Bloodbath on the investors call: Snap, Spotify, Intel; Twitter is building a super-app

Tiffany's is partnering with Nike to deliver a premium value to their customers.

If you are a public company you might get it with a bad quarter, after this you must deliver.

Few leaders understand this and think about the long term of the company.

Strategy

Evolving as aggregator

Spotify ($SPOT) has successfully managed to transition from type 3 aggregator to a type 1. How? They implemented a marketplace where labels have to compete for position, hence a higher price they get for each song.

Looking at their public results I have some observation:

1/ 12% YoY growth

2/ Operating expense 44%

3/ 10,151 FTEs at the end of 2022 Q4 (+32% YoY). This might be too high by any standards.

4/ Premium gross margin 28.6% vs. Ad-supported margin 5.1%. The company said that podcasts will save the margin, but looking at these margins I doubt this strategy is working

Money eventually will run out

There are some companies that were kept alive during these years because (1) investors already put some real money in them and won’t back down and (2) money where cheap. Now, nobody would be so happy to stop the funding because the decade of free money is over. Snap might be for sale afterall. Here are some ideas from their investors’ call summarising the entire 2022:

1/ Revenue growth - 0% (Apple’s ATT hit the company the most; META has the money to work around these, but not Snap)

2/ $584m spent on R&D. On what exactly? Flying cameras?!

3/ Guidance of -2 to -10% of revenuer fall in Q1 2023

4/ No ideas for further monetisation

5/ Cash relatively the same as last year, meaning the company has printed…shares. This circle will keep going unless someone will figure it out and say: STOP!

6/ Snap said in one of their letters that they may never reach profitability. Here is a summary of losses, but is the same from day one:

Big fish become small fish and viceversa

Intel had the worst week possible. I criticised them last year when on one hand they were asking subsidies from the state and on the other hand were rewarding shareholders with billions in dividend, but I was right. Here are my take from the last investors call:

1/ revenue down 32% - their most advanced revenue stream are the data centers, with two types of clients: (a) hyperscalers (Google, AWS, Azure) and other enterprise and/or governmental clients. The hyperscalers are moving to AMD chips due to their overall better performance, while the rest are staying for convenience. Not a nice place to be. (short reminder: Intel lost all the other chip wars, except the data centers…yet)

2/ Q1 2023 has a guidance of -$3 bn vs Q1 2022. This happens because in a bear market companies buy chips from the first player (ie. AMD), and only afterwards buy from the 2nd player (ie. Intel)

3/ They target a cost reduction of $3 bn in 2025 through salary cuts. Here are two strategies: (a) you punish everyone and start cutting at all levels or (b) you fire the underperformers. Having seen both strategies in practice, I know that second always delivers.

Chip Wars

This week the US signed a cooperation agreement with The Netherlands and Japan for not sharing top technology to China. Both the Netherlands and Japan have key positions in the supply chain of chip manufacturing. The details were not shared, but China will want revenge and what is the best revenge than the access of its market? LINK

Toyota is rethinking their EV strategy

There is an open secret that many automotive producers don’t favour full EV strategy and Toyota is one of them. LINK

“Energy policies are unique in different countries and people have different uses for cars, so why make just one solution?” - Akio Toyoda

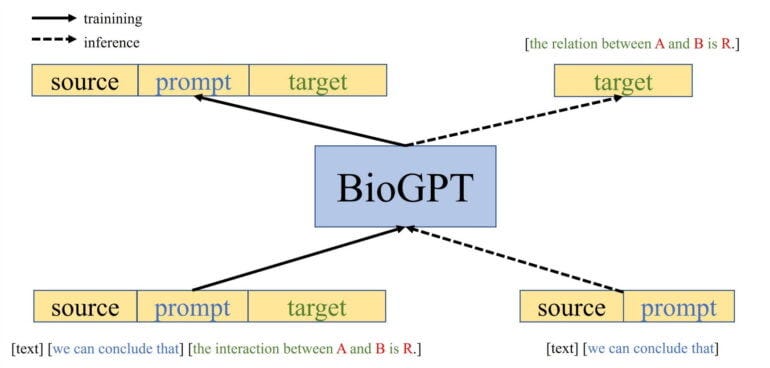

Goodbye, Dr. Google! Welcome, Chat BioGPT!

BioGPT is a transformer language model developed by Microsoft researchers and optimized for answering biomedical questions.

Twitter - the super app

With revenues plummeting from $5 bn to $1 bn, Elon’s plan to create a super app is on steroids. FT has an extensive article on what he is working on: peer-to-peer transactions, messaging, payments and ecommerce. LINK

The Economist has an interesting piece: “How Goldman Sachs went from apex predator to Wall Street laggard”. Well, is it clear that not all eggs will hatch gold, but it was interesting to try consumer payments. This was never the company’s strong point and will be the first to drop. LINK

Nike and Tifanny’s will make a shoe. All luxury brands are deploying consumer strategies in order to…sell more.

Firstly slowly, but then suddenly China starts to export better and better cars, displacing traditional car manufacturers from US, Germany and Japan. This will be painful for these major economies. LINK

SAP will cut 3,000 jobs. This company together with Siemens are the only two German companies presented in the top 100 most valuable companies. LINK

Data

Newzoo has an interesting report content creation. Of course, Gen Z are the most…creators:

50.4% - Average office occupancy rate last week in 10 major cities, the highest since the pandemic began, according to Kastle Systems. LINK

Apple’s average selling price (or ASP) was $858 in the quarter that ended last September. The ASP for Android phones in general was $218. Samsung and Google’s best Android devices still cost more than $600.

Amazon raised the minimum price for free online grocery delivery from $35 to $150. Do you remember when I said that the decade of free money is over? Well, it really is. LINK

Outside interest

Not all cappuccinos are created equal. A coffee at Costa Cafe has 5x more caffeine vs. one at Starbucks. LINK

Historic selfies Generated by an AI. LINK

Greenpeace has a carbon emissions map for proteins. LINK

Auschwitz 78th anniversary was marked recently. RIP! LINK

Morgan Stanley is fining their employees $1m for sending files over whatsapp. Security first! LINK

Is China good at megaprojects? Their latest developments have considerable flaws. LINK