 and the unmet demand for 14 Pro and 14 Max. ULTRA, Weak sales

NFTs represent self expression, place, identity and pop culture. I am bullish on their usage and impact in communities, that’s why I think subscribing to It’s NFT time newsletter will bring you valuable knowledge and ideas on how to use them for your own business. LINK

Whatsapp want to be a lot like Discord

The company is deploying several updates to make the app more enjoyable and to respond to users switching to other apps. LINK

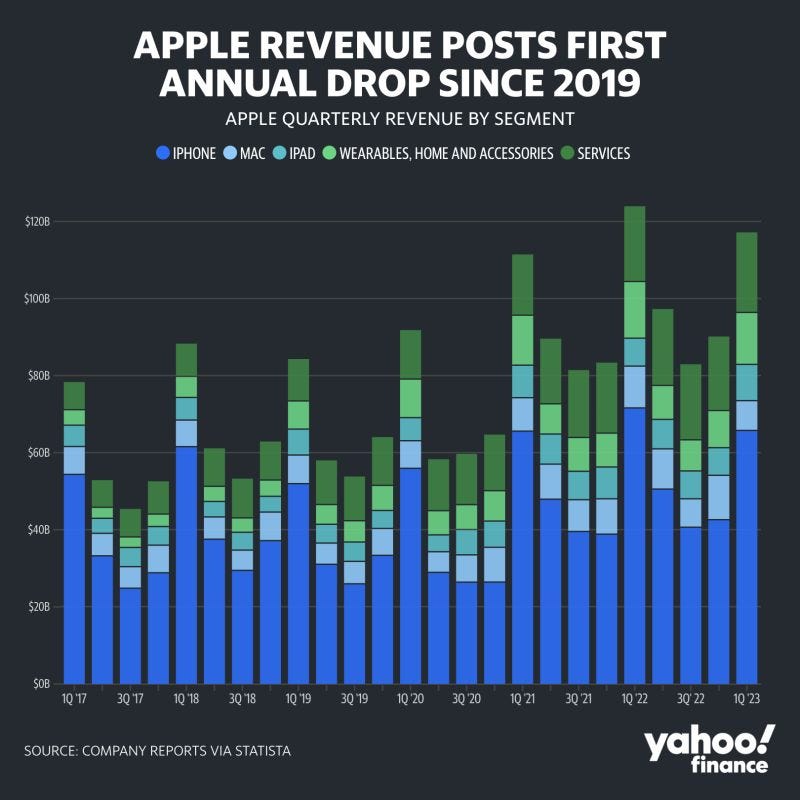

Apple had mixed results

The company announced the results of their last quarter and we now have a clear image of what’s happening there:

1/ The biggest hit was taken by the iPhone due to the “covid-zero” policy in China. (-8y/y)

Here it is worth mentioning that the company built a state-of-the-art collaboration system with the suppliers and taught them how to run the supply chain in a game where Apple obtained the quality and price and the supplier knowledge and free machinery. With the knowledge the supplier went further to other clients and made money. (there are multiple detailed stories on WSJ, Bloomberg and Financial Times)

Now, Apple suddenly realised that the world is not that flat and geopolitics matters. Hence, moving a part of the production to India and Vietnam, but giving it to the Chinese suppliers who opened business over there. Why? Well, India can compete on advanced manufacturing with China and Vietnam has a criminality problem beside the manufacturing one. However, slow parts of the production are moving to these new countries.

2/ Services +7 y/y - the plan is here to be one day more than 50% and to replace the iPhone

3/ Wearables -8% y/y - since the company doesn't offer details the explanations maybe is in between: poor sales of both Watch Series 8 (low differentiation to Series 7) and Watch Ultra (1,000 EUR - maybe too high)

Meanwhile, everyone is talking about the iPhone Ultra - an 1,500 to 2,000 EUR phone/computer.

Stripe is cutting down again their valuation

There are four main takeaways from this story with Stripe:

1/ Always is better to underpromise and overdeliver: from $95 bn valuation in 2021 to $74 bn, later to $63 bn and now to $55-60 bn. It sends two messages: greedy and arrogance

2/ The money became more expensive to sustain a private company, especially one with employee stock units. Any valuation of long-term revenue is subject to a discount rate and naturally rising interest rates increased the discount rate, which is to say it devalued long-term revenue. No matter how robust their moat or vast the addressable market may be, all companies (especially SaaS) are heavily affected.

3/ The competitive landscape is tough: PayPal, Square, Klarna, WePay, Stax, Shopify etc. They all climb the same mountain, but from different directions.

4/ Taking a long time to find product market fit is no longer an option, but Stripe seems in a good position to finally go public.

Data

Nearly half the Americans think the country is in a recession. LINK

The Drucker Institute has issued their annual list of the 250 Best-Managed companies of 2022. Hint! Microsoft ranks 1st and Apple 2nd. These two companies together with Johnson & Johnson are the only companies with AAA rating. LINK

In my Top 10 business predictions for 2022 I mentioned at point #10 that “The energy stocks will have a stellar year (e.g. Exxon & co)” LINK

Let’s see how the top players performed in 2022, now that we have their profits:

Exxon: $56 bn

Total Energies: $36 bn

Shell: $40 bn

BP: $24 bn

Chevron: $36 bn

QED.

The price of housing in Japan remained unchanged for the last 25 years:

Main reason: pro-market laws

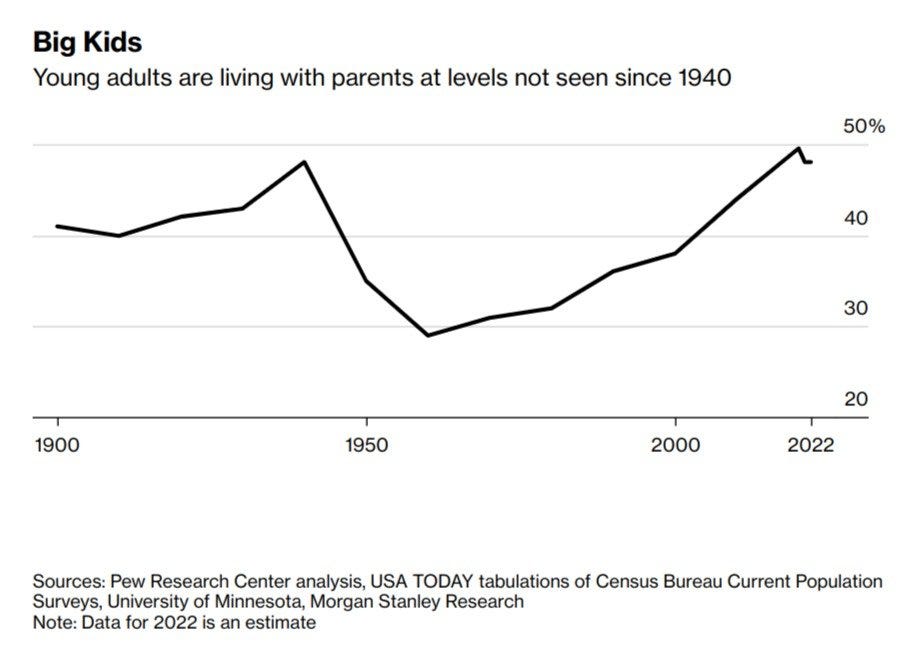

In 2022 48% of young adults (aged 18-29) lived at home in the US, which is the same percentage as 1940 when we had a global war.

Benedict Evans has released his annual presentation called “The Gatekeepers”. LINK

Outside interest

India just passed China as the most populous country in the world.

Look at where people live in India. Why?

It's the Ganges river basin. It hosts ~half the country's population. It's one of the densest places on Earth. Why? It's one of the main producers of wheat, peas, potatoes, rice, lentils, eggplant… Why?

It's hot (tropical)

It rains a lot

It has a many rivers bringing water and irrigation

The rivers also bring fertilising silts

AMC wants you to pay extra in the cinema (theatre) for the best places. Aviation pricing comes to the film industry. LINK

Forbes has an interesting article regarding the recent tech layoffs. LINK

You can now melt your snow from your Tesla with…and app. LINK

Want to impress people on Instagram? You can hire an LA studio for $64 to give you some…glam. LINK