Newsletter #4 - Predictions for 2023

Here are 11 business predictions that will shape the world this year.

Happy New Year! 🎉🥂

So many events happen, that sometimes you need to prioritise what’s really important and why. Through the predictions below I want to cover what’s the most relevant for companies and individuals.

1/ Cash is king.

The last decade was known as the “decade of free money”. With nearly zero interest rates, cash was available to invest in all kinds of crazy bets (including crypto). Well, not anymore:

“There’s always a risk of going too far or not going far enough, and it’s going to be a very difficult judgement to make.”— JEROME POWELL, U.S. FEDERAL RESERVE CHAIR

Who will be the most affected industries? Well, first of all the “cash burning machines” from the following domains: food delivery, micromobility, streaming, etc.

All the companies acting in this industry (and others alike) will have to meet the profitability goals asap and stop subsidising services. For example, not even one video streaming service is profitable. Here is some advice from Sequoia and Y Combinator to their portfolio companies.

Growth at all costs is no longer rewarded.

2/ Disney needs a new strategy.

Every CEO needs to understand what happened at Disney in 2022. The CEO’s first role is to properly communicate (internally and externally). Failing to communicate the expectations to investors and internal stakeholders, Bob Chapek - former CEO, had to leave the company. The new CEO is the retired legendary ex-CEO Bob Iger.

Bob Iger created over 15 years an entertainment behemoth. Through a strategy of smart acquisitions (e.g. Pixar, Marvel Entertainment, Lucas Films etc) and further investments in direct-to-consumer increased the market capitalization 5x, from around $50 bn to $250 bn.

So here are my list of the top priorities:

a) Stop the cash bleeding at Disney+. In 2022, this service lost $8 bn and is expected to lose $3 bn in 2023, according to Geetha Ranganathan, senior media analyst at Bloomberg Intelligence

b) Rethink the bundle package between Dinsey+, Hulu and ESPN+

c) Price increases - well, inflation. On top, the amusement parks missed the revenue numbers last year so another increase it’s likely

d) A new strategy - including reorganising the entire company.

e) A new CEO - Bob Iger is 72 years old. He surely wants to retire for good, but not until it sets the company on track and finds a suited CEO.

3/ Chat GPT

This year we will see if Open AI has a chance to get into the “Golden companies” circle made by Apple, Microsoft, Amazon and Alphabet. META tried, but failed. (hence the overall focus on the metaverse and their +$10 bn investments with modest results…so far)

The winner of 2022 was clear Chat GPT, which was launched by Open AI, and which has multiple usages:

Explaining complex concepts in simple terms

Correcting code (e.g. in python, java etc)

Writing essays

…and much more

Now you can incorporate Chat GPT in your email and can generate the answers to emails, can be the internal company chatbot (hint! Attention Druid AI & alike) and more. Google is not afraid of Chat GPT eating their profits, but most likely by Amazon and TikTok.

We are now transitioning to an applied AI world. And that is going to eat a lot of jobs.

4/ The Tesla stock is still overvalued at 35x P/E

… and that’s still a problem. Most of the EV cars that I saw last year while travelling (ie. Greece, Hungary, Czech Republic, Spain, Portugal) or at home (Romania) are not Teslas. But they have a much lower P/E than Tesla.

Additional problems:

Tesla was fined in South Korea for misleading marketing. Well, that battery range distance that you see is made for California weather, which is around 20 C most of the year. In the harsh winters of the northern hemisphere the battery can deplete to 30% per night. LINK

Tesla’s stock suffered another huge loss this week when the company announced the cars delivered (+40% vs Q4 2021, but under the 50% target). LINK

Autopilot - the company has the capabilities to differentiate itself through this service, but is not a “100% autopilot”...yet. Hence, it will be forbidden to use these words in marketing messages. At least in California. LINK

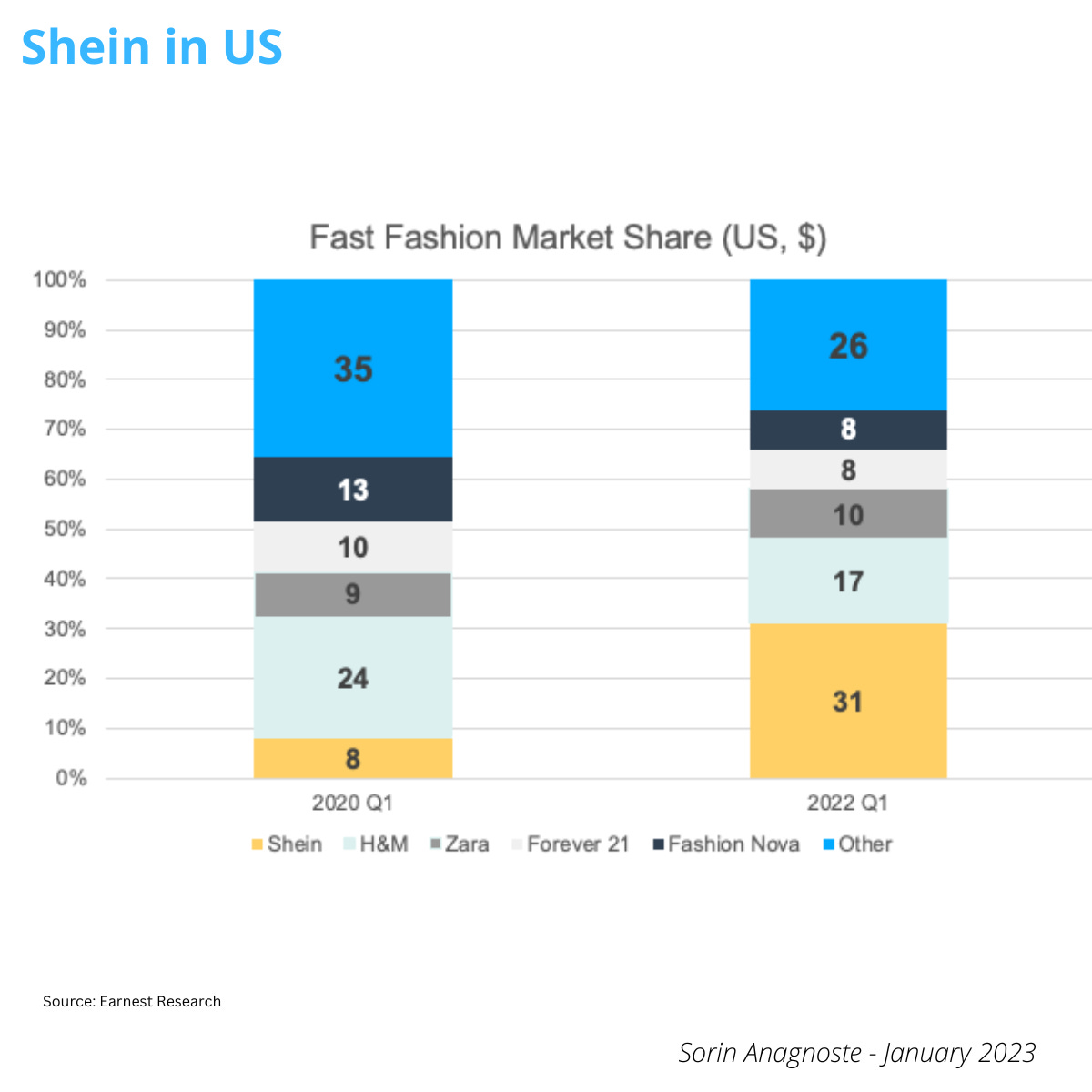

5/ SHEIN will be number one by revenue in Europe and US in the (ultra)fast-fashion industry

Shein is already top of mind in the US and UK, so now they are just capitalising on this.

The company solved successfully the “impossible triangle” of the fast fast-fashion industry: 1) quickly onboard loads of new styles at 2) low prices, while 3) being hyper-efficient in managing massive volumes of inventory.

Piper Sandler’s annual survey shows that Shein is now the 4th most popular clothing brand in the US.

One of the breakthroughs in Shein's success it's also related to data-led predictive short-run manufacturing. Their ERP system is embedded on the manufacturers' one so they know in real time what raw materials are available. As a result, they only order 500 units per item based on search behavior (not buying!) in a Tiktoky experience.

Finally, the customers keep coming back because (1) price and convenience and (2) the ads budget it's massive. (no stores, no rent).

6/ Bytedance (TikTok) will be the first Chinese company to reach a $1 trillion valuation

If not this year, for sure in 2024. In the dopamine game not even companies like Netflix can hold a candle to Bytedance:

The company is taking by storm the ad industry and established players like Alphabet, META or Snap are feeling it. REVENUE, AGENCIES

TikTok is now moving to other industries: music streaming, gaming, shopping and others. More pain to follow for all companies below:

7/ Apple will finally launch its glasses

Apple's next significant product, a mixed-reality headset, will finally launch this year. Job postings and staff changes on the company’s website hint to the device's features.

The headset will likely cost between $2,000 and $3,000, which is high even by Apple standards, but will include a M2 processor, more than 10 cameras, and the highest-resolution screens in a mass-market headset.

The gadget will run realityOS, which will offer mixed-reality versions of Apple applications like Messages, FaceTime, and Maps.

A few job posts suggest Apple is boosting the device's content. The company needs a software producer with expertise in visual effects and game asset pipelines to generate augmented and virtual reality content.

The listings also suggest Apple is planning a video service for the device with 3D VR content. This would follow the company's 2020 purchase of NextVR, which transmitted VR material to headsets.

8/ At least one European bank will be bailed out

The last quarter (ie. Q4 2022) has been dominated by rumours of Credit Suisse’s potential bankruptcy. If it happens, probably the government will step in because…system contagion. Not even established banks like BNP Paribas or Unicredit are considered safe. LINK

Traditional banking entered a phase of irreversible decline.

9/ Fintech banks will continue to innovate on products and grow on market share

The adoption is at least double digit across all over the world. Below you can see the most important players.

Sifted.eu has created a list of The European fintechs to watch in 2022. LINK

McKinsey has also outlined some opportunities. LINK

10/ The energy stocks will have a stellar year (e.g. Exxon & co)

Throughout the entire Europe companies are closing at an unprecedented rate due to high energy prices. Europe is looking to divest from the Russian sources, but creating sustainable alternatives might take some time. (wind and solar are unreliable sources due to the vulnerabilities they pose beside storage, so maybe LNG and/or nuclear might be the solutions).

The evolution of the main Energy sectors vs Retail & Tech is relevant:

Maybe tech will revive in 2023, but for sure the (classic) Energy stocks will continue to grow.

11/ Tech layoffs will continue

If Twitter could be run with only 25% personnel investors will ask the same from Google, Facebook and so on. WSJ has a compelling story about tech layoffs. LINK

Trueup.io has even a nice chart about:

Those affected by the layoffs are both blessed and cursed: What went wrong?....and/or…. How about starting my own company?

2023 looks promising! Let’s have the most of it!