(#63) Apple stops its car project; NVIDIA fantastic year; Reddit files for IPO, on Roblox, and Japan is back!

We'll have fewer unicorns.

Knowledge Partner: EY

Download the latest edition of EY Attractiveness Survey Romania, an in-depth study designed to help businesses make investment decisions.

Findings are based on the views of representative panels of international and local decision-makers. Click HERE.

Today’s menu

Reddit is heading towards an IPO

Nvidia 2023 stock: to the moon!

Why Apple stopped their car project

Fewer unicorns

Japan is back!

Strategy

Reddit has finally filed for its IPO

The company made $804 million in revenue in 2023 with a loss of $91 m.

Now, I am bullish about the company because:

1/ It has 850 million MAUs and 70 DAUs, making it the 7th most visited website in the USA, well above Amazon and Netflix

2/ It has a data sharing agreement with Google for AI training (worth 60m)

3/ In the end, I estimate that AI models will become a commodity and the real gold will be training data and Reddit will be the best positioned to take this advantage. IPO, Google

Apple stopped the “car project”

After a decade-long investment, the company announced that its 2,000 people working on the car project will transition to…generative AI projects. Because, why not? It’s 2024 and if it doesn’t have GenAI people will not like it.

So, what could have been done differently by Apple in cars:

1/ Cars are dangerous and they provoke deaths. Not a nice place to have your products involved.

2/ Consumers are irrational when buying 1-2k USD Apple products, but not a $40-80k car. We see how Tesla is struggling against the Chinese EVs.

3/ Competition is tough and probably only a few will make a profit in this area unless heavily supported by the government (ie. through subsidies and tariffs)

In conclusion: EVs are all about multimedia. So, why not focus on what are you good at (ie. software)? Eventually, Apple has all the money it needs to buy Tesla, if it wants to. LINK

Nvidia earnings: to the moon!

2023 was a stellar year for the company and 2024 will continue: more demand than supply.

Now, from their earnings:

1/ Nvidia does not sell only a hardware architecture, but also a software layer (ie. CUDA). Hard to beat at this game: hardware and software.

2/ New products in the pipeline:

“And so whenever we have a new generation of products — right now, we are ramping H200’s. There is no way we can reasonably keep up on demand in the short term as we ramp. We’re ramping Spectrum-X. We’re doing incredibly well with Spectrum-X. It’s our brand-new product into the world of ethernet. InfiniBand is the standard for AI-dedicated systems…with all of the new products, demand is greater than supply. And that’s just kind of the nature of new products and so we work as fast as we can to capture the demand.” (Jensen Huang). LINK

3/ The incumbents are buying the chips, although they don’t have something in mind if they will need them or how many of them. Here is Mark Zuckerberg from Meta:

“I recently shared that by the end of this year we’ll have about 350k H100s and including other GPUs that’ll be around 600k H100 equivalents of compute. We’re well-positioned now because of the lessons that we learned from Reels. We initially under-built our GPU clusters for Reels, and when we were going through that I decided that we should build enough capacity to support both Reels and another Reels-sized AI service that we expected to emerge so we wouldn’t be in that situation again. And at the time the decision was somewhat controversial and we faced a lot of questions about capex spending, but I’m really glad that we did this.” LINK

4/ Keep in mind that the H100 chip was developed before the GPT moment, hence a new version is under development.

At some point Nvidia will have a market correction, but not now. The chip industry is a cyclical one and we haven’t reached the tipping point…yet.

Fewer unicorns

The Economist has an article showing that the end of cheap money, challenges in existing investment, and the impact of AI all lead to fewer newer unicorns.

Investors are more reluctant to give money to companies that are not AI-first and the current collapse of some unicorns makes everyone sceptic. Not sure a bad thing. LINK

Instagram’s competitor Lapse raises $30 Million

We are entering a stage of Social Media where everything will be fragmented and each community will have its own platform. I’d expect even the users to develop their platform and compete with the incumbents. Just to sum up how many Twitter (now X) competitors we have: Threads, Mastodon, Blue Sky, Truth Social, Discord, Reddit, Counter Social, Warpcast and many more.

Here is Lapse, the app with the motto “Friends not followers”:

“The photo-sharing app has millions of users and is especially popular with teenagers, according to co-founder Dan Silvertown. On Lapse, users can take photos with their phone but then have to wait several hours for the pictures to “develop” — similar to the way a film camera works. The photos can then be posted to a social feed or saved privately to a journal.” LINK, Lapse

Roblox in 2023

It was a good year for one of the gaming darlings. Here is what they announced:

1/ Record earnings for developers: $741 million (+19% vs. 2022)

2/ Massive creator base.

Approximately 12,000 developers generated income through the platform, with a diverse range of earnings. Notably, some 3,500 developers earned over $10,000, and around 750 surpassed the $100,000 mark.

3/ Young player demographic - about 58%, are 16 years old or younger, highlighting the platform's appeal to a younger audience.

4/ High engagement

Roblox boasted an average of 68 million daily active users last year, generating $3.5 billion in bookings, despite a slight decrease in spending per person compared to the pandemic peak. The top 10 games on Roblox accounted for 30% of total player time, underscoring the concentration of player engagement around popular titles.

5/ Economic impact

The platform's digital currency, Robux, allows for the exchange of real-world money, with developers earning $0.0035 for every Robux spent in their games, demonstrating a unique economic model within the gaming industry. LINK

Artificial Intelligence

AI in banking will transform will transform 75% of the current activities. Layoffs will continue. LINK

Have all the incumbents shown their Generative AI monetization ideas?

Here is Adobe. LINK

Groq is fast (compared to ChatGPT or Gemini) but expensive. LINK

We have the first use cases of applied generative AI: admin stuff, customer care, software development, marketing, and many more. LINK

Things Happen

Microsoft partners with Mistral, a French AI start-up, in a second AI deal beyond OpenAI. LINK

Revolut is showing a loss for 2022, despite the profit in 2021 mainly due to crypto commissions. For 2023 they will reach profitability again. LINK

Japan is attracting TMSC to make new chips, unlike the EU and the USA where the regulations and government support have been mainly on camera, not on paper. LINK

How an African streaming service dethroned Netflix. LINK

Disney is looking for AI start-ups to invest in. LINK

Hindenburg has a new target: the Swiss fintech Temenos. LINK

Data

on Japan Nikkei 225 Index

“Japan’s benchmark Nikkei 225 index surged Thursday past the record it set in 1989 before its financial bubble burst, ushering in an era of faltering growth.” LINK

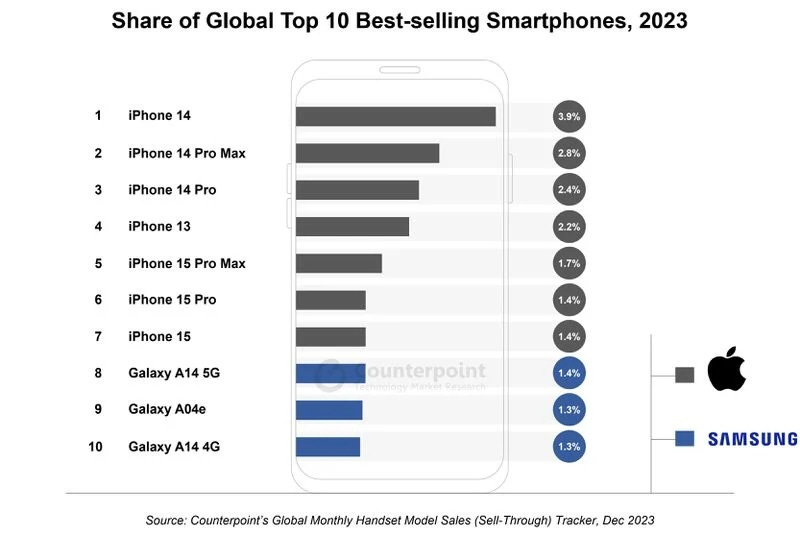

Apple captures Top 7 in the Top 10 Best-selling Smartphones in 2023:

NFTs are back. Here is Bloomberg:

“Startups are resurrecting narratives about NFTs being used in gaming, finance and art, claiming that they’ve learned hard lessons from the past that will make their latest attempt more endurable. They want the tokens to be seen as more than just expensive profile pictures limited to the rich and famous — but the digital assets aren’t on solid ground just yet.”

Outside Interest

Gen Z has a new status symbol: square iPhone cases. LINK

Investors don’t care that we trade in Russia, says Cadbury owner. LINK

Venezuela’s currency is so worthless there’s no point hiding PINs. LINK

What a 45-year-old orchestra conductor making $950,000 eats in San Francisco. LINK

Thank you for being an onStrategy reader!

If this email was forwarded to you please consider subscribing:

Interesting newsletters 💡

Sharing is caring

☕️ Did you enjoy the newsletter? Buy me a coffee ✅